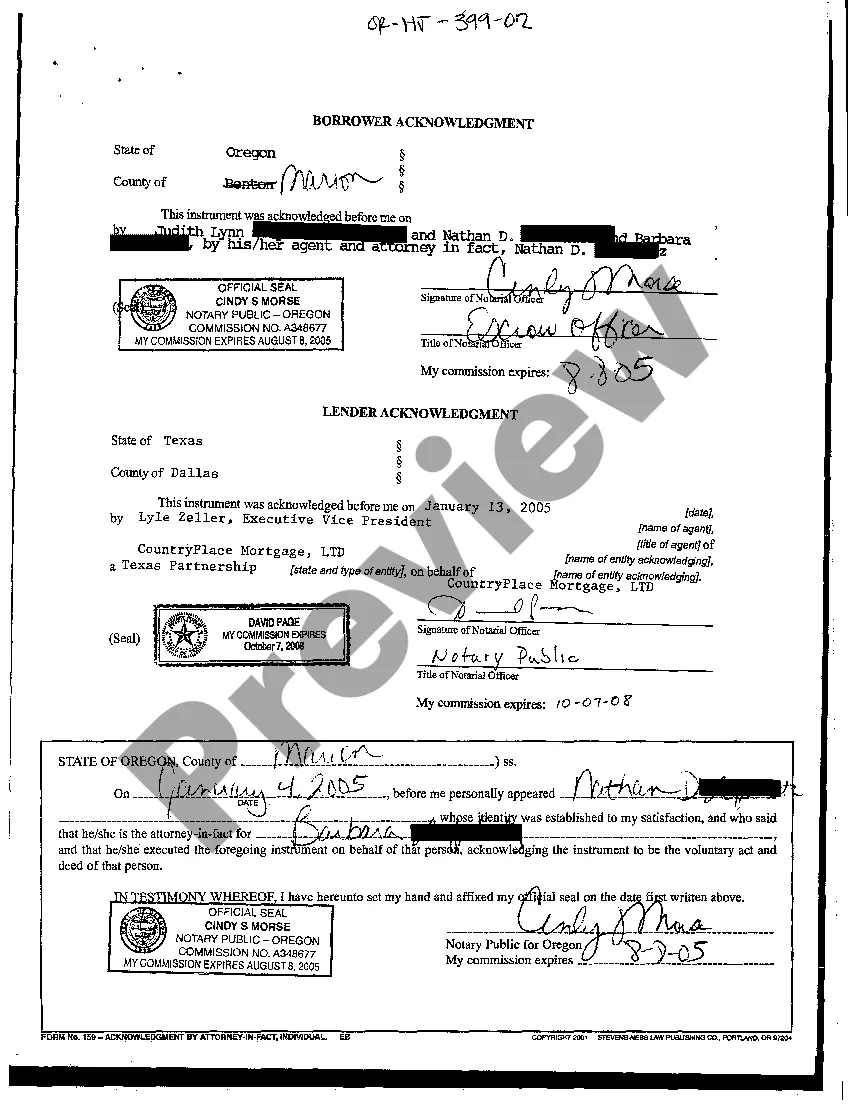

Bend Oregon Borrower Acknowledgment is a legal document used in the city of Bend, Oregon, that serves as an acknowledgment by the borrower of certain terms and conditions related to a loan or mortgage. This document plays a crucial role in ensuring transparency and understanding between the borrower and lender. The Bend Oregon Borrower Acknowledgment outlines the key terms of the loan agreement, such as the loan amount, interest rate, repayment terms, and any specific conditions or provisions applicable to the loan. It serves as evidence that the borrower has reviewed and understood these terms before proceeding with the loan. By signing the Bend Oregon Borrower Acknowledgment, the borrower acknowledges their responsibility for repaying the loan and agrees to comply with the terms and conditions outlined in the document. This acknowledgment is important for both the lender and borrower as it safeguards their rights and helps prevent any misunderstandings or disputes in the future. In Bend, Oregon, there may be several types of Borrower Acknowledgment, each specific to the type of loan or mortgage being obtained. Some common variations include: 1. Bend Oregon Mortgage Borrower Acknowledgment: This type of acknowledgment is used specifically for mortgage loans, outlining the terms and conditions relevant to the mortgage agreement, such as property details, loan duration, and escrow procedures. 2. Bend Oregon Business Loan Borrower Acknowledgment: For borrowers seeking business loans, this acknowledgment highlights specific terms relating to the loan's purpose, use of funds, repayment schedule, and any additional obligations tied to the business. 3. Bend Oregon Personal Loan Borrower Acknowledgment: Personal loans differ in nature from mortgages and business loans. This acknowledgment is tailored to personal loans, emphasizing terms like interest rate, repayment timeline, consequences of default, and any collateral requirements. Regardless of the loan type, the Bend Oregon Borrower Acknowledgment acts as a vital protective measure for all parties involved. It ensures that borrowers are well-informed about their obligations and the lender's expectations, promoting transparency and a smoother borrowing experience.

Bend Oregon Borrower Acknowledgment

Description

How to fill out Bend Oregon Borrower Acknowledgment?

We always want to reduce or avoid legal issues when dealing with nuanced law-related or financial matters. To accomplish this, we apply for attorney services that, usually, are very costly. Nevertheless, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of an attorney. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Bend Oregon Borrower Acknowledgment or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is just as straightforward if you’re new to the website! You can create your account within minutes.

- Make sure to check if the Bend Oregon Borrower Acknowledgment adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Bend Oregon Borrower Acknowledgment is suitable for you, you can select the subscription plan and proceed to payment.

- Then you can download the form in any available format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!