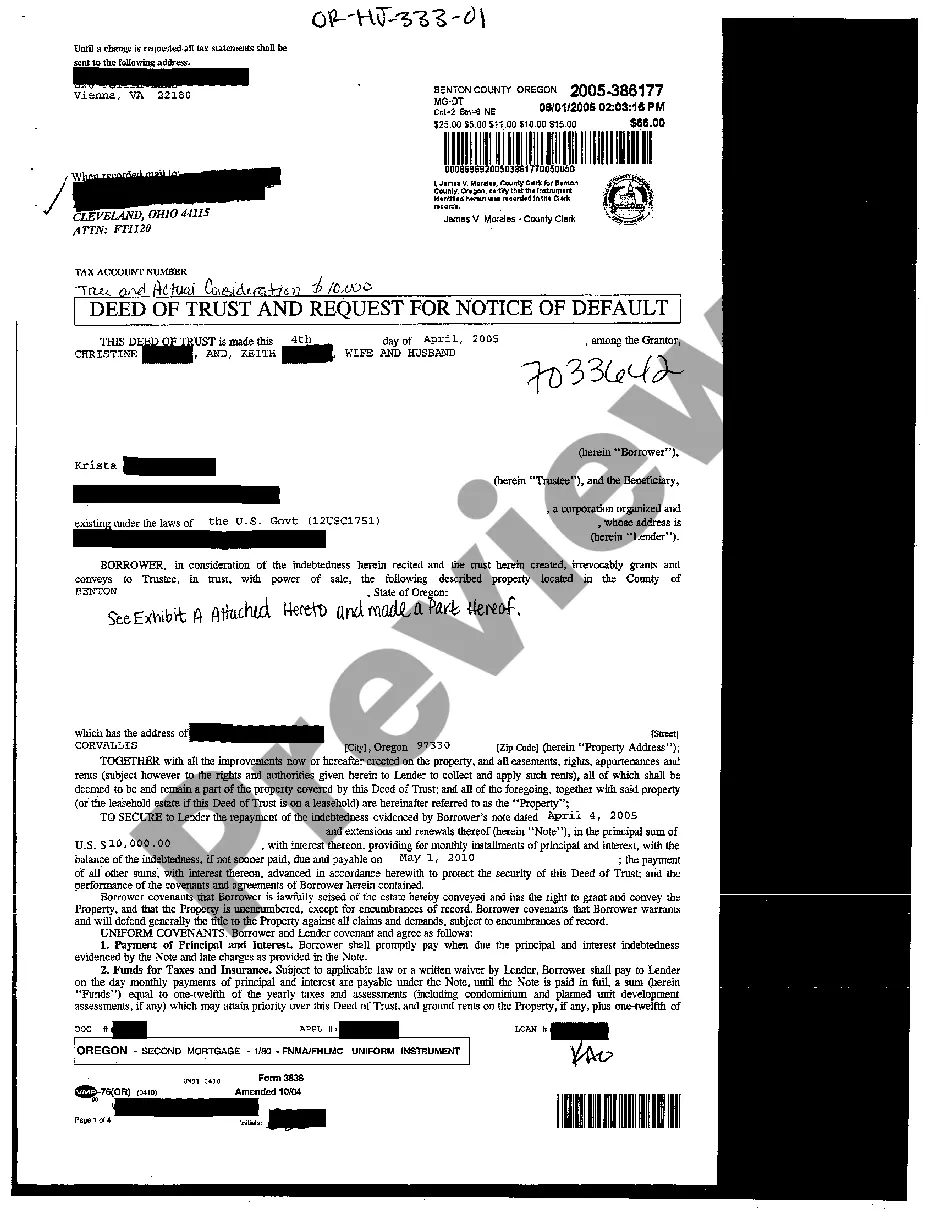

The Gresham Oregon Deed of Trust is a legal document that serves as security for a real estate loan transaction in the city of Gresham, Oregon. It is commonly used in real estate financing to provide lenders with the assurance of repayment in case the borrower defaults on the loan. A Deed of Trust in Gresham, Oregon consists of three parties: the borrower (also known as the trust or), the lender (also known as the beneficiary), and a third-party trustee. The borrower conveys the legal title to the property to the trustee as security for the loan, while still retaining possession and equitable rights to the property. This ensures the lender has the ability to foreclose on the property if necessary. The Gresham Oregon Deed of Trust outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and any specific provisions or clauses agreed upon by both parties. This document serves as evidence of the borrower's indebtedness and the lender's security interest in the property. Request for Notice of Default is a separate document that can be attached to the Gresham Oregon Deed of Trust. It allows an interested party, such as a secondary lien holder or an investor, to request written notice from the trustee if the borrower defaults on the loan. This provides an additional layer of protection and transparency for parties involved in the loan transaction. It's important to note that there may be variations of the Gresham Oregon Deed of Trust and Request for Notice of Default, depending on the specific requirements of the lender or the type of real estate transaction. For instance, different lenders may have their own customized versions of these documents, while commercial real estate transactions may have additional provisions and requirements. In conclusion, the Gresham Oregon Deed of Trust and Request for Notice of Default are crucial legal documents used in real estate financing transactions in Gresham, Oregon. These documents protect the rights of lenders and provide an important mechanism for addressing defaults in loan repayment. It is advisable to consult with a qualified attorney or real estate professional to ensure compliance with all legal requirements and to understand the specific terms and conditions of any deed of trust or request for notice of default involved in a particular transaction.

Gresham Oregon Deed of Trust and Request for Notice of Default

Description

How to fill out Gresham Oregon Deed Of Trust And Request For Notice Of Default?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Gresham Oregon Deed of Trust and Request for Notice of Default becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Gresham Oregon Deed of Trust and Request for Notice of Default takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Gresham Oregon Deed of Trust and Request for Notice of Default. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

In Oregon, the time frame to complete a foreclosure process can range from a few months to over a year, depending on various factors. The process typically involves notice requirements and waiting periods to allow borrowers time to respond. Understanding these timelines is important when dealing with a Gresham Oregon Deed of Trust and Request for Notice of Default.

One significant disadvantage of a deed of trust is the limited borrower's rights during foreclosure. Unlike traditional mortgages, the trustee has the power to sell the property without going through court in most cases. This aspect can create challenges if you find yourself needing to contest a default situation outlined in the Gresham Oregon Deed of Trust and Request for Notice of Default.

A deed of trust offers several advantages, such as streamlined foreclosure processes and potentially lower closing costs. However, one downside is that borrowers may face risks if they default, as the process can lead to the loss of their property. Weighing these pros and cons is essential, especially when considering Gresham Oregon Deed of Trust and Request for Notice of Default.

A request for notice of default means you are asking to be formally informed if the borrower falls behind on their payments. This request is important in the Gresham Oregon Deed of Trust and Request for Notice of Default, as it helps protect your interests as a lender. By being notified early, you can take appropriate actions to safeguard your investment.

The document that releases a deed of trust is known as a reconveyance deed. Once the borrower has fulfilled their obligations, this document serves to officially remove the lien from the property. In the context of the Gresham Oregon Deed of Trust and Request for Notice of Default, it is vital for property owners to obtain a reconveyance to clear their title and move forward uninhibited.

A default in a deed of trust occurs when a borrower fails to meet specific terms, such as not making mortgage payments. In the realm of the Gresham Oregon Deed of Trust and Request for Notice of Default, this can include any violations to the contract. Understanding these terms is essential for maintaining your mortgage and preventing foreclosure.

Receiving a default notice is a serious matter, as it indicates that you have missed one or more mortgage payments. In the Gresham Oregon Deed of Trust and Request for Notice of Default context, this notice opens a window for you to rectify the situation. You must act swiftly to avoid further repercussions, such as foreclosure, and exploring options with a financial advisor may prove beneficial.

A request for notice of default is a legal document that notifies the lender when a borrower has failed to meet their mortgage obligations. In the context of the Gresham Oregon Deed of Trust and Request for Notice of Default, this document ensures that you receive timely updates if your property falls into default. Understanding this request helps you stay informed and allows you to take necessary actions early.