The Hillsboro Oregon Line of Credit Instrument is a financial tool that provides individuals and businesses in Hillsboro, Oregon, with flexible access to funds on an as-needed basis. This type of instrument is used to cover unexpected expenses, manage cash flow fluctuations, finance projects, or bridge gaps between income and expenses. Being a line of credit, it allows borrowers to withdraw and repay funds without needing to reapply for a new loan each time. One type of Hillsboro Oregon Line of Credit Instrument is the Personal Line of Credit. This option is designed for individuals and can be used for various purposes, such as home renovations, debt consolidation, or emergencies. With a Personal Line of Credit, borrowers have the flexibility to access funds up to a predetermined credit limit and borrow only what they need. They can withdraw funds using a linked debit card, checks, or electronic transfers and are only charged interest on the amount actually borrowed. Another type of Hillsboro Oregon Line of Credit Instrument is the Business Line of Credit. This instrument is specifically tailored to meet the financial needs of businesses in Hillsboro, Oregon. It offers businesses quick access to funds to cover operational expenses, inventory purchases, marketing campaigns, or any other business-related costs. Similar to the Personal Line of Credit, businesses can withdraw funds up to their approved credit limit and only pay interest on the utilized amount. The Business Line of Credit is a valuable tool for businesses to manage cash flow and take advantage of growth opportunities without the need for traditional loans. The Hillsboro Oregon Line of Credit Instrument provides great flexibility and convenience to meet the financial needs of individuals and businesses alike. It offers a ready source of funds when unexpected expenses or opportunities arise, without the hassle of traditional loan applications. Whether for personal or business use, a line of credit allows borrowers to maintain financial stability and make timely decisions without compromising their financial well-being. Keywords: Hillsboro Oregon, line of credit, instrument, flexible access, funds, unexpected expenses, cash flow fluctuations, finance projects, bridge gaps, income, debt consolidation, emergencies, credit limit, borrow, withdrawal, linked debit card, checks, electronic transfers, interest, Business Line of Credit, operational expenses, inventory purchases, marketing campaigns, cash flow management, growth opportunities, loans, financial stability, well-being.

Hillsboro Oregon Line of Credit Instrument

State:

Oregon

City:

Hillsboro

Control #:

OR-HJ-295-01

Format:

PDF

Instant download

This form is available by subscription

Description

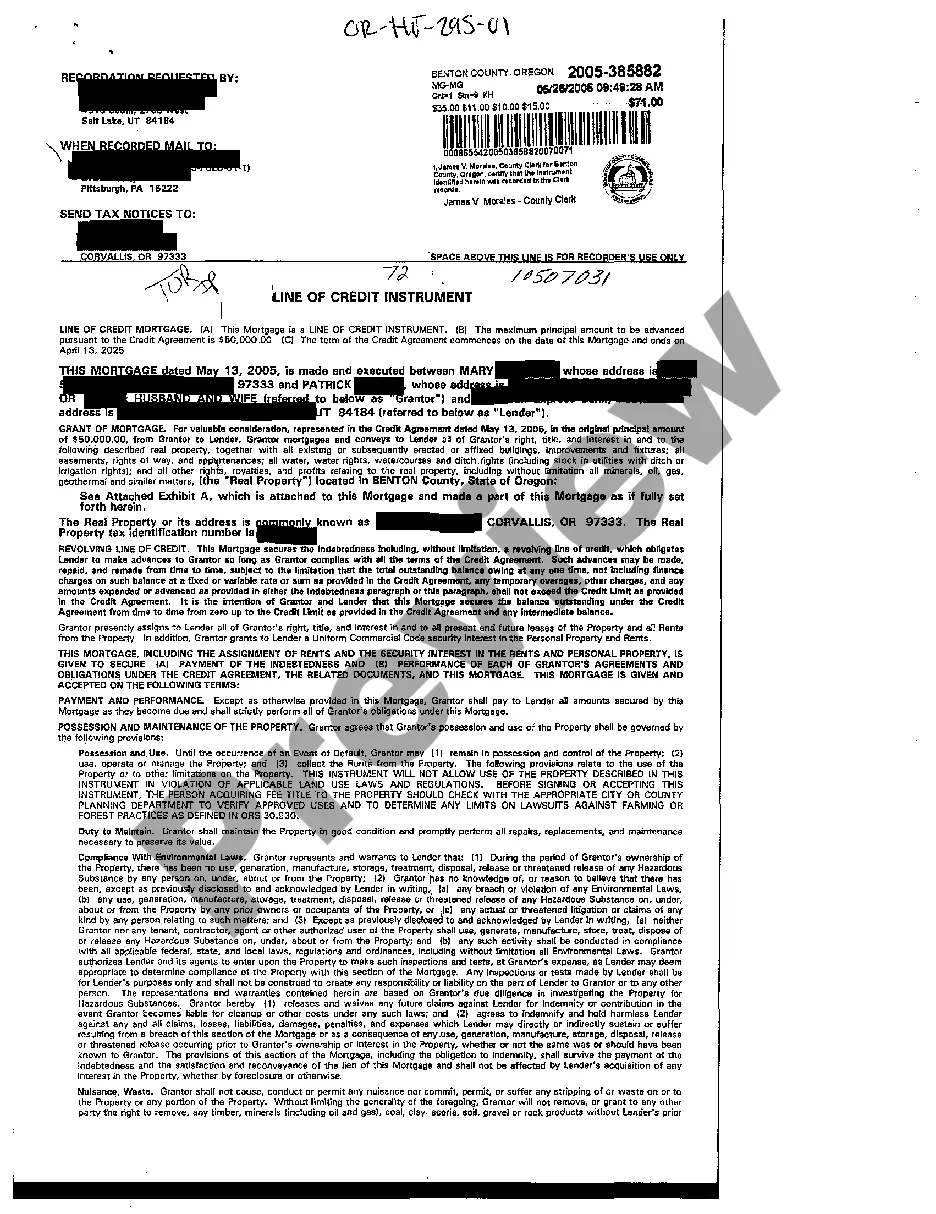

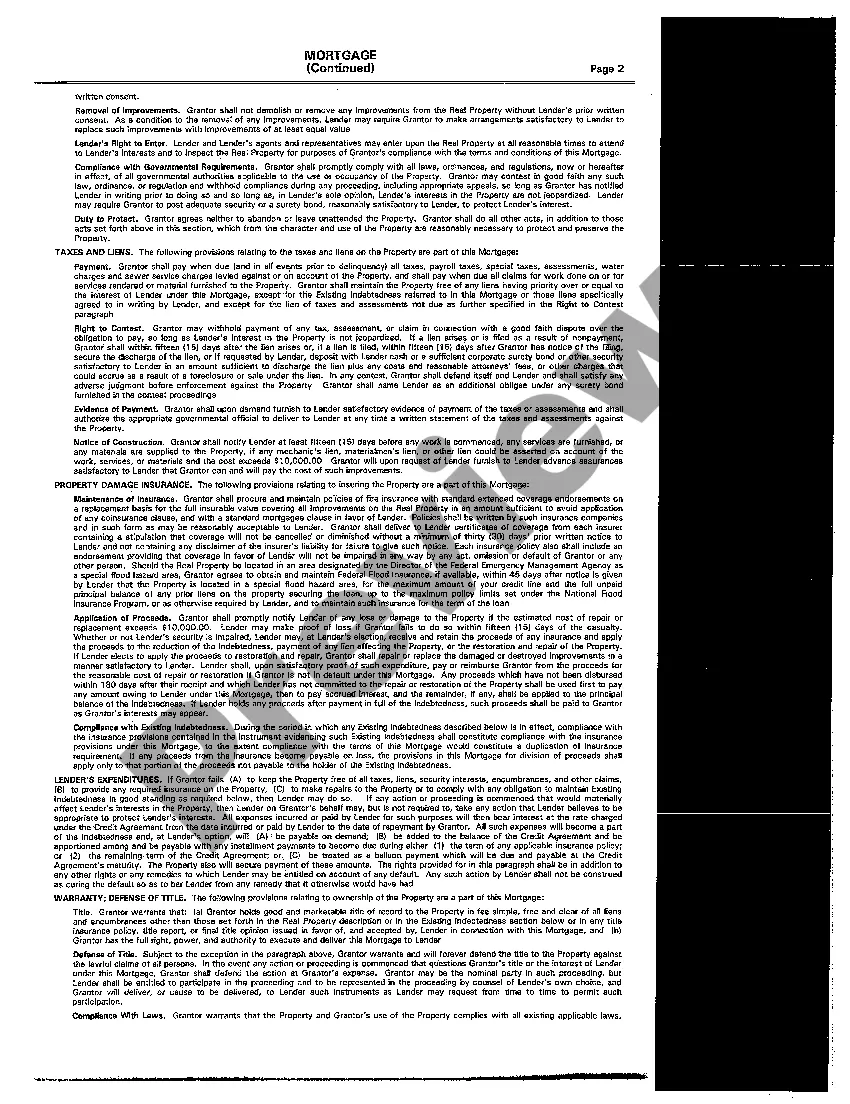

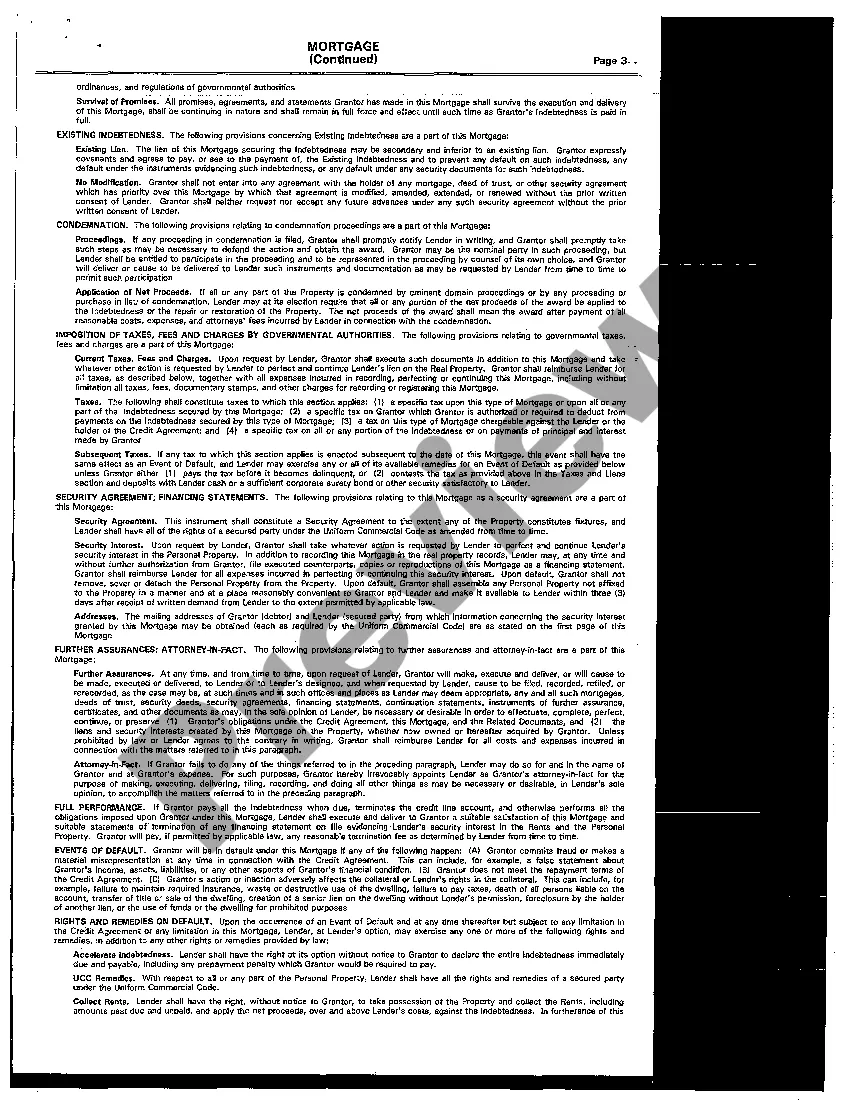

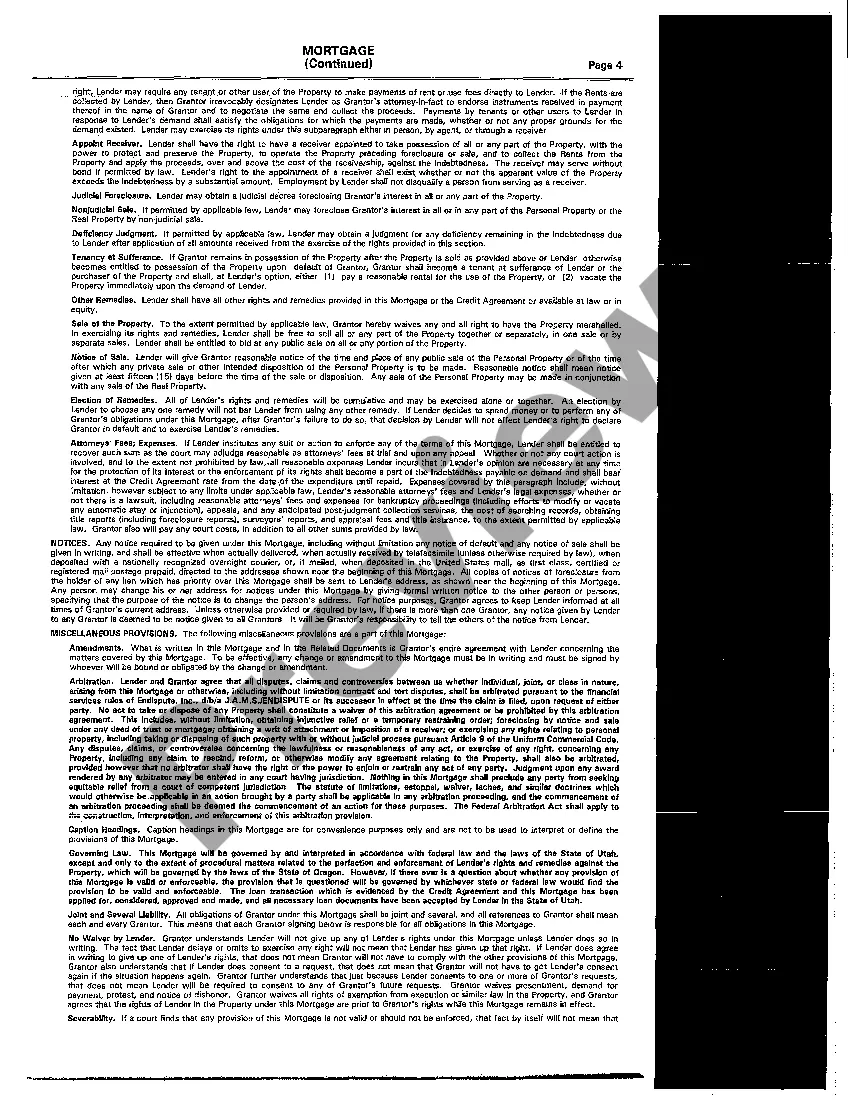

Line of Credit Instrument

The Hillsboro Oregon Line of Credit Instrument is a financial tool that provides individuals and businesses in Hillsboro, Oregon, with flexible access to funds on an as-needed basis. This type of instrument is used to cover unexpected expenses, manage cash flow fluctuations, finance projects, or bridge gaps between income and expenses. Being a line of credit, it allows borrowers to withdraw and repay funds without needing to reapply for a new loan each time. One type of Hillsboro Oregon Line of Credit Instrument is the Personal Line of Credit. This option is designed for individuals and can be used for various purposes, such as home renovations, debt consolidation, or emergencies. With a Personal Line of Credit, borrowers have the flexibility to access funds up to a predetermined credit limit and borrow only what they need. They can withdraw funds using a linked debit card, checks, or electronic transfers and are only charged interest on the amount actually borrowed. Another type of Hillsboro Oregon Line of Credit Instrument is the Business Line of Credit. This instrument is specifically tailored to meet the financial needs of businesses in Hillsboro, Oregon. It offers businesses quick access to funds to cover operational expenses, inventory purchases, marketing campaigns, or any other business-related costs. Similar to the Personal Line of Credit, businesses can withdraw funds up to their approved credit limit and only pay interest on the utilized amount. The Business Line of Credit is a valuable tool for businesses to manage cash flow and take advantage of growth opportunities without the need for traditional loans. The Hillsboro Oregon Line of Credit Instrument provides great flexibility and convenience to meet the financial needs of individuals and businesses alike. It offers a ready source of funds when unexpected expenses or opportunities arise, without the hassle of traditional loan applications. Whether for personal or business use, a line of credit allows borrowers to maintain financial stability and make timely decisions without compromising their financial well-being. Keywords: Hillsboro Oregon, line of credit, instrument, flexible access, funds, unexpected expenses, cash flow fluctuations, finance projects, bridge gaps, income, debt consolidation, emergencies, credit limit, borrow, withdrawal, linked debit card, checks, electronic transfers, interest, Business Line of Credit, operational expenses, inventory purchases, marketing campaigns, cash flow management, growth opportunities, loans, financial stability, well-being.

Free preview

How to fill out Hillsboro Oregon Line Of Credit Instrument?

If you’ve already used our service before, log in to your account and download the Hillsboro Oregon Line of Credit Instrument on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Hillsboro Oregon Line of Credit Instrument. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!