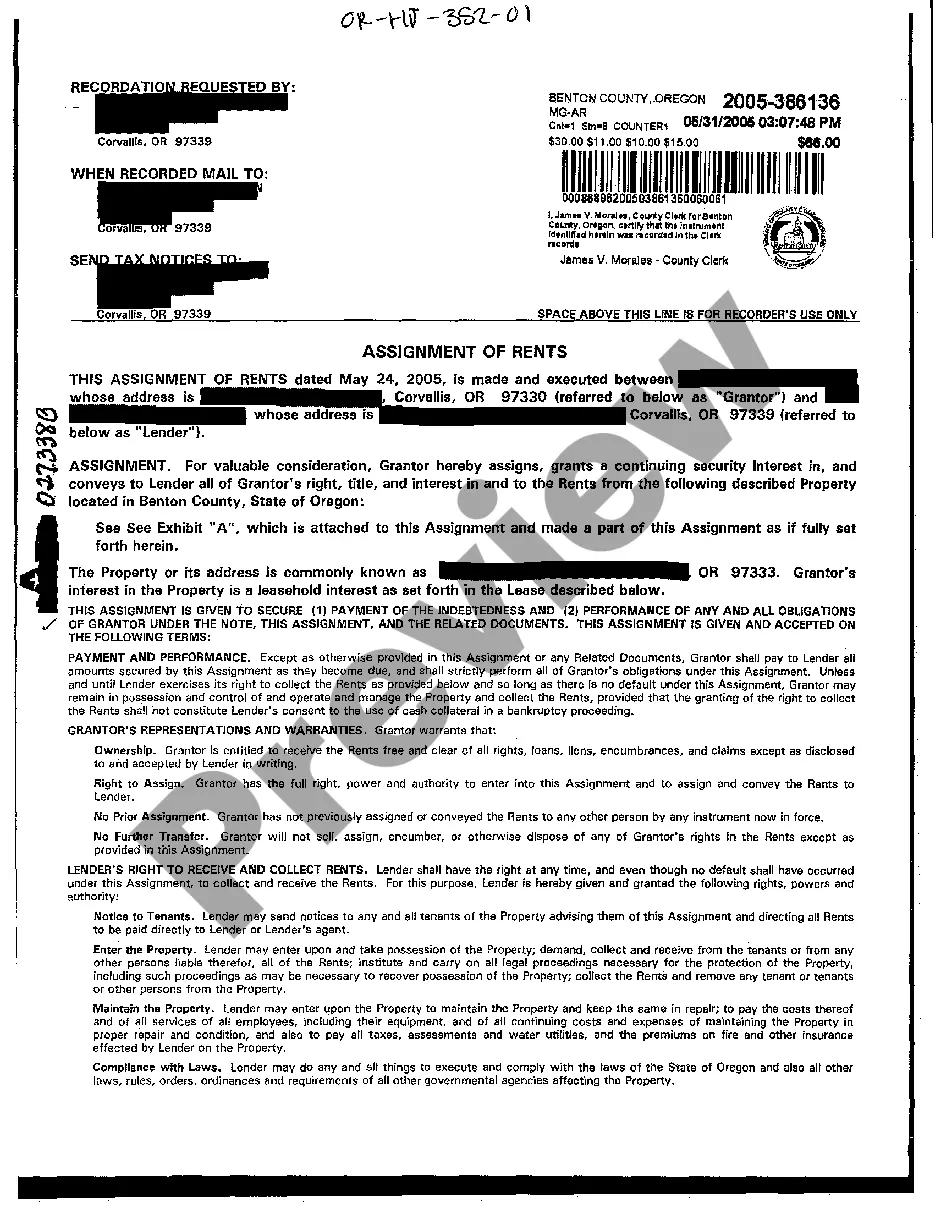

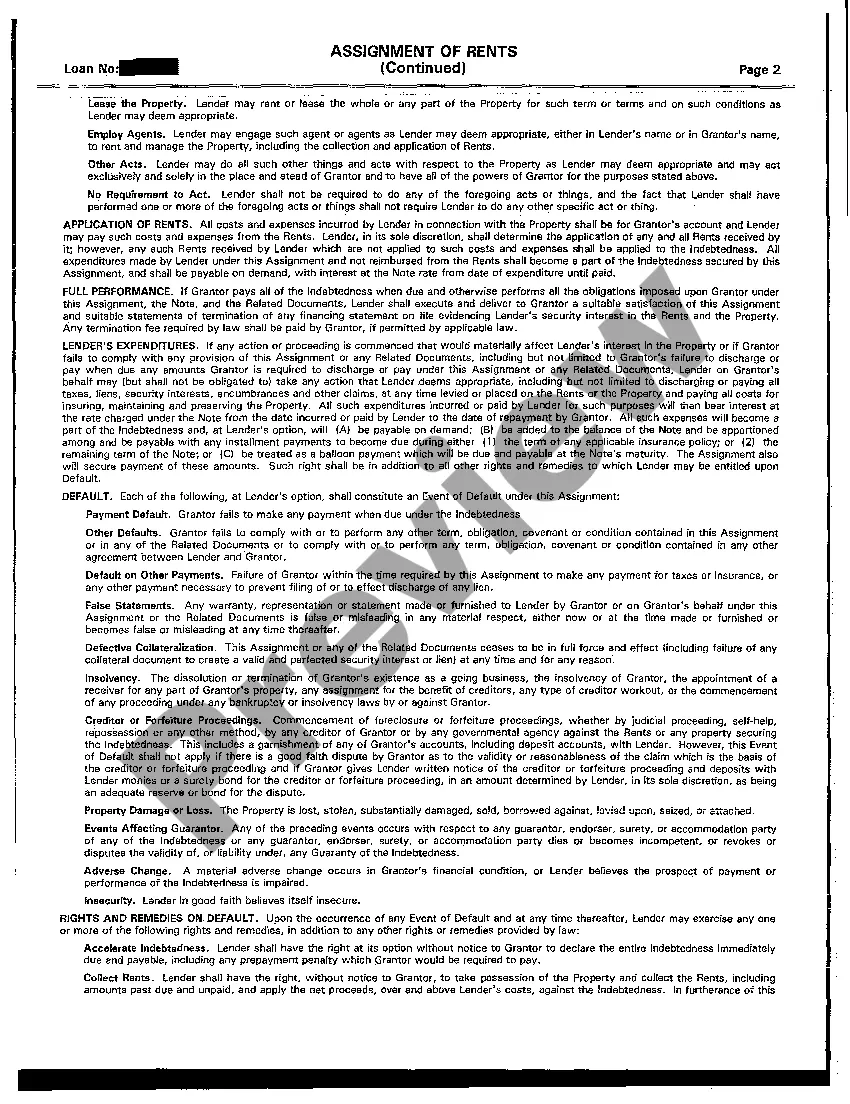

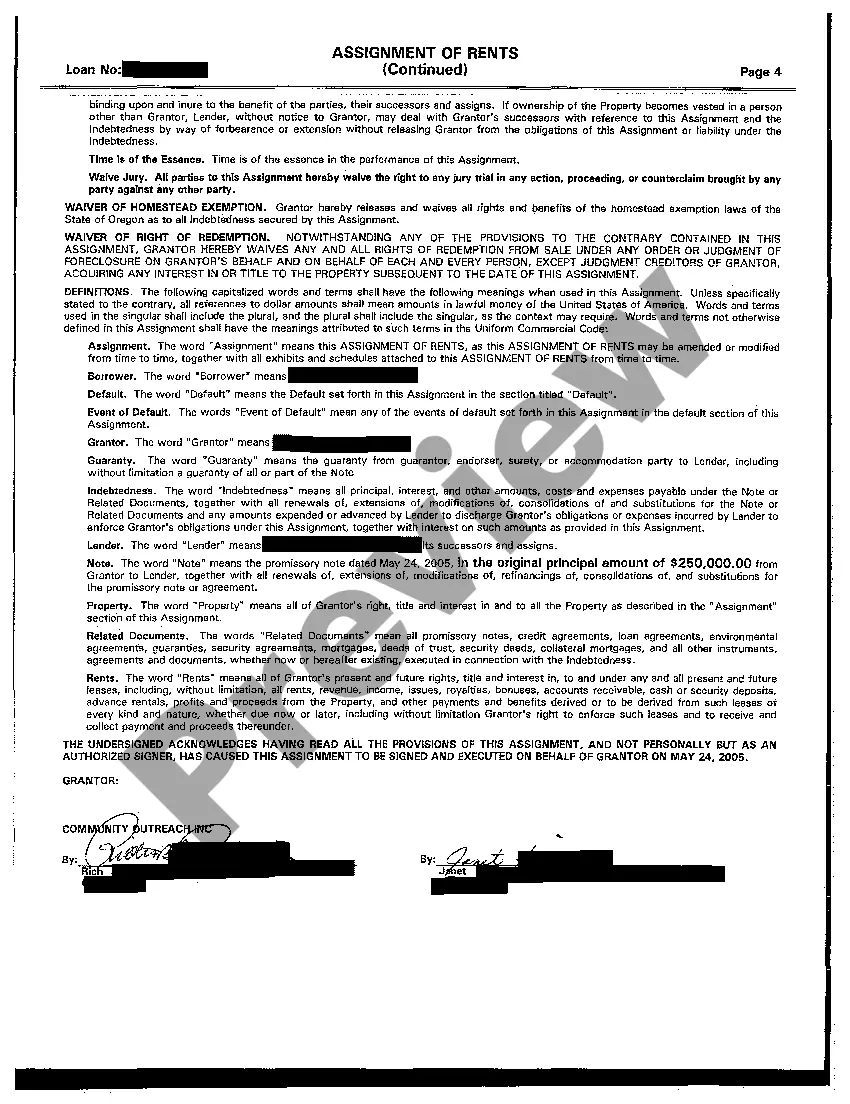

The Hillsboro Oregon Assignment of Rents is a legal document that transfers a borrower's right to collect and receive rental income from their property to a lender. This assignment serves as a collateral to secure a loan or mortgage, giving the lender the ability to collect rental income directly if the borrower defaults on their payments. In Hillsboro, Oregon, there are primarily two types of Assignment of Rents commonly utilized: 1. Absolute Assignment of Rents: In this type of assignment, the borrower transfers all rights and control over the rental income to the lender. The lender gains full control to collect and manage the rental payments as a means to cover any unpaid debts owed by the borrower. This type of assignment provides the highest level of security for the lender. 2. Conditional Assignment of Rents: Unlike absolute assignment, conditional assignment allows the borrower to retain some rights over the rental income. In this case, the borrower retains the right to collect rent until an event of default occurs, such as late payments or the borrower defaults on the loan. Only then, the lender steps in and gains the authority to collect the rents directly. The Hillsboro Oregon Assignment of Rents is a crucial component of a comprehensive loan agreement or mortgage, protecting the lender's interests by providing another source of repayment in case the borrower cannot fulfill their financial obligations. It ensures that the lender can recover their investment and offset any potential losses by accessing the rental income. Through the Hillsboro Oregon Assignment of Rents process, borrowers need to carefully review and understand the terms and conditions associated with the assignment. It is essential to consult with legal experts proficient in real estate and lending laws to ensure all parties' rights are adequately protected. In conclusion, the Hillsboro Oregon Assignment of Rents is an instrumental legal document used in securing loans and mortgages in the area. Both absolute and conditional assignments can be employed, depending on the borrower and lender's preferences. Understanding the assignment's terms and implications is crucial for both parties involved to mitigate any potential risks or disputes that may arise in the future.

Hillsboro Oregon Assignment of Rents

Description

How to fill out Hillsboro Oregon Assignment Of Rents?

If you are looking for a relevant form, it’s extremely hard to choose a better service than the US Legal Forms site – probably the most comprehensive online libraries. With this library, you can get a large number of templates for organization and personal purposes by categories and states, or keywords. With our advanced search function, discovering the latest Hillsboro Oregon Assignment of Rents is as elementary as 1-2-3. Additionally, the relevance of each file is confirmed by a group of professional attorneys that regularly review the templates on our platform and update them in accordance with the most recent state and county regulations.

If you already know about our platform and have a registered account, all you need to get the Hillsboro Oregon Assignment of Rents is to log in to your profile and click the Download option.

If you make use of US Legal Forms for the first time, just follow the guidelines below:

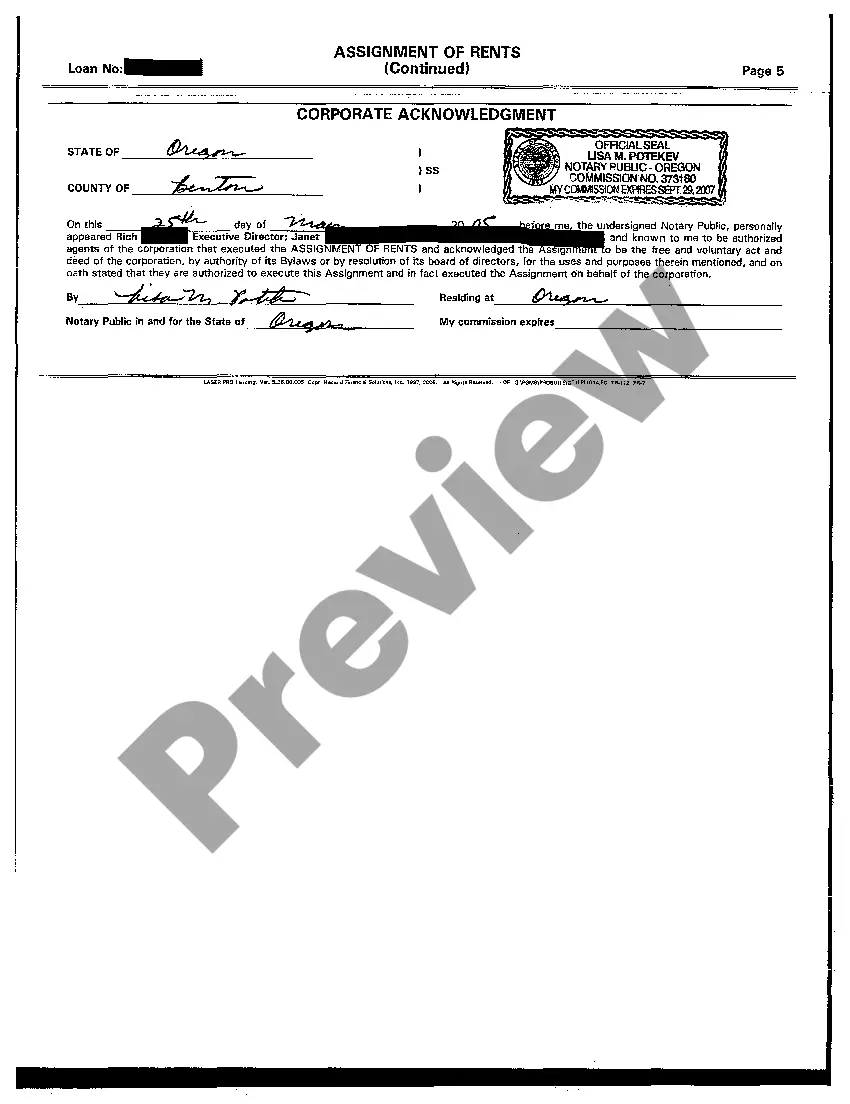

- Make sure you have opened the form you want. Check its information and use the Preview feature (if available) to see its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to find the proper record.

- Affirm your choice. Select the Buy now option. Next, choose your preferred pricing plan and provide credentials to register an account.

- Process the purchase. Use your credit card or PayPal account to complete the registration procedure.

- Receive the template. Select the format and save it to your system.

- Make modifications. Fill out, edit, print, and sign the acquired Hillsboro Oregon Assignment of Rents.

Each template you save in your profile does not have an expiry date and is yours permanently. You can easily gain access to them via the My Forms menu, so if you want to have an additional copy for editing or printing, you can return and export it once more anytime.

Make use of the US Legal Forms professional collection to get access to the Hillsboro Oregon Assignment of Rents you were seeking and a large number of other professional and state-specific templates in a single place!