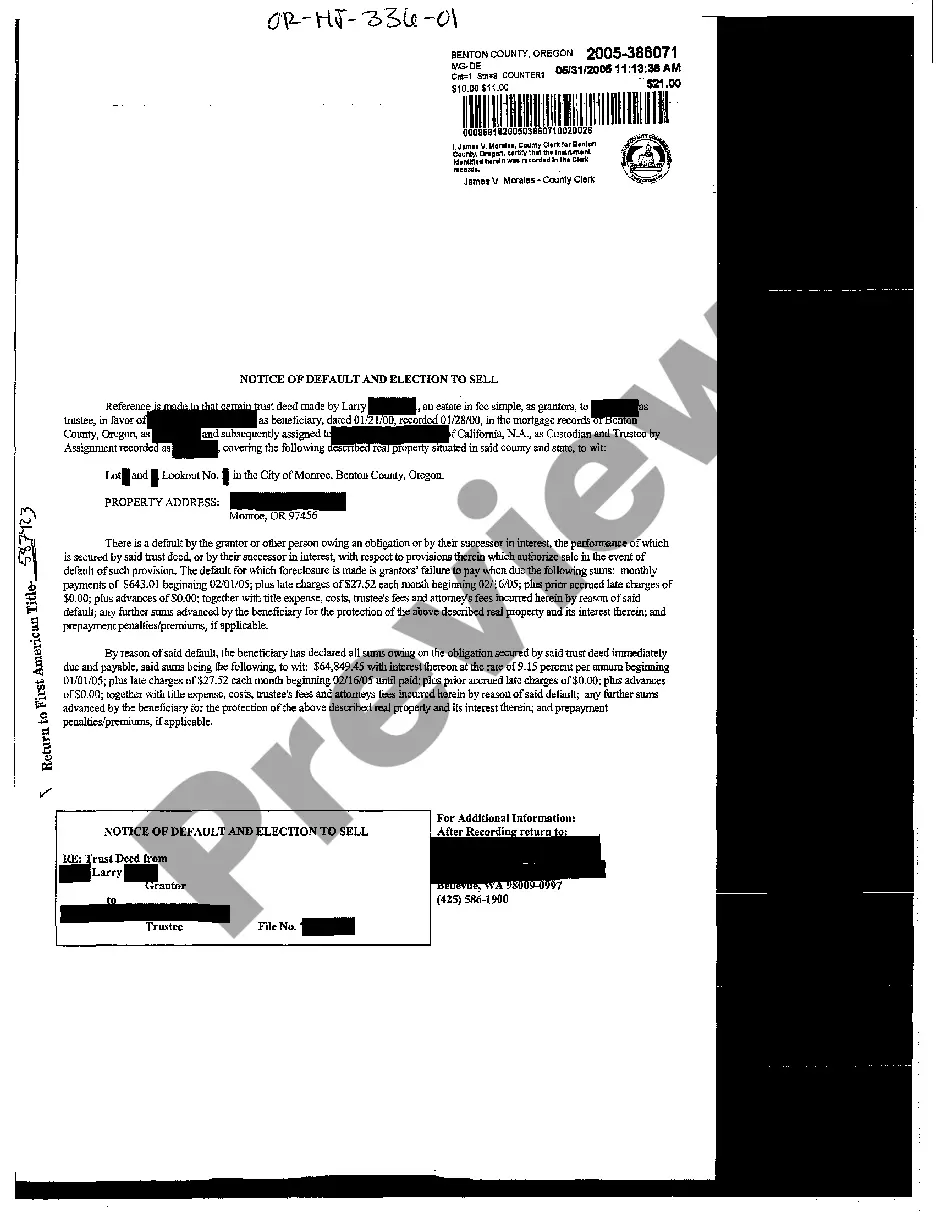

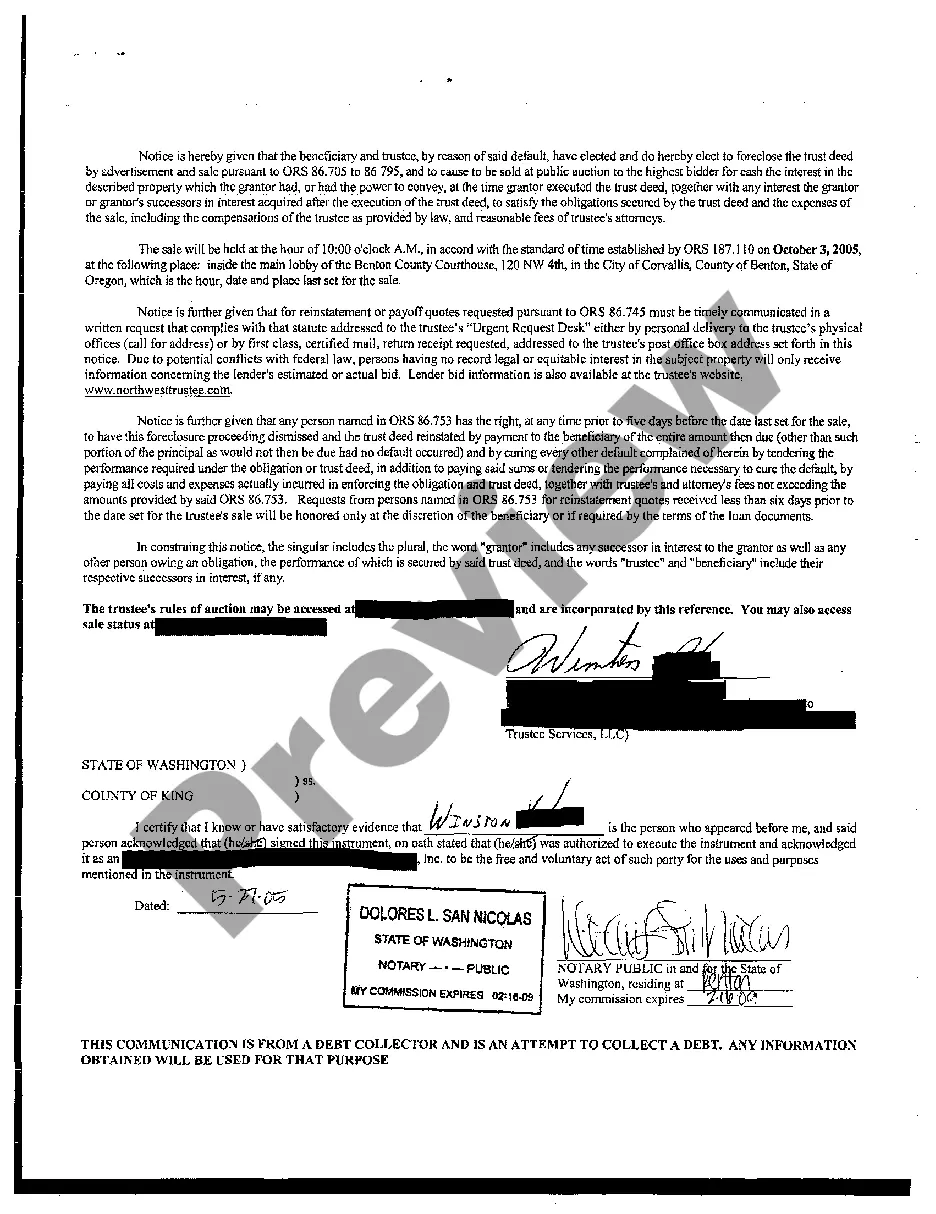

A Gresham Oregon Notice of Default and Election to Sell is a legal document that is filed by a mortgage lender when a borrower fails to make mortgage payments on their property. This notice serves as a formal notification to the borrower that they are in default on their loan and that the lender intends to sell the property through a public auction or trustee sale. The Notice of Default and Election to Sell is required by Oregon state law and must be served to the borrower in person or through certified mail. It contains important information such as the borrower's name, property address, loan amount, default amount, and the date by which the borrower must pay off the defaulted amount to avoid foreclosure. In Gresham, Oregon, there are a few different types of Notice of Default and Election to Sell that can be issued by lenders: 1. Standard Notice of Default and Election to Sell: This is the most common type of notice issued when a borrower defaults on their mortgage payments. It provides the borrower with a specific timeframe to cure the default amount, typically around 30 to 60 days, before the property is scheduled for foreclosure. 2. Notice of Default and Election to Sell — Trust Deed: This type of notice is specific to properties that have a trust deed as their mortgage instrument. It follows a similar process as the standard notice, but with slight variations to accommodate the trust deed agreement. 3. Notice of Default and Election to Sell — Judicial Foreclosure: In certain cases, such as when the mortgage agreement lacks a power of sale clause, lenders may opt for a judicial foreclosure process. In these instances, a Notice of Default and Election to Sell — Judicial Foreclosure is filed, initiating a lawsuit against the borrower to obtain a court order to sell the property. It is important for borrowers who receive a Gresham Oregon Notice of Default and Election to Sell to take immediate action to address the default amount to avoid foreclosure. They should consult with an attorney or a housing counseling agency to explore options such as loan modification, repayment plans, or other foreclosure alternatives available to them under Oregon law. Ignoring the notice can result in the loss of the property and damage to the borrower's creditworthiness.

Gresham Oregon Notice of Default and Election to Sell

Description

How to fill out Gresham Oregon Notice Of Default And Election To Sell?

If you are looking for a valid form template, it’s difficult to choose a more convenient service than the US Legal Forms website – one of the most comprehensive online libraries. Here you can find a large number of templates for organization and individual purposes by types and states, or key phrases. With the high-quality search function, finding the newest Gresham Oregon Notice of Default and Election to Sell is as easy as 1-2-3. Additionally, the relevance of each record is verified by a group of skilled lawyers that regularly check the templates on our platform and update them in accordance with the most recent state and county regulations.

If you already know about our platform and have an account, all you should do to receive the Gresham Oregon Notice of Default and Election to Sell is to log in to your account and click the Download option.

If you use US Legal Forms for the first time, just follow the instructions below:

- Make sure you have opened the form you require. Check its information and use the Preview option to check its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to get the appropriate document.

- Confirm your choice. Click the Buy now option. Next, select your preferred subscription plan and provide credentials to register an account.

- Process the financial transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Receive the template. Choose the file format and save it on your device.

- Make changes. Fill out, edit, print, and sign the acquired Gresham Oregon Notice of Default and Election to Sell.

Each template you add to your account does not have an expiry date and is yours forever. You can easily access them via the My Forms menu, so if you want to get an extra version for editing or printing, feel free to return and download it again at any moment.

Take advantage of the US Legal Forms extensive library to get access to the Gresham Oregon Notice of Default and Election to Sell you were looking for and a large number of other professional and state-specific templates in a single place!