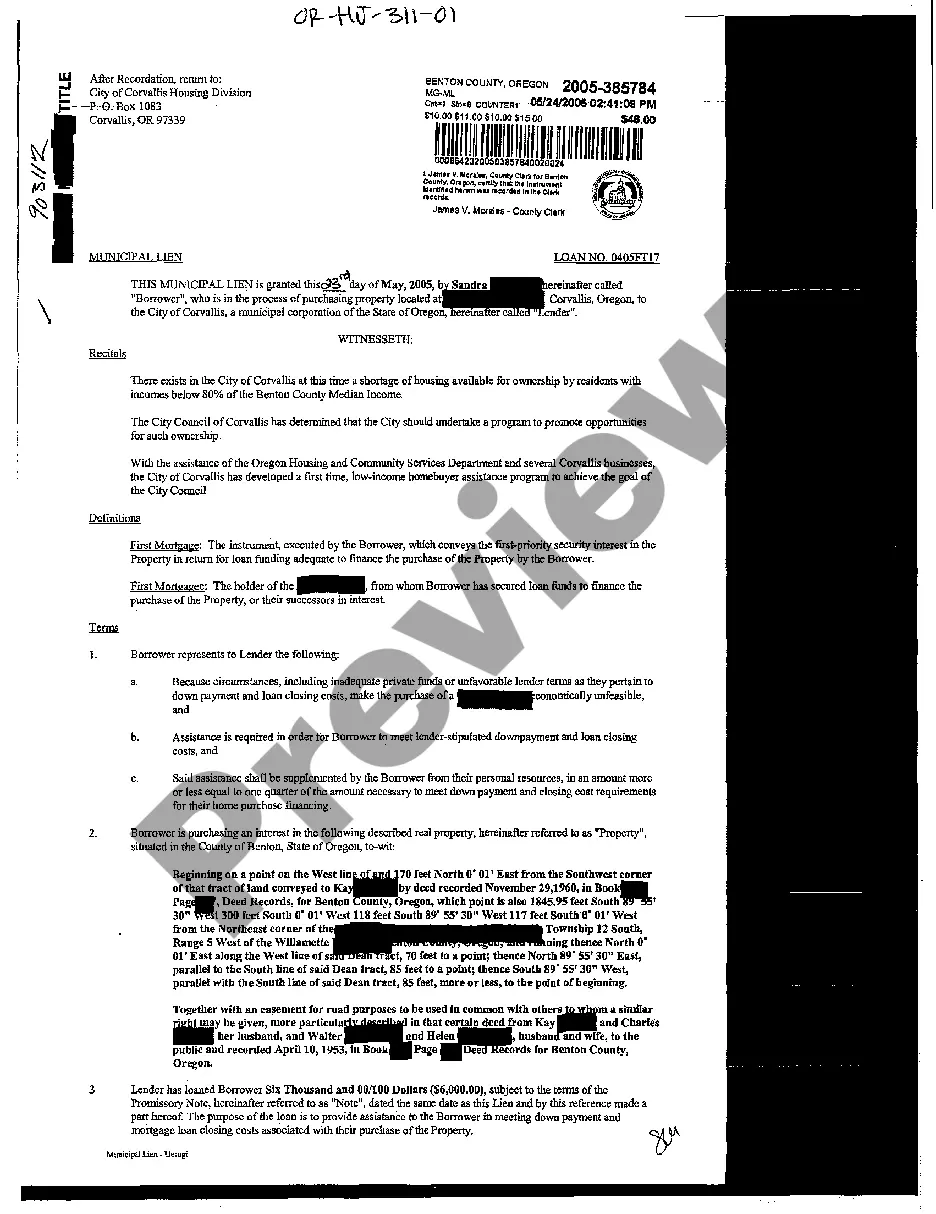

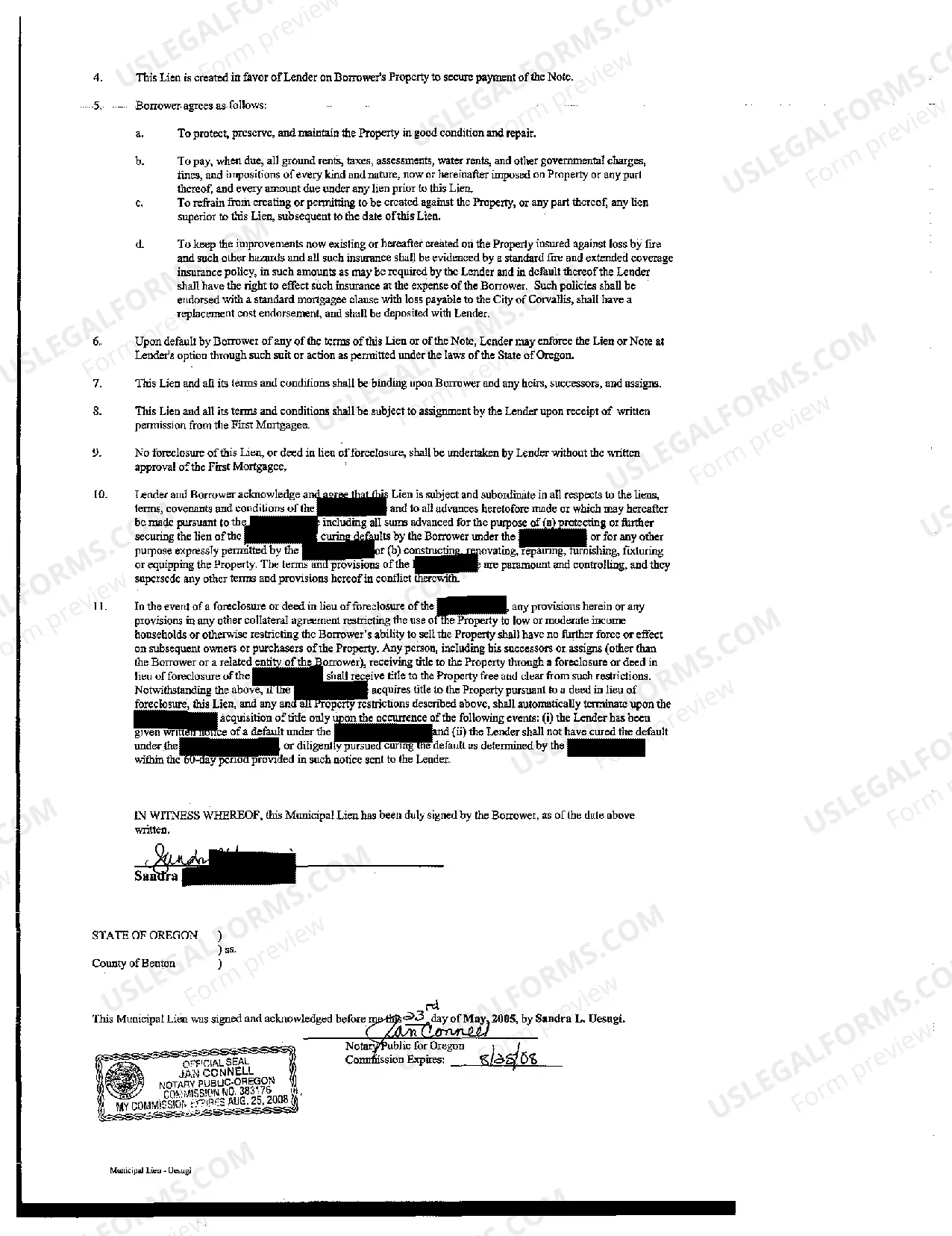

A municipal lien is a legal claim placed on a property by a local government entity as a means of collecting unpaid taxes or other charges owed to the municipality. In the case of Portland, Oregon, the Portland Bureau of Revenue and Financial Services (BROS) is responsible for managing municipal liens within the city. The Portland Oregon Municipal Lien is a mechanism used by the city to collect various debts owed by property owners. These liens are placed on the property's title, informing potential buyers, lenders, and other interested parties about the outstanding debt. When a property owner fails to pay their property taxes or other obligations, the BROS can initiate the process of placing a lien on the property. There are several types of liens that can be imposed in Portland, Oregon: 1. Property Tax Liens: These liens are placed on properties when the owners fail to pay their property taxes on time. Property tax liens ensure that delinquent taxes are eventually collected by the city. 2. Special Assessment Liens: Special assessments are charges imposed on property owners to fund specific improvements or services in their neighborhood, such as street repairs or sewer upgrades. If property owners fail to pay these assessments, the city can place a special assessment lien on their property. 3. Code Violation Liens: When property owners fail to comply with city ordinances or codes, they may be subject to code violation liens. These liens are placed on the property and serve as a means for the city to collect the fines or fees associated with the violation. 4. Unpaid Utility Bills Liens: If property owners neglect to pay their utility bills, such as water or sewer charges, the city can place liens on their property. These liens guarantee that the unpaid debts will be collected when the property is sold or refinanced. The Portland Oregon Municipal Lien allows the city to recover the owed funds by either collecting the debt directly from the property owner or through the sale of the property if the debt remains unpaid. Property owners are responsible for settling any outstanding debt and removing the lien from their property's title. In summary, the Portland Oregon Municipal Lien is a legal claim utilized by the City of Portland to ensure the collection of unpaid taxes, special assessments, code violation fines, or utility bills. This mechanism encourages property owners to fulfill their financial obligations and contributes to the overall financial health of the municipality.

Portland Oregon Municipal Lien

Description

How to fill out Portland Oregon Municipal Lien?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for someone without any legal background to create this sort of paperwork cfrom the ground up, mostly because of the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our service provides a massive catalog with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you want the Portland Oregon Municipal Lien or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Portland Oregon Municipal Lien quickly using our trustworthy service. In case you are already a subscriber, you can go on and log in to your account to get the appropriate form.

Nevertheless, if you are a novice to our library, ensure that you follow these steps prior to downloading the Portland Oregon Municipal Lien:

- Ensure the template you have chosen is suitable for your area because the rules of one state or county do not work for another state or county.

- Preview the document and read a short description (if available) of cases the document can be used for.

- If the form you chosen doesn’t suit your needs, you can start over and look for the necessary document.

- Click Buy now and choose the subscription option you prefer the best.

- Log in to your account login information or register for one from scratch.

- Pick the payment method and proceed to download the Portland Oregon Municipal Lien as soon as the payment is through.

You’re good to go! Now you can go on and print out the document or fill it out online. In case you have any issues getting your purchased forms, you can quickly access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.