Eugene, Oregon Change or Modification of Deed of Trusts: A Comprehensive Overview Keywords: Eugene Oregon, Change or Modification, Deed of Trust, Types Introduction: In Eugene, Oregon, a change or modification of a deed of trust refers to the legal process through which alterations are made to the terms, conditions, or parties involved in an existing deed of trust. These changes allow lenders and borrowers to modify the original agreement to better suit their evolving needs and circumstances. Several types of changes or modifications are recognized in Eugene, Oregon. Let's explore them in detail: 1. Substitution of Trustee: One common type of change in Eugene, Oregon, is the substitution of trustee. This occurs when the lender, also known as the beneficiary, appoints a new trustee to oversee the deed of trust. Reasons for substitution may include replacing an unresponsive trustee or assigning a more qualified professional to handle the ongoing obligations and responsibilities associated with the trust. 2. Amendment to Loan Terms: Borrowers and lenders may decide to modify the loan terms stated in the original deed of trust. Such adjustments might include changes to interest rates, repayment schedules, loan amounts, or adding/removing prepayment penalties. These amendments aim to provide financial flexibility to borrowers and ensure the continued success of the lending relationship. 3. Addition or Removal of Co-Borrowers: If there is a need to alter the list of people responsible for repaying the loan, a change or modification of a deed of trust will be necessary. This modification allows for the addition or removal of co-borrowers while ensuring compliance with legal requirements and financial implications concerning the property. 4. Release of Collateral: A change or modification may also be required if the borrower seeks to release a portion of the collateral identified in the original deed of trust. This process permits the removal of specific properties from the trust while maintaining the validity of the remaining terms. 5. Assignment or Transfer of Interest: In some cases, a lender may choose to assign or transfer its interest in the deed of trust to another entity. This change ensures proper documentation and allows for the smooth transition of rights and responsibilities between the original lender and the new party. Additional Considerations: When pursuing a change or modification of a deed of trust in Eugene, Oregon, it is crucial to adhere to legal requirements, consult with an experienced attorney, and ensure that all parties involved consent to the modifications. Proper documentation, including a recorded modification agreement, is necessary to validate and enforce the changes made. Conclusion: Eugene, Oregon recognizes various types of changes or modifications to deed of trusts, including substitution of trustee, amendment of loan terms, addition or removal of co-borrowers, release of collateral, and assignment or transfer of interest. Each modification serves to address the specific needs and circumstances of the borrower and lender while ensuring compliance with legal regulations. Seeking professional advice when undertaking these modifications is essential to safeguard the rights and interests of all parties involved.

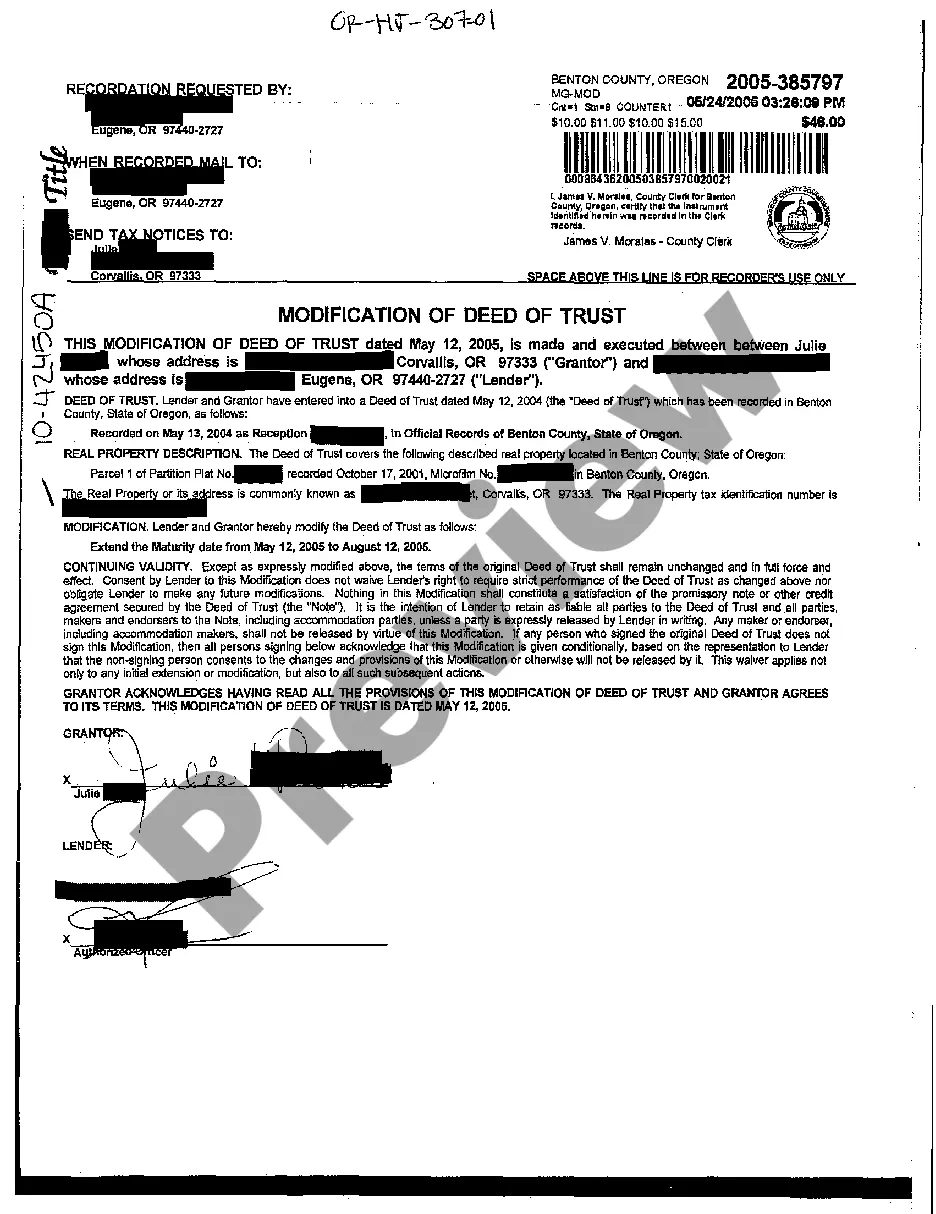

Eugene Oregon Change or Modification of Deed of Trusts

Description

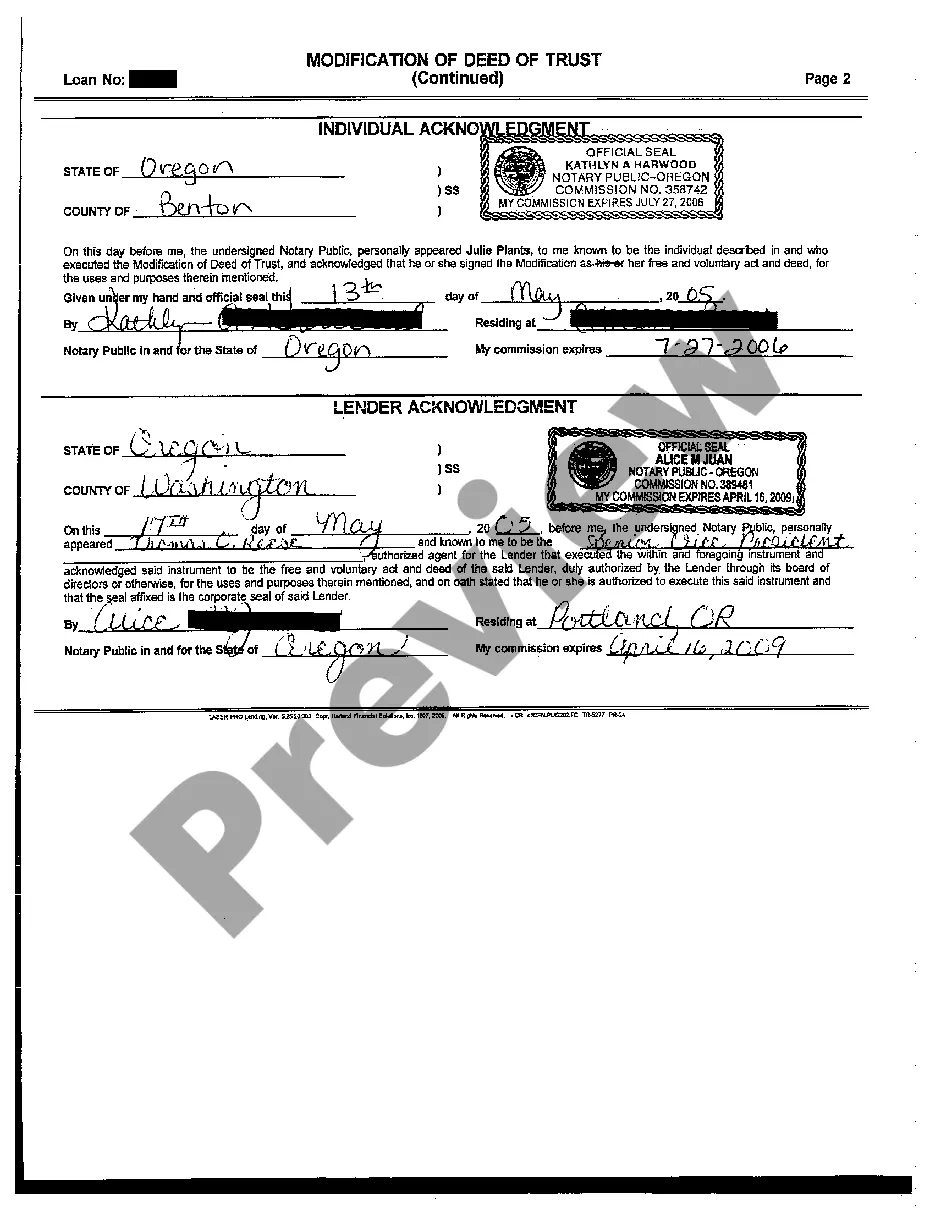

How to fill out Eugene Oregon Change Or Modification Of Deed Of Trusts?

Are you looking for a reliable and affordable legal forms provider to buy the Eugene Oregon Change or Modification of Deed of Trusts? US Legal Forms is your go-to choice.

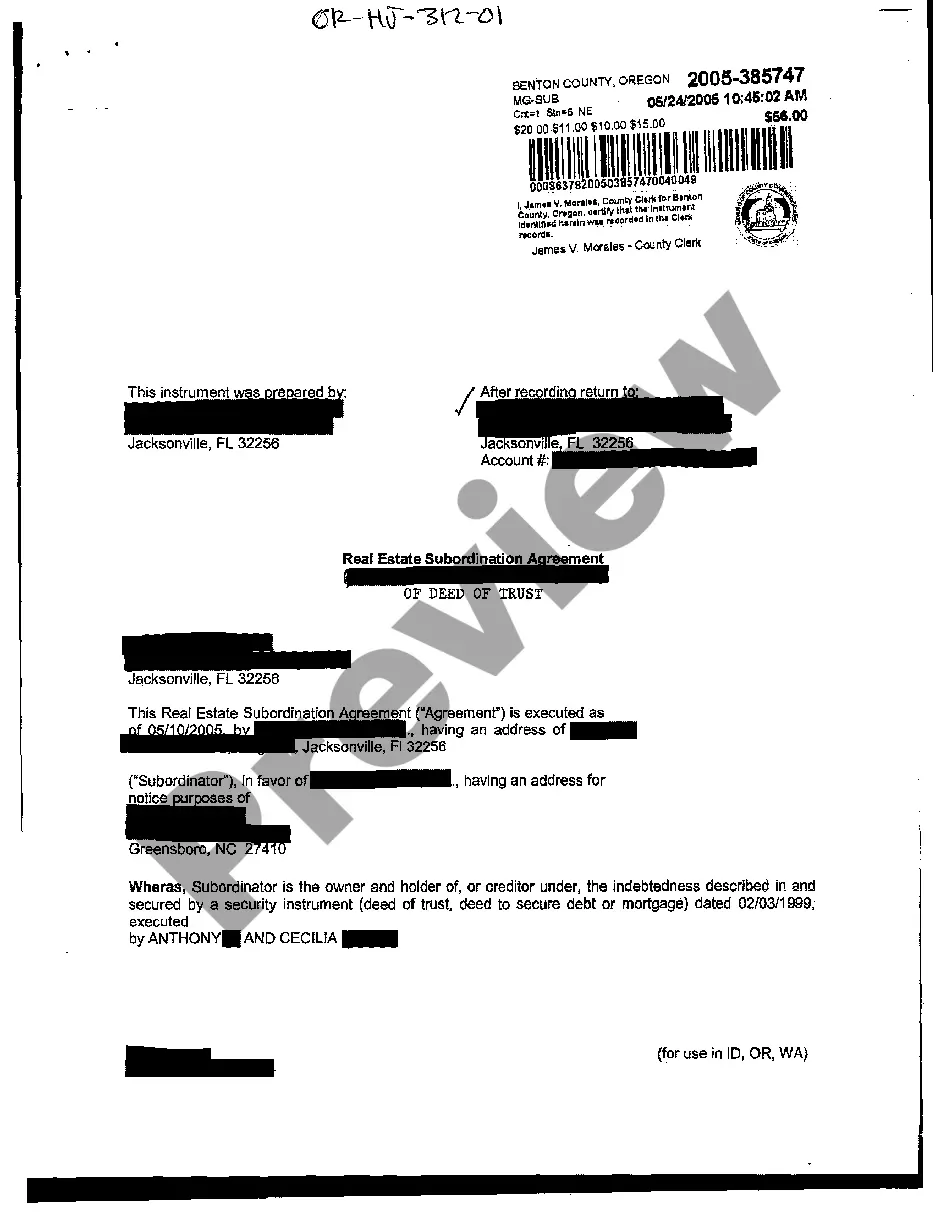

No matter if you require a simple agreement to set rules for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed in accordance with the requirements of separate state and area.

To download the form, you need to log in account, find the required form, and click the Download button next to it. Please take into account that you can download your previously purchased document templates at any time in the My Forms tab.

Are you new to our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Eugene Oregon Change or Modification of Deed of Trusts conforms to the laws of your state and local area.

- Read the form’s description (if available) to find out who and what the form is good for.

- Restart the search if the form isn’t good for your specific scenario.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Eugene Oregon Change or Modification of Deed of Trusts in any available format. You can get back to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting hours researching legal paperwork online for good.