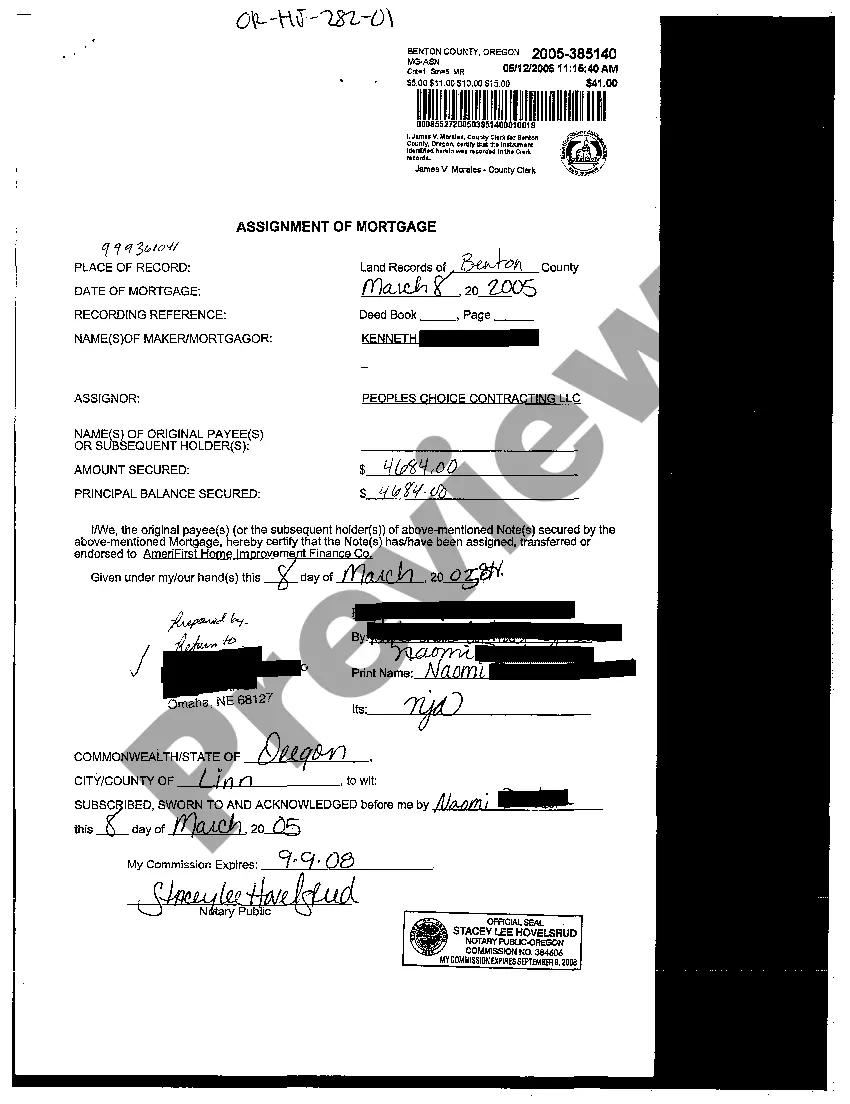

Portland Oregon Assignment of Mortgage is a legal process that involves transferring the rights and obligations of a mortgage from the original lender (assignor) to a new borrower (assignee). This document plays a crucial role in real estate transactions, ensuring smooth property ownership transfers while protecting the interests of all parties involved. The Assignment of Mortgage in Portland Oregon is governed by state laws and regulations, which outline specific requirements and procedures that must be followed. This assignment can only occur if the original mortgage has been properly recorded and established. There are two main types of Portland Oregon Assignment of Mortgage: 1. Voluntary Assignment: This type of assignment takes place when the original lender willingly decides to transfer the mortgage rights to another party. The assignor, in this case, is usually a financial institution or lender seeking to sell the mortgage to investors or other lenders. The assignee, the new borrower, is typically a qualified individual or entity who agrees to assume the original mortgage terms and conditions. 2. Involuntary Assignment: This occurs when the mortgage assignment is not initiated voluntarily by the original lender. It often happens in situations such as foreclosure, bankruptcy, or when a mortgage is sold off due to default or non-payment by the initial borrower. In this case, the assignor is forced to transfer the mortgage to a third party, typically an entity responsible for handling the foreclosure or debt collection process. The Portland Oregon Assignment of Mortgage requires specific documentation to be filed with the county recorder's office. This documentation typically includes an Assignment of Mortgage form, which states the details of the transfer, including the names of the assignor and assignee, the property address, and the mortgage terms. Additionally, an Affidavit of Consideration, which discloses any monetary consideration exchanged during the assignment, must also be submitted. It is important to note that the Assignment of Mortgage does not alter the terms and conditions of the mortgage itself. The assignee assumes the same rights and obligations as the assignor, including repayment terms, interest rates, and any other provisions outlined in the original loan agreement. In conclusion, the Portland Oregon Assignment of Mortgage is a legal process that involves the transfer of mortgage rights and responsibilities from the original lender to a new borrower. Whether voluntary or involuntary, the assignment requires specific documentation to be filed with the county recorder's office. This meticulous process ensures transparency and protects the interests of all parties involved in real estate transactions.

Portland Oregon Assignment of Mortgage

Description

How to fill out Portland Oregon Assignment Of Mortgage?

We always want to reduce or avoid legal damage when dealing with nuanced law-related or financial matters. To accomplish this, we apply for legal solutions that, usually, are extremely costly. However, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to a lawyer. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Portland Oregon Assignment of Mortgage or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Portland Oregon Assignment of Mortgage adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Portland Oregon Assignment of Mortgage is suitable for your case, you can pick the subscription plan and make a payment.

- Then you can download the form in any available format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!