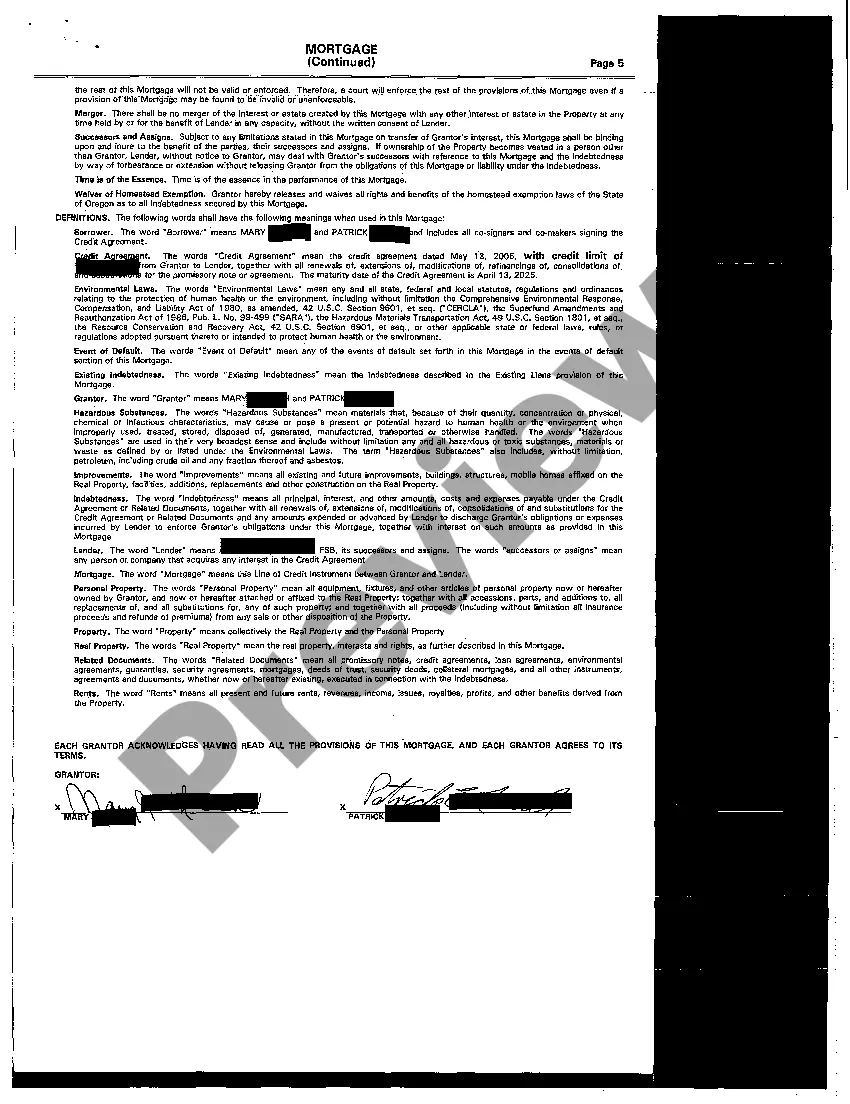

Eugene Oregon Line of Credit Instrument is a financial tool offered to individuals and businesses alike by various financial institutions in Eugene, Oregon. It is a flexible borrowing arrangement that allows the borrower to access funds up to a predetermined credit limit. A line of credit acts as a financial safety net, providing the borrower with quick access to funds whenever needed. Unlike traditional loans, where the borrower receives a lump sum upfront and repays it in scheduled installments, a line of credit allows users to draw funds as and when required, up to a specified limit. Interest is only charged on the amount borrowed and not on the entire credit limit. The primary benefit of this instrument is its convenience and flexibility. By obtaining a line of credit, individuals and businesses can access funds whenever they face unexpected expenses, unforeseen emergencies, or require working capital for ongoing projects. It serves as a valuable tool for managing cash flow fluctuations and addressing short-term financial needs. Eugene Oregon Line of Credit Instrument is available in different variations tailored to meet specific requirements. Some common types include: 1. Personal Line of Credit: This line of credit is typically designed for individuals and provides them with access to funds for personal use. It can be used for home renovations, education expenses, medical bills, or any other personal financial need. 2. Business Line of Credit: Geared towards businesses, this type of line of credit helps entrepreneurs and companies manage their finances efficiently. It can be utilized for purchasing inventory, covering operational costs, managing cash flow, and handling unforeseen business expenses. 3. Home Equity Line of Credit (HELOT): With a HELOT, homeowners can leverage the equity built in their property to access funds. This line of credit is often used for home renovations, debt consolidation, or other major expenses. 4. Secured Line of Credit: In some cases, financial institutions may require collateral to provide a line of credit. This type of line of credit is typically secured against assets owned by the borrower, such as real estate, vehicles, or other valuable possessions. 5. Unsecured Line of Credit: Unlike a secured line of credit, an unsecured line of credit does not require collateral. It is solely based on the borrower's creditworthiness and financial history. However, unsecured lines of credit generally have lower credit limits and higher interest rates. Eugene Oregon Line of Credit Instrument offers individuals and businesses the flexibility to manage their financial needs efficiently. Whether it's for personal use or to support business operations, this financial tool provides quick access to funds whenever required. It is essential to assess individual requirements, interest rates, terms, and conditions before opting for a particular line of credit instrument offered by financial institutions in Eugene, Oregon.

Eugene Oregon Line of Credit Instrument

Description

How to fill out Eugene Oregon Line Of Credit Instrument?

Do you need a trustworthy and inexpensive legal forms provider to buy the Eugene Oregon Line of Credit Instrument? US Legal Forms is your go-to choice.

Whether you require a simple agreement to set regulations for cohabitating with your partner or a package of forms to advance your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and frameworked in accordance with the requirements of particular state and area.

To download the document, you need to log in account, find the required form, and hit the Download button next to it. Please remember that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Eugene Oregon Line of Credit Instrument conforms to the regulations of your state and local area.

- Read the form’s description (if provided) to find out who and what the document is intended for.

- Restart the search if the form isn’t good for your specific scenario.

Now you can register your account. Then select the subscription option and proceed to payment. Once the payment is done, download the Eugene Oregon Line of Credit Instrument in any provided file format. You can get back to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting hours learning about legal paperwork online for good.