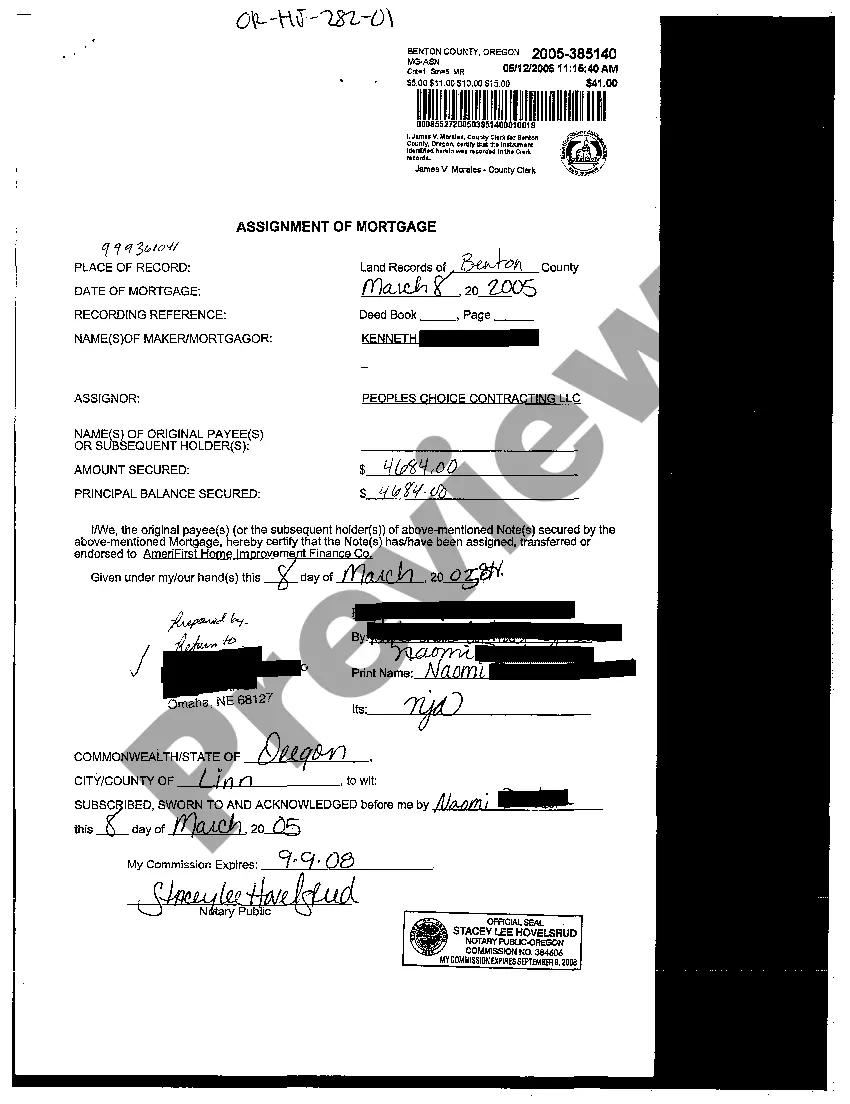

Bend Oregon Assignment of Mortgage is a legal document that transfers the rights and obligations of a mortgage from one party to another in the city of Bend, Oregon. This document is commonly used in real estate transactions when a property with an existing mortgage is sold or transferred to a new owner. An Assignment of Mortgage in Bend, Oregon outlines the terms and conditions of the transfer, including the name of the original mortgagee (the lender or the party holding the mortgage), the name of the assignor (the current mortgage holder), and the name of the assignee (the new mortgage holder or the purchaser of the property). It also includes the details of the mortgage, such as the original loan amount, interest rate, and repayment terms. By executing an Assignment of Mortgage, the assignor relinquishes their rights and responsibilities as the mortgage holder, while the assignee assumes the rights and obligations associated with the loan. This process ensures a smooth transfer of ownership and financing between parties involved in the real estate transaction. There are several types of Bend Oregon Assignment of Mortgage, including: 1. Partial Assignment of Mortgage: In this type of assignment, a portion of the mortgage is transferred from the assignor to the assignee. This can occur when a borrower seeks refinancing and wants to transfer a specific portion of their mortgage to a new lender. 2. Full Assignment of Mortgage: As the name suggests, a full assignment of mortgage transfers the entire mortgage from the original mortgage holder to a new party. This commonly occurs when a property is sold, and the new owner takes over the existing mortgage. 3. Assignment of Mortgage with Assumption: In this type of assignment, the assignee "assumes" responsibility for the mortgage, taking over the loan and becoming the new borrower. This usually happens when the original borrower is unable to continue making payments and wants to transfer the loan to another financially capable party. 4. Assignment of Mortgage in Default: When a borrower defaults on their mortgage payments, the lender can assign the mortgage to a new party. This type of assignment typically occurs when the lender wants to mitigate its losses and transfer the loan to a third party, such as a loan servicing company or an investor specializing in distressed mortgages. It is important to note that the specific requirements and regulations for the Bend Oregon Assignment of Mortgage may vary, so it is advisable to consult with a qualified attorney or real estate professional familiar with local laws and practices ensuring compliance and effectiveness of the assignment.

Bend Oregon Assignment of Mortgage

Description

How to fill out Bend Oregon Assignment Of Mortgage?

Are you looking for a reliable and affordable legal forms provider to buy the Bend Oregon Assignment of Mortgage? US Legal Forms is your go-to solution.

Whether you need a basic arrangement to set regulations for cohabitating with your partner or a package of forms to move your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed based on the requirements of particular state and county.

To download the form, you need to log in account, find the required template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Bend Oregon Assignment of Mortgage conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to learn who and what the form is good for.

- Restart the search if the template isn’t suitable for your specific scenario.

Now you can register your account. Then select the subscription plan and proceed to payment. Once the payment is completed, download the Bend Oregon Assignment of Mortgage in any provided file format. You can get back to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting your valuable time learning about legal papers online once and for all.