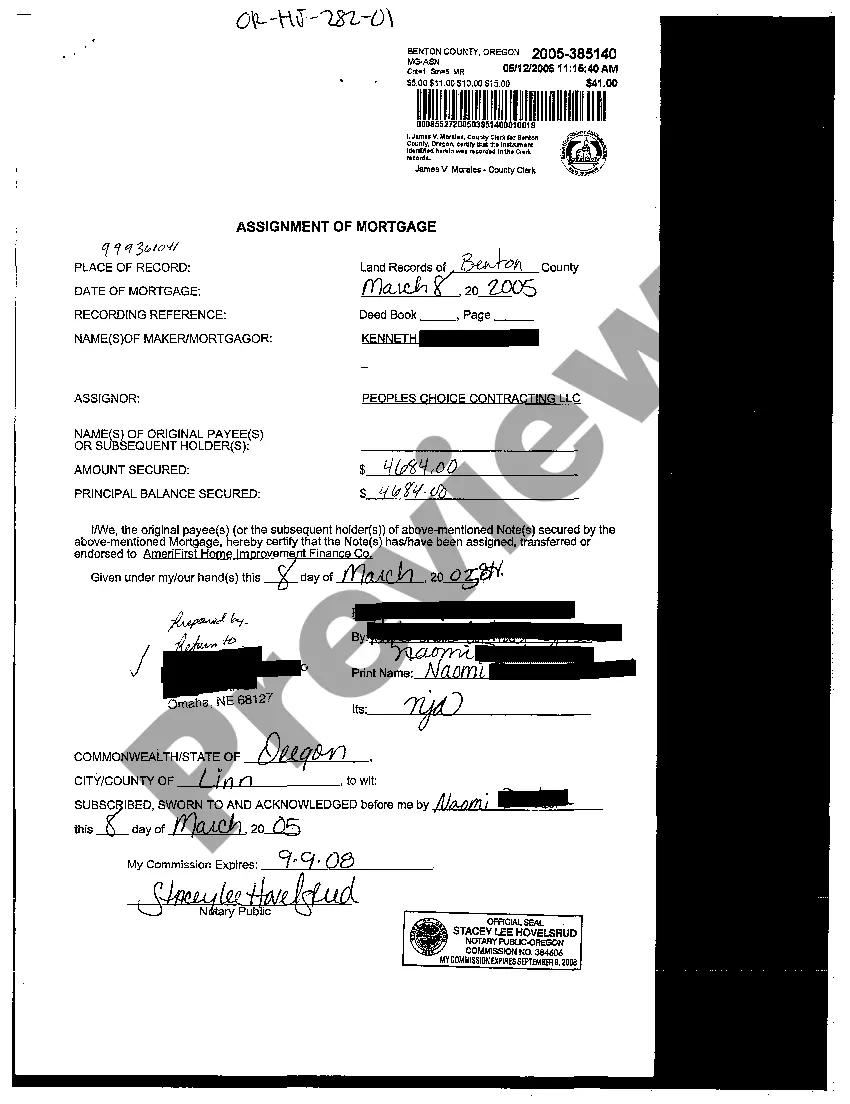

The Gresham Oregon Assignment of Mortgage is a legal document used in real estate transactions that transfers the rights and obligations of a mortgage from one party to another. This process allows the original mortgage holder (assignor) to transfer their interest in the property to a new party (assignee) without the need to refinance the mortgage. The Assignment of Mortgage is typically used when a property is being sold, and the buyer wants to assume the existing mortgage. By assigning the mortgage, the buyer takes over responsibility for making mortgage payments and becomes the new legal owner of the mortgage note. In Gresham, Oregon, there are a few different types of Assignment of Mortgage that may be used, depending on the specific circumstances: 1. Standard Assignment of Mortgage: This is the most common type where the assignor transfers the mortgage to the assignee along with all rights and obligations. The assignee assumes responsibility for making payments and has the legal authority to enforce the mortgage terms. 2. Partial Assignment of Mortgage: In some cases, only a portion of the mortgage is assigned. This might happen when there is more than one lender involved in the financing of the property, and one of them decides to transfer their share to another party. 3. Assignment of Mortgage with Assumption: This type of assignment occurs when the buyer of a property takes over the mortgage of the seller, known as assuming the loan. The assignee becomes responsible for making payments and fulfilling the terms of the original mortgage. 4. Assignment of Mortgage with Novation: Novation is a legal term that refers to the substitution of a new party in a contract while releasing the original party from their obligations. In this type of assignment, both the assignor and the assignee agree to a novation, transferring the mortgage rights and obligations to the new party. It's important to note that the Assignment of Mortgage must be properly executed, usually in writing, and recorded with the appropriate county office to ensure its enforceability. Additionally, seeking legal advice before engaging in an Assignment of Mortgage is recommended to fully understand the implications and requirements associated with the process.

Gresham Oregon Assignment of Mortgage

Description

How to fill out Gresham Oregon Assignment Of Mortgage?

Benefit from the US Legal Forms and obtain instant access to any form template you want. Our helpful website with thousands of templates simplifies the way to find and get almost any document sample you require. It is possible to download, fill, and certify the Gresham Oregon Assignment of Mortgage in a few minutes instead of surfing the Net for several hours searching for an appropriate template.

Utilizing our catalog is a superb strategy to increase the safety of your document submissions. Our professional legal professionals regularly check all the records to make sure that the templates are relevant for a particular state and compliant with new laws and regulations.

How do you get the Gresham Oregon Assignment of Mortgage? If you already have a profile, just log in to the account. The Download option will be enabled on all the samples you view. Moreover, you can get all the earlier saved records in the My Forms menu.

If you haven’t registered a profile yet, follow the instruction below:

- Find the form you require. Ensure that it is the form you were looking for: check its headline and description, and take take advantage of the Preview function if it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the saving process. Click Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Save the document. Indicate the format to get the Gresham Oregon Assignment of Mortgage and edit and fill, or sign it for your needs.

US Legal Forms is among the most considerable and reliable form libraries on the web. Our company is always happy to assist you in any legal process, even if it is just downloading the Gresham Oregon Assignment of Mortgage.

Feel free to take full advantage of our platform and make your document experience as convenient as possible!