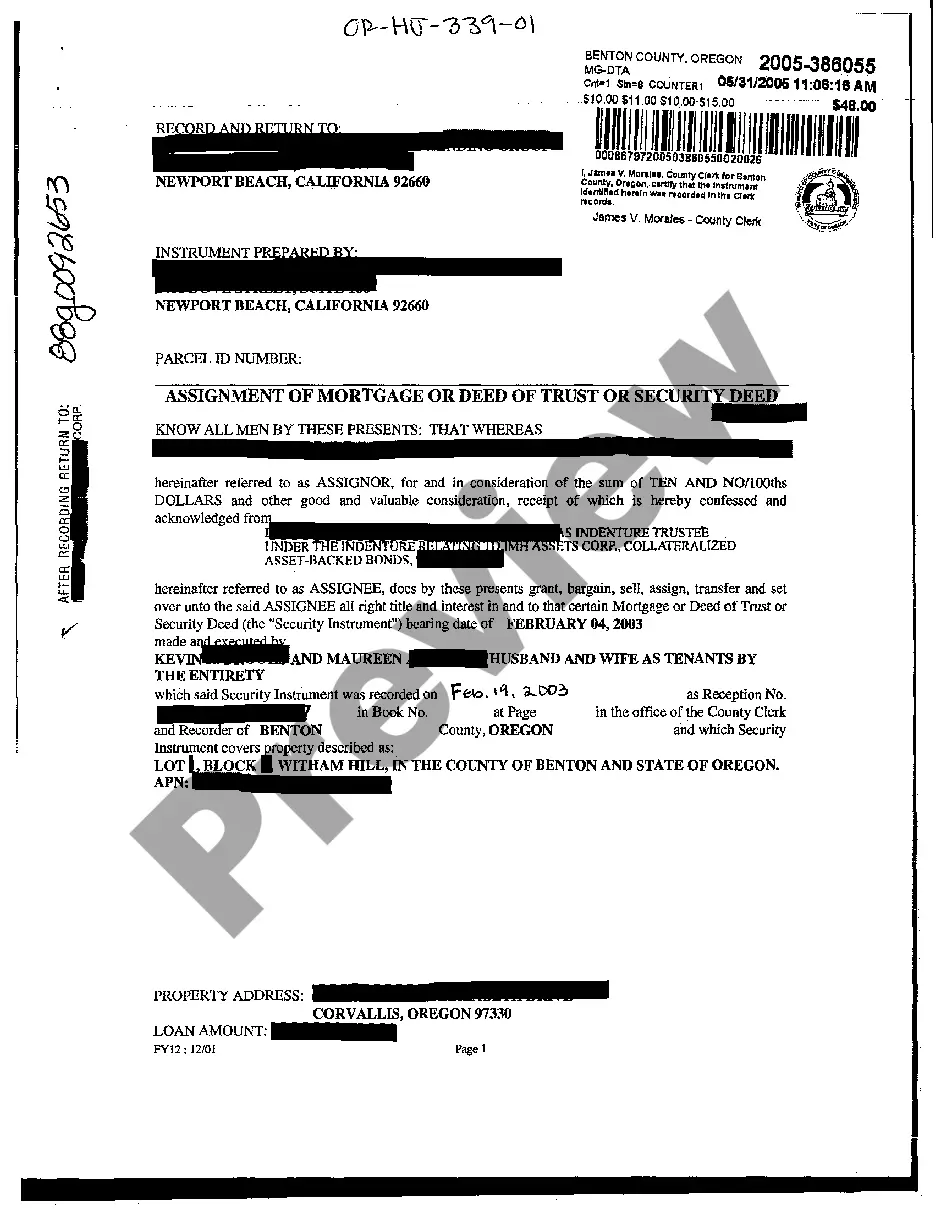

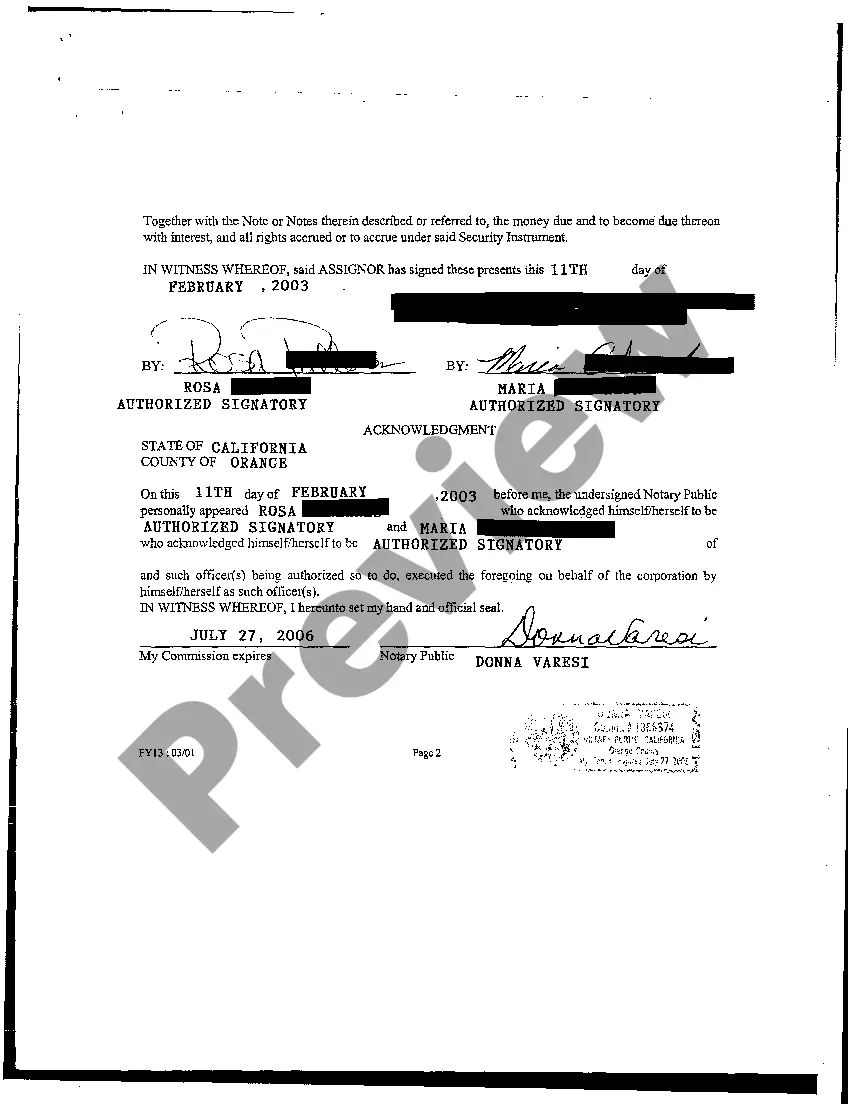

In the context of real estate transactions and property ownership, an Assignment of Mortgage, Deed of Trust, or Security Deed plays a crucial role. Bend, Oregon, a beautiful city located in Central Oregon in the United States, follows standard practices when it comes to these legal agreements. An Assignment of Mortgage, also known as an Assignment of Deed of Trust or Assignment of Security Deed, involves the transfer of the existing mortgage or deed of trust (also referred to as a security deed) from one party to another. It represents a legally binding documentation that proves the transfer of rights, interests, and obligations associated with the mortgage or deed of trust. In Bend, Oregon, several types of Assignment of Mortgage or Deed of Trust or Security Deed can be witnessed based on specific circumstances and requirements. Let's explore some of these variations: 1. Standard Assignment of Mortgage: This is the most common type of assignment, wherein the original lender transfers the mortgage or deed of trust to another party, such as a new lender or an investor. This type of assignment often occurs when a loan is sold on the secondary market. 2. Assignment of Mortgage for Loan Modification: In situations where the terms of a mortgage need to be modified or renegotiated, an assignment can take place between the original lender and the borrower or a loan modification specialist. Such assignments may involve changes in interest rates, payment amounts, or loan durations to make the mortgage more manageable for the borrower. 3. Assignment of Deed of Trust in Foreclosure Proceedings: In the unfortunate event of a foreclosure, an assignment may occur when a lender sells or transfers the loan (secured by a deed of trust) to a third party, such as a foreclosure attorney, trustee, or investor. This assignment allows the new party to proceed with the foreclosure process, including the sale of the property to recover the debt owed. 4. Assignment of Mortgage or Deed of Trust in Loan Servicing: Sometimes, a lender may outsource the servicing of a mortgage or deed of trust to a specialized loan service. This type of assignment ensures that the borrower's payments, escrow accounts, and other related matters are handled by the designated servicing company. 5. Assignment of Security Deed in Title Transfers: When the ownership of a property changes hands, typically through a sale, an assignment of security deed may occur. This process involves the transfer of the existing mortgage or deed of trust from the seller to the buyer, ensuring the buyer assumes responsibility for the loan. Overall, Bend, Oregon, adheres to well-established practices regarding Assignment of Mortgage, Deed of Trust, or Security Deed, allowing for smooth property transactions and mortgage transfers in various scenarios. It is essential to consult with legal professionals or real estate experts in Bend to ensure compliance with local laws and regulations when engaging in these assignments.

Bend Oregon Assignment of Mortgage or Deed of Trust or Security Deed

Description

How to fill out Bend Oregon Assignment Of Mortgage Or Deed Of Trust Or Security Deed?

If you are looking for a relevant form, it’s difficult to find a better place than the US Legal Forms site – one of the most extensive online libraries. With this library, you can find thousands of templates for business and personal purposes by categories and regions, or key phrases. With the high-quality search option, discovering the most recent Bend Oregon Assignment of Mortgage or Deed of Trust or Security Deed is as elementary as 1-2-3. Moreover, the relevance of every document is proved by a team of professional attorneys that regularly review the templates on our platform and update them according to the most recent state and county demands.

If you already know about our system and have a registered account, all you should do to get the Bend Oregon Assignment of Mortgage or Deed of Trust or Security Deed is to log in to your profile and click the Download button.

If you make use of US Legal Forms for the first time, just follow the instructions below:

- Make sure you have opened the form you require. Check its information and use the Preview option (if available) to see its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to find the appropriate document.

- Affirm your choice. Choose the Buy now button. Next, select the preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Receive the template. Indicate the format and download it on your device.

- Make changes. Fill out, revise, print, and sign the acquired Bend Oregon Assignment of Mortgage or Deed of Trust or Security Deed.

Every single template you add to your profile has no expiration date and is yours permanently. You always have the ability to gain access to them via the My Forms menu, so if you need to receive an extra version for modifying or creating a hard copy, feel free to come back and export it once more anytime.

Take advantage of the US Legal Forms professional catalogue to gain access to the Bend Oregon Assignment of Mortgage or Deed of Trust or Security Deed you were looking for and thousands of other professional and state-specific templates on a single website!