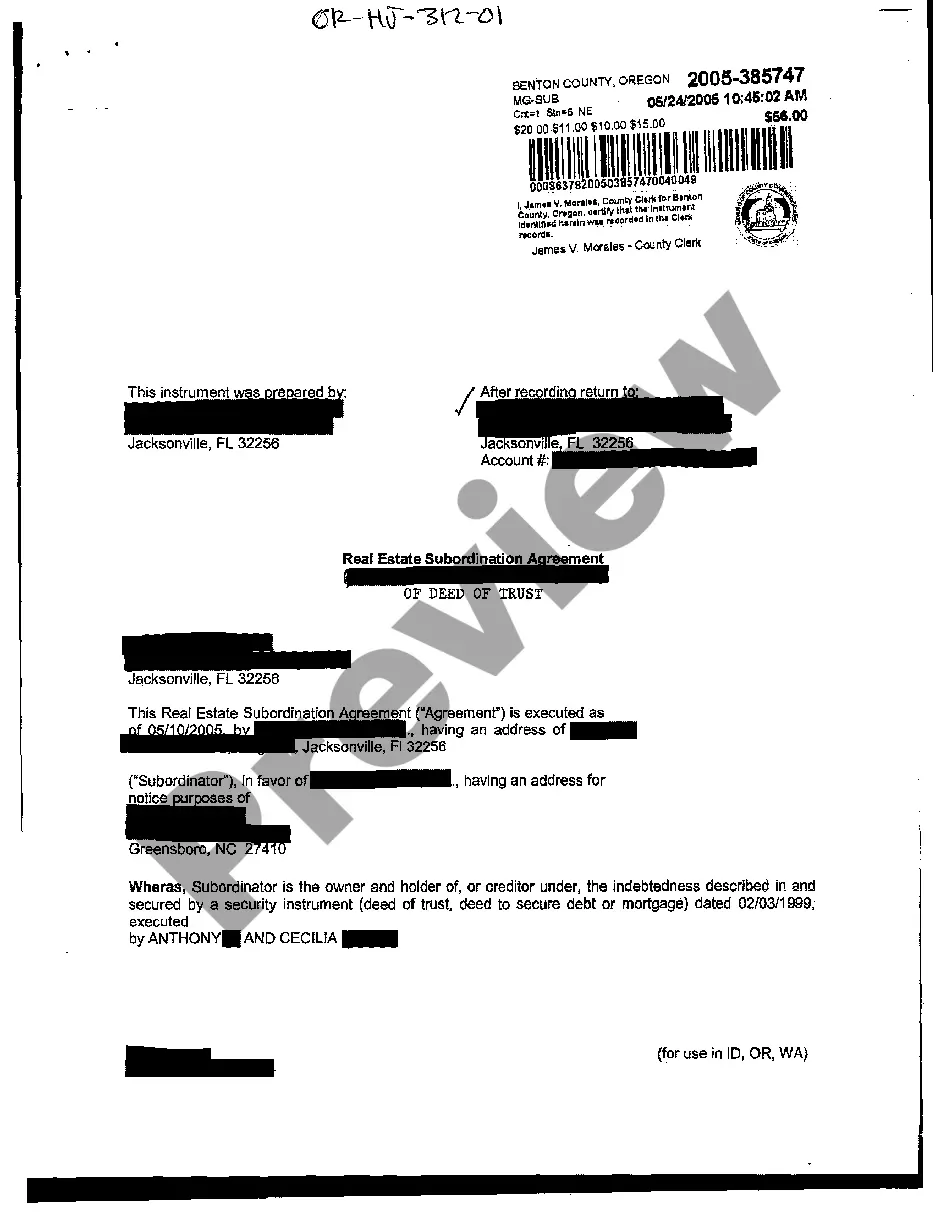

A Gresham Oregon Real Estate Subordination Agreement is a legal document that establishes the priority of liens on a property in Gresham, Oregon. This agreement allows multiple parties with different interests in the property to determine the order in which their claims will be satisfied in the event of a foreclosure or sale. In a typical Gresham Oregon Real Estate Subordination Agreement, the primary focus is usually on mortgage loans and their respective lenders. When a property owner seeks additional financing on a property that already has an existing mortgage, the new lender may require a subordination agreement to ensure its loan takes priority over the existing mortgage. There are various types of Gresham Oregon Real Estate Subordination Agreements, each serving a specific purpose. Some commonly used subordination agreements include: 1. First Mortgage Subordination Agreement: This type of agreement is utilized when a property owner wants to obtain a second mortgage or line of credit on their property, while keeping the first mortgage in place. The first mortgage lender may be willing to subordinate their lien, allowing the new lender's loan to take priority while preserving the existing mortgage's position. 2. Leasehold Subordination Agreement: When a property owner leases their property to a tenant, the underlying leasehold interest can potentially complicate financing options for the property. In this scenario, a leasehold subordination agreement may be required, allowing a lender to take priority over the tenant's leasehold interest. 3. Condominium Subordination Agreement: In the case of a condominium development, where units are individually owned, a condominium association may require unit owners to sign a subordination agreement. This agreement ensures that the association's liens for unpaid assessments, fees, or charges take precedence over any individual owner's mortgage. 4. Construction Loan Subordination Agreement: During the construction phase of a property, a developer may secure a construction loan to finance the project. If the developer also has an existing mortgage on the property, a construction loan subordination agreement can establish the priority of these loans, ensuring that the construction lender's lien takes priority until the project is completed. Gresham Oregon Real Estate Subordination Agreements are vital legal instruments that protect the interests of various parties involved in real estate transactions. They provide clarity and security for lenders, property owners, tenants, and association boards by outlining the hierarchy of liens in the event of default or foreclosure. It is important to consult with a qualified real estate attorney or professional when drafting or signing such agreements to ensure compliance with local laws and regulations.

Gresham Oregon Real Estate Subordination Agreement

Description

How to fill out Gresham Oregon Real Estate Subordination Agreement?

If you are looking for a relevant form template, it’s extremely hard to find a better service than the US Legal Forms website – one of the most comprehensive online libraries. With this library, you can find a huge number of document samples for business and individual purposes by types and states, or key phrases. With our advanced search function, getting the most up-to-date Gresham Oregon Real Estate Subordination Agreement is as elementary as 1-2-3. Furthermore, the relevance of each record is verified by a group of expert attorneys that on a regular basis check the templates on our platform and revise them based on the latest state and county regulations.

If you already know about our platform and have an account, all you should do to receive the Gresham Oregon Real Estate Subordination Agreement is to log in to your profile and click the Download option.

If you use US Legal Forms for the first time, just follow the instructions below:

- Make sure you have discovered the form you want. Check its explanation and use the Preview function (if available) to check its content. If it doesn’t meet your requirements, utilize the Search field at the top of the screen to discover the needed file.

- Affirm your choice. Choose the Buy now option. Following that, choose the preferred subscription plan and provide credentials to sign up for an account.

- Make the financial transaction. Use your bank card or PayPal account to complete the registration procedure.

- Receive the form. Pick the format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the acquired Gresham Oregon Real Estate Subordination Agreement.

Every single form you add to your profile does not have an expiration date and is yours permanently. You can easily access them using the My Forms menu, so if you want to receive an extra duplicate for modifying or printing, you may come back and save it once more at any time.

Take advantage of the US Legal Forms professional collection to gain access to the Gresham Oregon Real Estate Subordination Agreement you were looking for and a huge number of other professional and state-specific samples on one platform!

Form popularity

FAQ

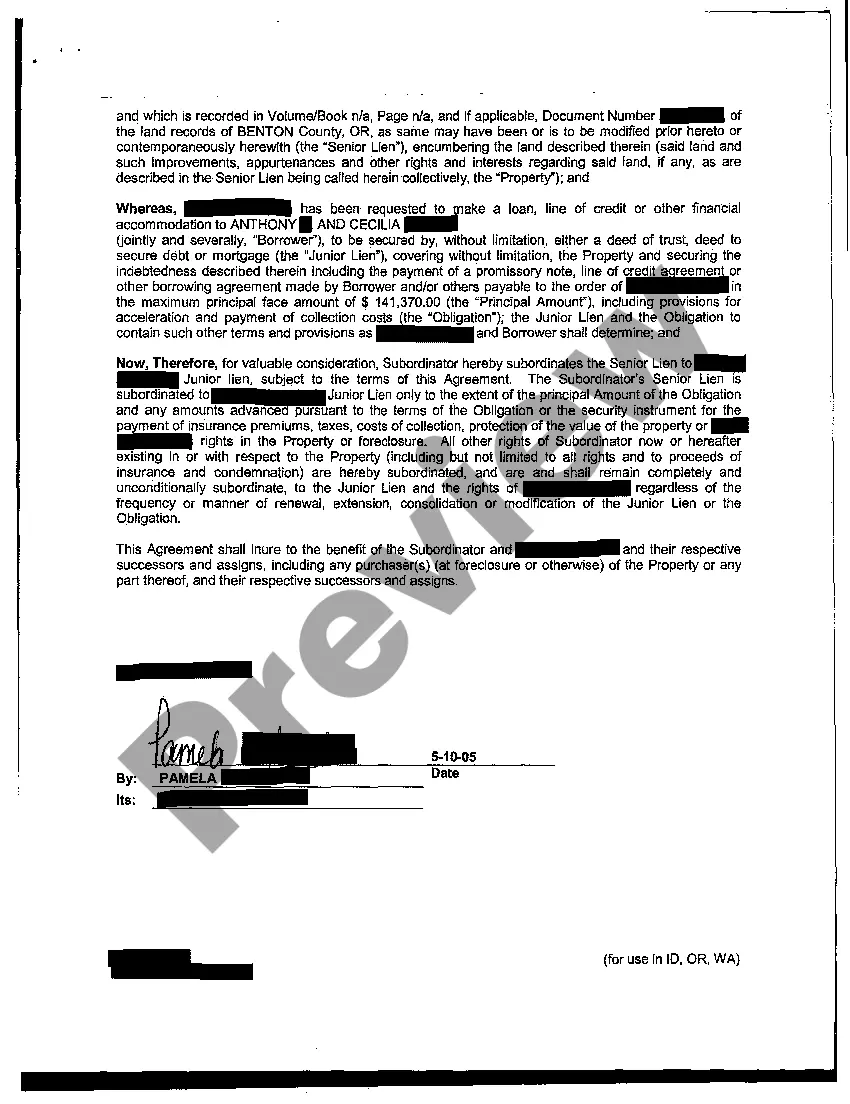

Requirements for a subordination agreement typically include the consent of all parties involved, clear identification of the loans, and detailed terms regarding the subordinate position of the second mortgage. In the realm of Gresham Oregon Real Estate Subordination Agreements, both lenders and borrowers must ensure compliance with local regulations to validate the agreement. Additionally, proper documentation and recording with the county are essential for establishing the agreement legally. Using platforms like USLegalForms can simplify this process by providing the necessary templates and guidance.

The purpose of a subordination agreement is to alter the priority of claims against a property. In a Gresham Oregon Real Estate Subordination Agreement, this document ensures that a second mortgage or lien remains subordinate to the first mortgage, thereby protecting the primary lender's interest. This arrangement can facilitate refinancing or additional borrowing while maintaining clarity about payment priorities. It is a strategic tool for real estate owners looking to manage their debt effectively.

A Gresham Oregon Real Estate Subordination Agreement becomes appropriate in scenarios like refinancing or when a borrower seeks new financing while having existing liens. It allows involved parties to reorganize their priorities, ensuring that the transaction proceeds smoothly. Understanding the timing and context can help you make an informed decision.

A Gresham Oregon Real Estate Subordination Agreement rearranges the priority of liens, allowing one creditor to take precedence over another. This can be crucial during refinancing or obtaining new loans, as it helps define which lienholder receives payment first. Understanding its role can simplify complex real estate transactions.

To obtain a Gresham Oregon Real Estate Subordination Agreement, begin by discussing your needs with your lender. They can provide the necessary documents and guide the process. Additionally, platforms like US Legal Forms can offer easy-to-use templates and further assistance tailored to your specific requirements.

A deed of subordination alters the priority of existing liens on a property in favor of another, often allowing a junior lender to become senior. Conversely, a deed of priority solidifies the existing senior status of a lienholder. Understanding these differences is pivotal for anyone navigating a Gresham Oregon Real Estate Subordination Agreement.

A Gresham Oregon Real Estate Subordination Agreement focuses on prioritizing one creditor over another regarding property liens. In contrast, an Intercreditor agreement outlines how two or more creditors will cooperate, managing their rights and responsibilities toward the borrower. Understanding these distinctions can be crucial in making informed financial decisions.

A Gresham Oregon Real Estate Subordination Agreement typically does not require notarization to be valid. However, having a notary public witness the signing can provide an additional layer of authenticity and help in case disputes arise. It's always wise to check local regulations to ensure compliance, as variations may exist.

A real estate attorney or qualified legal professional generally prepares a Gresham Oregon Real Estate Subordination Agreement. This expertise ensures the agreement complies with legal standards and effectively represents the interests of all parties involved. Resources like US Legal Forms can assist in finding templates or guidance for DIY preparation. Engaging a professional can help clarify complex terms and protect your investment.

To fill out a Gresham Oregon Real Estate Subordination Agreement, start by gathering all necessary information, including the details of the involved parties and property. Clearly outline the terms, such as the order of payments and any conditions. Consider using templates available from platforms like US Legal Forms, which provide a structured approach to complete the document correctly. Consulting a legal professional can also ensure accuracy and compliance with local laws.