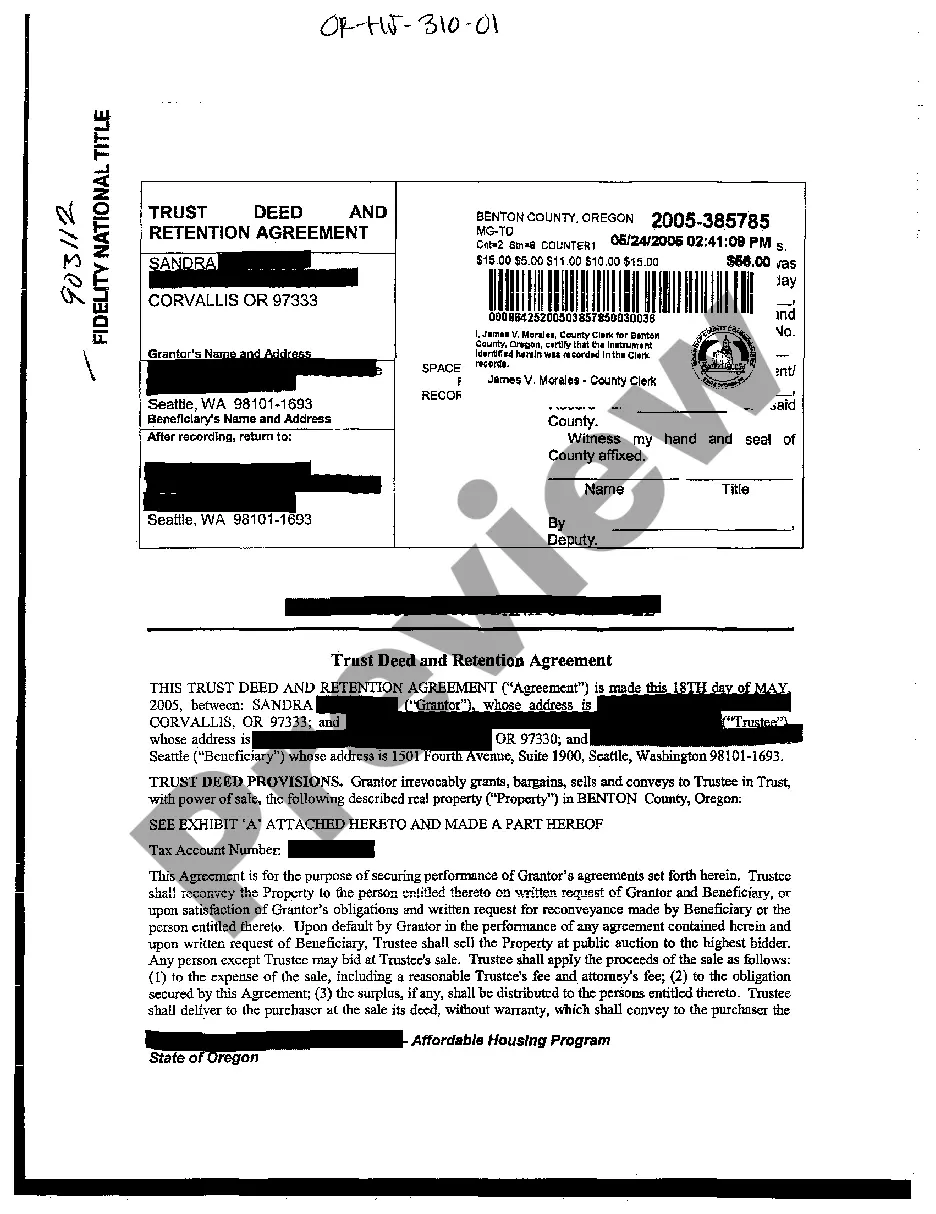

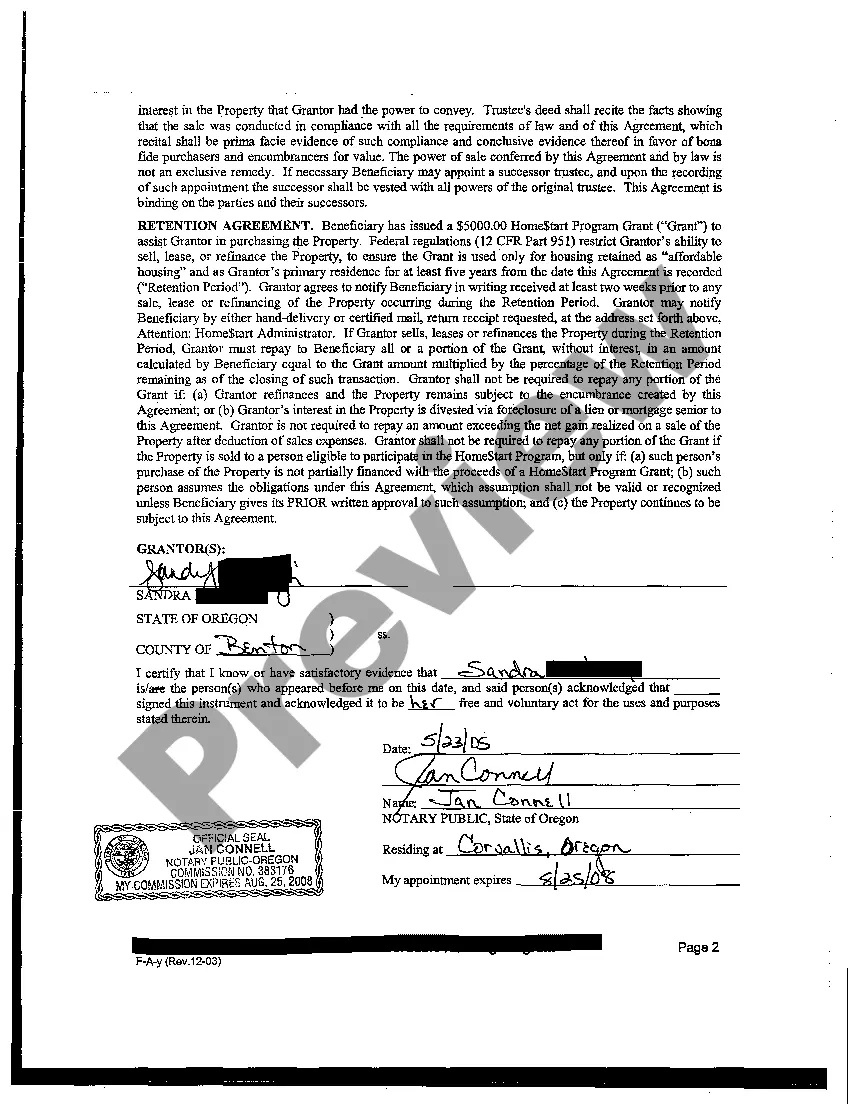

Gresham Oregon Trust Deed and Retention Agreement is a legal contract that serves as a means of securing a loan or financing for a property in Gresham, Oregon. This agreement is commonly used in real estate transactions and is regulated by Oregon state laws. A Gresham Oregon Trust Deed and Retention Agreement involves three parties: the borrower (also known as the trust or), the lender (also known as the beneficiary), and the trustee. The borrower is the owner of the property, usually seeking financing for various purposes such as purchasing a new property, home improvement, or debt consolidation. The lender, often a financial institution or private lender, provides the funds for the loan. To secure the loan, the borrower signs a promissory note, which outlines the terms of repayment and interest. Additionally, the borrower grants a trust deed to the lender, allowing them to place a lien on the property. The trustee, usually a third party, holds the legal title to the property until the loan is repaid in full. They act as a neutral party to ensure that both the borrower and lender fulfill their obligations as stated in the agreement. In case of default by the borrower, the trustee has the authority to initiate foreclosure proceedings to recover the remaining debt by selling the property. There are several types of Gresham Oregon Trust Deed and Retention Agreements, each with its own nuances and purposes. These include: 1. First Trust Deed: This is the primary lien on the property and takes priority over any other subsequent loans or liens on the property. 2. Second Trust Deed: Also known as a second mortgage, it is subordinate to the first trust deed and is typically obtained when the borrower needs additional financing. 3. Junior Trust Deed: Similar to a second trust deed, it is a subordinate lien but is third or lower in priority behind previous trust deeds. 4. Wraparound Trust Deed: In this arrangement, the borrower assumes the existing loan and extends it with additional financing, creating a new trust deed. The wraparound trust deed consolidates both loans and allows the borrower to make a single payment. Overall, Gresham Oregon Trust Deed and Retention Agreement provides a reliable and legally binding method of securing financing for properties in Gresham, Oregon. It offers benefits to both borrowers and lenders, ensuring transparency and protection of interests throughout the loan repayment process.

Gresham Oregon Trust Deed and Retention Agreement

Description

How to fill out Gresham Oregon Trust Deed And Retention Agreement?

If you are searching for a relevant form template, it’s impossible to find a better service than the US Legal Forms website – one of the most comprehensive libraries on the web. With this library, you can get a large number of document samples for company and individual purposes by categories and states, or keywords. With our advanced search option, discovering the latest Gresham Oregon Trust Deed and Retention Agreement is as easy as 1-2-3. Moreover, the relevance of every file is confirmed by a team of expert attorneys that regularly check the templates on our website and update them in accordance with the latest state and county demands.

If you already know about our system and have an account, all you need to get the Gresham Oregon Trust Deed and Retention Agreement is to log in to your account and click the Download button.

If you use US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have chosen the sample you require. Look at its explanation and utilize the Preview function (if available) to see its content. If it doesn’t meet your needs, use the Search option near the top of the screen to get the needed record.

- Confirm your decision. Choose the Buy now button. After that, pick your preferred subscription plan and provide credentials to register an account.

- Process the transaction. Make use of your bank card or PayPal account to finish the registration procedure.

- Get the template. Select the file format and download it on your device.

- Make modifications. Fill out, edit, print, and sign the received Gresham Oregon Trust Deed and Retention Agreement.

Every template you add to your account has no expiry date and is yours permanently. You can easily access them via the My Forms menu, so if you need to receive an extra version for enhancing or creating a hard copy, feel free to return and download it again at any moment.

Make use of the US Legal Forms extensive catalogue to gain access to the Gresham Oregon Trust Deed and Retention Agreement you were seeking and a large number of other professional and state-specific samples in one place!