The Eugene Oregon Deed of Partial Re conveyance is a legal document that allows homeowners to release a portion of their property from a mortgage or trust deed. This deed is commonly used when a homeowner has paid off a portion of their mortgage and wants to remove a specific parcel or lot from the encumbrance of the loan. In Eugene, Oregon, there are two types of Deeds of Partial Re conveyance commonly used: 1. Eugene Oregon Deed of Partial Re conveyance — Property Division: This type of deed is utilized when a property owner wants to divide their land into separate parcels or lots. It allows the owner to release the title of specific portions of the property, freeing them from the mortgage or trust deed. 2. Eugene Oregon Deed of Partial Re conveyance — Payoff: This deed is typically employed when a property owner has made partial payments on their mortgage, resulting in the loan balance being reduced. By utilizing this deed, the homeowner can effectively release the paid-off portion from the encumbrance of the mortgage or trust deed. The Eugene Oregon Deed of Partial Re conveyance process involves several steps. Firstly, the property owner must obtain the necessary forms from the Eugene County Recorder's Office or a legal professional. The deed should include accurate and specific descriptions of the portion being released, along with any associated legal descriptions or parcel numbers. Next, the deed must be properly executed and notarized. It is recommended to seek legal advice during this process to ensure all requirements are met to make the deed legally binding. Once the deed is completed, it should be filed with the Eugene County Recorder's Office for public record, ensuring the partial reconveyance is officially documented. The Eugene Oregon Deed of Partial Re conveyance provides flexibility for property owners, allowing them to divide or release specific portions of their properties from existing mortgage or trust deeds. This process grants homeowners more control over their real estate assets while maintaining financial stability. It is important to consult with legal professionals or real estate experts for guidance and accurate execution of deeds to avoid any potential legal issues.

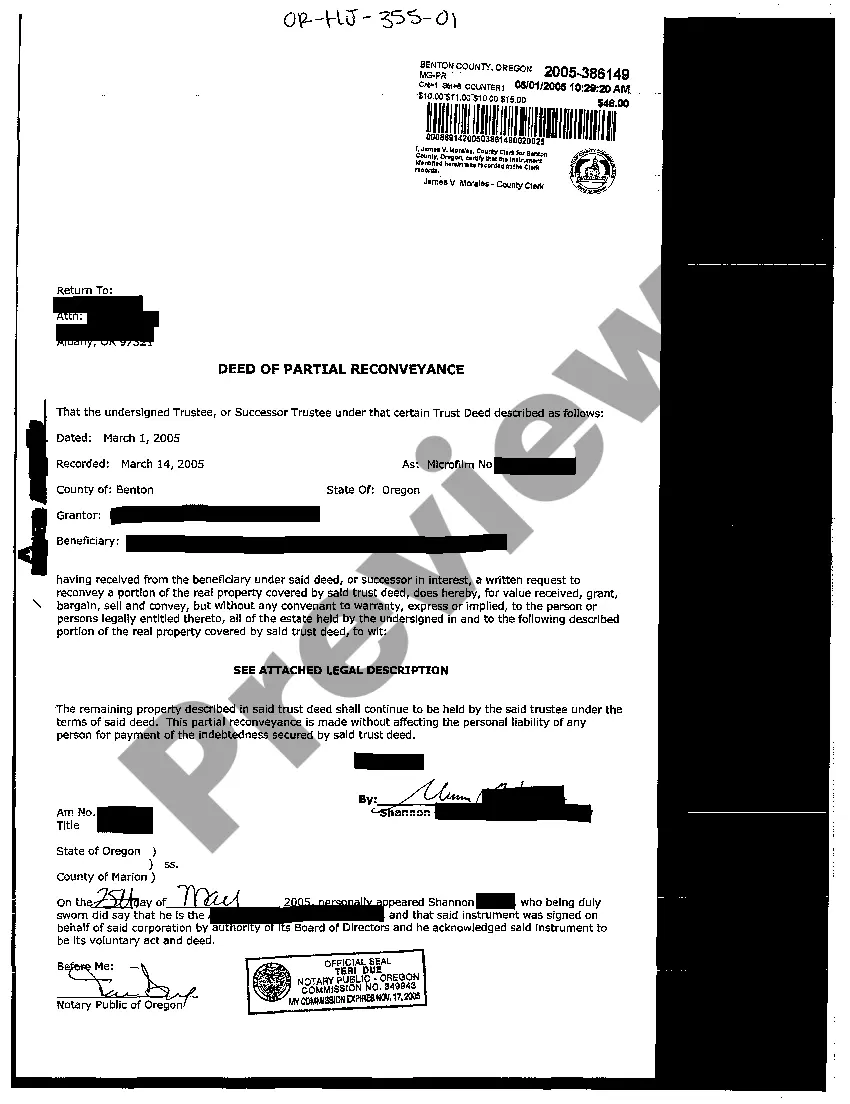

Eugene Oregon Deed of Partial Reconveyance

Description

How to fill out Eugene Oregon Deed Of Partial Reconveyance?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Eugene Oregon Deed of Partial Reconveyance becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Eugene Oregon Deed of Partial Reconveyance takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of additional steps to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve picked the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Eugene Oregon Deed of Partial Reconveyance. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!