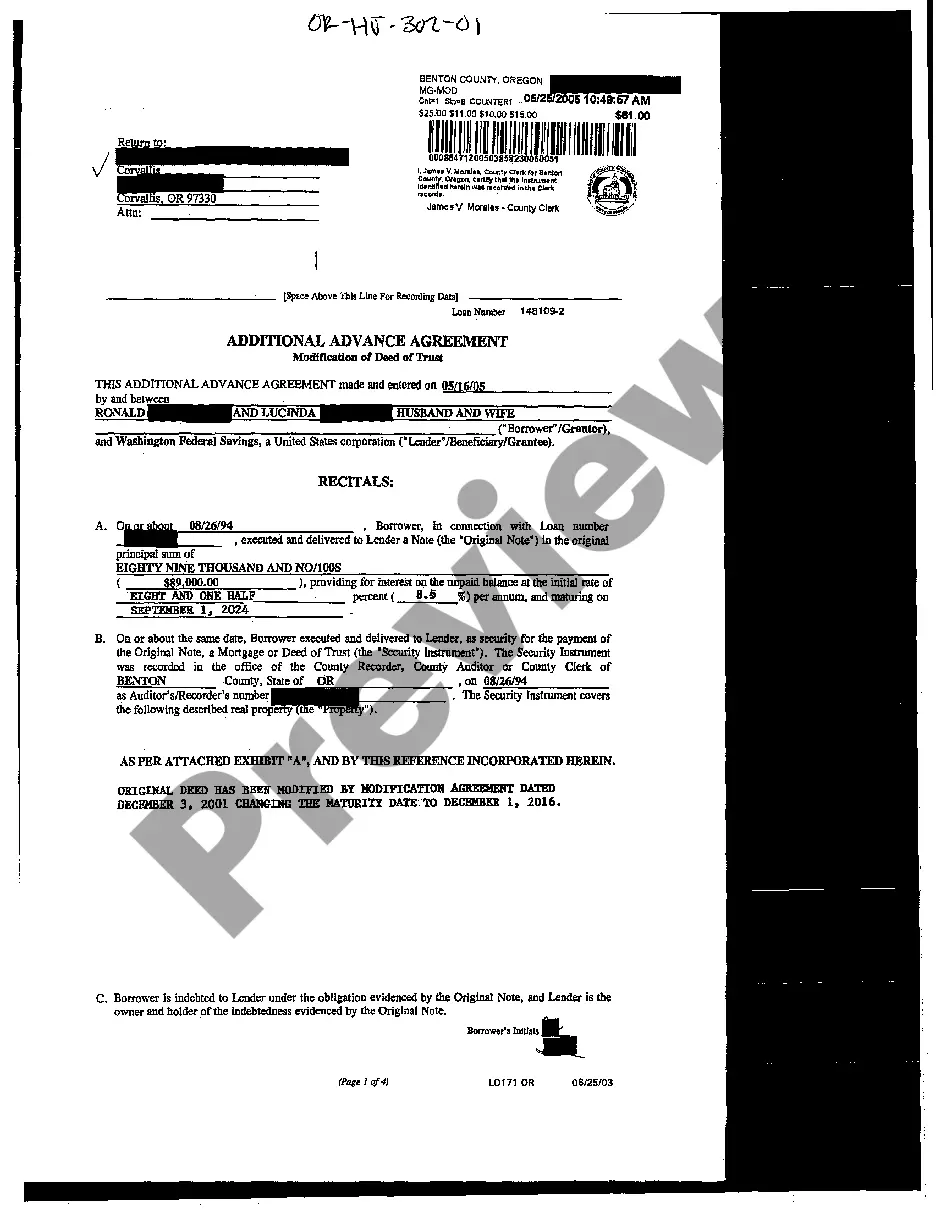

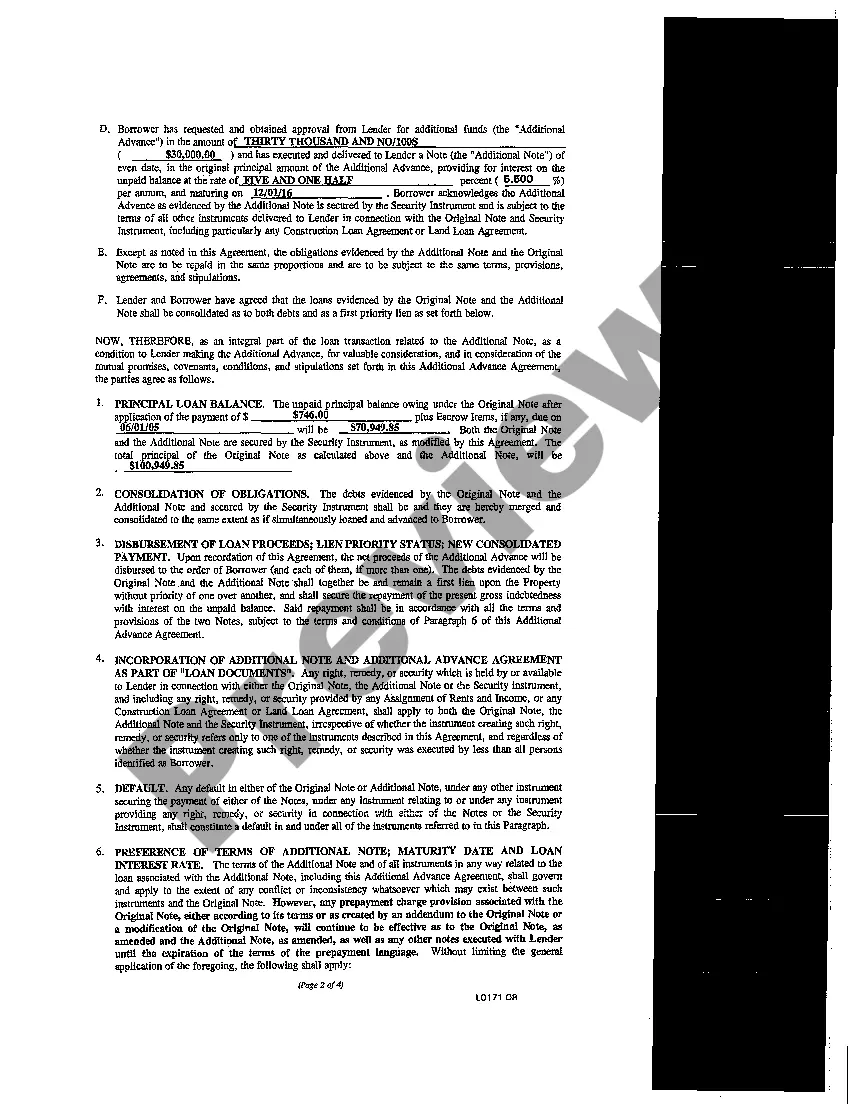

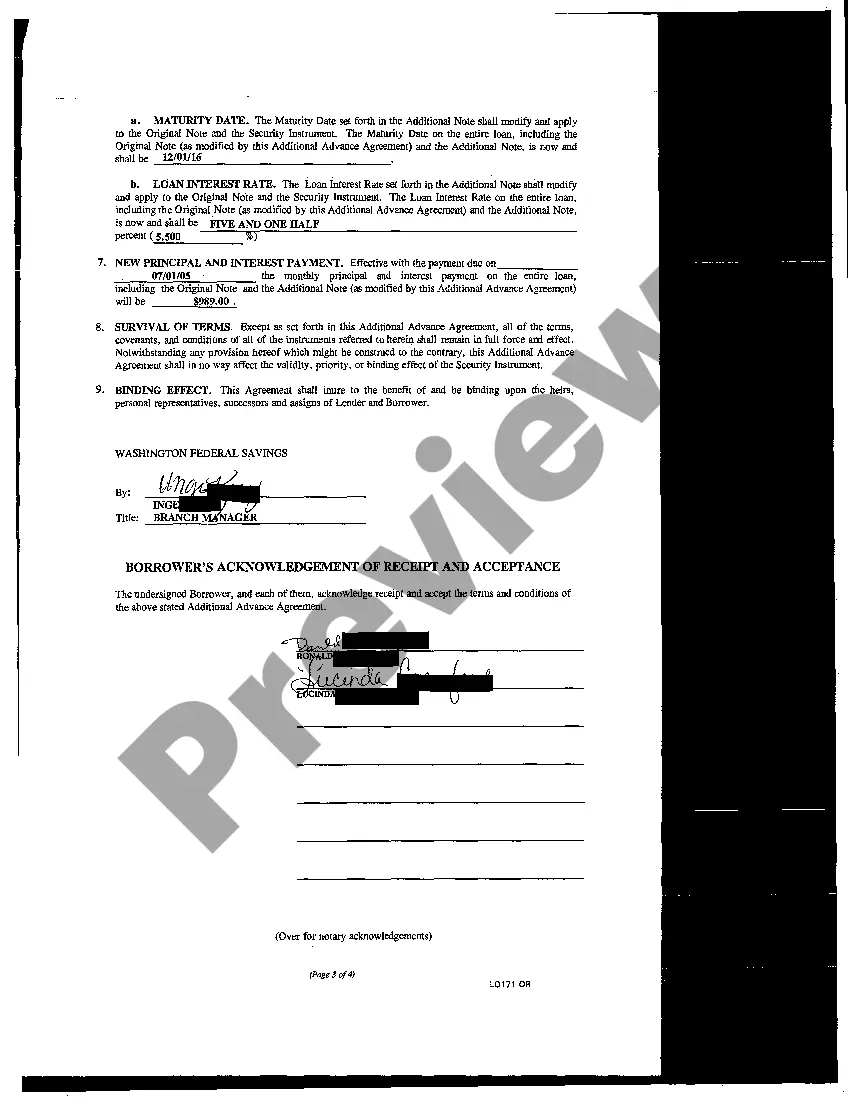

Portland Oregon Additional Advance Agreement is a legal document that outlines the terms and conditions related to obtaining additional advances in the city of Portland, Oregon. This agreement is commonly used by individuals, businesses, or organizations that have previously entered into a loan or credit agreement and wish to access further funds beyond the original agreement. The purpose is to provide clarity and protect the rights of both the borrower and the lender. The Portland Oregon Additional Advance Agreement elaborates on various key aspects, including the conditions under which an additional advance can be requested, the maximum amount that can be borrowed, interest rates, repayment terms, and any associated fees or charges. It typically specifies the required documentation, such as financial statements and credit reports, that the borrower needs to provide to support their request for an additional advance. There are different types of Portland Oregon Additional Advance Agreements that may be tailored to suit specific needs or scenarios. These may include: 1. Personal Additional Advance Agreement: This type of agreement is designed for individuals seeking extra funds for personal reasons, such as home renovations, medical expenses, or education fees. 2. Business Additional Advance Agreement: This agreement is specifically crafted for businesses or organizations requiring additional financing to expand their operations, purchase new equipment, or fund projects. 3. Real Estate Additional Advance Agreement: This agreement is applicable to individuals or developers engaged in real estate projects who need additional funds for construction, property acquisition, or renovations. 4. Emergency Additional Advance Agreement: This type of agreement is formulated to address unforeseen circumstances or emergencies where immediate access to funds is required, such as medical emergencies or unexpected repairs. Regardless of the type, the Portland Oregon Additional Advance Agreement serves as a legally binding contract between the borrower and the lender. It ensures transparency, defines the rights and responsibilities of both parties, and helps prevent misunderstandings or disputes. Please note that while this content provides an overview of the subject, it is essential to consult with a legal professional to fully understand the specifics of a Portland Oregon Additional Advance Agreement and ensure compliance with local laws and regulations.

Portland Oregon Additional Advance Agreement

Description

How to fill out Portland Oregon Additional Advance Agreement?

We always strive to minimize or prevent legal damage when dealing with nuanced law-related or financial matters. To do so, we apply for attorney solutions that, usually, are extremely expensive. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to a lawyer. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Portland Oregon Additional Advance Agreement or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Portland Oregon Additional Advance Agreement complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Portland Oregon Additional Advance Agreement is proper for you, you can select the subscription plan and make a payment.

- Then you can download the document in any available file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!