In Gresham, Oregon, an Assignment of Mortgage, Deed of Trust, or Security Deed is a legal document that plays a vital role in real estate transactions. It facilitates the transfer of an existing mortgage or deed of trust from one party to another, typically when the underlying property is sold or when there is a need for the mortgage holder to grant an interest in the property as collateral. There are various types of Assignment of Mortgage, Deed of Trust, or Security Deed commonly used in Gresham, Oregon, each serving different purposes. These include: 1. Assignment of Mortgage: This type of document is used when the lender transfers the rights and obligations of a mortgage loan to another party. It ensures that the new party, known as the assignee, assumes all responsibilities related to the mortgage, including receiving payments and enforcing the terms of the loan. 2. Assignment of Deed of Trust: Unlike a mortgage, where the lender holds the property's title until the loan is repaid, a deed of trust involves three parties: the borrower (trust or), the lender (beneficiary), and a neutral third party known as the trustee. When an assignment of deed of trust occurs, the lender transfers their interest in the deed of trust to another party, who becomes the new beneficiary and assumes the lender's rights and powers. 3. Assignment of Security Deed: In Oregon, a security deed functions similarly to a deed of trust, where the borrower conveys legal title to a trustee in favor of the lender until the loan is satisfied. An assignment of security deed is used when the lender assigns their rights and interests in the security deed to another party, enabling the assignee to enforce the terms, receive payments, and potentially foreclose on the property in case of default. The process of assigning a mortgage, deed of trust, or security deed involves the preparation of a detailed assignment document, which clearly identifies the parties involved, the property details, the terms of the original agreement, and the rights being transferred. This document is typically recorded in the County Recorder's Office to ensure its public record. In Gresham, Oregon, it's essential for all parties involved in a mortgage assignment to work closely with legal professionals to ensure compliance with state laws and regulations. This helps protect the rights and interests of both the assignor and the assignee throughout the transaction. Overall, the Assignment of Mortgage, Deed of Trust, or Security Deed serves as a crucial mechanism in the real estate market of Gresham, Oregon, as it enables the efficient transfer of mortgage rights and responsibilities, facilitating property transactions and ensuring the security of lenders and borrowers.

Gresham Oregon Assignment of Mortgage or Deed of Trust or Security Deed

State:

Oregon

City:

Gresham

Control #:

OR-HJ-339-01

Format:

PDF

Instant download

This form is available by subscription

Description

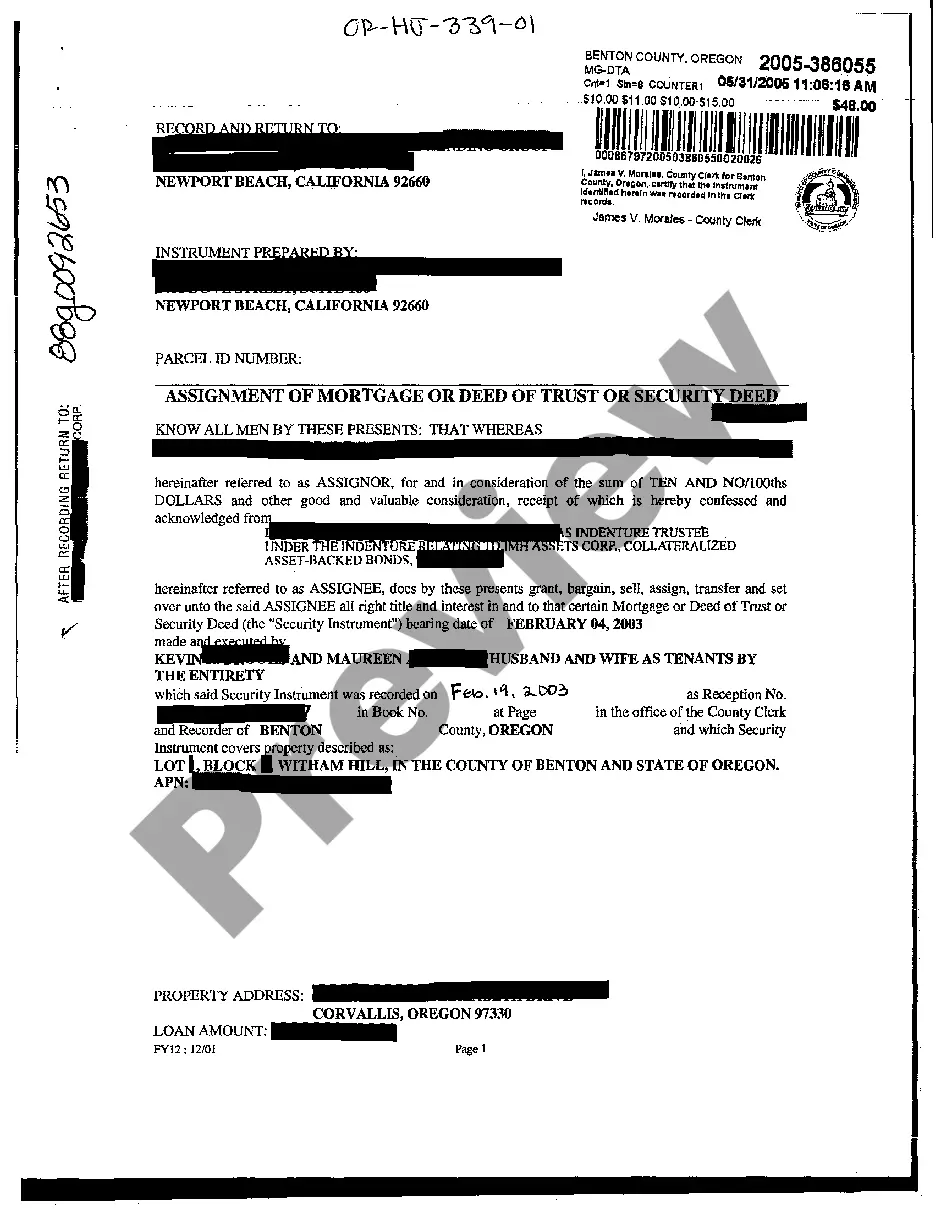

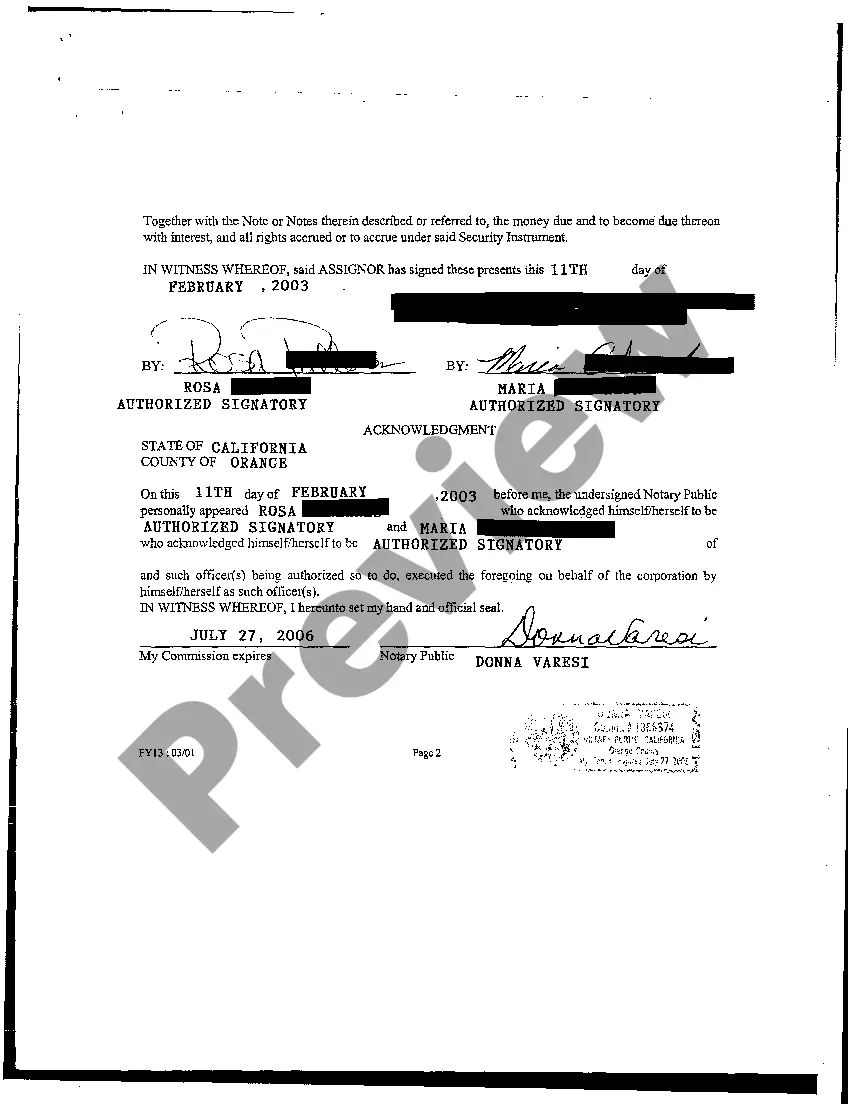

Assignment of Mortgage or Deed of Trust or Security Deed

In Gresham, Oregon, an Assignment of Mortgage, Deed of Trust, or Security Deed is a legal document that plays a vital role in real estate transactions. It facilitates the transfer of an existing mortgage or deed of trust from one party to another, typically when the underlying property is sold or when there is a need for the mortgage holder to grant an interest in the property as collateral. There are various types of Assignment of Mortgage, Deed of Trust, or Security Deed commonly used in Gresham, Oregon, each serving different purposes. These include: 1. Assignment of Mortgage: This type of document is used when the lender transfers the rights and obligations of a mortgage loan to another party. It ensures that the new party, known as the assignee, assumes all responsibilities related to the mortgage, including receiving payments and enforcing the terms of the loan. 2. Assignment of Deed of Trust: Unlike a mortgage, where the lender holds the property's title until the loan is repaid, a deed of trust involves three parties: the borrower (trust or), the lender (beneficiary), and a neutral third party known as the trustee. When an assignment of deed of trust occurs, the lender transfers their interest in the deed of trust to another party, who becomes the new beneficiary and assumes the lender's rights and powers. 3. Assignment of Security Deed: In Oregon, a security deed functions similarly to a deed of trust, where the borrower conveys legal title to a trustee in favor of the lender until the loan is satisfied. An assignment of security deed is used when the lender assigns their rights and interests in the security deed to another party, enabling the assignee to enforce the terms, receive payments, and potentially foreclose on the property in case of default. The process of assigning a mortgage, deed of trust, or security deed involves the preparation of a detailed assignment document, which clearly identifies the parties involved, the property details, the terms of the original agreement, and the rights being transferred. This document is typically recorded in the County Recorder's Office to ensure its public record. In Gresham, Oregon, it's essential for all parties involved in a mortgage assignment to work closely with legal professionals to ensure compliance with state laws and regulations. This helps protect the rights and interests of both the assignor and the assignee throughout the transaction. Overall, the Assignment of Mortgage, Deed of Trust, or Security Deed serves as a crucial mechanism in the real estate market of Gresham, Oregon, as it enables the efficient transfer of mortgage rights and responsibilities, facilitating property transactions and ensuring the security of lenders and borrowers.

Free preview

How to fill out Gresham Oregon Assignment Of Mortgage Or Deed Of Trust Or Security Deed?

If you’ve already used our service before, log in to your account and download the Gresham Oregon Assignment of Mortgage or Deed of Trust or Security Deed on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make sure you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Gresham Oregon Assignment of Mortgage or Deed of Trust or Security Deed. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!