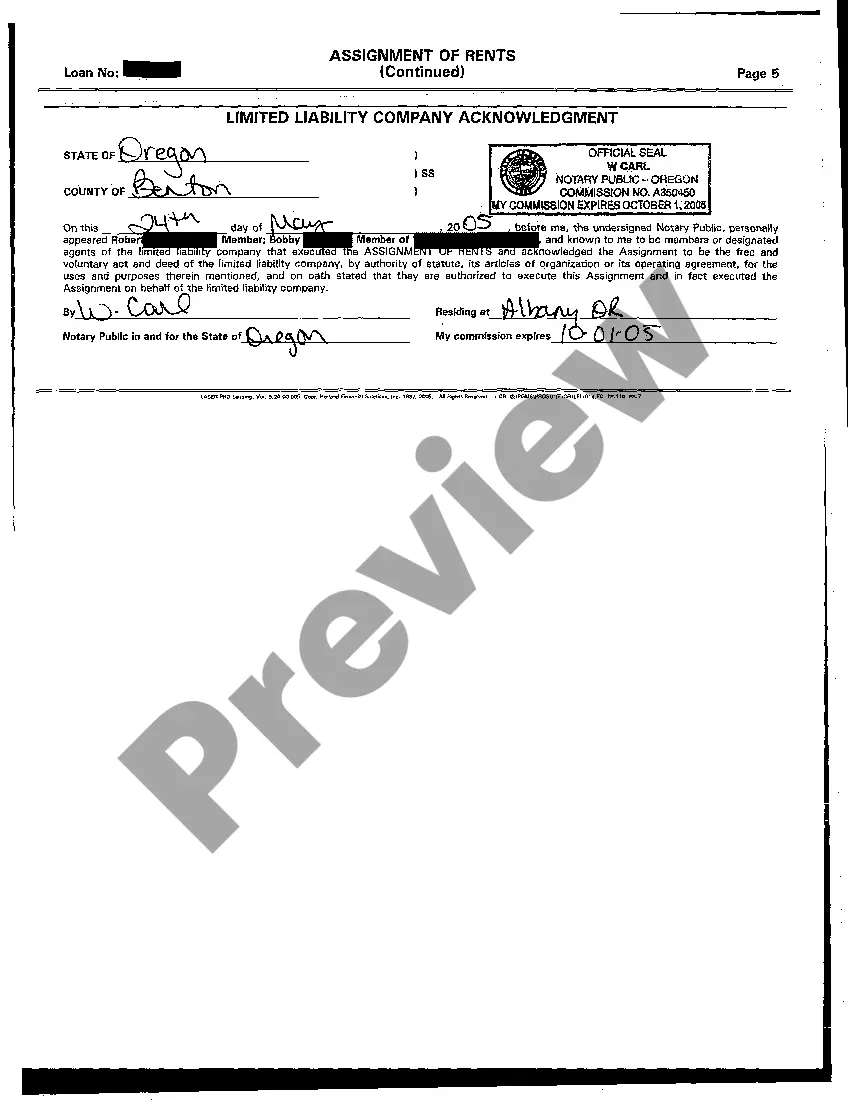

Portland Oregon Assignment of Rents is a legal process that allows a lender to gain control of rental income from a property when the borrower defaults on their mortgage or loan. This method is commonly used by lenders as a means of protecting their interests and recovering their investments. In a Portland Oregon Assignment of Rents, the borrower agrees to assign their rights to collect rent from tenants to the lender. This agreement allows the lender to step in and manage the rental income directly if the borrower fails to meet their financial obligations. The lender then uses the rental income to cover mortgage payments, property taxes, insurance, and other expenses related to the property. There are several types of Portland Oregon Assignment of Rents, which include: 1. Absolute Assignment of Rents: This type gives the lender complete control over the rental income without any restrictions. The lender can use the funds to cover all expenses related to the property, including their loan repayment and additional costs. 2. Conditional Assignment of Rents: In this type, the borrower retains control over the rental income until a default occurs. If the borrower fails to meet their financial obligations, the lender can step in and collect the rent directly. 3. Partial Assignment of Rents: As the name suggests, this type allows the lender to collect only a portion of the rental income. The agreement specifies the percentage or amount that the lender can access, while the borrower retains control over the remaining portion. Portland Oregon Assignment of Rents provides lenders with a crucial tool to protect their investment in case of default. By utilizing this legal process, lenders can ensure the continuity of rental income, thereby safeguarding their financial interests. It is important for borrowers to carefully review and understand the terms of the assignment before entering into any agreements to avoid any potential conflicts in the future.

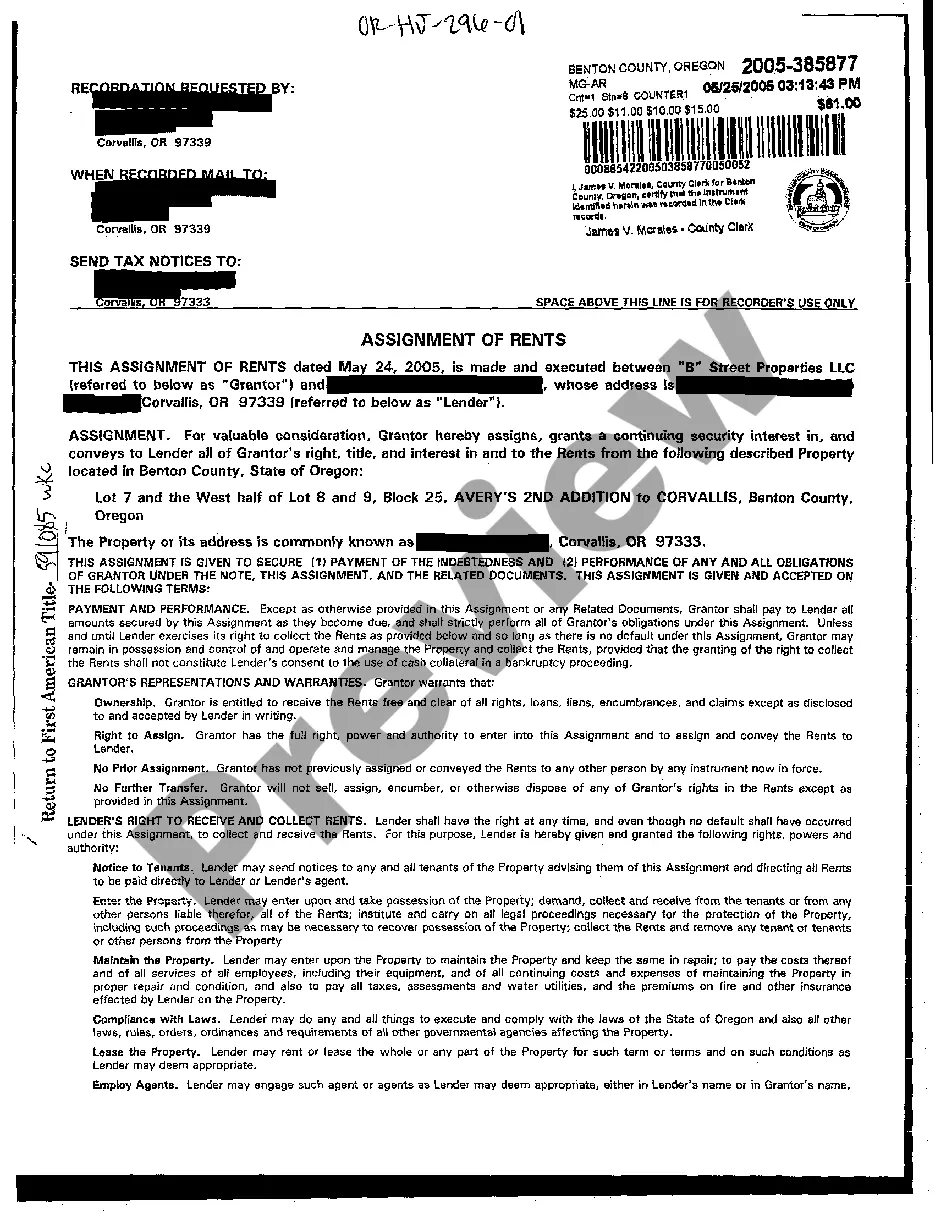

Portland Oregon Assignment of Rents

State:

Oregon

City:

Portland

Control #:

OR-HJ-296-01

Format:

PDF

Instant download

This form is available by subscription

Description

Assignment of Rents

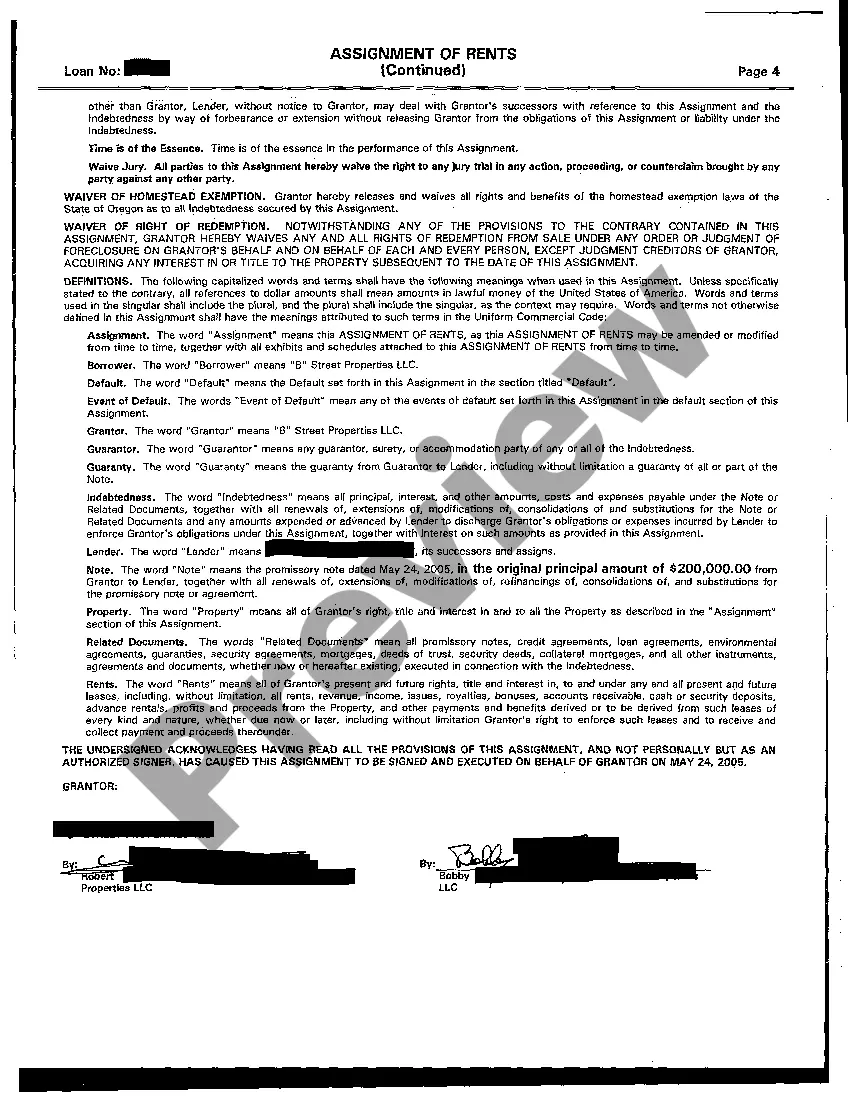

Portland Oregon Assignment of Rents is a legal process that allows a lender to gain control of rental income from a property when the borrower defaults on their mortgage or loan. This method is commonly used by lenders as a means of protecting their interests and recovering their investments. In a Portland Oregon Assignment of Rents, the borrower agrees to assign their rights to collect rent from tenants to the lender. This agreement allows the lender to step in and manage the rental income directly if the borrower fails to meet their financial obligations. The lender then uses the rental income to cover mortgage payments, property taxes, insurance, and other expenses related to the property. There are several types of Portland Oregon Assignment of Rents, which include: 1. Absolute Assignment of Rents: This type gives the lender complete control over the rental income without any restrictions. The lender can use the funds to cover all expenses related to the property, including their loan repayment and additional costs. 2. Conditional Assignment of Rents: In this type, the borrower retains control over the rental income until a default occurs. If the borrower fails to meet their financial obligations, the lender can step in and collect the rent directly. 3. Partial Assignment of Rents: As the name suggests, this type allows the lender to collect only a portion of the rental income. The agreement specifies the percentage or amount that the lender can access, while the borrower retains control over the remaining portion. Portland Oregon Assignment of Rents provides lenders with a crucial tool to protect their investment in case of default. By utilizing this legal process, lenders can ensure the continuity of rental income, thereby safeguarding their financial interests. It is important for borrowers to carefully review and understand the terms of the assignment before entering into any agreements to avoid any potential conflicts in the future.

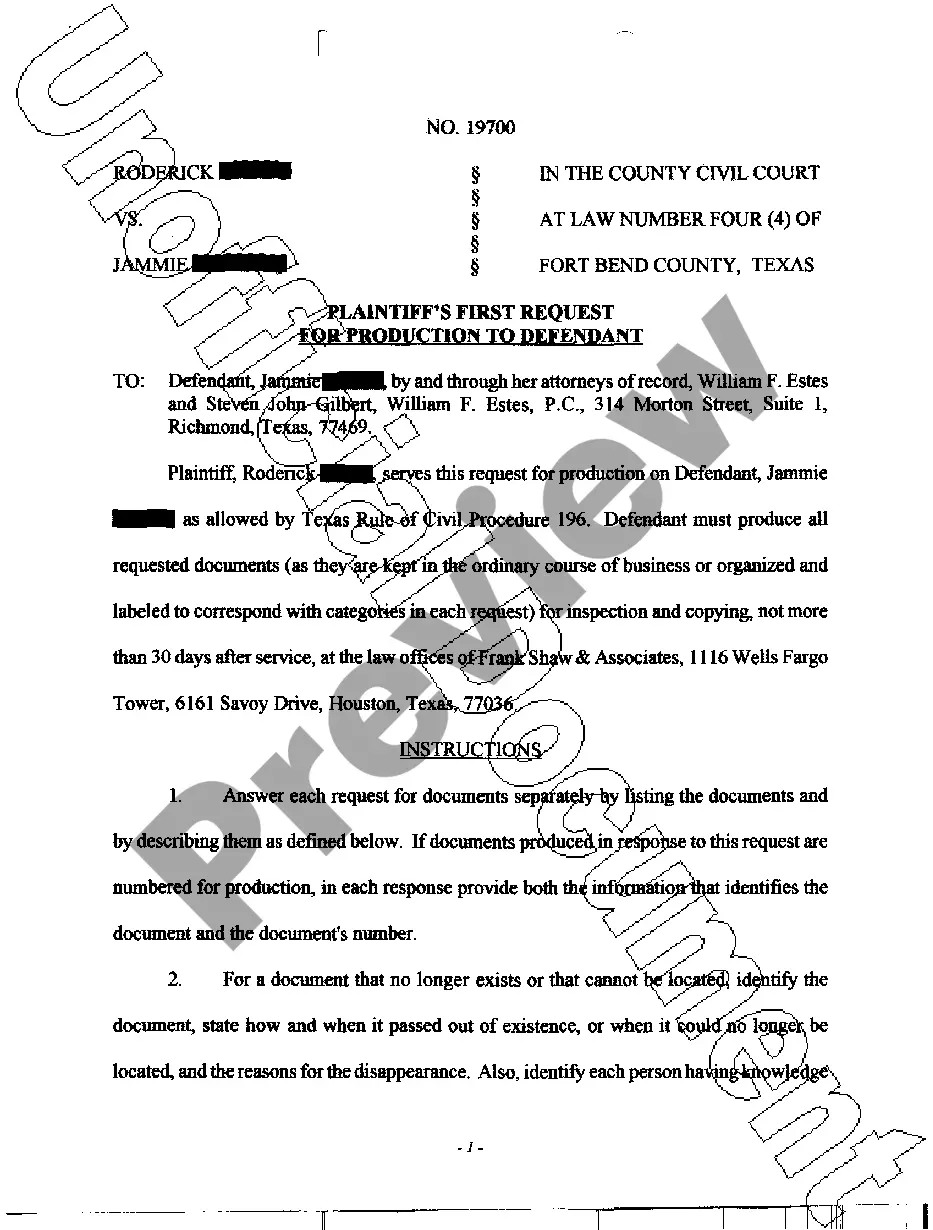

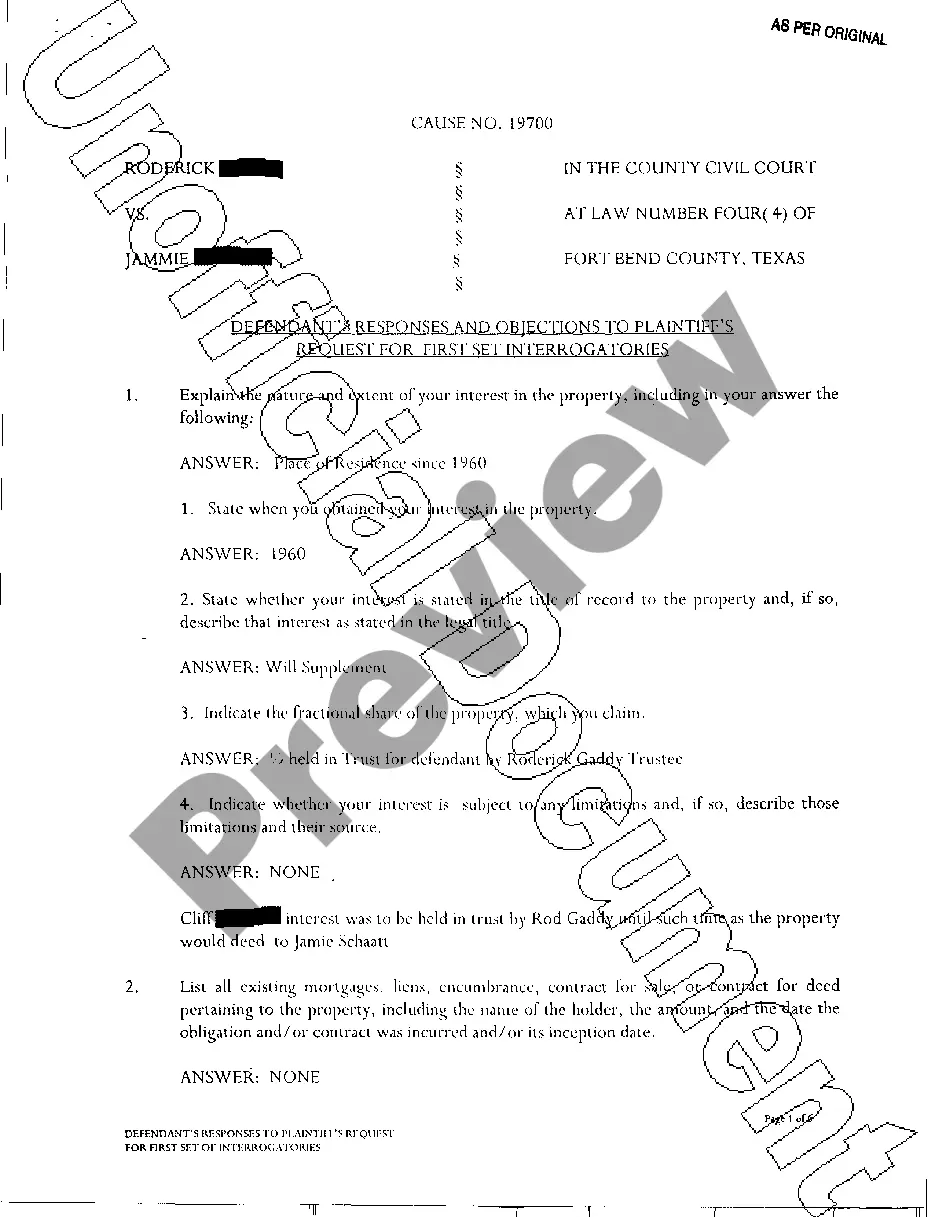

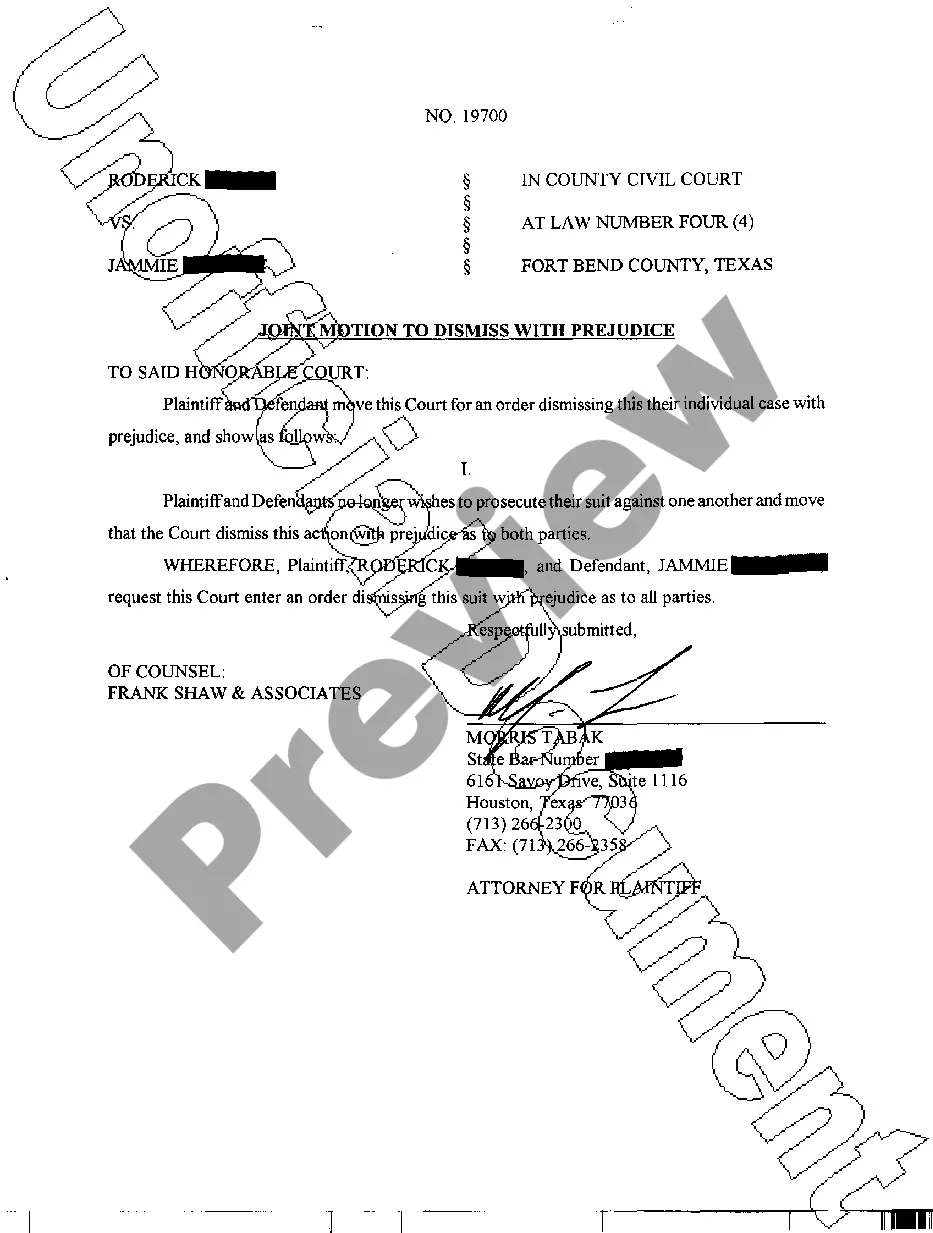

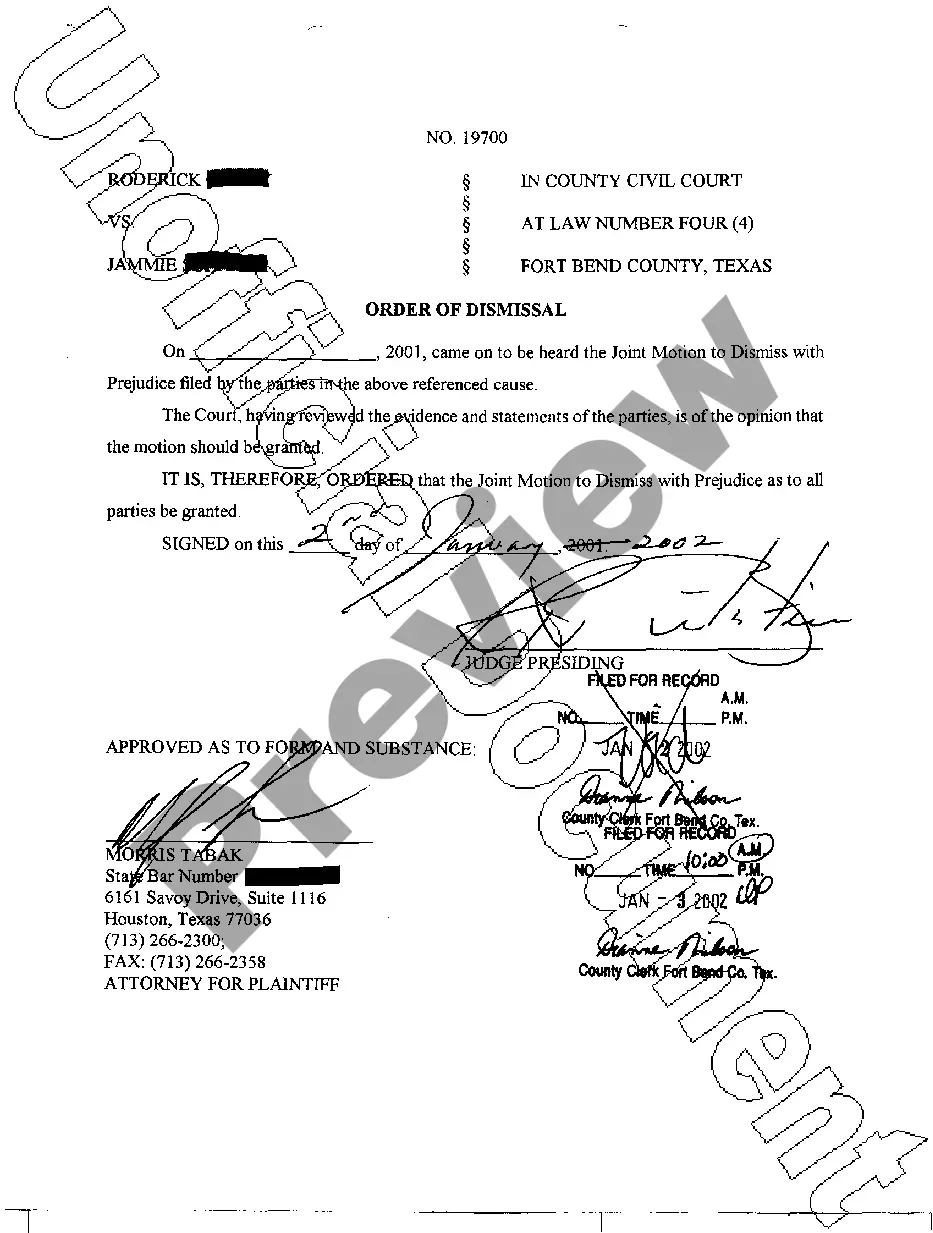

Free preview

How to fill out Portland Oregon Assignment Of Rents?

If you’ve already used our service before, log in to your account and save the Portland Oregon Assignment of Rents on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Make sure you’ve located an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Portland Oregon Assignment of Rents. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!