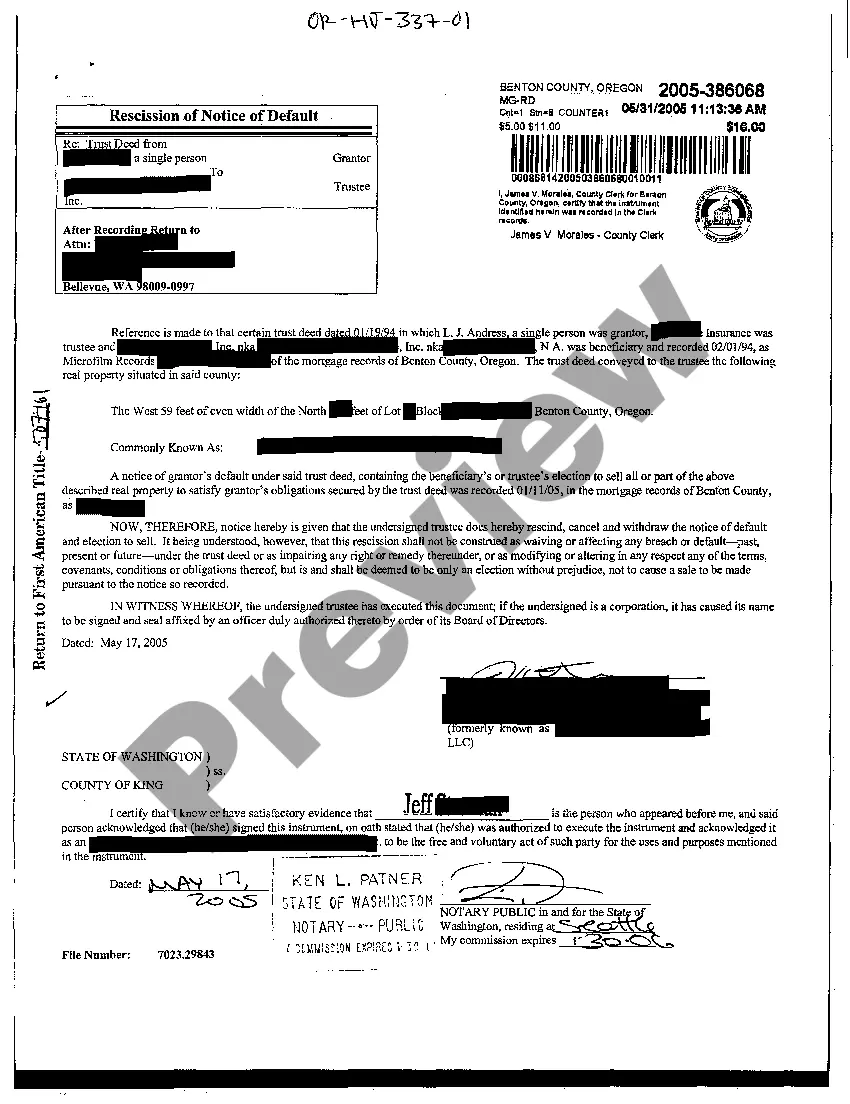

Bend, Oregon Rescission of Notice of Default: Understanding the Process and Its Types Introduction: A Bend, Oregon Rescission of Notice of Default refers to the cancellation or reversal of a notice of default that was previously issued to a borrower who had fallen behind on their mortgage payments. This legal procedure allows homeowners in Bend, Oregon to resolve their default status and avoid foreclosure. In this article, we will delve into the intricacies of the Bend, Oregon Rescission of Notice of Default process, highlighting different types of rescission, and explaining relevant keywords associated with this topic. 1. Definition and Purpose: A rescission of notice of default is initiated when a borrower rectifies the default condition, typically by bringing their mortgage payments current or reaching an agreement with the lender to cure the default. The purpose of this process is to give homeowners a second chance to reinstate their mortgage and recover their property, halting foreclosure proceedings. 2. Types of Bend, Oregon Rescission of Notice of Default: While the general concept remains the same, there are various types of rescission of notice of default applicable in Bend, Oregon. Some of these include: a) Statutory Rescission: Statutory rescission occurs when the borrower fulfills the conditions specified in Oregon state law, such as paying all overdue amounts and associated fees within a specific timeframe. b) Court-Ordered Rescission: In certain cases, borrowers may need to seek court intervention to rescind a notice of default. This often happens when disputes or legal complexities arise during the default resolution process. c) Loan Modification Rescission: If a borrower successfully negotiates a loan modification with their lender, the lender may agree to rescind the notice of default as part of the modified agreement terms. This enables the borrower to maintain their homeownership while adhering to the revised payment plan. d) Short Sale Rescission: When a homeowner opts for a short sale, wherein the property is sold for less than the outstanding mortgage balance, the lender may rescind the notice of default upon completion of the sale. This allows the borrower to avoid foreclosure and the associated financial consequences. 3. Relevant Keywords: To better understand the Bend, Oregon Rescission of Notice of Default process, it is essential to be familiar with the following keywords: i) Notice of Default (NOD): A notice sent to a borrower by the lender, stating that the borrower is in default on their mortgage payment and foreclosure proceedings may commence if the default is not rectified within a specified timeframe. ii) Foreclosure: The legal process by which a lender takes possession of a property due to the borrower's default on mortgage payments. iii) Reinstatement: The act of bringing a mortgage loan current by paying all delinquent amounts, including interest, penalties, and fees. iv) Mortgage Modification: An alteration made to the original mortgage terms and conditions agreed upon by both the borrower and the lender. It can involve changes to interest rate, loan duration, or payment amounts, ultimately assisting the borrower in meeting their financial obligations. v) Continuing Default: If a borrower falls behind on mortgage payments again after the rescission of a notice of default, the lender may reinstate foreclosure proceedings. Conclusion: Understanding the Bend, Oregon Rescission of Notice of Default process is crucial for homeowners facing delinquencies to protect their property from foreclosure. By familiarizing themselves with the various types of rescission and associated keywords, borrowers can navigate this legal process effectively and ultimately secure their homeownership.

Bend Oregon Rescission of Notice of Default

Description

How to fill out Bend Oregon Rescission Of Notice Of Default?

Regardless of social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person with no legal education to create this sort of paperwork cfrom the ground up, mostly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes in handy. Our platform provides a huge collection with over 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also is a great asset for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you require the Bend Oregon Rescission of Notice of Default or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Bend Oregon Rescission of Notice of Default in minutes employing our trusted platform. In case you are presently a subscriber, you can go ahead and log in to your account to get the needed form.

However, if you are a novice to our library, ensure that you follow these steps before obtaining the Bend Oregon Rescission of Notice of Default:

- Be sure the form you have found is good for your location since the regulations of one state or county do not work for another state or county.

- Preview the document and read a brief description (if available) of scenarios the paper can be used for.

- If the form you picked doesn’t meet your needs, you can start again and search for the necessary form.

- Click Buy now and choose the subscription option that suits you the best.

- with your credentials or register for one from scratch.

- Select the payment method and proceed to download the Bend Oregon Rescission of Notice of Default once the payment is done.

You’re good to go! Now you can go ahead and print the document or complete it online. If you have any issues getting your purchased documents, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.