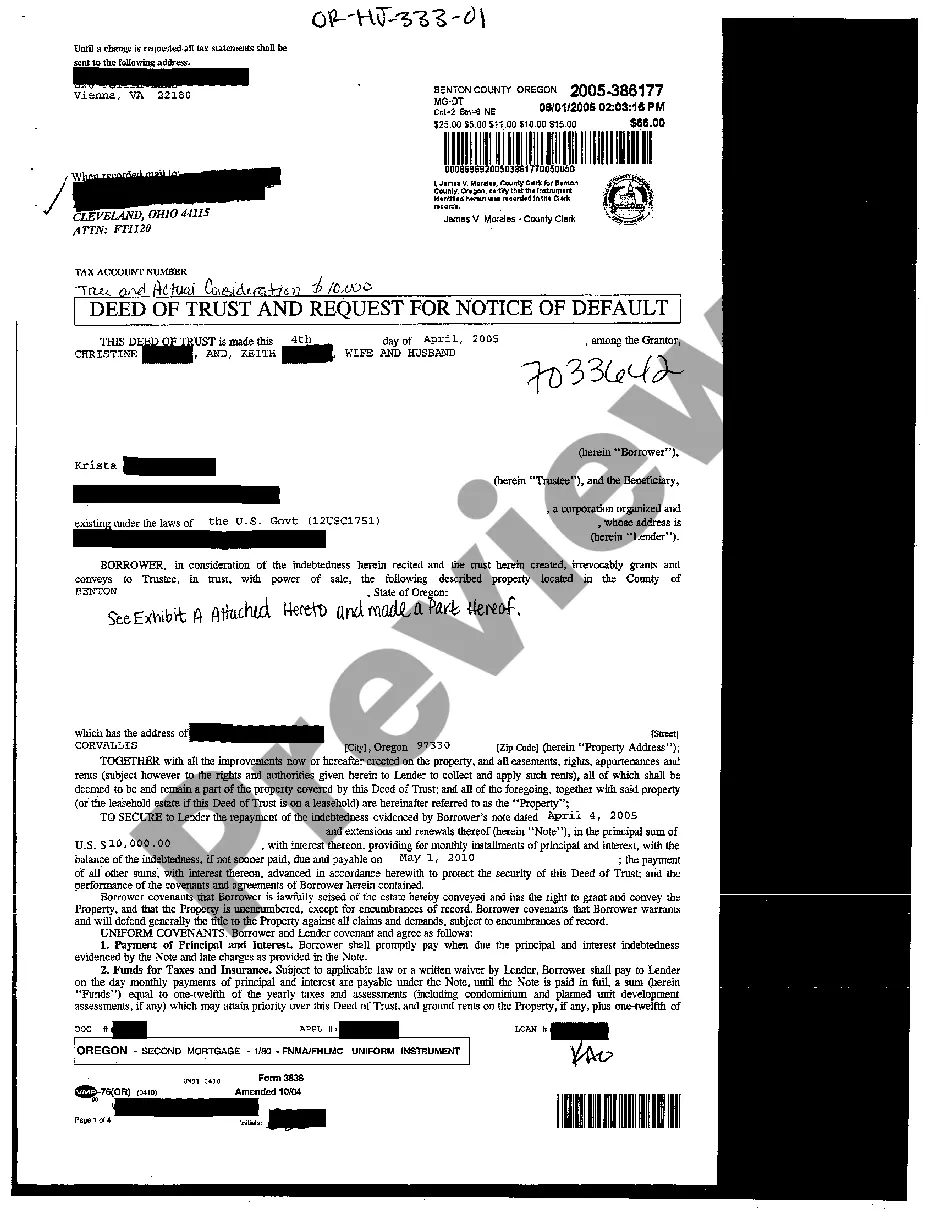

Eugene Oregon Deed of Trust and Request for Notice of Default: A Comprehensive Guide In Eugene, Oregon, the Deed of Trust and Request for Notice of Default play vital roles in real estate transactions and foreclosure proceedings. Let's delve into a detailed description of these documents, outlining their functions, requirements, and variations. 1. Eugene Oregon Deed of Trust: The Eugene Oregon Deed of Trust is a legally binding document that serves as security for a loan in real estate transactions. It establishes a lien on a property to protect the lender's interests until the borrower repays the loan amount in full. Key features of this deed include: a) Parties involved: The parties to a typical Eugene Oregon Deed of Trust are the borrower (trust or), lender (beneficiary), and a third-party trustee. b) Collateral: The property being purchased or refinanced is used as collateral for the loan. c) Trustee's role: The trustee is responsible for holding the legal title to the property until the loan is fully satisfied or in the event of default. d) Foreclosure process: In case of default, the trustee can initiate the foreclosure process on behalf of the beneficiary. 2. Request for Notice of Default: The Request for Notice of Default is a legal document filed by a junior lien holder or an interested party to receive notice in case of default. Its primary purpose is to keep stakeholders informed about any potential foreclosure actions. Here are some key details regarding this request: a) Filing requirement: The party must file the Request for Notice of Default with the county clerk's office where the property is located. b) Parties involved: The requester of the notice and the respective county clerk's office c) Importance: By receiving notice, the requester gains the opportunity to protect their interests by taking necessary actions like bidding on the property or addressing any defaults. Types of Eugene Oregon Deed of Trust and Request for Notice of Default: 1. Residential Deed of Trust and Request for Notice of Default: This type involves residential properties, such as single-family homes, townhouses, or condominiums. The process typically follows the regulations and guidelines set forth by the state of Oregon. 2. Commercial Deed of Trust and Request for Notice of Default: In commercial real estate transactions, a Commercial Deed of Trust and Request for Notice of Default are utilized. These documents allow lenders to secure loans against commercial properties like office spaces, retail buildings, or industrial properties. 3. Trust Deed variations: Depending on the specific terms and conditions agreed upon, variations of Deeds of Trust can exist, including adjustable-rate trust deeds, fixed-rate trust deeds, wraparound trust deeds, or land installment contracts. By obtaining a comprehensive understanding of the Eugene Oregon Deed of Trust and Request for Notice of Default, property owners, lenders, and interested parties can navigate real estate transactions and foreclosure processes effectively while protecting their respective interests.

Eugene Oregon Deed of Trust and Request for Notice of Default

Description

How to fill out Eugene Oregon Deed Of Trust And Request For Notice Of Default?

We always want to minimize or prevent legal issues when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney solutions that, as a rule, are very costly. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to an attorney. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Eugene Oregon Deed of Trust and Request for Notice of Default or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is equally effortless if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Eugene Oregon Deed of Trust and Request for Notice of Default complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Eugene Oregon Deed of Trust and Request for Notice of Default is proper for your case, you can pick the subscription option and proceed to payment.

- Then you can download the form in any suitable file format.

For over 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!