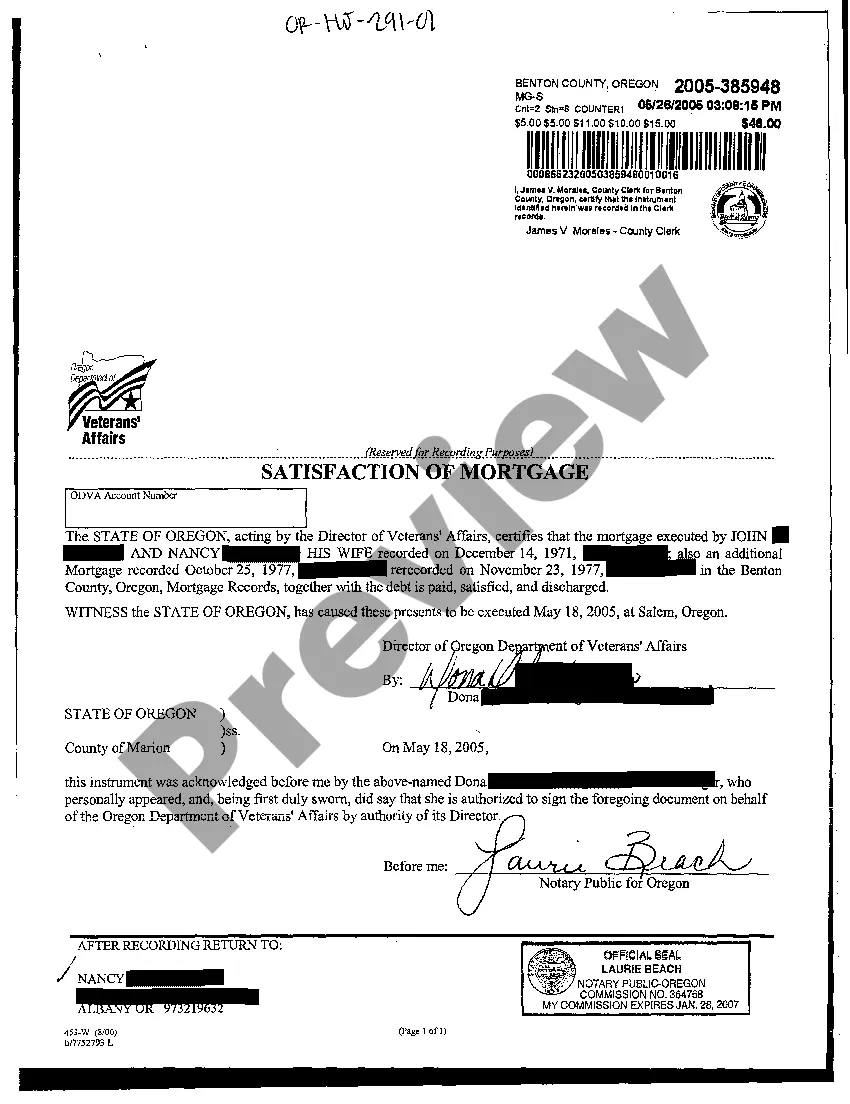

Bend Oregon Sample Satisfaction of Mortgage is a legal document that signifies the full repayment of a mortgage loan taken out by a borrower in Bend, Oregon. This document provides evidence to the public and relevant authorities that the borrower has fulfilled their financial obligation and that the lender's lien or claim on the property has been released. A Bend Oregon Sample Satisfaction of Mortgage generally includes crucial information such as the names and addresses of the borrower (mortgagor) and the lender (mortgagee), details about the mortgage loan agreement, and specifics about the property. It states that the mortgage has been paid in full and that the mortgagee no longer has any legal claim or interest in the property. The importance of a properly executed Bend Oregon Sample Satisfaction of Mortgage cannot be overstated. It is essential for the borrower to obtain this document, as it formally establishes that all outstanding obligations and debts associated with the mortgage have been settled. The borrower can then present this document to the relevant county office or recorder's office for public decoration, ensuring that the change in ownership or release of lien is legally recognized. Different types of Bend Oregon Sample Satisfaction of Mortgage might include variations based on the lender or mortgage company, the specific terms of the mortgage agreement, and any associated legal or financial considerations. It is important to note that although there may be various formats or templates for this document, the essential elements and purpose remain the same — acknowledging the satisfaction of the mortgage. In summary, a Bend Oregon Sample Satisfaction of Mortgage is a vital legal document that affirms the repayment and release of a mortgage loan in Bend, Oregon. It is essential for borrowers to promptly obtain this document to ensure clarity and legal recognition of their property ownership. By complying with the necessary procedures and requirements, individuals can enjoy the peace of mind that comes with fully repaying their mortgage and releasing any claims on their property.

Bend Oregon Sample Satisfaction of Mortgage

Description

How to fill out Bend Oregon Sample Satisfaction Of Mortgage?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for someone without any legal education to draft this sort of paperwork from scratch, mainly because of the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our service offers a huge catalog with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you need the Bend Oregon Sample Satisfaction of Mortgage or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Bend Oregon Sample Satisfaction of Mortgage quickly using our trustworthy service. In case you are already a subscriber, you can go on and log in to your account to download the needed form.

Nevertheless, if you are unfamiliar with our library, make sure to follow these steps prior to downloading the Bend Oregon Sample Satisfaction of Mortgage:

- Be sure the template you have found is good for your location since the regulations of one state or area do not work for another state or area.

- Preview the document and go through a short outline (if provided) of scenarios the document can be used for.

- If the one you selected doesn’t meet your requirements, you can start again and look for the needed document.

- Click Buy now and pick the subscription option you prefer the best.

- Log in to your account credentials or create one from scratch.

- Select the payment gateway and proceed to download the Bend Oregon Sample Satisfaction of Mortgage as soon as the payment is done.

You’re good to go! Now you can go on and print out the document or fill it out online. In case you have any problems getting your purchased forms, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.