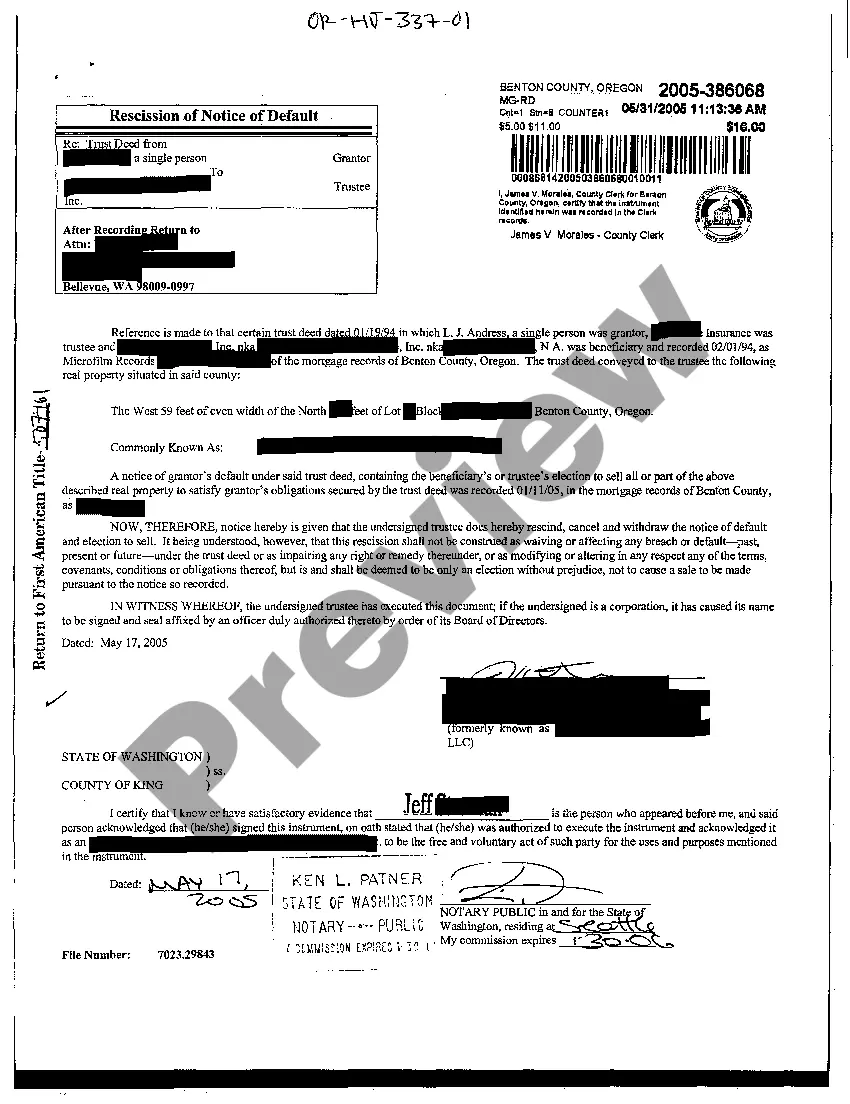

Hillsboro Oregon Rescission of Notice of Default is a legal process that allows homeowners to rectify a default on their mortgage loan. When a homeowner in Hillsboro, Oregon fails to make regular mortgage payments, the lender issues a Notice of Default. However, the homeowner has the opportunity to stop foreclosure proceedings by initiating the rescission process. This action requires fulfilling specific criteria as outlined in the legal system. The Hillsboro Oregon Rescission of Notice of Default follows strict guidelines to ensure fairness and protect both the homeowner and the lender. It involves presenting a valid reason for the default, as well as providing supporting documentation to prove the financial hardship faced by the homeowner. Common reasons for default rescission include loss of employment, medical emergencies, or unexpected financial burdens. Different types of Hillsboro Oregon Rescission of Notice of Default can be categorized based on the stage of foreclosure proceedings and the steps taken to mitigate the default. Some variations include: 1. Pre-foreclosure rescission: This occurs when homeowners become aware of the Notice of Default early on and decide to take immediate action to prevent further legal actions. They consult with their lender, negotiate payment plans, or seek refinancing options to resolve the default. 2. Court-ordered rescission: In some cases, homeowners may need to involve the court system to achieve a rescission of the Notice of Default. This can occur when disputes arise between the lender and borrower regarding the validity of the default or if the lender fails to comply with legal requirements during the foreclosure process. 3. Loan modification rescission: Homeowners may work with their lenders to modify their loan terms, effectively rescinding the Notice of Default. This can involve reducing interest rates, extending the loan period, or adjusting monthly payments to make them more manageable. 4. Short sale or deed in lieu rescission: If the homeowner is unable to reinstate the loan or modify the terms, they may opt for a short sale, where the property is sold for less than the outstanding loan balance. Similarly, a deed in lieu of foreclosure allows homeowners to transfer ownership of the property to the lender in exchange for avoiding foreclosure. Both options involve rescinding the Notice of Default by resolving the outstanding debt. In conclusion, Hillsboro Oregon Rescission of Notice of Default is a legal process that allows homeowners to rectify a default on their mortgage loan and prevent foreclosure. Various types of rescission exist, depending on the stage of foreclosure proceedings and the actions taken by homeowners to resolve the default. Understanding the options available during the Hillsboro Oregon Rescission of Notice of Default process can help homeowners find the best solution to protect their homes and financial well-being.

Hillsboro Oregon Rescission of Notice of Default

Description

How to fill out Hillsboro Oregon Rescission Of Notice Of Default?

If you are searching for a relevant form template, it’s extremely hard to choose a more convenient place than the US Legal Forms site – one of the most comprehensive libraries on the internet. Here you can get a huge number of document samples for business and personal purposes by types and states, or key phrases. With our advanced search function, discovering the newest Hillsboro Oregon Rescission of Notice of Default is as easy as 1-2-3. Additionally, the relevance of every record is confirmed by a team of professional attorneys that regularly check the templates on our platform and update them in accordance with the most recent state and county requirements.

If you already know about our platform and have an account, all you need to get the Hillsboro Oregon Rescission of Notice of Default is to log in to your profile and click the Download button.

If you use US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have opened the sample you want. Read its explanation and make use of the Preview feature (if available) to see its content. If it doesn’t meet your requirements, utilize the Search field at the top of the screen to find the proper record.

- Affirm your decision. Choose the Buy now button. Next, pick the preferred subscription plan and provide credentials to register an account.

- Make the purchase. Use your bank card or PayPal account to finish the registration procedure.

- Obtain the template. Indicate the file format and save it on your device.

- Make changes. Fill out, revise, print, and sign the obtained Hillsboro Oregon Rescission of Notice of Default.

Every template you save in your profile does not have an expiration date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you need to get an extra duplicate for editing or printing, you may return and save it again whenever you want.

Make use of the US Legal Forms extensive library to gain access to the Hillsboro Oregon Rescission of Notice of Default you were seeking and a huge number of other professional and state-specific templates on one website!

Form popularity

FAQ

If you want to exercise your right of rescission, follow these steps: Notify your lender in writing. Use the address provided on the lender's notice explaining your right to rescind. Make sure your notice to your lender is mailed or delivered before your three-day window closes.

Lender may rescind any notice of default at any time before Trustee's sale by executing a notice of rescission and recording it.

A ?default? occurs when a borrower does not make his or her mortgage loan payment and falls behind. When this happens, he or she risks the home heading into the foreclosure process. Usually, the foreclosure process is started within thirty days after the due date is not met.

How to write a letter rescinding your resignation Address your boss and HR.Start with a retraction statement.Request to keep your job.Apologize for the inconvenience.Explain your reasoning.List the benefits of keeping you on.Discuss your plans.Close with thanks.

The right of rescission refers to the right of a consumer to cancel certain types of loans. If you are refinancing a mortgage, and you want to rescind (cancel) your mortgage contract; the three-day clock does not start until. You sign the credit contract (usually known as the Promissory Note)

It states that the person who holds the loan on the house is behind on mortgage payments and the bank is in the process of taking action. If the mortgage is not paid up to date, the lender will seize the home.

A default notice is often called a rescission notice when it contains details of the default but also states, where permitted by the contract, that unless the default is remedied, reasonable costs are paid and interest is paid within the time specified, the contract is at an end.

In the context of mortgage foreclosure, a notice of default is a formal notice that a lender filed with courts to notify the borrower who has failed to make payments that the lender intends to conduct a sale foreclosure.

If you miss payments or you don't pay the right amount, your creditor may send you a default notice, also known as a notice of default. If the default is applied it'll be recorded in your credit file and can affect your credit rating. An account defaults when you break the terms of the credit agreement.

Technically speaking, a notice of default is not a foreclosure. Instead, it serves as notice that you are behind in your payments and that your property may be sold as a result of foreclosure if you don't act soon.