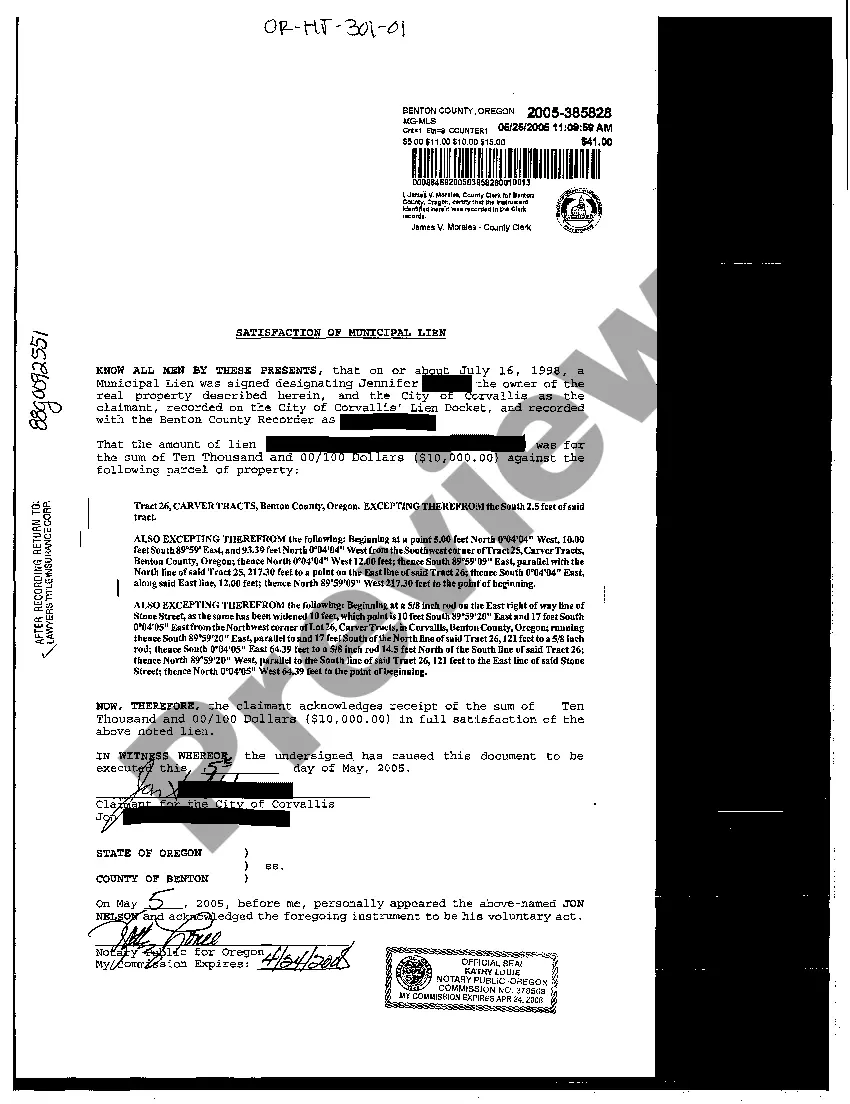

A Detailed Description of Eugene, Oregon Satisfaction of Municipal Lien In Eugene, Oregon, satisfaction of municipal lien refers to the process of resolving a municipal lien that has been placed on a property due to unpaid taxes or other municipal charges. This lien serves as a claim by the local government on the property, making it necessary to resolve the outstanding dues before any further actions can be taken. The satisfaction of municipal lien in Eugene involves several steps to ensure a property owner clears their dues and releases the lien encumbering the property title. These steps typically include: 1. Identification of the Lien: When a property owner receives notification of a municipal lien against their property, it is essential to carefully review all relevant documentation to understand the nature of the lien, including the outstanding balance, the reason for the lien, and the due process involved. 2. Payment Plan Options: Eugene, Oregon offers various payment plan options to property owners facing a municipal lien. These plans allow individuals to pay off their debts gradually over an extended period, making it easier to manage their financial obligations. 3. Settlement Negotiations: In certain cases, property owners may opt for negotiation with the municipal authority to settle the lien. This could involve discussing payment plans or potential reductions in the outstanding balance in exchange for prompt payment or other mutually agreed-upon terms. 4. Full Payment: A property owner can satisfy the municipal lien by paying the full amount owed. This typically involves settling the principal amount along with any accrued interest and additional fees specified by the municipality. 5. Lien Release: Once the payment is made, the city or municipality will issue a satisfaction or release of lien document, which needs to be recorded with the county recorder's office. This document serves as evidence that the lien has been fully satisfied and is no longer encumbering the property. Different Types of Eugene, Oregon Satisfaction of Municipal Lien: There are various types of municipal liens that can be placed on a property in Eugene, Oregon. Some common types include: 1. Property Tax Liens: Municipal liens can be enforced due to unpaid property taxes. These liens ensure that the government has a claim on the property until the outstanding taxes are paid. 2. Municipal Code Violation Liens: If a property owner has violated certain municipal codes, such as building or zoning regulations, the city may place a lien on the property. These liens aim to compel owners to rectify the violations or pay fines or penalties related to the violation. 3. Utility Liens: Municipalities may impose liens on properties with outstanding utility bills, including water, sewer, or garbage collection services. These liens ensure that property owners settle the unpaid utility charges before transferring ownership or making further improvements. 4. Special Assessments and Fees: Municipalities may also place liens on properties for special assessments or fees related to public improvements or services, such as street repairs, sidewalk installations, or neighborhood revitalization projects. Understanding the process and types of Eugene, Oregon satisfaction of municipal lien is crucial for property owners to handle such situations effectively. It is always recommended consulting with legal and financial professionals to ensure compliance with local regulations and secure a smooth resolution.

Eugene Oregon Satisfaction of Municipal Lien

Description

How to fill out Eugene Oregon Satisfaction Of Municipal Lien?

No matter the social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for someone without any legal education to draft this sort of paperwork from scratch, mostly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our platform offers a massive collection with more than 85,000 ready-to-use state-specific documents that work for practically any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you require the Eugene Oregon Satisfaction of Municipal Lien or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Eugene Oregon Satisfaction of Municipal Lien in minutes employing our reliable platform. If you are already an existing customer, you can go ahead and log in to your account to get the needed form.

Nevertheless, in case you are a novice to our library, ensure that you follow these steps before obtaining the Eugene Oregon Satisfaction of Municipal Lien:

- Ensure the template you have chosen is good for your area considering that the rules of one state or area do not work for another state or area.

- Review the document and read a short description (if provided) of scenarios the document can be used for.

- In case the form you chosen doesn’t meet your requirements, you can start again and look for the suitable document.

- Click Buy now and pick the subscription plan you prefer the best.

- with your login information or create one from scratch.

- Choose the payment method and proceed to download the Eugene Oregon Satisfaction of Municipal Lien as soon as the payment is done.

You’re all set! Now you can go ahead and print out the document or fill it out online. Should you have any issues getting your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.