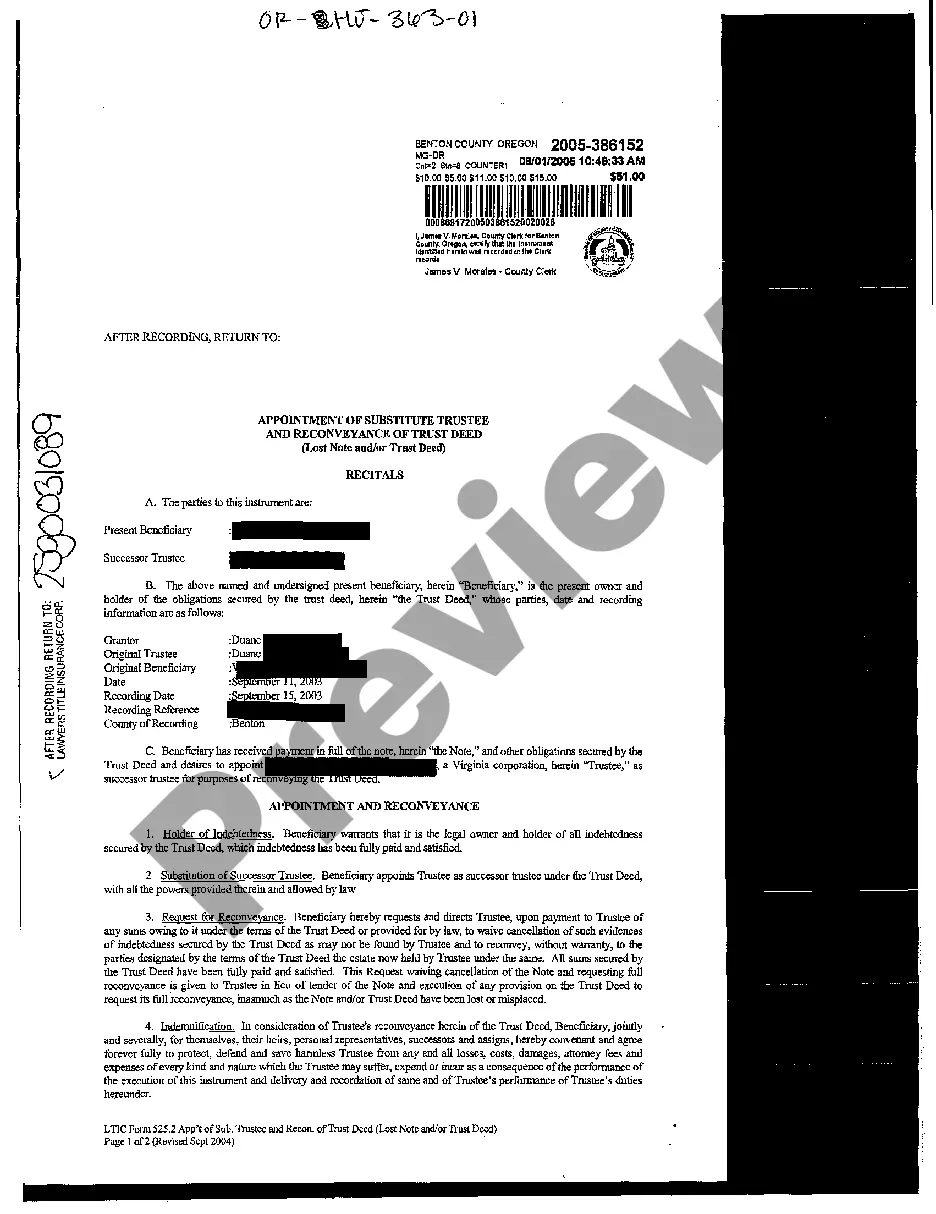

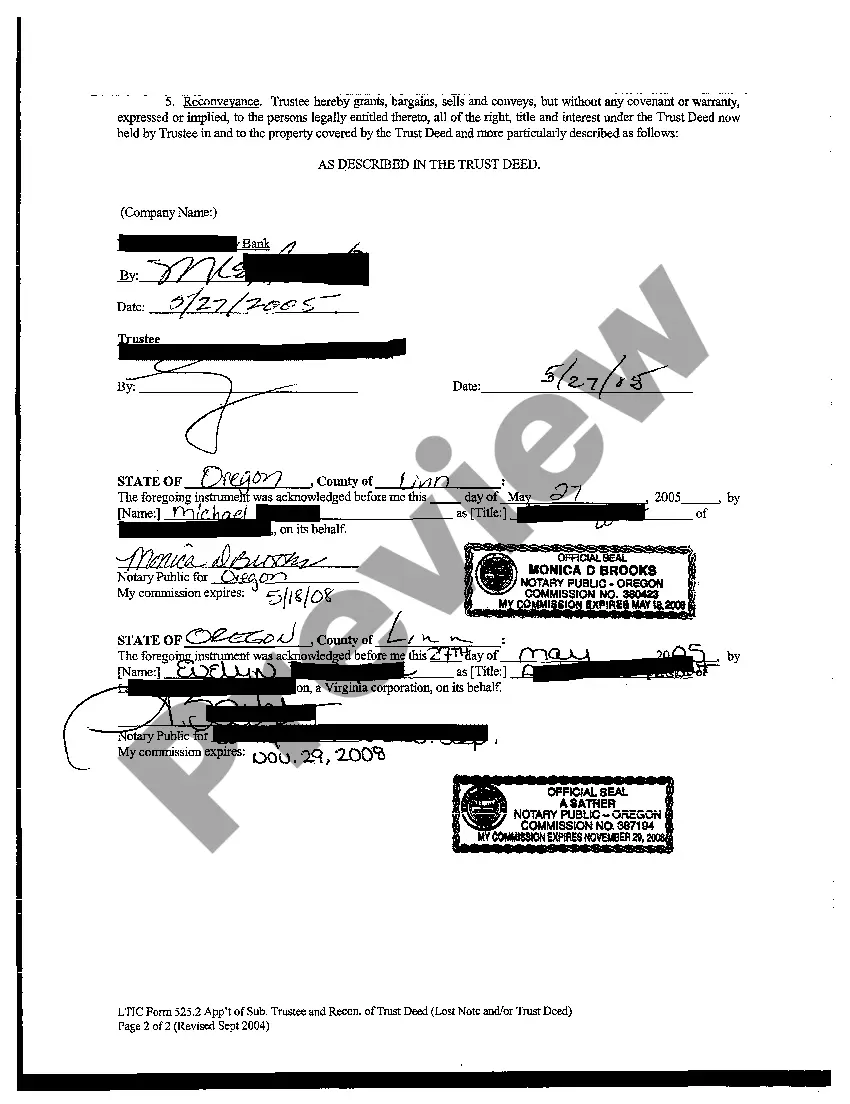

Portland Oregon Appointment of Substitute Trustee and Re conveyance of Trust Deed are important legal processes that involve the transfer and management of property titles in the Portland, Oregon area. When a person or entity has taken out a loan for a property and secured it by executing a Trust Deed, this legal document serves as security for the lender. In the event of a default, the lender may initiate the process of appointing a Substitute Trustee and executing a reconveyance of the Trust Deed. The Appointment of Substitute Trustee typically occurs when the original Trustee is unable or unwilling to perform their duties. This could be due to various reasons such as retirement, resignation, or incapacity. The appointment of a Substitute Trustee is necessary to ensure the smooth and lawful administration of the Trust Deed. The Substitute Trustee is a neutral third party who undertakes the responsibilities and duties of the original Trustee. The lender or the beneficiary of the Trust Deed is usually the party responsible for making the appointment. The Re conveyance of Trust Deed is the process by which the lender releases their claim on the property once the loan has been fully repaid or otherwise satisfied. It is a legal document used to formally convey the release of the lender's interest in the property back to the borrower. The Re conveyance of Trust Deed serves as evidence that the loan has been fully satisfied, and it allows the borrower to gain clear and unencumbered ownership of the property. In Portland, Oregon, there may be different types of Appointment of Substitute Trustee and Re conveyance of Trust Deed, such as: 1. Voluntary Re conveyance: This occurs when the borrower fulfills their loan obligations, typically by repaying the loan in full. The lender willingly releases their claim on the property through a formal reconveyance process. 2. Deed In Lieu of Foreclosure: In certain situations where the borrower is facing financial hardship and is unable to meet their loan obligations, they may choose to voluntarily transfer the property to the lender in exchange for the cancellation of the debt. This process avoids foreclosure and allows the lender to take ownership through a reconveyance. 3. Foreclosure and Re conveyance: If the borrower defaults on their loan, the lender may initiate foreclosure proceedings to recover their investment. Upon successfully completing the foreclosure process, the lender can acquire ownership of the property and subsequently execute a reconveyance of the Trust Deed. 4. Non-Judicial Foreclosure and Re conveyance: In Oregon, foreclosures can be conducted through both judicial and non-judicial processes. Non-judicial foreclosures are often preferred due to their efficiency and speed. In this scenario, the Substitute Trustee appointed by the lender follows specific legal procedures to carry out the foreclosure and subsequent reconveyance. Overall, the Appointment of Substitute Trustee and Re conveyance of Trust Deed are crucial steps in ensuring the proper transfer of property titles and resolving loan obligations in Portland, Oregon. These legal processes protect the interests of both lenders and borrowers while upholding the requirements of state laws.

Portland Oregon Appointment of Substitute Trustee and Reconveyance of Trust Deed

Description

How to fill out Portland Oregon Appointment Of Substitute Trustee And Reconveyance Of Trust Deed?

Regardless of one’s social or professional standing, completing legal-related documents is an unfortunate requirement in today's society.

Often, it’s nearly unattainable for an individual without legal training to create such documents from the ground up, primarily because of the intricate language and legal subtleties they encompass.

This is where US Legal Forms comes to the aid.

Confirm that the template you selected is applicable to your region since the regulations of one state do not apply to another area.

Examine the form and read through a brief overview (if offered) of scenarios the document can be utilized for.

- Our service offers a vast collection of over 85,000 ready-to-use state-specific templates suitable for nearly any legal situation.

- US Legal Forms also acts as a valuable resource for associates or legal advisors aiming to enhance their efficiency by using our DIY forms.

- Whether you need the Portland Oregon Appointment of Substitute Trustee and Reconveyance of Trust Deed or any other documentation applicable in your region, with US Legal Forms, everything is easily accessible.

- Here’s how you can quickly acquire the Portland Oregon Appointment of Substitute Trustee and Reconveyance of Trust Deed utilizing our dependable platform.

- If you’re already a subscriber, simply Log In to access your required form.

- However, if you’re new to our site, please ensure you follow these guidelines prior to downloading the Portland Oregon Appointment of Substitute Trustee and Reconveyance of Trust Deed.

Form popularity

FAQ

A substitution of trustee simply names a new person to take over that position, as well as a secondary trustee if necessary. A substitution of trustee and full reconveyance serves two purposes: It enables a lender (such as a mortgage company) to appoint a new trustee. It allows the new trustee to release the lien.

In a trust, assets are held and managed by one person or people (the trustee) to benefit another person or people (the beneficiary). The person providing the assets is called the settlor.

A deed of appointment of trustees and conveyance, incorporating resignation, where a person nominated in the trust deed (an appointor) is adding trustees and one of the existing trustees is resigning at the same time.

A professional fiduciary that is not an Oregon bank or trust company can act as trustee, if a court appoints it and it posts a bond. You can appoint more than one trustee, delegating different duties to each trustee if you wish, and you can retain the power to remove the trustee and appoint a new one.

A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower. In most cases, the trustee is an escrow If you don't repay your loan, the escrow company's attorney must begin the foreclosure process.

?Beneficiary? means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).

A trustee deed?sometimes called a deed of trust or a trust deed?is a legal document created when someone purchases real estate in a trust deed state, such as California (check your local laws to see what is required in your state). A trust deed is used in place of a mortgage.

In Oregon, any competent adult can be the trustee, including the person setting up the trust. An Oregon bank or trust company can also act as trustee. You can appoint more than one trustee, can delegate different duties to each trustee, and can retain the power to remove the trustee and appoint a new one.

And although a beneficiary generally has very little control over the trust's management, they are entitled to receive what the trust allocates to them. In general, a trustee has extensive powers when it comes to overseeing the trust.

A document known as a substitution of trustee and full reconveyance identifies the person who has the authority to reconvey the property and remove the lien. Most importantly, a deed of full reconveyance, known as a satisfaction of mortgage in some states, transfers title back to the borrower.