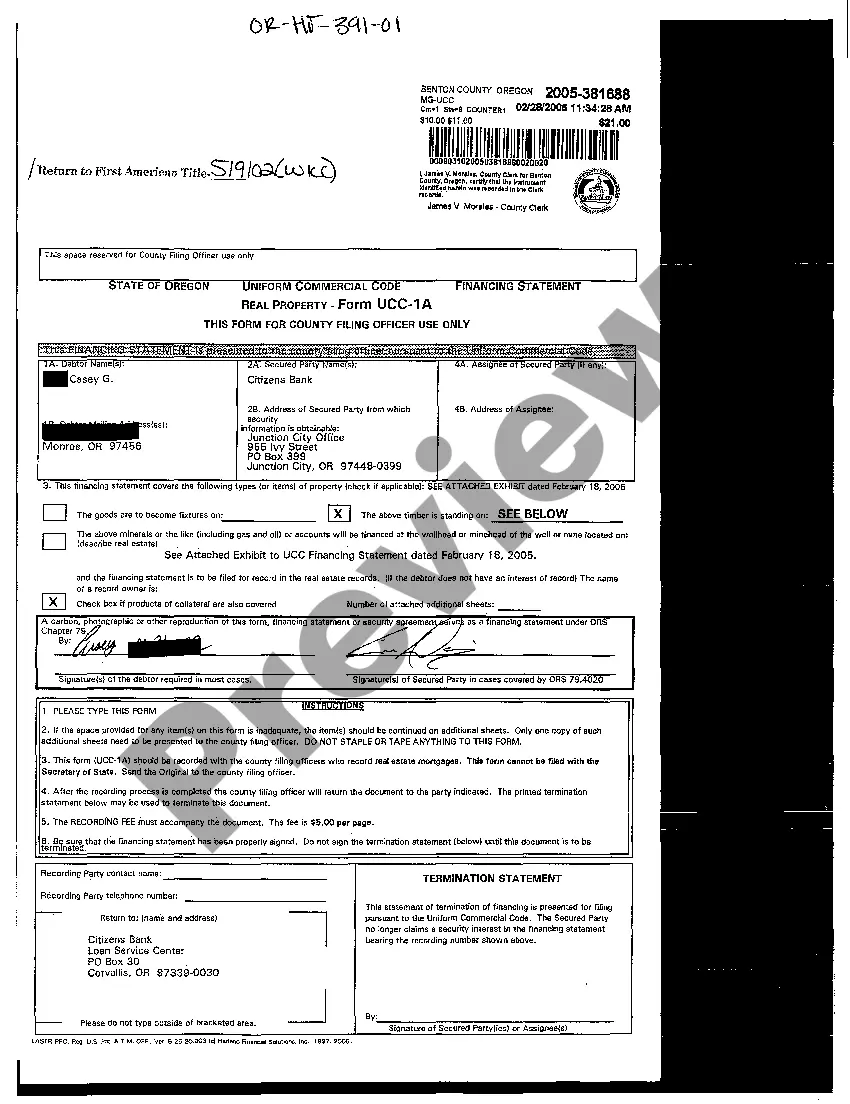

Bend Oregon Real Property refers to any land, buildings, or improvements located in Bend, Oregon. It is essential for potential buyers, sellers, and lenders to have a clear understanding of the property's legal status and any existing liens or encumbrances. The Form UCC-1A is a crucial document used in the process of securing financing against real property. The UCC-1A, also known as a financing statement, is a legal form used to establish a creditor's security interest in the real property. By filing this form with the appropriate government office, lenders can protect their rights and ensure they are paid before other creditors in the event of default or foreclosure. In Bend, Oregon, there are different types of UCC-1A forms that individuals should be familiar with, including: 1. UCC-1A Financing Statement: This is the most common form used to establish the security interest in real property. It includes details about the debtor, the secured party, and specific information about the property being used as collateral. 2. UCC-1A Amendment: If there are any changes to the original UCC-1A filing, such as amendments to the debtor's information, additional collateral, or the release of a lien, an amendment form must be filed to reflect those changes accurately. 3. UCC-1A Continuation: A continuation form must be filed to extend the effectiveness of the UCC-1A filing beyond the initial expiration date. This is crucial to maintain the priority of the security interest against any competing creditors. 4. UCC-1A Termination: Once the secured debt is paid off, the lender must file a termination form to release the lien against the real property. This ensures that the property's title is clear and unencumbered. It is important to note that completing and filing the UCC-1A form accurately is a critical step in securing financing against Bend, Oregon real property. Any errors or omissions may result in potential disputes or complications in the future. Engaging the services of a qualified attorney or real estate professional can help ensure the proper completion and filing of the necessary forms, protecting both lenders and borrowers in any real estate transaction.

Bend Oregon Real Property refers to any land, buildings, or improvements located in Bend, Oregon. It is essential for potential buyers, sellers, and lenders to have a clear understanding of the property's legal status and any existing liens or encumbrances. The Form UCC-1A is a crucial document used in the process of securing financing against real property. The UCC-1A, also known as a financing statement, is a legal form used to establish a creditor's security interest in the real property. By filing this form with the appropriate government office, lenders can protect their rights and ensure they are paid before other creditors in the event of default or foreclosure. In Bend, Oregon, there are different types of UCC-1A forms that individuals should be familiar with, including: 1. UCC-1A Financing Statement: This is the most common form used to establish the security interest in real property. It includes details about the debtor, the secured party, and specific information about the property being used as collateral. 2. UCC-1A Amendment: If there are any changes to the original UCC-1A filing, such as amendments to the debtor's information, additional collateral, or the release of a lien, an amendment form must be filed to reflect those changes accurately. 3. UCC-1A Continuation: A continuation form must be filed to extend the effectiveness of the UCC-1A filing beyond the initial expiration date. This is crucial to maintain the priority of the security interest against any competing creditors. 4. UCC-1A Termination: Once the secured debt is paid off, the lender must file a termination form to release the lien against the real property. This ensures that the property's title is clear and unencumbered. It is important to note that completing and filing the UCC-1A form accurately is a critical step in securing financing against Bend, Oregon real property. Any errors or omissions may result in potential disputes or complications in the future. Engaging the services of a qualified attorney or real estate professional can help ensure the proper completion and filing of the necessary forms, protecting both lenders and borrowers in any real estate transaction.