A Bend Oregon Line of Credit Instrument, also known as a Bend Oregon LOC, is a financial tool that provides individuals and businesses with a flexible and convenient way to access borrowed funds. It is a revolving credit facility that allows borrowers to withdraw funds up to a predetermined credit limit, whenever they need the money, without the need for multiple loan applications. This type of instrument is especially useful for covering ongoing expenses, managing cash flow, and addressing unexpected financial needs in the Bend, Oregon region. The Bend Oregon LOC offers several key benefits to borrowers. First, it provides a continuous source of available credit. Once approved, borrowers can access funds as needed, repay them, and then reuse them without the need for additional loan applications. This flexibility ensures that funds are easily accessible at any time, offering peace of mind and financial stability. Furthermore, a Bend Oregon LOC typically carries a variable interest rate, which means that borrowers only pay interest on the amount withdrawn rather than the entire credit limit. The interest is based on the outstanding balance, making it an attractive option for individuals or businesses who may require funds intermittently or irregularly. Different types of Bend Oregon Line of Credit Instruments may exist, each tailored to specific needs and circumstances. Here are a few examples: 1. Personal Line of Credit: This type of LOC is designed for individuals who need to cover personal expenses such as home improvements, vacations, or unexpected emergencies. It allows borrowers to access funds as needed and make flexible repayment arrangements. 2. Business Line of Credit: Geared towards small businesses, this LOC facilitates working capital management, payable obligations, and other short-term expenses. It provides a source of readily available funds to bridge gaps in cash flow and finance growth opportunities. 3. Home Equity Line of Credit (HELOT): This particular LOC utilizes the equity in a homeowner's property as collateral. It allows homeowners in Bend, Oregon, to access a line of credit based on the appraised value of their home, providing a financial tool for various purposes, such as home renovations, debt consolidation, or tuition fees. 4. Commercial Line of Credit: Aimed at established businesses and corporations, this LOC assists in managing fluctuating cash flow, operating expenses, and growth initiatives. It provides a flexible financial cushion to meet the unique needs of commercial enterprises in Bend, Oregon. In summary, a Bend Oregon Line of Credit Instrument is a versatile and customizable financial product that enables individuals and businesses in Bend, Oregon, to access funds as needed, based on a predetermined credit limit. With various types available, such as personal, business, home equity, and commercial lines of credit, this instrument offers a convenient and flexible solution for managing ongoing expenses and addressing unexpected financial needs.

Bend Oregon Line of Credit Instrument

Description

How to fill out Bend Oregon Line Of Credit Instrument?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Bend Oregon Line of Credit Instrument gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Bend Oregon Line of Credit Instrument takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a couple of more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

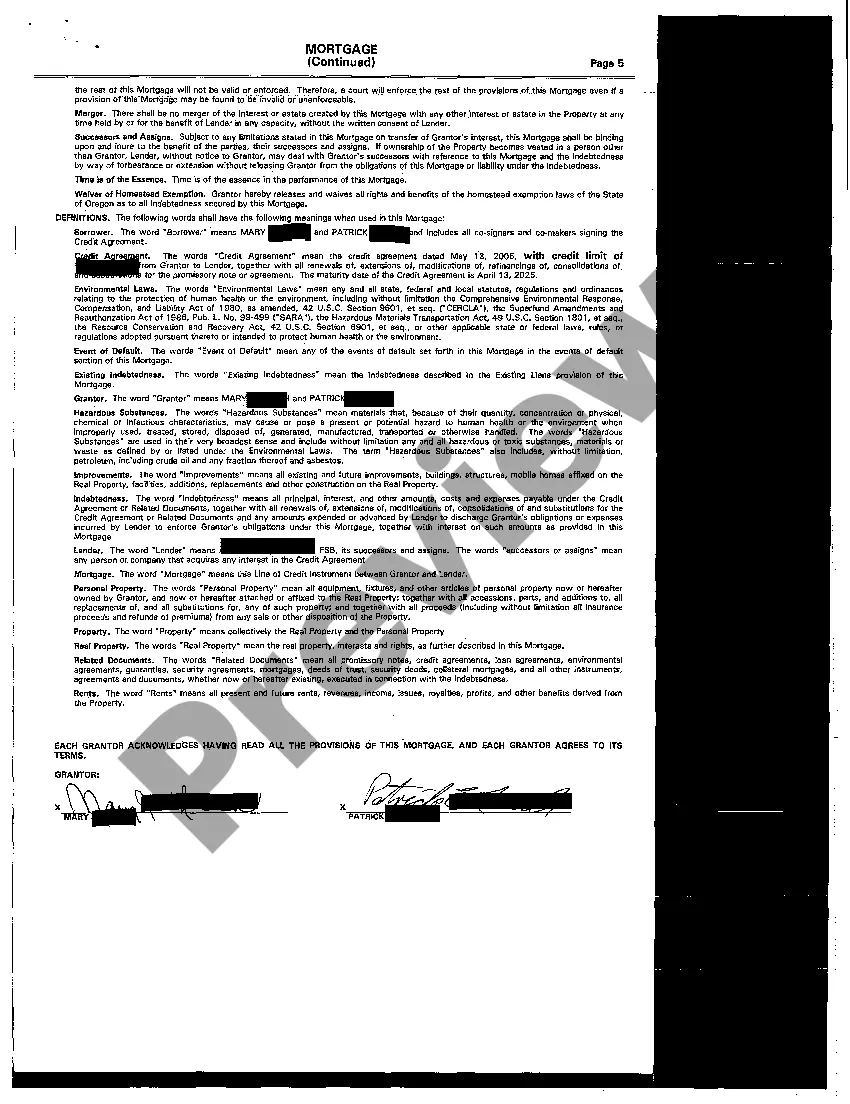

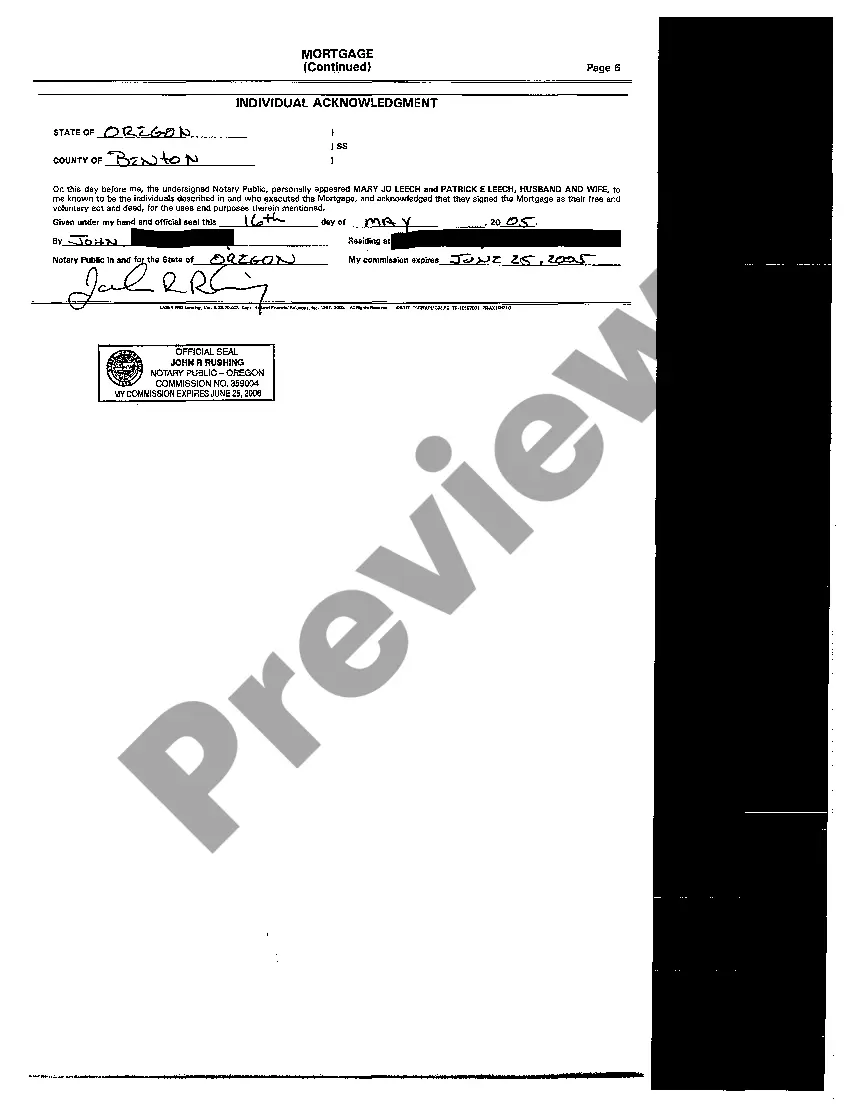

- Look at the Preview mode and form description. Make sure you’ve picked the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Bend Oregon Line of Credit Instrument. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!