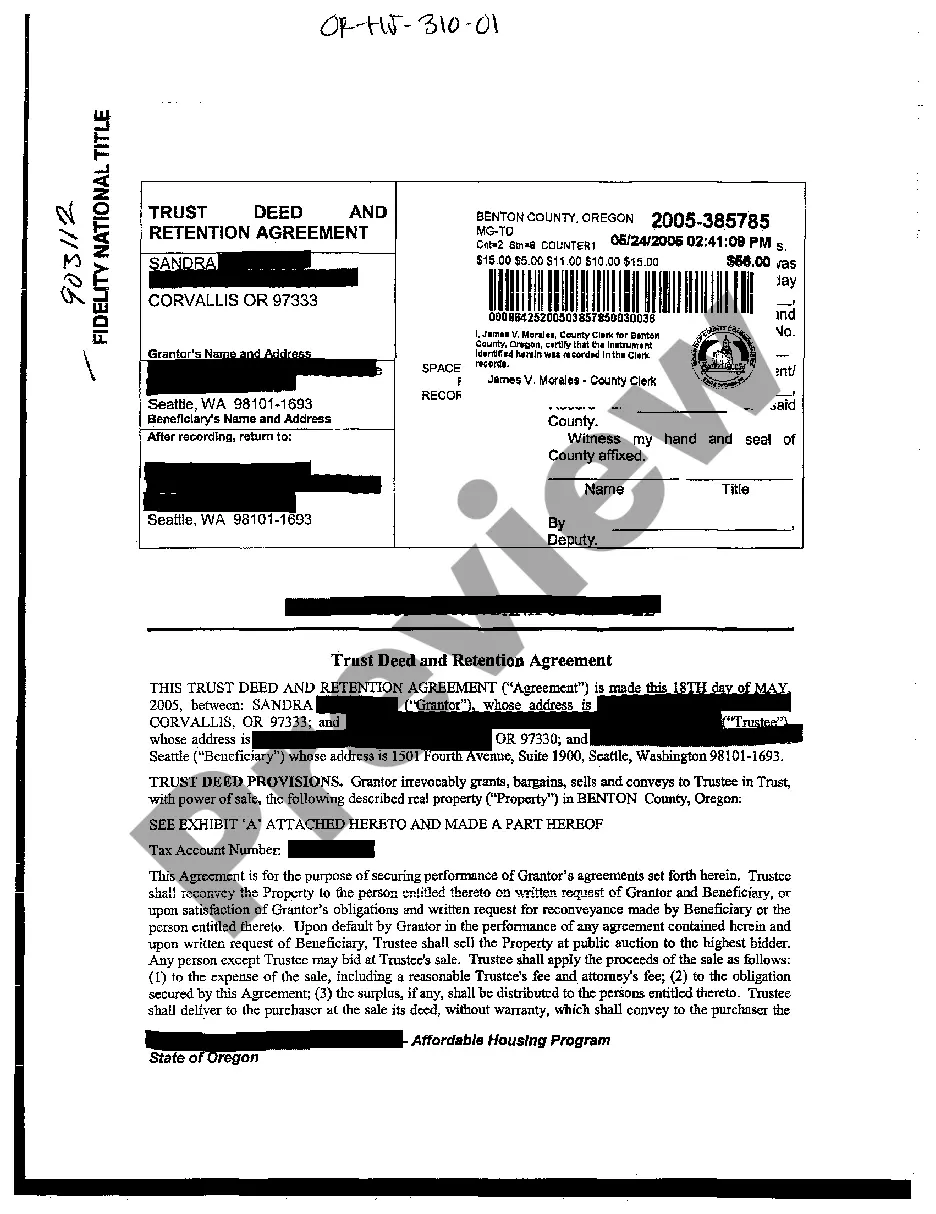

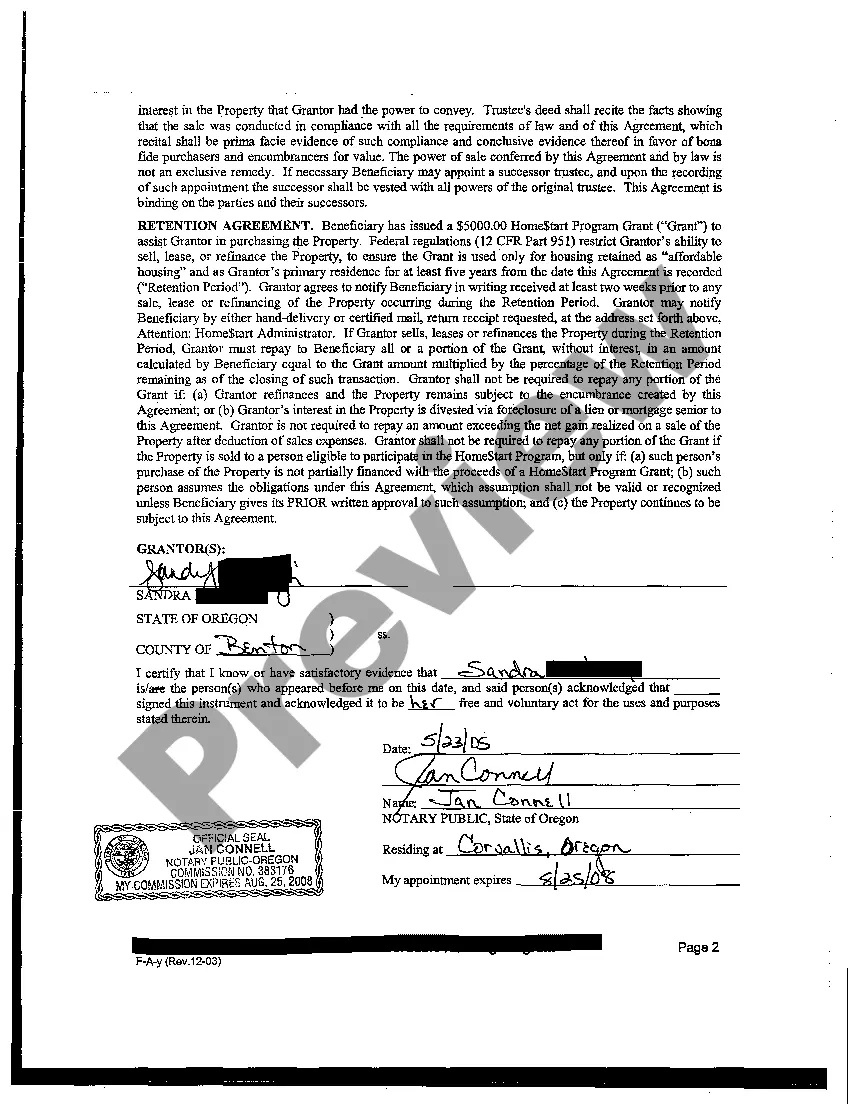

A Bend Oregon Trust Deed and Retention Agreement is a legal document that serves as a security instrument for a real estate transaction in Bend, Oregon. This agreement involves three parties: the borrower (also known as the trust or), the lender (also known as the beneficiary), and a neutral third party known as the trustee. The purpose of a trust deed is to provide security to the lender in the event that the borrower defaults on their loan payments. It involves the borrower transferring the legal title of their property to the trustee, who holds it as security on behalf of the lender until the loan is fully repaid. There are different types of Bend Oregon Trust Deed and Retention Agreements: 1. Standard Trust Deed and Retention Agreement: This is the most common type of trust deed used in real estate transactions. It outlines the terms and conditions of the loan, including the interest rate, payment schedule, and any additional provisions agreed upon by the borrower and the lender. 2. Junior Trust Deed and Retention Agreement: In some cases, there may be multiple trust deeds on a property. A junior trust deed is a secondary lien that is subordinate to the first trust deed. If the property goes into foreclosure, the senior trust deed (first lien) is paid off first before any funds go to the junior trust deed. 3. Trust Deed and Retention Agreement with Power of Sale: This type of trust deed includes a power of sale provision, which gives the trustee the authority to sell the property without court involvement in the event of default. This helps expedite the foreclosure process and allows the lender to recover their investment faster. It is important for both the borrower and the lender to fully understand the terms and implications of the Bend Oregon Trust Deed and Retention Agreement before entering into it. Seeking legal advice and conducting thorough due diligence is recommended to ensure all parties involved are protected and knowledgeable about their rights and obligations.

Bend Oregon Trust Deed and Retention Agreement

State:

Oregon

City:

Bend

Control #:

OR-HJ-310-01

Format:

PDF

Instant download

This form is available by subscription

Description

Trust Deed and Retention Agreement

A Bend Oregon Trust Deed and Retention Agreement is a legal document that serves as a security instrument for a real estate transaction in Bend, Oregon. This agreement involves three parties: the borrower (also known as the trust or), the lender (also known as the beneficiary), and a neutral third party known as the trustee. The purpose of a trust deed is to provide security to the lender in the event that the borrower defaults on their loan payments. It involves the borrower transferring the legal title of their property to the trustee, who holds it as security on behalf of the lender until the loan is fully repaid. There are different types of Bend Oregon Trust Deed and Retention Agreements: 1. Standard Trust Deed and Retention Agreement: This is the most common type of trust deed used in real estate transactions. It outlines the terms and conditions of the loan, including the interest rate, payment schedule, and any additional provisions agreed upon by the borrower and the lender. 2. Junior Trust Deed and Retention Agreement: In some cases, there may be multiple trust deeds on a property. A junior trust deed is a secondary lien that is subordinate to the first trust deed. If the property goes into foreclosure, the senior trust deed (first lien) is paid off first before any funds go to the junior trust deed. 3. Trust Deed and Retention Agreement with Power of Sale: This type of trust deed includes a power of sale provision, which gives the trustee the authority to sell the property without court involvement in the event of default. This helps expedite the foreclosure process and allows the lender to recover their investment faster. It is important for both the borrower and the lender to fully understand the terms and implications of the Bend Oregon Trust Deed and Retention Agreement before entering into it. Seeking legal advice and conducting thorough due diligence is recommended to ensure all parties involved are protected and knowledgeable about their rights and obligations.

Free preview

How to fill out Bend Oregon Trust Deed And Retention Agreement?

If you’ve already utilized our service before, log in to your account and download the Bend Oregon Trust Deed and Retention Agreement on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Ensure you’ve found a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Bend Oregon Trust Deed and Retention Agreement. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!