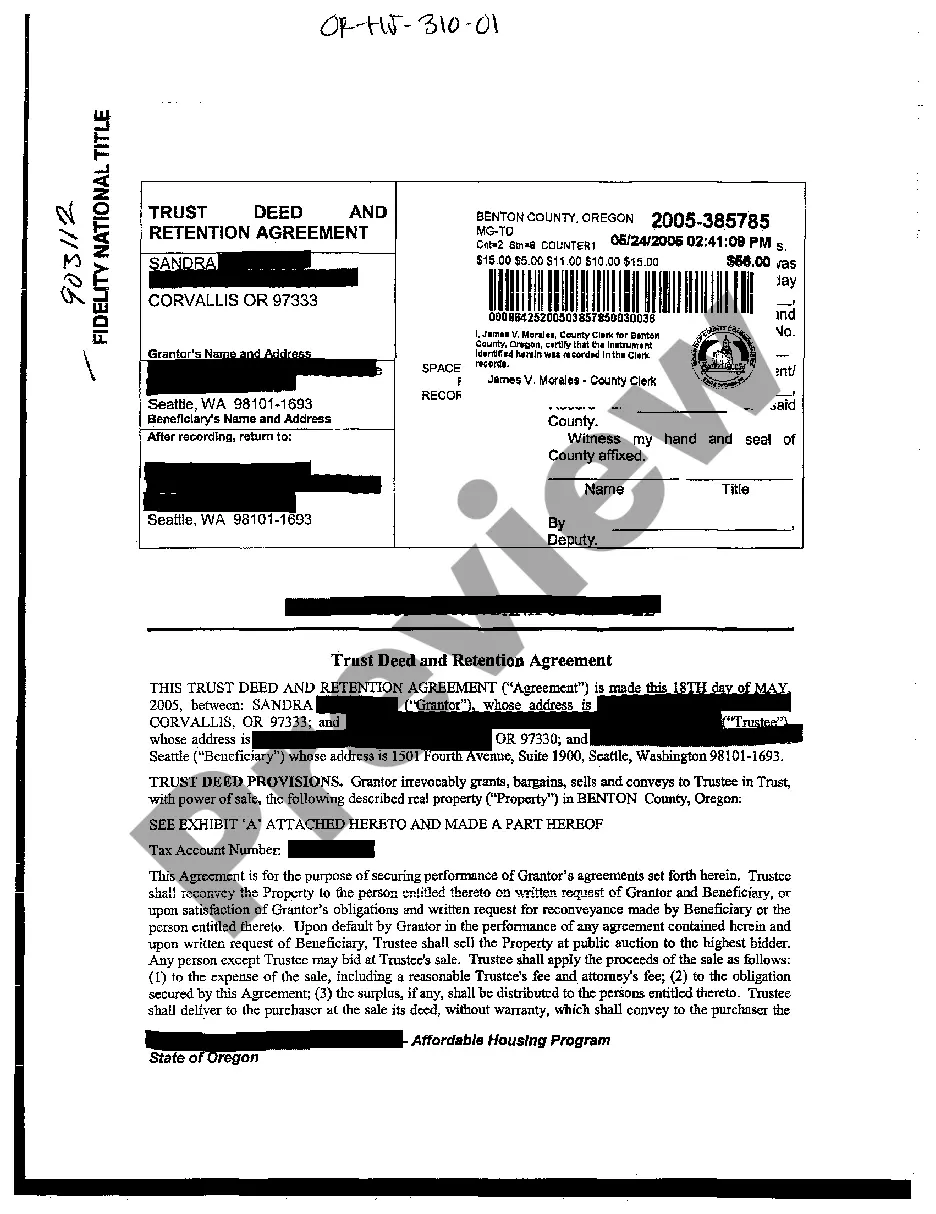

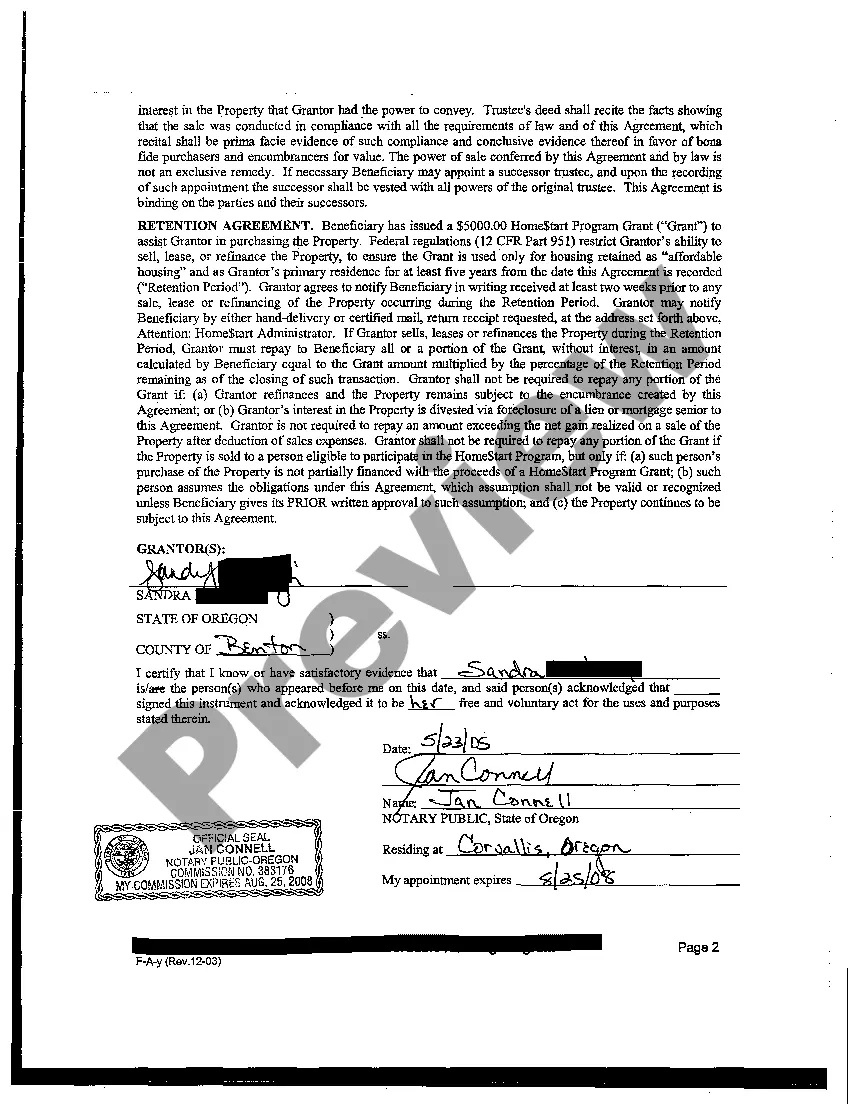

Portland Oregon Trust Deed and Retention Agreement: Detailed Description and Types A Portland Oregon Trust Deed and Retention Agreement is a legal document that outlines the terms and conditions between a lender, a borrower, and a trustee in a real estate transaction in Portland, Oregon. This agreement is commonly used in the state to secure a loan against a property. By signing this agreement, the borrower acknowledges the debt owed to the lender and grants the lender the right to hold a trustee's legal title to the property as collateral until the debt is repaid. The Trust Deed and Retention Agreement typically consists of several key elements, including: 1. Parties Involved: It identifies the lender, the borrower, and the trustee appointed to hold the title of the property. 2. Property Description: This section provides a detailed description of the property being used as collateral for the loan, including its address, legal description, and boundaries. 3. Loan Terms: The agreement specifies the loan amount, interest rate, repayment terms, and any additional fees or charges associated with the loan. It also outlines the consequences of late payments or default. 4. Transfer of Title: The borrower transfers the legal title of the property to the trustee to be held until the loan is fully repaid. This ensures that if the borrower fails to meet their obligations, the lender can initiate foreclosure proceedings. 5. Default and Foreclosure: The agreement includes provisions that define the circumstances under which the borrower could be considered in default, such as non-payment of installments or violation of the agreement terms. It also outlines the foreclosure process that the lender can undertake in case of default. Different types of Portland Oregon Trust Deed and Retention Agreements include: 1. First Trust Deed: This is the most common type of trust deed used in real estate transactions. It is the primary lien on the property and takes priority in case of foreclosure or sale of the property. 2. Second Trust Deed: This type of trust deed is a secondary lien on the property, typically obtained when the borrower needs additional financing beyond the first trust deed. In case of default, the first trust deed holder has priority over the second trust deed holder. 3. Wraparound Trust Deed: This trust deed combines multiple loans into a single agreement. It allows the borrower to make one payment to the primary lender, who distributes the appropriate amounts to the secondary lenders. In conclusion, a Portland Oregon Trust Deed and Retention Agreement is a legally binding document that secures the repayment of a loan using a property as collateral. It protects the interests of both the lender and the borrower while facilitating real estate transactions in the Portland area. The various types of trust deeds, including first, second, and wraparound trust deeds, provide flexibility based on the borrower's financial needs and borrowing requirements.

Portland Oregon Trust Deed and Retention Agreement

Description

How to fill out Portland Oregon Trust Deed And Retention Agreement?

Obtaining verified templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

This is an online collection of over 85,000 legal documents catering to both personal and professional requirements, as well as various real-life scenarios.

All the files are accurately sorted by purpose and jurisdiction types, enabling you to find the Portland Oregon Trust Deed and Retention Agreement swiftly and effortlessly.

Maintaining paperwork organized and compliant with legal standards is crucial. Utilize the US Legal Forms library to consistently have essential document templates readily available for any purpose!

- Review the Preview mode and document description.

- Ensure you've chosen the correct one that satisfies your needs and fully aligns with your local jurisdiction requirements.

- Look for an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to locate the appropriate one.

- If it meets your criteria, advance to the following step.

Form popularity

FAQ

Because of this, deeds of trusts can be preferable, especially for smaller, non-traditional lenders....Start Deed of Trust. StateMortgage allowedDeed of trust allowedOklahomaYOregonYPennsylvaniaYRhode IslandY47 more rows

The Oregon Trust Deed Act was established in 1959 to make the foreclosure process easier and faster by not involving the courts. The Act allows the lender to file a trust deed, which assigns the deed to a third-party (trustee).

A legal document (which may be a deed or other instrument) that creates a trust. The trust document appoints the trustees and states the terms of the trust, including who the beneficiaries are and the trust property that will be subject to the trust.

The Beneficiary of a Deed of Trust is the Lender, and the Deed serves to protect their investment. The Trustor is the borrower. While the legal title on the property is put into a Trust, as long as timely and consistent payments are made, the borrower has equitable title.

The trustee must be one of the following: An attorney under the Oregon State Bar. A law firm under the Oregon State Bar. A title company.

The Oregon Trust Deed Act (OTDA) requires lenders to record all deed of trust assignments before initiating nonjudicial foreclosures.

A legal document that creates a trust, giving a person or organization the right to manage money or property for someone else, and says how this should be done: The trust deed stated clearly what they were entitled to do with the property. The pension scheme is governed by a trust deed and a set of rules.

A trust deed is similar to a mortgage but usually gives the security holder a ?right of sale.? This ?right of sale? allows the security holder to foreclose on the property without having to file a lawsuit in court. This process is called ?foreclosure by advertisement and sale? and is found in ORS 86.735.

?Beneficiary? means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).