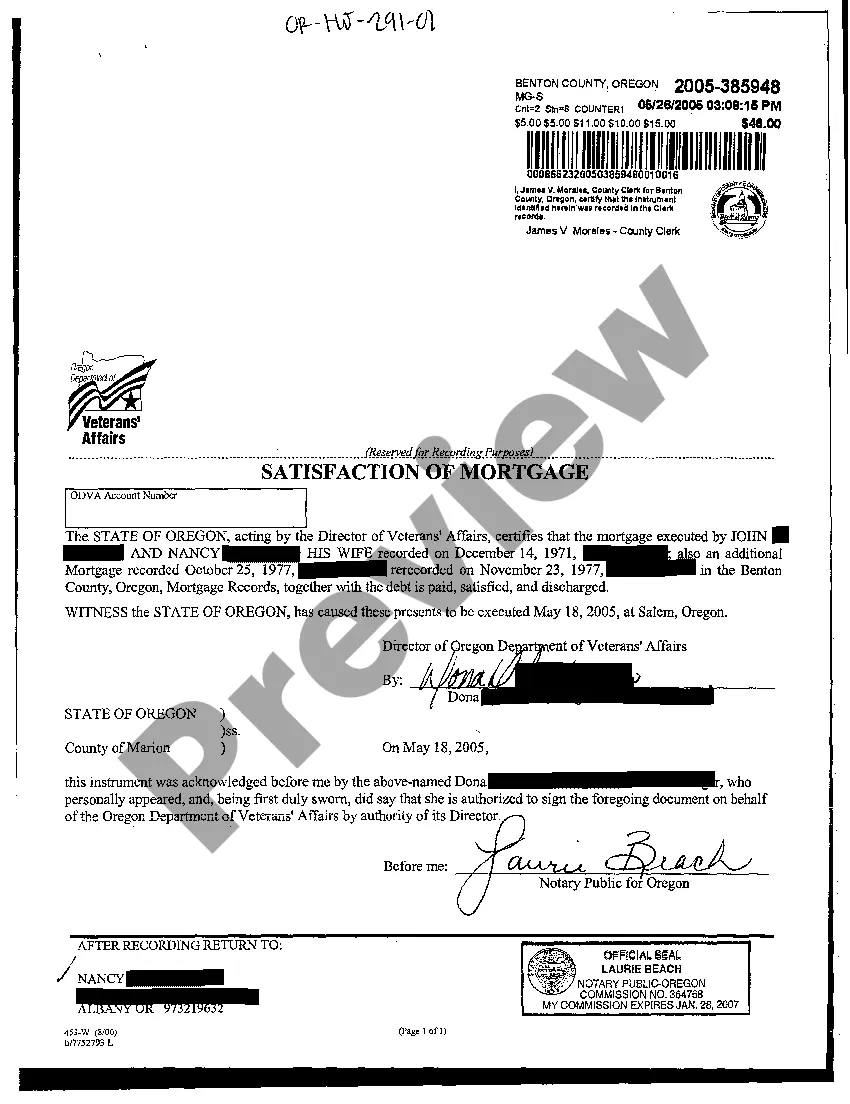

Gresham Oregon Sample Satisfaction of Mortgage is a legal document that serves as proof that a mortgage loan has been fully paid off and satisfied. It is an essential part of the mortgage closing process and signifies that the borrower has successfully repaid the mortgage debt in Gresham, Oregon. The Gresham Oregon Sample Satisfaction of Mortgage typically contains key information such as the names of the lender (mortgagee) and the borrower (mortgagor), the date of the original mortgage agreement, the loan amount, and the property description. It also includes a statement confirming that the mortgage debt has been fully satisfied and released, absolving the borrower from any further obligations or responsibilities related to the loan. There are various types of Gresham Oregon Sample Satisfaction of Mortgages depending on the specific circumstances. Some common types include: 1. Full Satisfaction of Mortgage: This type of satisfaction of mortgage is used when all outstanding loan payments have been made in full, and there are no remaining obligations regarding the mortgage. 2. Partial Satisfaction of Mortgage: When a borrower has paid off a portion of the mortgage debt, a partial satisfaction of mortgage is used to reflect the partial release of the property from the mortgage lien. It states the specific amount of the mortgage that has been satisfied. 3. Subordinate Satisfaction of Mortgage: In cases where a borrower refinances their mortgage or obtains additional loans using the property as collateral, a subordinate satisfaction of mortgage is used to acknowledge that the original mortgage remains in effect but is subordinate to the new loans. 4. Assignment of Satisfaction of Mortgage: This type of satisfaction of mortgage is used when the original lender transfers the mortgage debt to another party, such as a new lender or a loan servicing company. It acknowledges the transfer of the mortgage satisfaction rights to the assignee. Gresham Oregon Sample Satisfaction of Mortgages are important documents for both lenders and borrowers. For lenders, they provide evidence of the borrower's successful repayment and release the mortgage lien on the property. For borrowers, they serve as proof that they have fulfilled their mortgage obligations and can provide peace of mind that their property is free and clear of any encumbrances. In conclusion, Gresham Oregon Sample Satisfaction of Mortgage is a crucial instrument in the mortgage closing process that confirms the complete repayment and satisfaction of a mortgage loan. Different types of satisfaction of mortgages exist to address various circumstances, such as full satisfaction, partial satisfaction, subordinate satisfaction, and assignment of satisfaction. These documents play an integral role in maintaining accurate property records and providing legal assurance for both borrowers and lenders.

Gresham Oregon Sample Satisfaction of Mortgage

Description

How to fill out Gresham Oregon Sample Satisfaction Of Mortgage?

No matter what social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for a person without any law education to draft such paperwork cfrom the ground up, mostly because of the convoluted jargon and legal nuances they come with. This is where US Legal Forms comes to the rescue. Our platform provides a massive catalog with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also is an excellent asset for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you need the Gresham Oregon Sample Satisfaction of Mortgage or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Gresham Oregon Sample Satisfaction of Mortgage quickly employing our trusted platform. If you are already a subscriber, you can go on and log in to your account to download the appropriate form.

However, in case you are a novice to our library, make sure to follow these steps before downloading the Gresham Oregon Sample Satisfaction of Mortgage:

- Ensure the template you have found is specific to your location since the rules of one state or area do not work for another state or area.

- Preview the form and read a short description (if provided) of cases the document can be used for.

- In case the one you chosen doesn’t meet your requirements, you can start over and look for the needed document.

- Click Buy now and choose the subscription option you prefer the best.

- with your credentials or register for one from scratch.

- Select the payment gateway and proceed to download the Gresham Oregon Sample Satisfaction of Mortgage as soon as the payment is through.

You’re all set! Now you can go on and print the form or fill it out online. In case you have any problems locating your purchased documents, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.