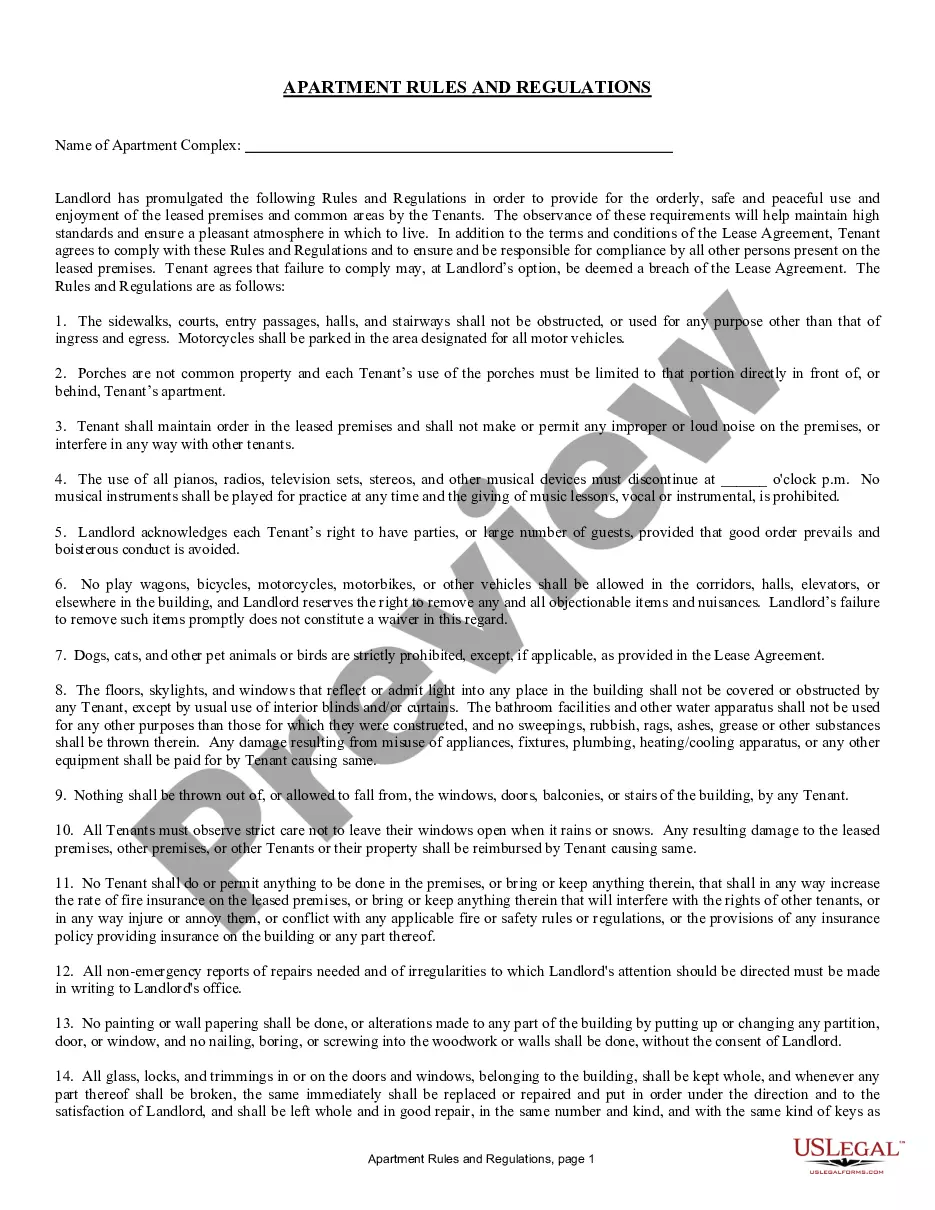

Hillsboro Oregon Real Estate Subordination Agreement is a legal contract that establishes the order of priority of multiple mortgage liens on a property in Hillsboro, Oregon. It allows a property owner to refinance or obtain additional financing while maintaining the existing mortgage(s) on the property. In simple terms, a subordination agreement rearranges the priority of loans, giving the new loan first lien priority over the existing mortgage(s), which become secondary liens. This agreement is often required by lenders when a property owner wants to take out a new loan, lease the property, or conduct any other activity that might affect the property's title. Key factors in Hillsboro Oregon Real Estate Subordination Agreement: 1. Property Address: The agreement specifies the address of the property in Hillsboro, Oregon, to which it applies. 2. Parties Involved: It identifies the parties involved, including the property owner(s), lender(s) of the existing mortgage(s), and the new lender. 3. Mortgage Details: The agreement outlines the specifics of the existing mortgage(s), including the lender name, loan amount, interest rate, and other relevant terms. 4. New Loan Details: It includes the terms and conditions of the new loan, such as the amount, interest rate, repayment terms, and any additional requirements. 5. Lien Priority: The document clarifies that the new loan will hold the first lien position, while the existing mortgage(s) will be subordinate (secondary liens) in priority. 6. Agreement Conditions: It may outline conditions that need to be fulfilled for the subordination agreement to be effective, such as maintaining proper insurance coverage and not defaulting on any existing loans. 7. Legalities and Signatures: The agreement is typically prepared by an attorney or experienced real estate professional and must be signed by all parties involved to be legally binding. Different types of Hillsboro Oregon Real Estate Subordination Agreement may exist depending on the specific circumstances. These could include: 1. Refinance Subordination Agreement: Used when the property owner wishes to refinance their existing mortgage(s) with a new loan, while keeping the current mortgage(s) as secondary liens. 2. Lease Subordination Agreement: Applied when the property owner intends to lease the property and the tenant's interest needs to be subordinated to the existing mortgage(s) or a new loan. 3. Construction Loan Subordination Agreement: Relevant when the property owner wants to secure additional financing for construction or renovation while retaining the existing mortgage(s) on the property. In conclusion, a Hillsboro Oregon Real Estate Subordination Agreement is a crucial legal document that manages lien priority among multiple mortgage loans on a property. These agreements enable property owners to access new financing opportunities while maintaining the existing mortgage(s) in a secondary lien position.

Hillsboro Oregon Real Estate Subordination Agreement

Description

How to fill out Hillsboro Oregon Real Estate Subordination Agreement?

Take advantage of the US Legal Forms and obtain instant access to any form you require. Our useful platform with a huge number of documents makes it easy to find and obtain virtually any document sample you will need. It is possible to save, complete, and certify the Hillsboro Oregon Real Estate Subordination Agreement in a few minutes instead of browsing the web for several hours trying to find an appropriate template.

Using our catalog is an excellent strategy to raise the safety of your record submissions. Our professional attorneys regularly review all the records to ensure that the forms are relevant for a particular region and compliant with new acts and polices.

How do you obtain the Hillsboro Oregon Real Estate Subordination Agreement? If you have a profile, just log in to the account. The Download option will be enabled on all the documents you look at. Moreover, you can find all the previously saved files in the My Forms menu.

If you haven’t registered a profile yet, follow the tips listed below:

- Find the template you need. Ensure that it is the form you were seeking: check its title and description, and use the Preview feature when it is available. Otherwise, use the Search field to find the needed one.

- Launch the downloading process. Click Buy Now and select the pricing plan you like. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Export the document. Pick the format to get the Hillsboro Oregon Real Estate Subordination Agreement and change and complete, or sign it for your needs.

US Legal Forms is probably the most significant and trustworthy document libraries on the web. Our company is always ready to help you in virtually any legal process, even if it is just downloading the Hillsboro Oregon Real Estate Subordination Agreement.

Feel free to make the most of our form catalog and make your document experience as convenient as possible!