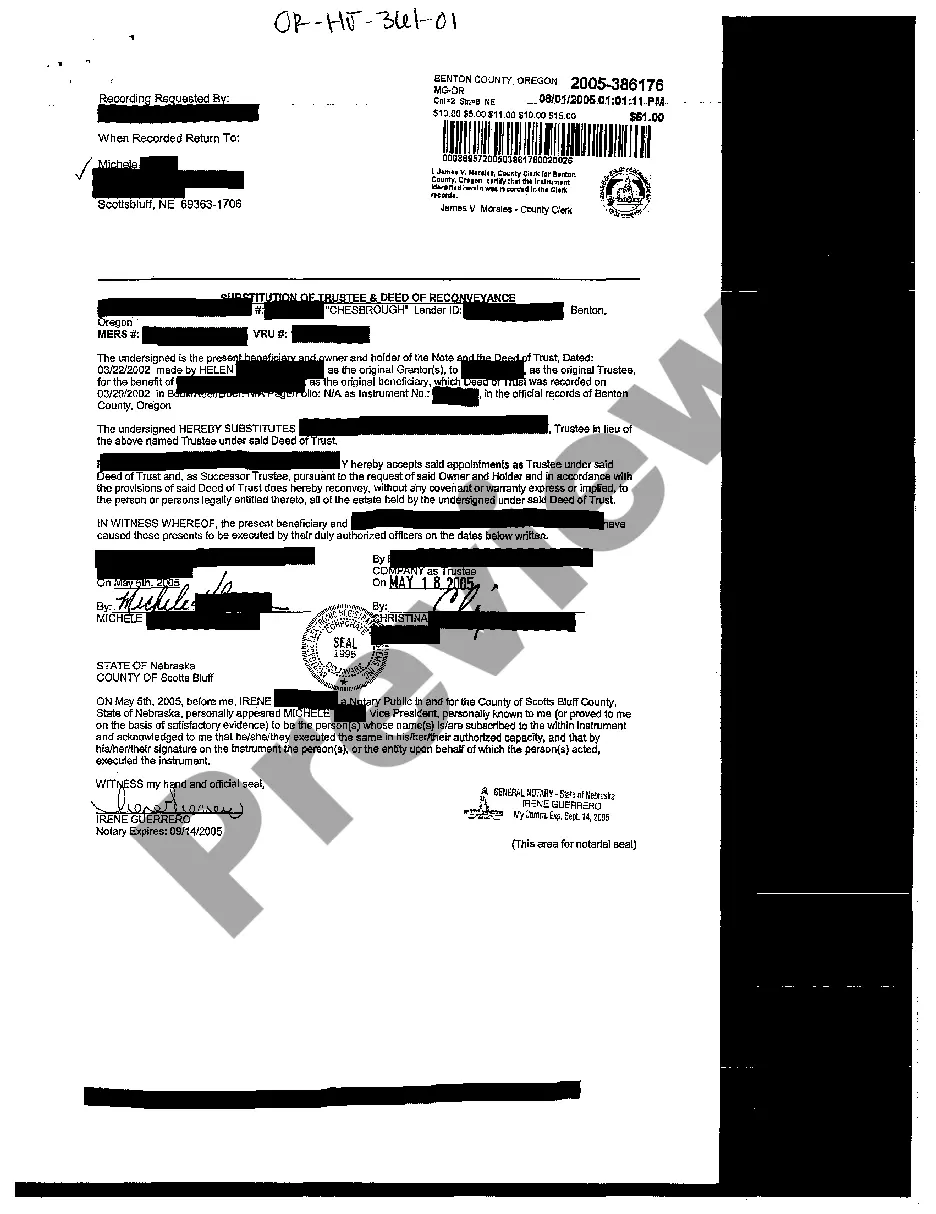

Gresham, Oregon Substitution of Trustee and Deed Re conveyance play vital roles in the real estate industry, specifically in mortgage transactions. When property owners secure a mortgage loan, they typically sign a trust deed that grants the lender a security interest in the property in case of default. The Gresham Oregon Substitution of Trustee and Deed Re conveyance process allows for changes to the trustee named in the original trust deed or clears the lien when the loan is paid off. One type of Gresham Oregon Substitution of Trustee is initiated when the lender decides to replace the original trustee named in the trust deed with a new one. This could be due to changes within the lender's organization, a desire to streamline operations, or a consolidation of loan servicing. The process involves preparing the necessary legal documents, including the Substitution of Trustee form, which is then recorded with the appropriate county recorder's office. The new trustee assumes the responsibilities and duties previously held by the original trustee. Another type of Gresham Oregon Substitution of Trustee occurs when the property owner refinances their mortgage loan with a different lender. In this scenario, the new lender becomes the beneficiary of the trust deed, and the original trustee is substituted with a new one to reflect the change in ownership. The process involves executing a Substitution of Trustee agreement and recording it to update public records. Deed reconveyance is the second part of this process. Once the mortgage loan is fully paid off, the lender issues a Deed of Re conveyance to the property owner. This document states that the lender's security interest has been satisfied, and the trust deed is void. The Deed of Re conveyance must be recorded with the county recorder's office to clear the property title from any liens associated with the mortgage. Gresham Oregon Substitution of Trustee and Deed Re conveyance are crucial steps in properly documenting changes in ownership and releasing liens after a mortgage loan is paid off. These legally binding processes protect the interests of all parties involved and ensure accurate public records.

Gresham Oregon Substitution of Trustee and Deed Reconveyance

Description

How to fill out Gresham Oregon Substitution Of Trustee And Deed Reconveyance?

We always strive to minimize or avoid legal issues when dealing with nuanced law-related or financial matters. To do so, we sign up for attorney services that, usually, are very costly. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to legal counsel. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Gresham Oregon Substitution of Trustee and Deed Reconveyance or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Gresham Oregon Substitution of Trustee and Deed Reconveyance adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Gresham Oregon Substitution of Trustee and Deed Reconveyance would work for your case, you can choose the subscription plan and make a payment.

- Then you can download the form in any suitable file format.

For over 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!