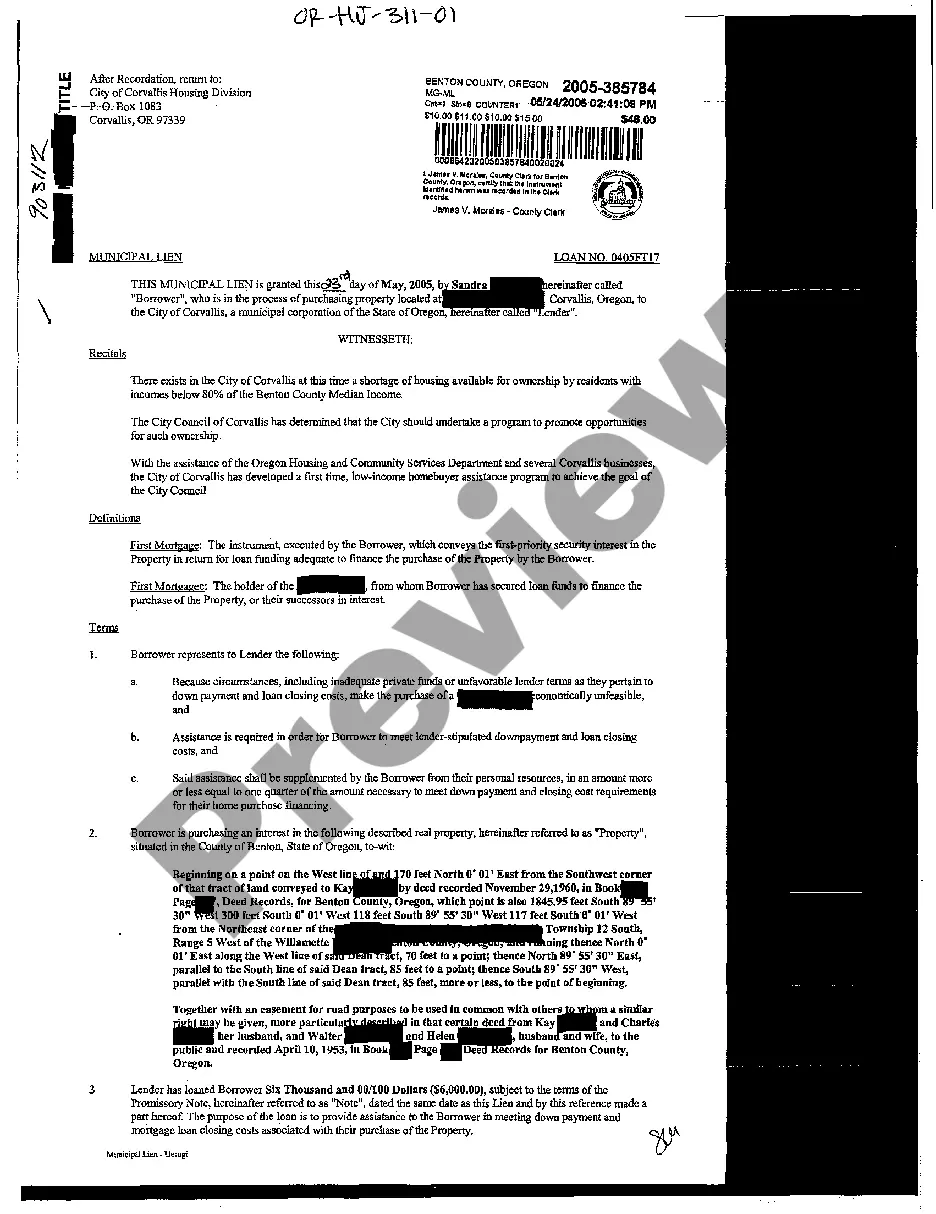

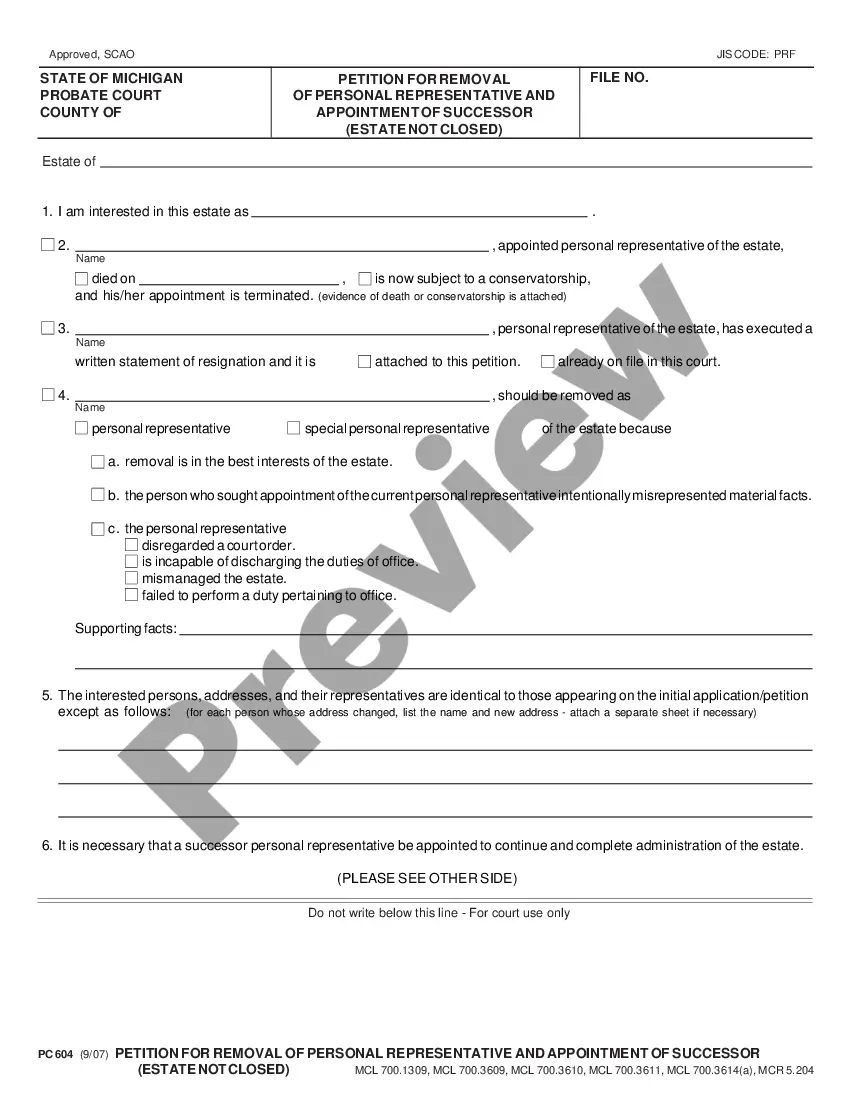

Gresham Oregon Municipal Lien is a legal claim or encumbrance placed on a property within the city limits of Gresham, Oregon, by the municipal government. This lien is typically imposed when property owners fail to pay their outstanding debts to the city, such as unpaid water bills, property taxes, fines, or code violations. Municipal liens serve as a way for the city to recover these delinquent payments by giving them the authority to pursue the sale of the property to satisfy the debt. The lien is recorded with the county recorder's office and becomes part of the property's public records, alerting potential buyers or lenders of the outstanding debt. There are several types of Gresham Oregon Municipal Liens that can be imposed depending on the nature of the debt owed to the city: 1. Property tax lien: When property owners fail to pay their property taxes, the city may place a property tax lien on the property. This lien takes precedence over other liens and may lead to foreclosure if left unresolved. 2. Water and sewer lien: If property owners neglect to pay their water and sewer bills, the city has the authority to place a lien on the property. This ensures payment for the services provided by the city and may result in a shut-off of utilities if the debt remains unpaid. 3. Code enforcement lien: Gresham's municipal government can issue code violations for various reasons, such as unkempt properties or failure to comply with building regulations. If these violations go unaddressed, the city can place a code enforcement lien on the property in question. 4. Fine lien: In instances where individuals receive fines for violations such as traffic violations, parking tickets, or other city infractions and refuse or fail to pay them, the city can impose a fine lien on the property, making it an encumbrance on the title. To remove any type of Gresham Oregon Municipal Lien, property owners must repay the outstanding debt, including any interest or penalties incurred. Once the debt is settled, the lien will be released, and the property's title will be free from encumbrances. It's important for property owners to promptly address any unpaid bills or violations to avoid the potential consequences of a municipal lien on their property.

Gresham Oregon Municipal Lien

Description

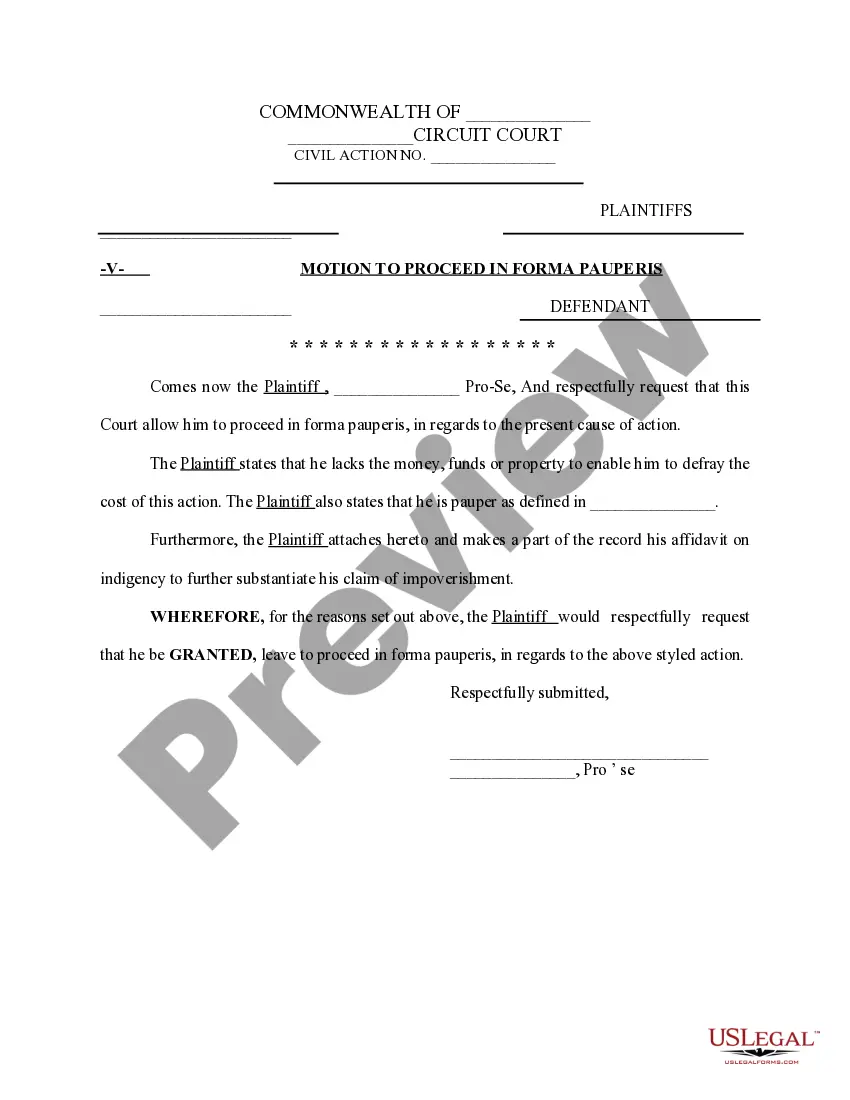

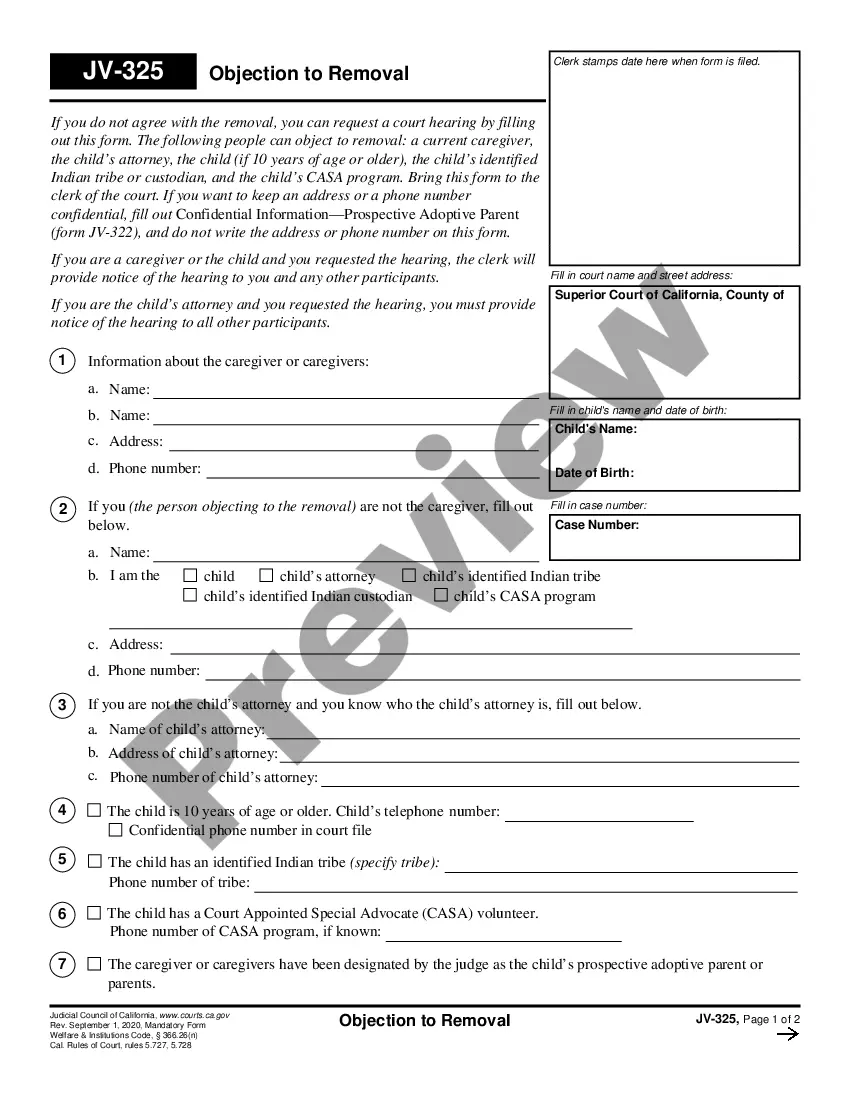

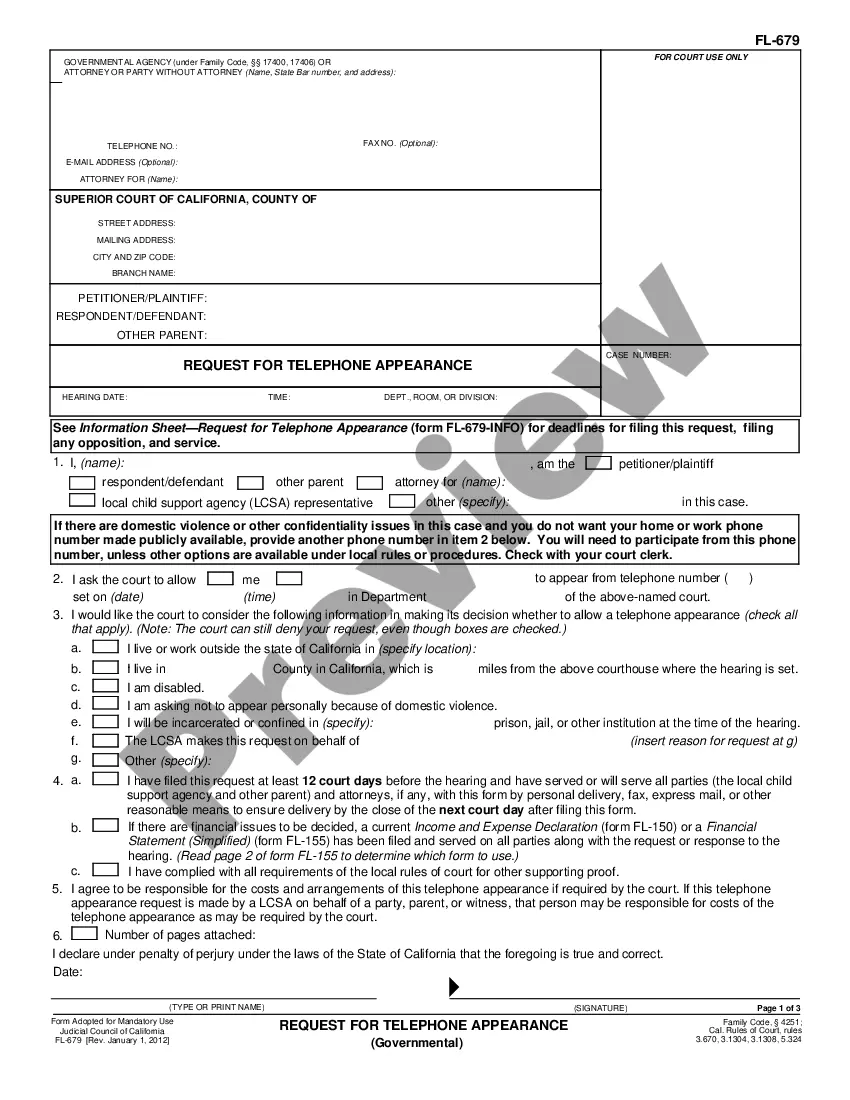

How to fill out Gresham Oregon Municipal Lien?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Gresham Oregon Municipal Lien gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Gresham Oregon Municipal Lien takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make sure you’ve picked the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Gresham Oregon Municipal Lien. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

In Pennsylvania, a municipal lien typically lasts for five years from the date it is filed. However, this duration can vary based on specific circumstances surrounding the lien. For residents and property owners in Gresham, Oregon, understanding this timeframe can aid in resolving any municipal lien issues before they affect property value or ownership rights.

A municipal lien includes any debt owed to a local government that attaches to a property. Common examples include unpaid property taxes, utility bills, or violations of municipal codes in Gresham, Oregon. Recognizing what constitutes a municipal lien is important for homeowners and prospective buyers to avoid future complications.

A municipal lien search on a house involves investigating whether any liens have been placed against the property by the local government. This search typically reveals information about unpaid taxes, assessments, or municipal fees in Gresham, Oregon. Conducting a municipal lien search ensures you understand any financial obligations associated with the property, helping you make an informed decision.

Yes, Oregon is indeed a lien state. This means that certain types of debts can result in a lien being placed against your property. Specifically, properties in Gresham, Oregon can have municipal liens if local governments enforce them for municipal services, taxes, or assessments. Understanding this can help you navigate any potential municipal lien issues effectively.

Filing a complaint with the city of Gresham is straightforward. Begin by visiting the city’s official website to find the appropriate complaint form. Fill out the form with accurate details about your concern, such as the nature of the issue and any relevant evidence. Using uslegalforms can help you create a well-structured complaint that clearly communicates your concerns, ensuring it reaches the right department efficiently.

To place a Gresham Oregon Municipal Lien on your property, you must first complete a formal application. This involves gathering relevant documentation, such as proof of ownership and details of the debt. Once you have the necessary paperwork, you can file it with the local government office that handles liens. You can also consider using uslegalforms to simplify this process and ensure proper compliance with local laws.

Today, Gresham is a dynamic, innovative and rapidly growing city with a mutual desire and drive to thrive.

How Can I Invest in Tax Liens? Investors can purchase property tax liens the same way actual properties can be bought and sold at auctions. The auctions are held in a physical setting or online, and investors can either bid down on the interest rate on the lien or bid up a premium they will pay for it.

Our Code Compliance team assists property owners in resolving general nuisance issues in Gresham, including: Abandoned vehicles....Report a code violation Report online through My Gresham. Call 503-618-2248. Only non-emergency issues should be reported.

These are tax deed states: Alaska, Arkansas, California, Connecticut, Delaware, Georgia, Hawaii, Idaho, Kansas, Maine, Michigan, Missouri, Nevada, New Hampshire, New Mexico, New York, North Carolina, North Dakota, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Dakota, Tennessee, Texas, Utah, Virginia, Washington,