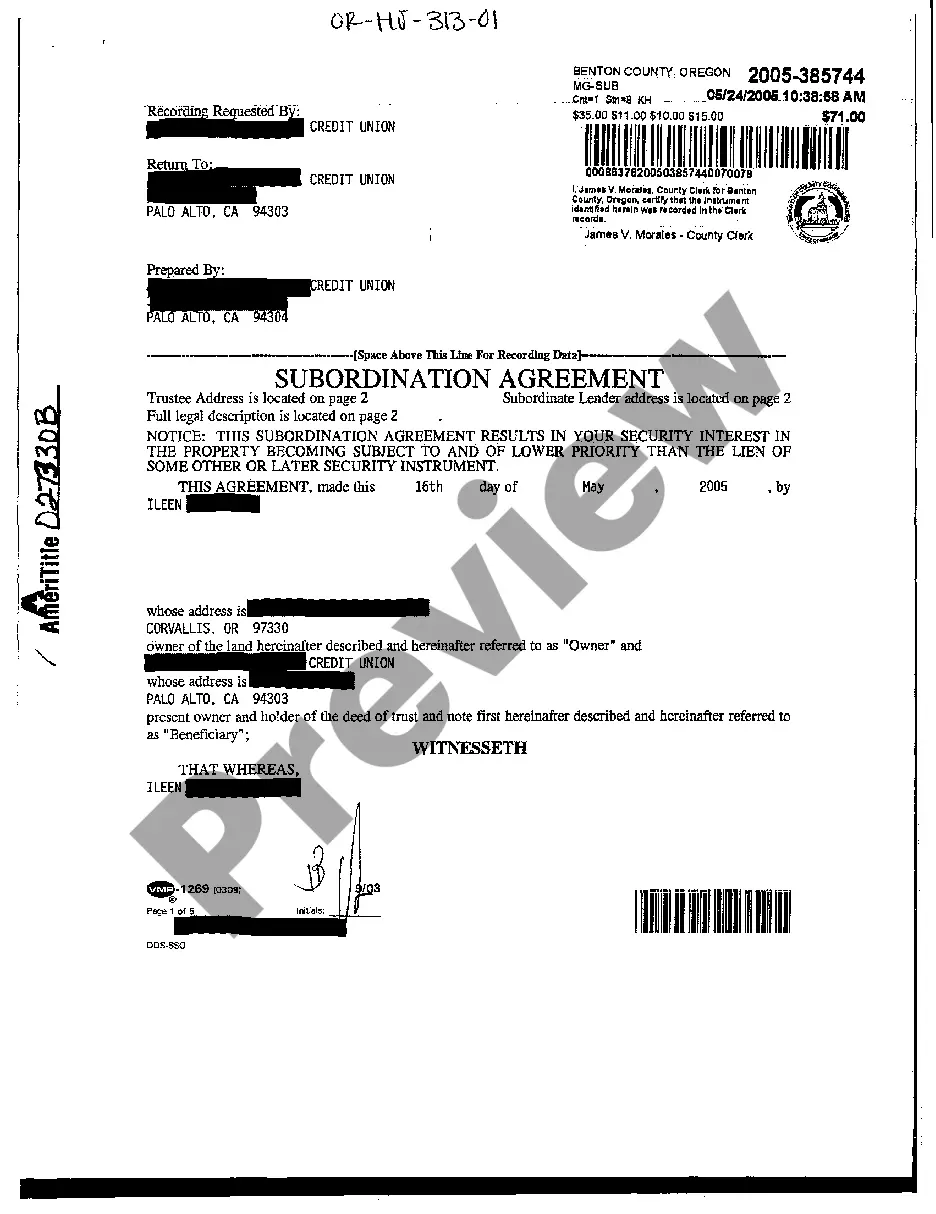

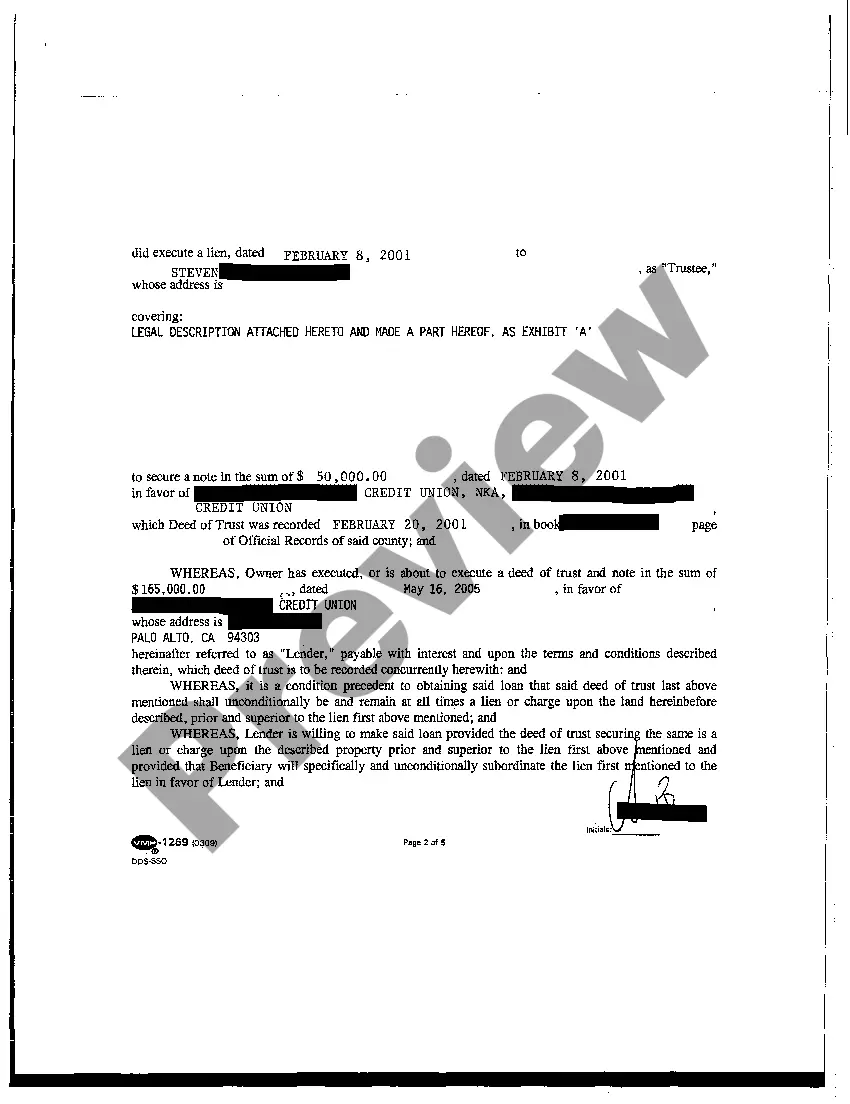

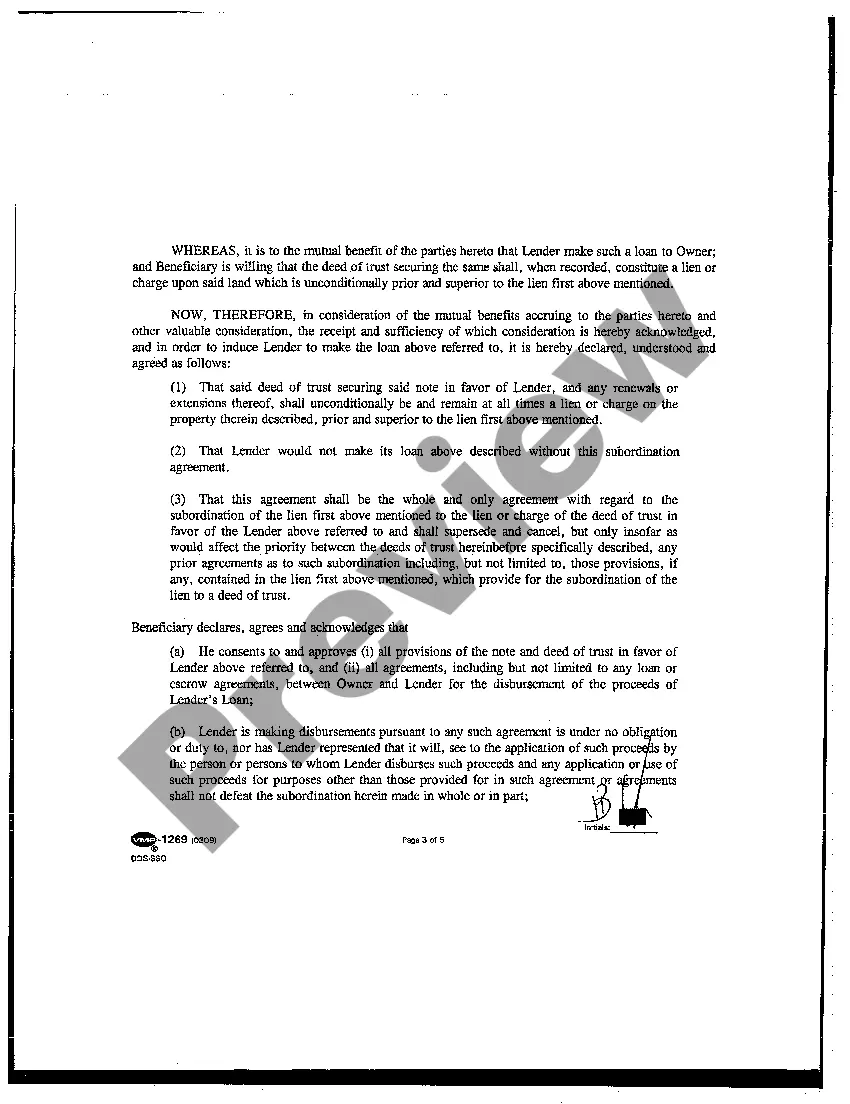

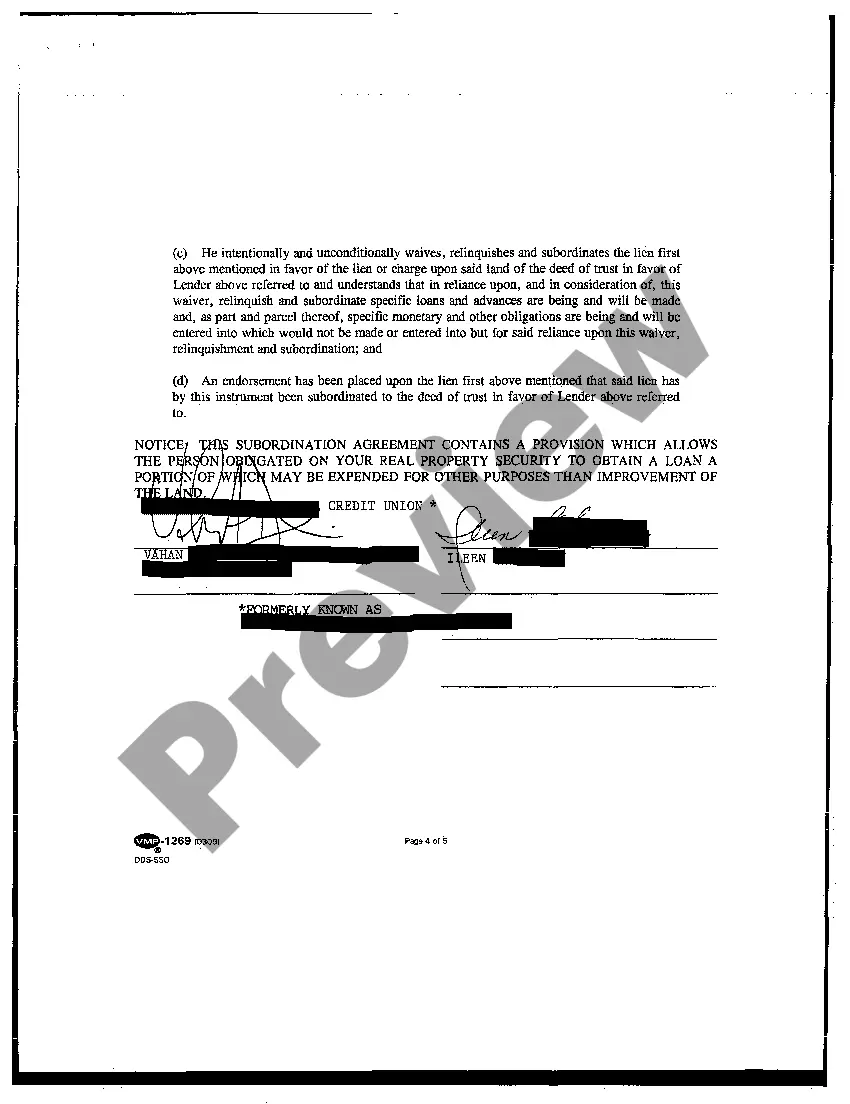

A Hillsboro Oregon subordination agreement refers to a legal document that establishes the priority of various interests in specific properties located in Hillsboro, Oregon. It is commonly used in real estate transactions to establish the hierarchy of different liens or mortgages on a property in the event of a foreclosure or sale. A subordination agreement is typically created when a property owner wants to take out a new loan or mortgage, but there is an existing lien or mortgage already in place. The purpose of this agreement is to allow the new loan to take priority over the existing loan, ensuring that the lender of the new loan will have the first claim on the property's proceeds in case of default. Keyword: Hillsboro Oregon Subordination Agreement There are different types of Hillsboro Oregon Subordination Agreements that may be encountered, including: 1. Mortgage Subordination Agreement: This type of agreement is used when a property owner wants to obtain a new mortgage loan while there is an existing mortgage on the property. The agreement ensures that the existing mortgage will be subordinate to the new mortgage, giving the new lender priority in case of foreclosure or sale. 2. Lien Subordination Agreement: In situations where there are multiple liens on a property, a lien subordination agreement establishes the hierarchy of these liens. This agreement allows certain liens to be subordinated to others, determining the order in which they will be repaid when the property is sold or foreclosed upon. 3. Intercreditor Subordination Agreement: When there are multiple lenders involved in a real estate transaction, an intercreditor subordination agreement may be used. This agreement establishes the relationship and priority of the different lenders, ensuring that each lender's rights and protections are clearly defined. Overall, Hillsboro Oregon subordination agreements are crucial in determining the priority of various interests in real estate transactions. They play a vital role in protecting the rights of lenders and property owners, ensuring clarity and fairness in the event of foreclosure or sale.

Hillsboro Oregon Subordination Agreement

Description

How to fill out Hillsboro Oregon Subordination Agreement?

We always strive to minimize or avoid legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for legal solutions that, usually, are very costly. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to an attorney. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Hillsboro Oregon Subordination Agreement or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is just as straightforward if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the Hillsboro Oregon Subordination Agreement complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Hillsboro Oregon Subordination Agreement would work for you, you can choose the subscription option and proceed to payment.

- Then you can download the document in any available format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!