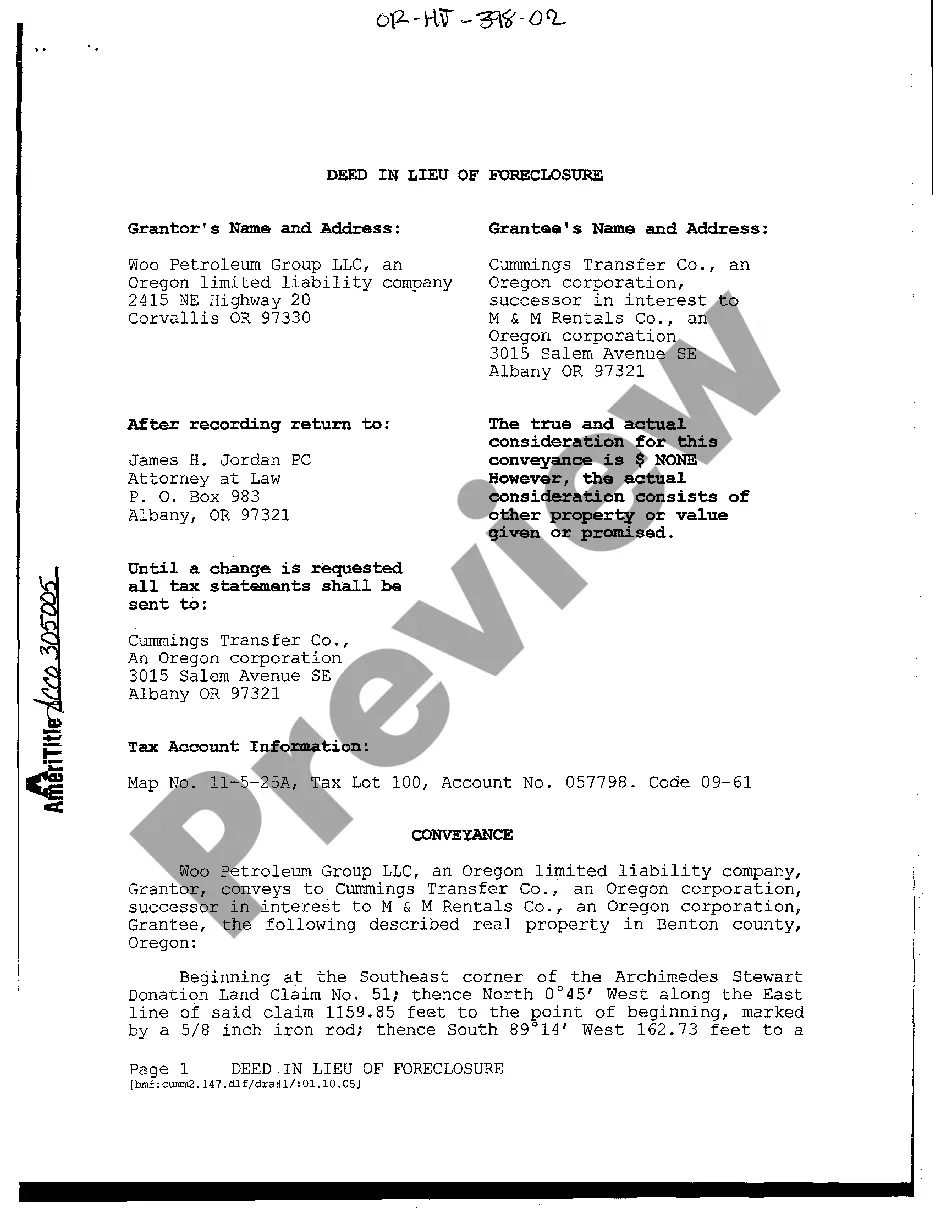

Hillsboro Oregon Deed in Lieu of Foreclosure is a legal arrangement between a homeowner and a lender that allows the borrower to transfer the property's ownership to the lender to avoid foreclosure. This process is a voluntary alternative to foreclosure and can provide benefits to both parties involved. The primary goal of Hillsboro Oregon Deed in Lieu of Foreclosure is to relieve the borrower from the burden of an impending foreclosure, while also allowing the lender to regain control of the property without going through the lengthy and costly foreclosure process. This agreement is often considered when the borrower is unable to make mortgage payments and has exhausted all other options for loan modification or repayment plans. By opting for a Hillsboro Oregon Deed in Lieu of Foreclosure, the homeowner voluntarily surrenders their property's deed to the lender, effectively transferring ownership. In return, the lender agrees to release the borrower from any remaining mortgage obligations and cancels the foreclosure proceedings. This arrangement is advantageous for both parties in different ways. For the homeowner, it can help preserve their credit score by avoiding a foreclosure, which can have long-lasting negative effects. It also eliminates the stress and uncertainty associated with the foreclosure process. Additionally, certain lenders may offer relocation assistance or financial incentives to encourage the homeowner to cooperate and facilitate a smoother transition. For the lender, a Hillsboro Oregon Deed in Lieu of Foreclosure can save time and resources that would otherwise be spent on a potentially lengthy foreclosure process. It allows the lender to take possession of the property more quickly, reducing the risk of damage or neglect. Furthermore, it may be a mutually beneficial solution when the property's value is less than the outstanding mortgage balance or if the borrower has demonstrated financial hardship. It's important to note that there are no specific subtypes of Hillsboro Oregon Deed in Lieu of Foreclosure. However, variations in the agreement terms and conditions can exist depending on the specific circumstances and negotiations between the borrower and lender. Factors such as the amount of outstanding debt, additional liens on the property, or potential tax implications may influence the final terms of the agreement. In conclusion, a Hillsboro Oregon Deed in Lieu of Foreclosure is a voluntary arrangement where a homeowner transfers ownership of their property to the lender to avoid foreclosure. It offers benefits to both parties involved, providing the homeowner with the opportunity to preserve their credit score and avoid foreclosure-related stress, while enabling the lender to regain control of the property more efficiently.

Hillsboro Oregon Deed in Lieu of Foreclosure

Description

How to fill out Hillsboro Oregon Deed In Lieu Of Foreclosure?

We always strive to minimize or prevent legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for attorney solutions that, usually, are extremely expensive. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to an attorney. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Hillsboro Oregon Deed in Lieu of Foreclosure or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Hillsboro Oregon Deed in Lieu of Foreclosure complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Hillsboro Oregon Deed in Lieu of Foreclosure is suitable for you, you can select the subscription option and make a payment.

- Then you can download the document in any suitable format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

Your credit score may drop by a range of 50 to 125 points after a deed in lieu of foreclosure, depending on where it stood before the deed in lieu, according to FICO data. The impact is slightly less severe than a foreclosure filing, though, which may drop your credit score by as many as 160 points.

Banks sometimes agree to these terms to avoid the expense and hassle of foreclosing. If you have a lot of equity in the property, though, a deed in lieu usually isn't a good way to go. In most cases, you'll be better off by selling the home and paying off the debt.

Your credit score may drop by a range of 50 to 125 points after a deed in lieu of foreclosure, depending on where it stood before the deed in lieu, according to FICO data. The impact is slightly less severe than a foreclosure filing, though, which may drop your credit score by as many as 160 points.

A deed in lieu means you and your lender reach a mutual understanding that you're no longer able to make your mortgage loan payments. The lender agrees to avoid putting you into foreclosure when you hand the property over amicably. In exchange, the lender releases you from your obligations under the mortgage.

Less damage to your credit: A deed in lieu agreement stays on your credit report for 4 years while a foreclosure sticks around for 7 years. Taking a deed in lieu agreement can allow you to buy a new home sooner than if you go through a foreclosure.

One downside to a deed in lieu is that you may face taxes on the amount of your forgiven debt, which the IRS considers income. The taxable amount is the total debt at the time it was forgiven minus the fair market value of the home at that time.

The purchaser has no responsibility because the purchaser receives the property title without the mortgage and junior liens. What is a major disadvantage to lenders of accepting a deed in lieu of foreclosure? The lender takes the real estate subject to all junior liens.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.