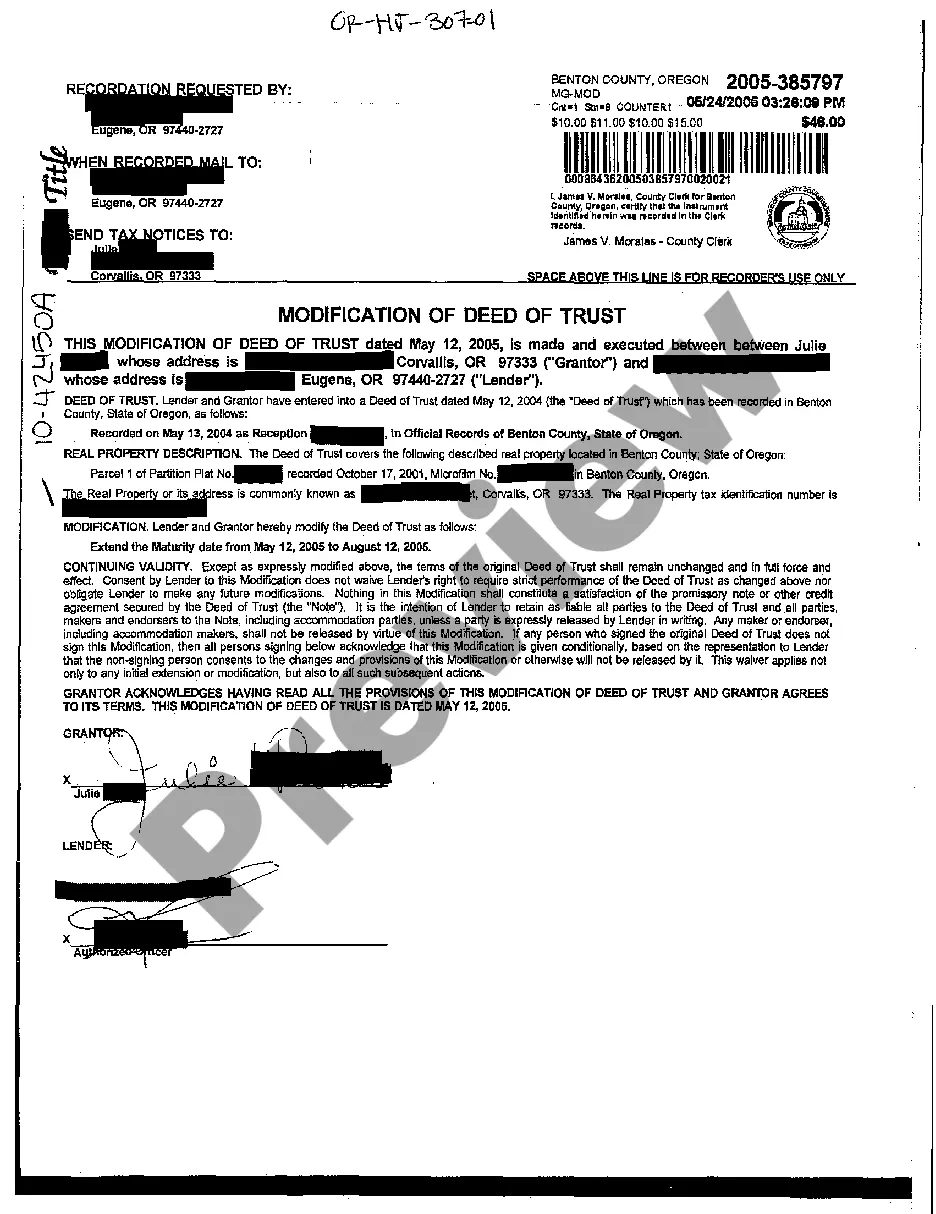

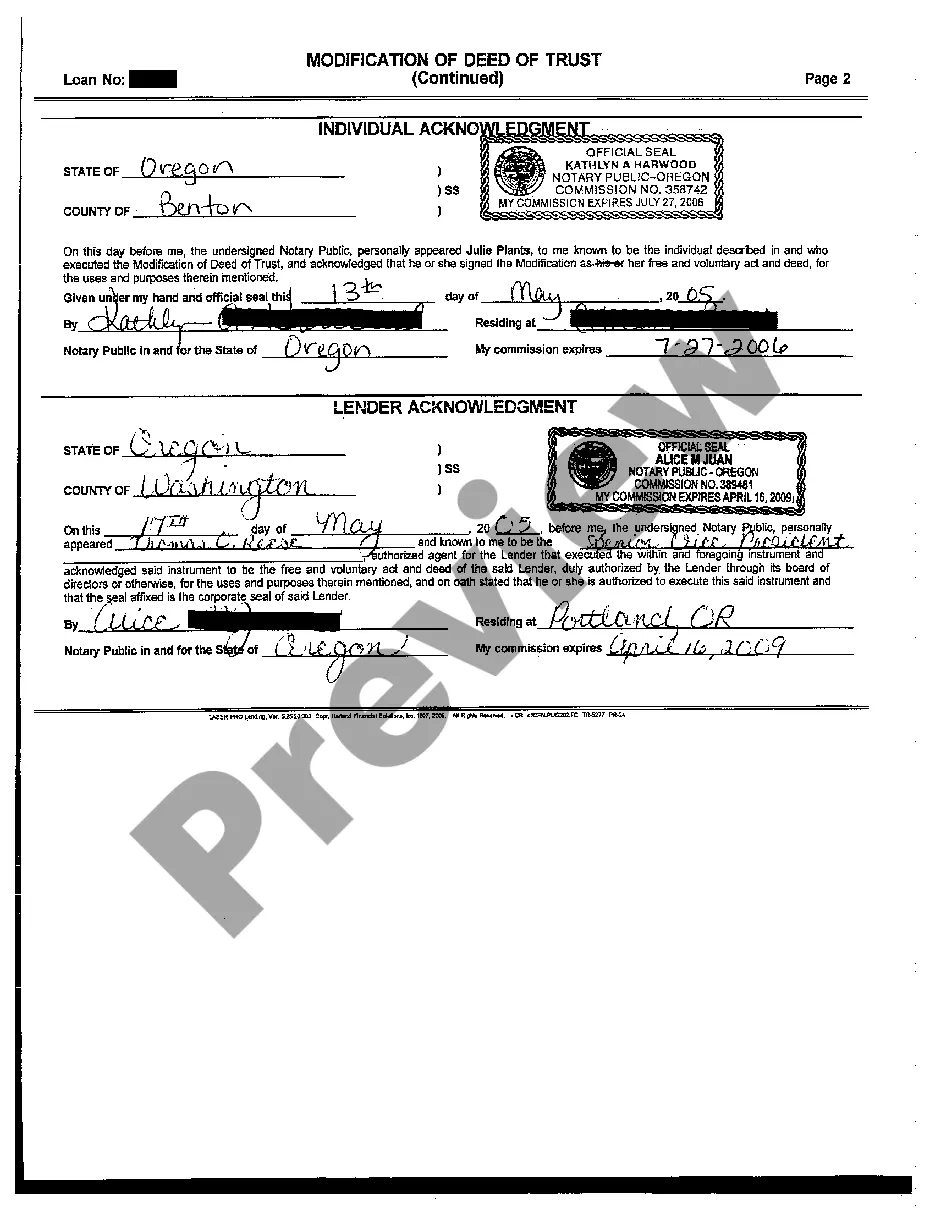

Portland Oregon Change or Modification of Deed of Trusts: A Comprehensive Guide Introduction: In Portland, Oregon, the process of changing or modifying a deed of trust can be essential for homeowners and lenders seeking to alter the terms of a trust agreement. Whether it involves adjusting interest rates, extending loan terms, or adding or removing a party to the trust, the knowledgeable handling of these changes is crucial to ensure legal compliance and protect the rights and interests of all involved parties. In this article, we will delve into the details of change or modification of deed of trusts in Portland, Oregon, outlining the main types of modifications and providing a comprehensive overview of the process. 1. Types of Portland Oregon Change or Modification of Deed of Trusts: a) Interest Rate Modification: This type of modification involves altering the interest rate on an existing mortgage loan. It may be pursued to accommodate changing market conditions, lower monthly payments, or reduce the overall cost of the loan. b) Loan Term Extension: Homeowners or lenders may seek to extend the loan term, allowing for more manageable monthly payments or accommodating unforeseen financial circumstances. Extending the loan term can provide flexibility and alleviate financial burdens. c) Assumption Agreement Modification: Should one party wish to assume the responsibilities and obligations of the deed of trust, a modification to the assumption agreement is necessary. This frees the original borrower from loan obligations and transfers them to the new party. d) Co-borrower Addition or Removal: This modification involves adding or removing a co-borrower from the deed of trust. It often occurs in cases of marriage, divorce, or changes in financial responsibility. 2. Process of Change or Modification of Deed of Trusts: a) Consultation: To initiate the change or modification process, homeowners or lenders must consult with a qualified real estate attorney or a reputable title company to ensure compliance with state laws and regulations. b) Documentation: Prepare the necessary documents for modification, including a modification agreement, promissory note, and any other supporting documentation required by the lender or involved parties. c) Notarization: All modifications must undergo notarization to attest to the authenticity and validity of the changes being made. The parties involved must sign the modified documents in front of a notary public. d) Recording: Submit the modified documents for recording at the county recorder's office where the property is located. Pay the applicable recording fees, and obtain proof of recording for future reference. e) Notice to All Parties: After recording, provide a copy of the modified documents to all relevant parties, including the lender, homeowner, co-borrowers, and any other involved entities. f) Compliance Check: Ensure that the modification complies with the terms set forth by the lender, as failure to comply may result in penalties or invalidated modifications. g) Retain Copies: Maintain a secure copy of all modified documents for future reference and legal protection. Conclusion: The change or modification of deed of trusts in Portland, Oregon, provides homeowners and lenders with the flexibility needed to adapt to changing financial circumstances, market conditions, and personal situations. Whether it involves interest rate adjustments, loan term extensions, assumption agreement modifications, or changes in co-borrower arrangements, seeking professional guidance and adhering to the legal requirements of the modification process are essential. By doing so, homeowners and lenders can ensure a smooth and legally sound modification process that protects the rights and interests of all parties involved in the deed of trust agreement.

Portland Oregon Change or Modification of Deed of Trusts

State:

Oregon

City:

Portland

Control #:

OR-HJ-307-01

Format:

PDF

Instant download

This form is available by subscription

Description

Change or Modification of Deed of Trusts

Portland Oregon Change or Modification of Deed of Trusts: A Comprehensive Guide Introduction: In Portland, Oregon, the process of changing or modifying a deed of trust can be essential for homeowners and lenders seeking to alter the terms of a trust agreement. Whether it involves adjusting interest rates, extending loan terms, or adding or removing a party to the trust, the knowledgeable handling of these changes is crucial to ensure legal compliance and protect the rights and interests of all involved parties. In this article, we will delve into the details of change or modification of deed of trusts in Portland, Oregon, outlining the main types of modifications and providing a comprehensive overview of the process. 1. Types of Portland Oregon Change or Modification of Deed of Trusts: a) Interest Rate Modification: This type of modification involves altering the interest rate on an existing mortgage loan. It may be pursued to accommodate changing market conditions, lower monthly payments, or reduce the overall cost of the loan. b) Loan Term Extension: Homeowners or lenders may seek to extend the loan term, allowing for more manageable monthly payments or accommodating unforeseen financial circumstances. Extending the loan term can provide flexibility and alleviate financial burdens. c) Assumption Agreement Modification: Should one party wish to assume the responsibilities and obligations of the deed of trust, a modification to the assumption agreement is necessary. This frees the original borrower from loan obligations and transfers them to the new party. d) Co-borrower Addition or Removal: This modification involves adding or removing a co-borrower from the deed of trust. It often occurs in cases of marriage, divorce, or changes in financial responsibility. 2. Process of Change or Modification of Deed of Trusts: a) Consultation: To initiate the change or modification process, homeowners or lenders must consult with a qualified real estate attorney or a reputable title company to ensure compliance with state laws and regulations. b) Documentation: Prepare the necessary documents for modification, including a modification agreement, promissory note, and any other supporting documentation required by the lender or involved parties. c) Notarization: All modifications must undergo notarization to attest to the authenticity and validity of the changes being made. The parties involved must sign the modified documents in front of a notary public. d) Recording: Submit the modified documents for recording at the county recorder's office where the property is located. Pay the applicable recording fees, and obtain proof of recording for future reference. e) Notice to All Parties: After recording, provide a copy of the modified documents to all relevant parties, including the lender, homeowner, co-borrowers, and any other involved entities. f) Compliance Check: Ensure that the modification complies with the terms set forth by the lender, as failure to comply may result in penalties or invalidated modifications. g) Retain Copies: Maintain a secure copy of all modified documents for future reference and legal protection. Conclusion: The change or modification of deed of trusts in Portland, Oregon, provides homeowners and lenders with the flexibility needed to adapt to changing financial circumstances, market conditions, and personal situations. Whether it involves interest rate adjustments, loan term extensions, assumption agreement modifications, or changes in co-borrower arrangements, seeking professional guidance and adhering to the legal requirements of the modification process are essential. By doing so, homeowners and lenders can ensure a smooth and legally sound modification process that protects the rights and interests of all parties involved in the deed of trust agreement.

Free preview

How to fill out Portland Oregon Change Or Modification Of Deed Of Trusts?

If you’ve already utilized our service before, log in to your account and download the Portland Oregon Change or Modification of Deed of Trusts on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Portland Oregon Change or Modification of Deed of Trusts. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!