Title: Exploring the Eugene Oregon Appointment of Substitute Trustee and Re conveyance of Trust Deed: Types and Overview Introduction: The Eugene Oregon Appointment of Substitute Trustee and Re conveyance of Trust Deed play a vital role in property transactions and mortgage processes. Understanding these terms is crucial for both real estate professionals and homeowners alike. This article will provide a detailed description of these concepts, highlighting their significance, key processes, and different types if applicable. 1. Eugene Oregon Appointment of Substitute Trustee: The Appointment of Substitute Trustee is a legal document commonly used in Eugene, Oregon, in mortgage-related transactions. It occurs when a lender or mortgage holder appoints a new trustee to replace the original trustee specified in the trust deed. This appointment generally takes place for various reasons, such as trustee retirement, resignation, or in cases where a trustee is unable to perform their duties effectively. Keywords/Phrases: Eugene Oregon Appointment of Substitute Trustee, trustee retirement, trustee resignation, replacing original trustee. 2. Re conveyance of Trust Deed: Re conveyance of Trust Deed refers to the process of transferring the legal title or ownership of a property back to the borrower once the mortgage or loan secured by the trust deed is paid off entirely. It occurs when the borrower fulfills all financial obligations, including principal, interest, and fees, to the lender or mortgage holder. The reconveyance document is then filed with the county recorder's office, officially releasing the lender's claim on the property. Keywords/Phrases: Re conveyance of Trust Deed, transferring ownership, paying off mortgage, financial obligations, county recorder's office. Types of Eugene Oregon Appointment of Substitute Trustee and Re conveyance of Trust Deed: a. Voluntary Appointment of Substitute Trustee: In this type, the change in trustee occurs due to a mutual agreement between the lender and the trustee. The original trustee is replaced by a new trustee as specified in a written agreement, ensuring a smooth transition while maintaining legal compliance. Keywords/Phrases: Voluntary Appointment of Substitute Trustee, mutual agreement, smooth transition. b. Involuntary Appointment of Substitute Trustee: This type of appointment of a substitute trustee is initiated by the lender or mortgage holder due to the trustee's inability to perform their duties or any breach of contract. It is typically done to protect the lender's interests and ensure proper handling of the trust deed. Keywords/Phrases: Involuntary Appointment of Substitute Trustee, breach of contract, protecting lender's interests. Conclusion: Understanding the Eugene Oregon Appointment of Substitute Trustee and Re conveyance of Trust Deed is vital when dealing with property transactions and mortgage repayments. By comprehending the processes involved and potential types of these agreements, homeowners and real estate professionals can navigate these legal aspects effectively, ensuring a smooth transaction while safeguarding their interests.

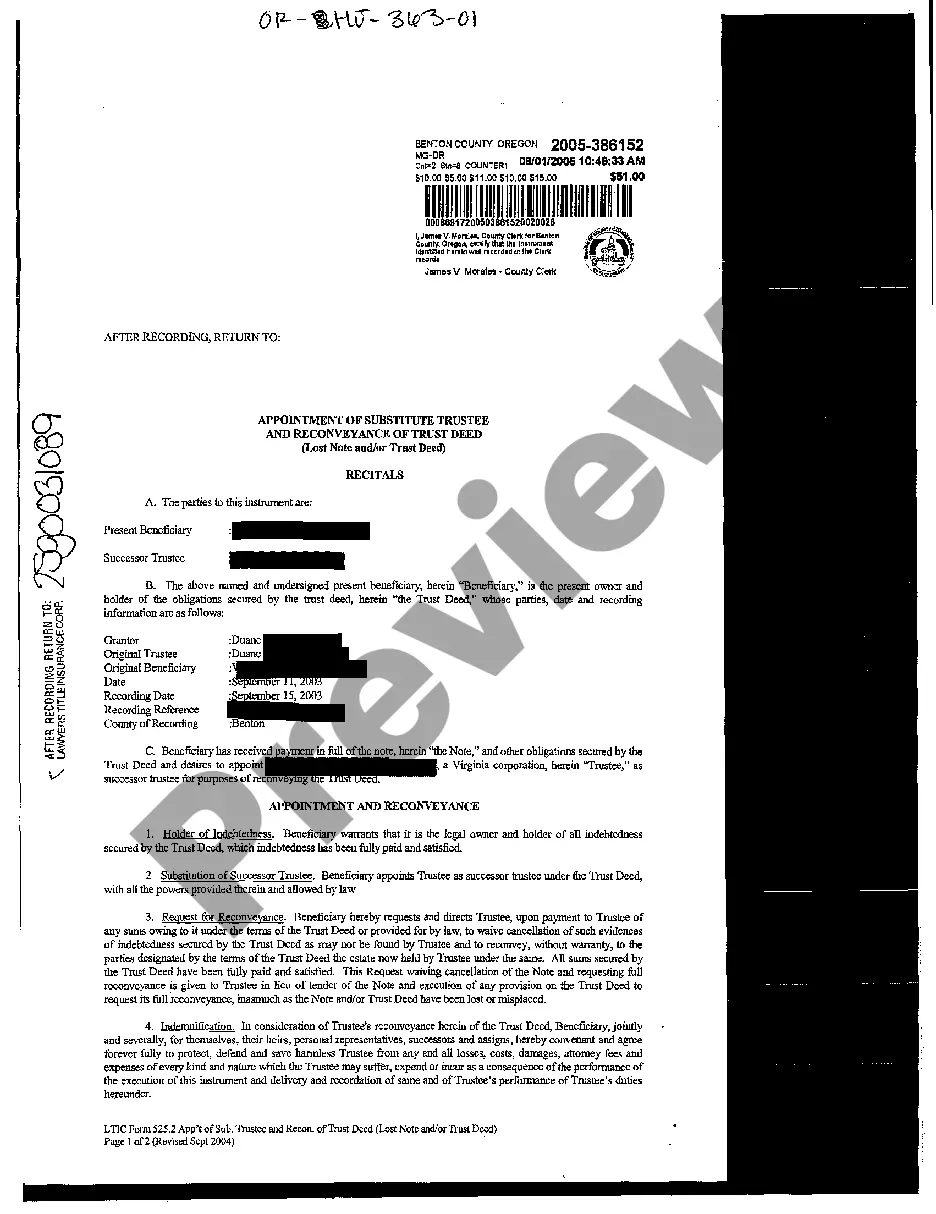

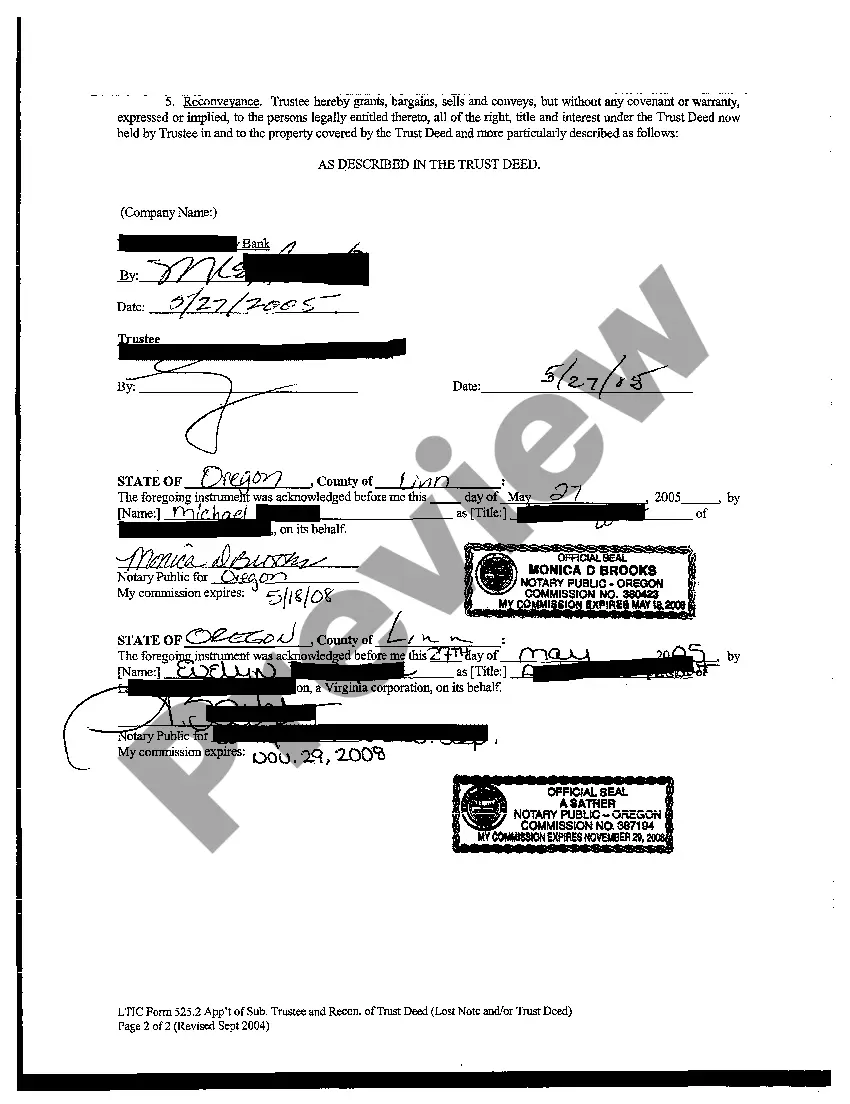

Hj363

Description

How to fill out Eugene Oregon Appointment Of Substitute Trustee And Reconveyance Of Trust Deed?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Eugene Oregon Appointment of Substitute Trustee and Reconveyance of Trust Deed becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Eugene Oregon Appointment of Substitute Trustee and Reconveyance of Trust Deed takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve chosen the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Eugene Oregon Appointment of Substitute Trustee and Reconveyance of Trust Deed. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!