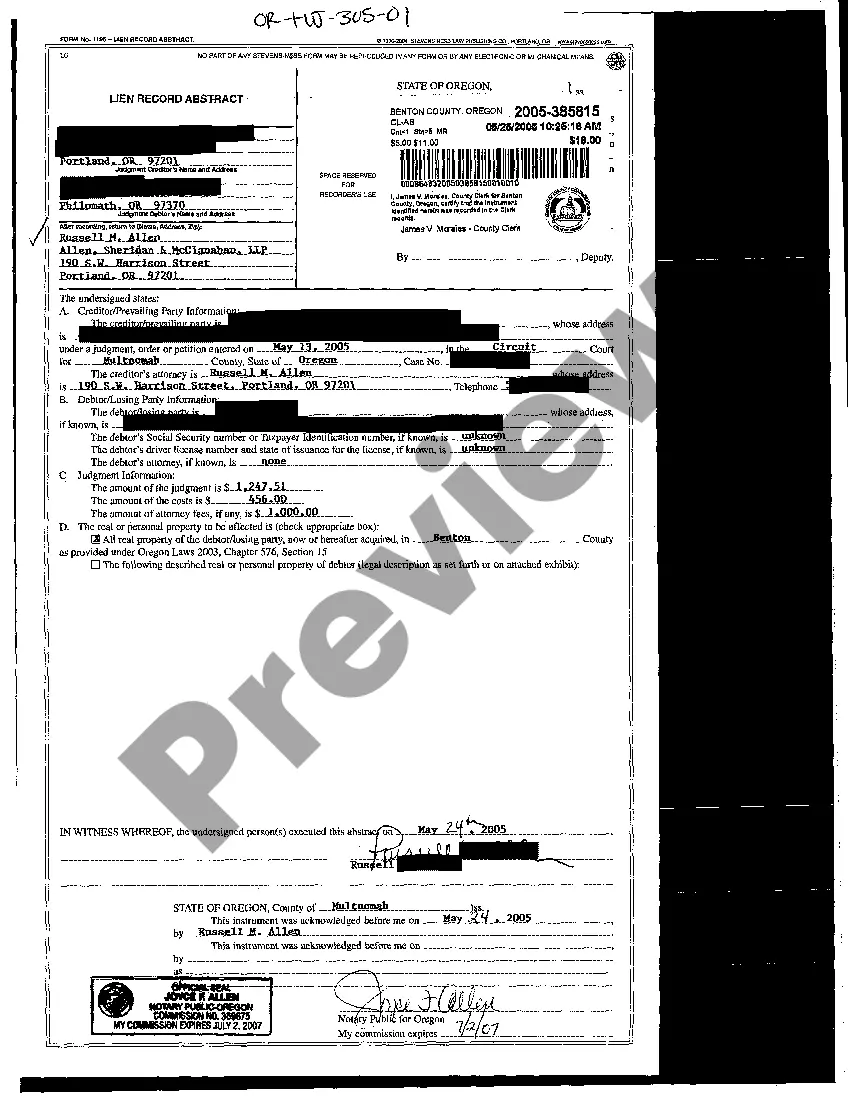

Portland Oregon Lien Record Abstract is a comprehensive document that contains information on various liens associated with properties in the city of Portland, Oregon. This abstract is a vital tool for potential property buyers, lenders, real estate agents, and other stakeholders to gather insights on the existing liens and encumbrances on a property before making any financial commitments. The Portland Oregon Lien Record Abstract provides a detailed account of the liens placed on properties within the city limits, helping stakeholders make informed decisions about property purchases or investments. By examining this abstract, individuals can ascertain if there are any outstanding debts, taxes, or claims against a particular property that may affect its value or transferability. Key Types of Portland Oregon Lien Record Abstracts: 1. Property Tax Lien Abstract: This abstract variant specifically focuses on property tax-related liens. It provides information on any outstanding or delinquent property tax payments associated with a particular property. 2. Mechanic's Lien Abstract: This variant of the Portland Oregon Lien Record Abstract focuses on liens filed by contractors, subcontractors, or suppliers who provided labor, materials, or services for construction or improvement projects. It includes details such as the amount owed, the date of filing, and the involved parties. 3. Judgment Lien Abstract: This abstract showcases liens placed on properties as a result of court judgments. It includes information about any outstanding monetary judgments against the property owner, including the amount owed and the date of the judgment. 4. HOA Lien Abstract: This variant of the Lien Record Abstract focuses on liens filed by the Homeowners' Association (HOA). It contains information about any unpaid HOA fees or violations that can impact the property's marketability or transferability. 5. State Tax Lien Abstract: This abstract variant highlights liens filed by the State of Oregon for unpaid state taxes. It includes details such as the type of tax owed, the amount owed, and the date of filing. 6. Federal Tax Lien Abstract: This variant provides information on liens filed by the Internal Revenue Service (IRS) for unpaid federal taxes. It includes details on the amount owed, the date of filing, and any additional penalties or interest accrued. Potential property buyers, lenders, and real estate professionals can access these specific Portland Oregon Lien Record Abstracts to comprehensively evaluate a property's financial health and mitigate any risks associated with recorded liens. It is important to conduct due diligence by examining these abstracts in order to make informed decisions, protect investments, and ensure a smooth transaction process.

Portland Oregon Lien Record Abstract

Description

How to fill out Portland Oregon Lien Record Abstract?

If you are searching for a valid form template, it’s impossible to find a better service than the US Legal Forms site – one of the most considerable online libraries. Here you can find a large number of document samples for business and individual purposes by categories and regions, or keywords. With the high-quality search option, getting the most recent Portland Oregon Lien Record Abstract is as elementary as 1-2-3. Moreover, the relevance of each and every file is proved by a group of skilled lawyers that regularly check the templates on our website and update them based on the newest state and county requirements.

If you already know about our platform and have an account, all you should do to receive the Portland Oregon Lien Record Abstract is to log in to your user profile and click the Download option.

If you make use of US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have found the sample you require. Check its information and utilize the Preview option to check its content. If it doesn’t suit your needs, utilize the Search option at the top of the screen to discover the needed file.

- Confirm your selection. Click the Buy now option. After that, pick the preferred pricing plan and provide credentials to register an account.

- Process the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Obtain the form. Indicate the format and save it on your device.

- Make changes. Fill out, revise, print, and sign the received Portland Oregon Lien Record Abstract.

Every single form you add to your user profile has no expiry date and is yours permanently. You can easily gain access to them using the My Forms menu, so if you want to receive an extra duplicate for enhancing or creating a hard copy, feel free to return and export it once again anytime.

Make use of the US Legal Forms professional collection to get access to the Portland Oregon Lien Record Abstract you were looking for and a large number of other professional and state-specific templates in one place!