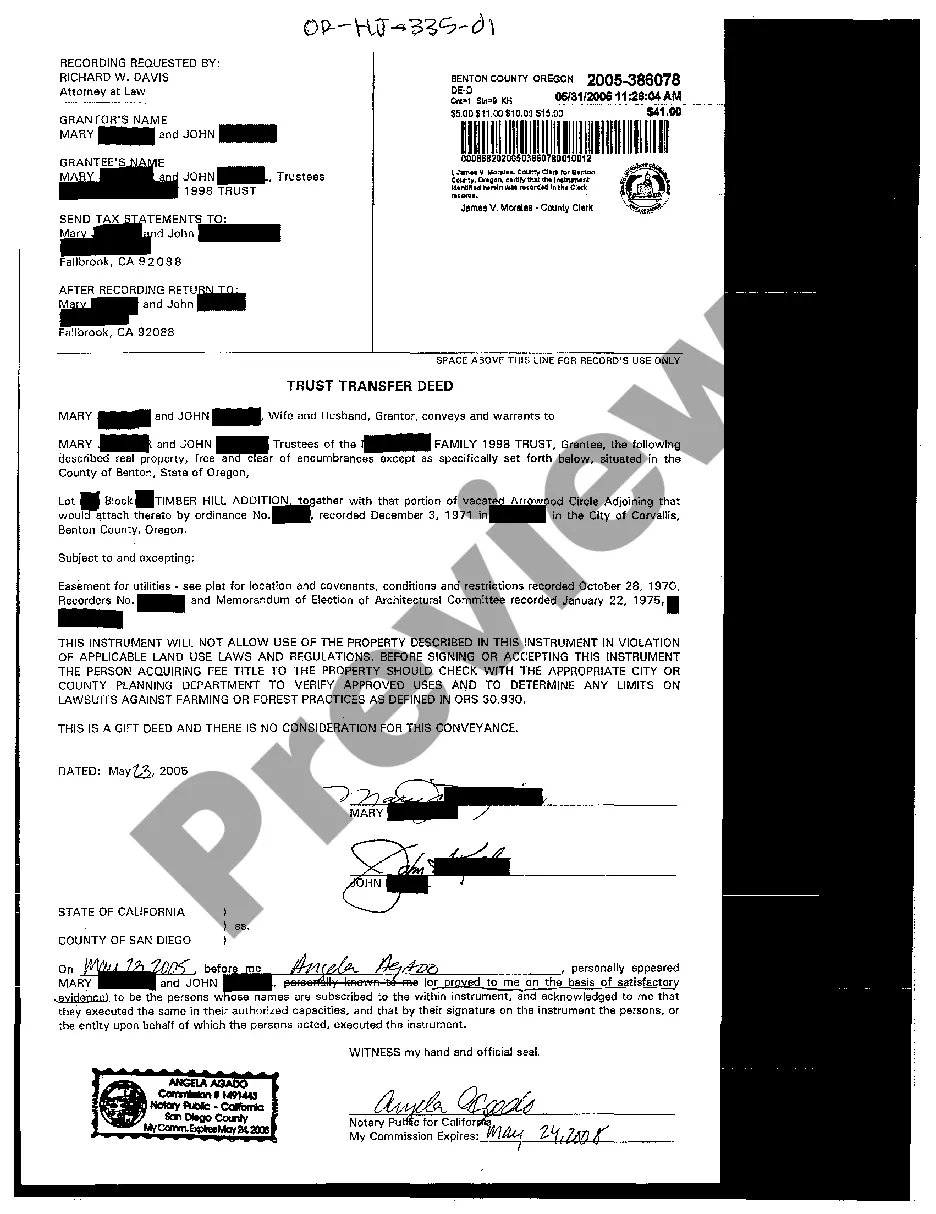

Hillsboro Oregon Trust and Transfer Deed is a legal document frequently used in real estate transactions in the city of Hillsboro, Oregon. This document serves as an important tool for transferring ownership of property from one individual or entity (granter) to another (grantee) while ensuring the protection of the interests of both parties involved. The Hillsboro Oregon Trust and Transfer Deed outlines the specific details of the property being transferred, including its address, legal description, and any encumbrances or liens against it. It is typically prepared by a licensed attorney or a title company to ensure its legality and accuracy. There are several types of Hillsboro Oregon Trust and Transfer Deed that vary depending on the purpose of the transfer. Here are a few common types: 1. Warranty Deed: This is the most commonly used form of transfer deed, offering the highest level of protection to the grantee. It guarantees that the granter has a valid title to the property, free from any undisclosed encumbrances or claims. 2. Quitclaim Deed: This type of deed is often used in cases where the granter is not making any promises or warranties regarding the title. It transfers only the interest the granter may have in the property, if any. 3. Trust Deed: Sometimes referred to as a deed of trust, this type of transfer deed is used when the property being transferred is being used as collateral for a loan. In this case, the trust deed gives the lender (beneficiary) the right to foreclose on the property if the borrower (trust or) defaults on the loan. 4. Special Warranty Deed: Similar to a warranty deed, a special warranty deed guarantees that the granter has clear title to the property during their ownership. However, it only covers claims or encumbrances that occurred during the granter's ownership and does not offer protection for any issues prior to that. It is important for both the granter and grantee to fully understand the implications of the Hillsboro Oregon Trust and Transfer Deed before proceeding with a real estate transaction. Seeking guidance from a qualified real estate professional or attorney is highly recommended ensuring the process is legally sound and protects the interests of all parties involved.

Hillsboro Oregon Trust and Transfer Deed

Description

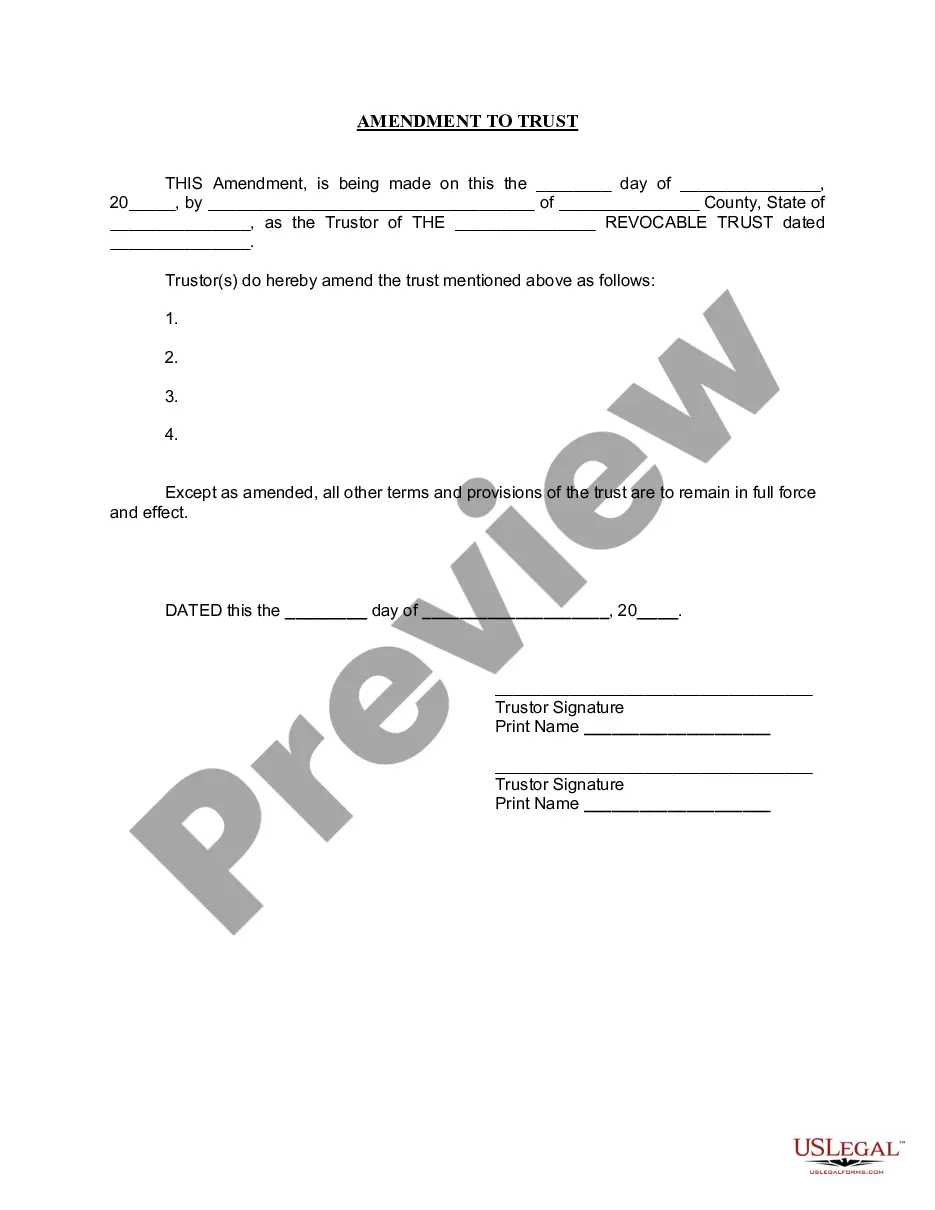

How to fill out Hillsboro Oregon Trust And Transfer Deed?

If you’ve already utilized our service before, log in to your account and save the Hillsboro Oregon Trust and Transfer Deed on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make sure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Hillsboro Oregon Trust and Transfer Deed. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!

Form popularity

FAQ

A trust can be a good way to cut the tax to be paid on your inheritance. But you need professional advice to get it right. Always talk to a solicitor/independent financial adviser. If you put things into a trust, provided certain conditions are met, they no longer belong to you.

A basic trust plan may run anywhere from $2,000 to $3,000 or more, depending on complexity. There are additional costs for making changes and administration costs after your death. Different types of trusts and trustees can require different fees for administration and wealth management.

Under Oregon inheritance laws, If you have a spouse but no descendants (children, grandchildren), your spouse will inherit everything. If you have children but no spouse, your children will inherit everything. If you have a spouse and descendants (with that spouse), your spouse inherits everything.

With that said, revocable trusts, irrevocable trusts, and asset protection trusts are among some of the most common types to consider. Not only that, but these trusts offer long-term benefits that can strengthen your estate plan and successfully protect your assets.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

How to Create a Living Trust in Oregon Figure out which type of trust you need to make.Do a property inventory.Choose your trustee.Draw up the trust document.Sign the trust document in front of a notary public. Fund the trust by transferring your property into it.

The trust allows you to keep your family matters private. While a will becomes public record when probate occurs, a trust is never probated and never made public. No one will know who your beneficiaries are, what assets are in the trust, or what the conditions of the trust are.

How to Create a Living Trust in Oregon Figure out which type of trust you need to make.Do a property inventory.Choose your trustee.Draw up the trust document.Sign the trust document in front of a notary public. Fund the trust by transferring your property into it.

Pricing for and Individual Trust Plan and for a Joint Trust Plan. Pricing depends on the size of the Estate. $3,200 for Estates under $2 million. $4,200 for Estates between $2 million and $5 million, and Estates over $5 million are subject to a special fee agreement based on the complexity of the Estate.