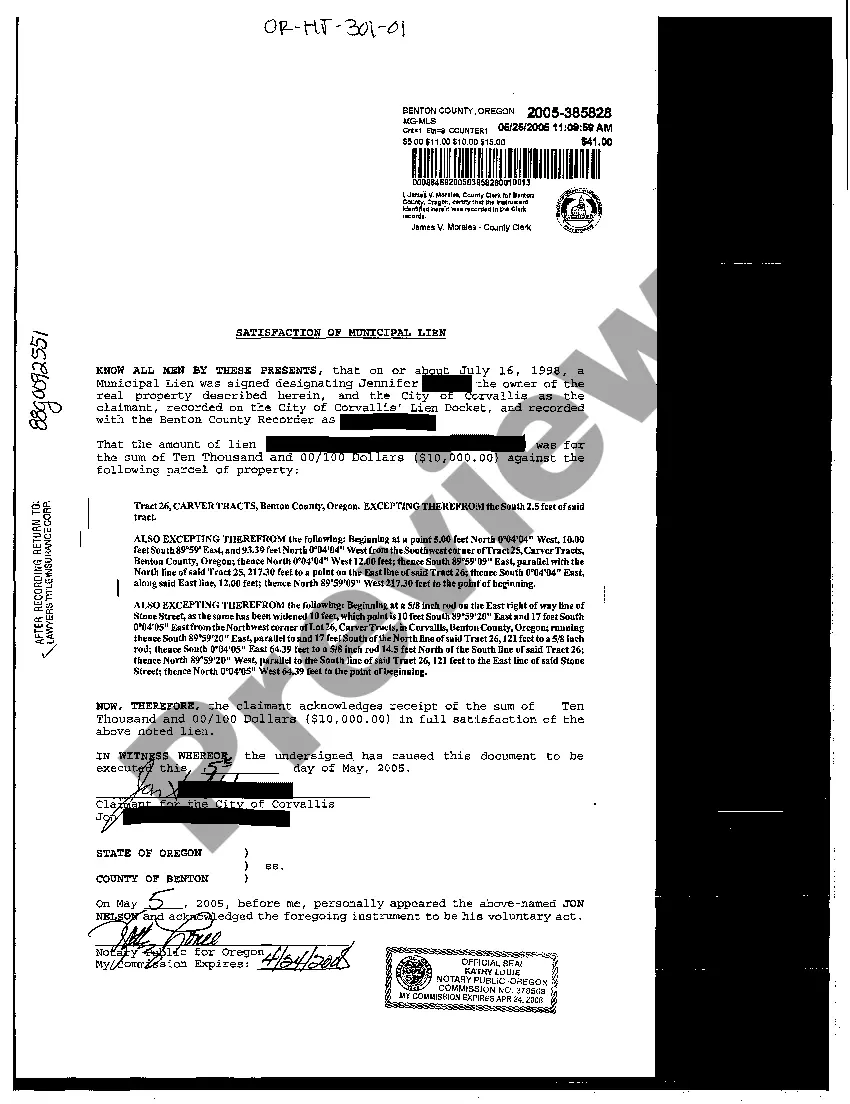

Bend Oregon Satisfaction of Municipal Lien: Explained and Types In Bend, Oregon, the Satisfaction of Municipal Lien is a legal process that allows property owners to resolve outstanding liens placed on their property by the local municipality. A municipal lien is often imposed when property owners fail to pay certain municipal charges or fees, such as property taxes, special assessments, or fines. Resolving these liens is crucial for property owners seeking to clear their title, sell, or refinance their property. The Satisfaction of Municipal Lien process in Bend involves the following steps: 1. Identification of the Lien: Property owners must first determine the nature and scope of the lien, which can vary depending on the specific municipal charges or fees owed. Liens can originate from unpaid property taxes, code violations, utility bills, or any other costs imposed by the municipality. 2. Verification of the Lien Amount: The property owner must ensure that the amount claimed in the lien is accurate. This typically involves reviewing official records and verifying the balance owed, including any penalties or interest that may have accrued. 3. Payment or Negotiation: Once the lien amount is verified, the property owner has two options: pay the balance in full or negotiate with the municipality for a reduced settlement. Negotiations may involve discussing a payment plan, requesting a partial waiver of penalties, or exploring other options to satisfy the lien. 4. Documenting the Satisfaction: After settling the outstanding balance, the property owner must obtain a satisfaction document from the municipal authority that issued the lien. This document, often called a "Release of Lien" or "Satisfaction of Lien," certifies that the lien has been satisfied and should be recorded with the county recorder or clerk's office to remove the lien from the property's title. In Bend, Oregon, there are a few different types of Satisfaction of Municipal Lien that property owners might encounter: 1. Property Tax Liens: These are the most common type of lien, imposed when property owners fail to pay their property taxes. Resolving property tax liens is essential for property owners to maintain clear title and avoid potential foreclosure proceedings. 2. Code Violation Liens: If property owners violate local building codes, zoning regulations, or property maintenance requirements, the municipality can impose liens to ensure compliance. Resolving these liens usually involves addressing the code violations and paying any associated fines or penalties. 3. Utility Lien: Failure to pay utility bills, such as water, sewer, or garbage services, can result in the municipality placing a lien on the property. Resolving utility liens requires paying off the outstanding balances, often in addition to any potential penalties or late fees. In conclusion, the Bend Oregon Satisfaction of Municipal Lien process is crucial for property owners seeking to resolve outstanding liens imposed by the municipality. By identifying the type of lien, verifying the amount owed, negotiating if necessary, and obtaining the necessary documentation, property owners can successfully remove liens from their property titles and ensure a clean and clear ownership.

Bend Oregon Satisfaction of Municipal Lien

Description

How to fill out Bend Oregon Satisfaction Of Municipal Lien?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for a person without any law education to draft such papers from scratch, mainly because of the convoluted terminology and legal subtleties they come with. This is where US Legal Forms can save the day. Our platform provides a huge catalog with over 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you require the Bend Oregon Satisfaction of Municipal Lien or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Bend Oregon Satisfaction of Municipal Lien in minutes using our reliable platform. If you are presently an existing customer, you can go ahead and log in to your account to download the appropriate form.

However, in case you are new to our platform, ensure that you follow these steps before obtaining the Bend Oregon Satisfaction of Municipal Lien:

- Ensure the form you have chosen is good for your location since the rules of one state or county do not work for another state or county.

- Review the form and read a quick outline (if available) of scenarios the document can be used for.

- In case the form you chosen doesn’t suit your needs, you can start over and look for the needed document.

- Click Buy now and choose the subscription option you prefer the best.

- Access an account {using your login information or register for one from scratch.

- Pick the payment gateway and proceed to download the Bend Oregon Satisfaction of Municipal Lien once the payment is through.

You’re all set! Now you can go ahead and print out the form or fill it out online. Should you have any issues getting your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.