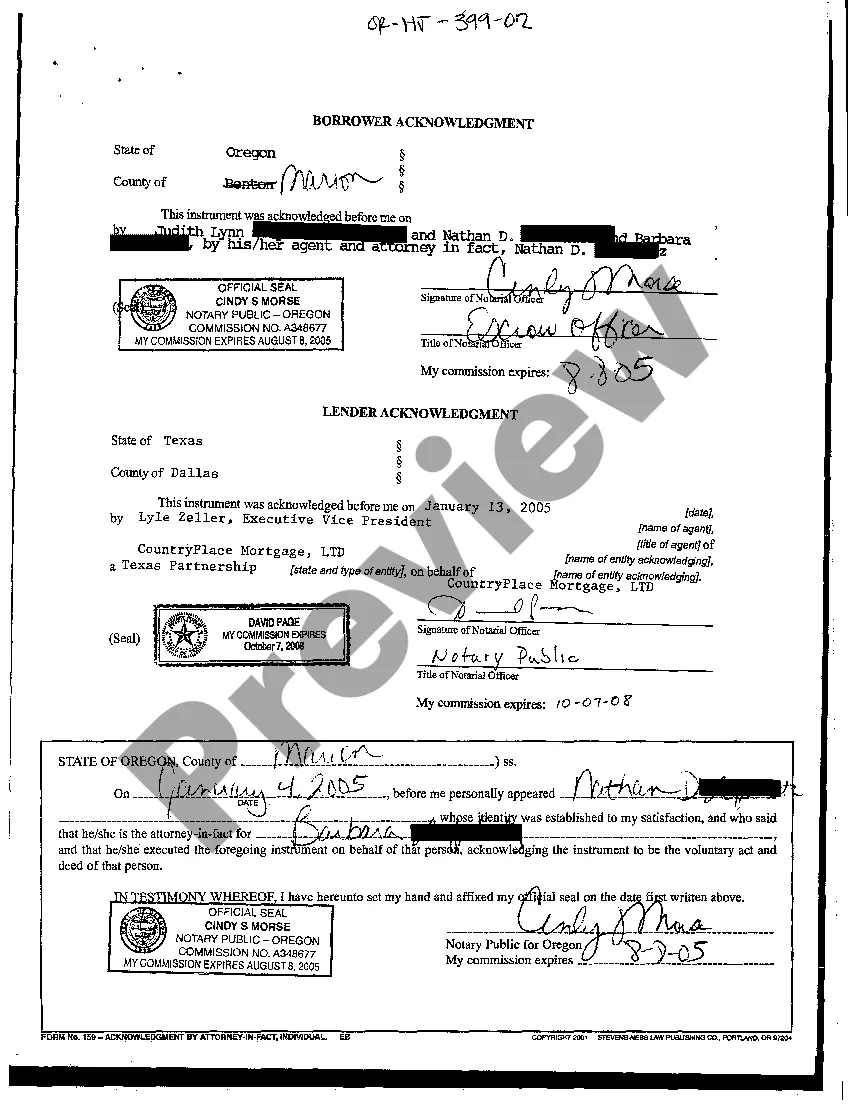

Eugene Oregon Borrower Acknowledgment is a legal document required during real estate transactions in Eugene, Oregon. This acknowledgment certifies that the borrower has received and understands the terms and conditions of the loan agreement they are entering into. It is an essential part of the loan process, serving to protect both the borrower and the lender. The Eugene Oregon Borrower Acknowledgment includes various key details related to the loan, such as the loan amount, interest rate, repayment schedule, and any applicable fees or penalties. By signing this document, the borrower acknowledges their responsibility to repay the loan according to the agreed-upon terms. There are several types of Eugene Oregon Borrower Acknowledgment, each designed for specific loan scenarios. Some of these variations may include: 1. Residential Mortgage Borrower Acknowledgment: This type of acknowledgment is used for residential mortgage loans and includes details specific to home loans, such as property information and mortgage insurance requirements. 2. Commercial Loan Borrower Acknowledgment: Meant for commercial loans, this acknowledgment outlines the terms and conditions related to financing commercial properties, including commercial real estate or business loans. 3. Refinance Borrower Acknowledgment: Used in refinancing situations, this acknowledgment acknowledges the necessary changes made to an existing loan, such as new interest rates, payment terms, or loan duration. 4. Construction Loan Borrower Acknowledgment: Specifically tailored for construction loans, this acknowledgment includes additional provisions related to the building or renovation process, such as construction timelines, inspection requirements, and disbursement of funds. In conclusion, the Eugene Oregon Borrower Acknowledgment is a critical legal document used in real estate transactions. It ensures that the borrower fully comprehends the terms and conditions of their loan agreement. With different types available, borrowers can find specific acknowledgments tailored to their particular loan type, such as residential, commercial, refinance, or construction loans.

Eugene Oregon Borrower Acknowledgment

Description

How to fill out Eugene Oregon Borrower Acknowledgment?

Make use of the US Legal Forms and have immediate access to any form template you need. Our helpful website with a huge number of documents makes it easy to find and obtain almost any document sample you will need. You are able to save, complete, and certify the Eugene Oregon Borrower Acknowledgment in a couple of minutes instead of surfing the Net for several hours seeking a proper template.

Using our collection is a superb strategy to increase the safety of your form filing. Our experienced attorneys regularly check all the records to ensure that the templates are relevant for a particular region and compliant with new acts and polices.

How can you get the Eugene Oregon Borrower Acknowledgment? If you already have a profile, just log in to the account. The Download button will be enabled on all the samples you look at. Furthermore, you can get all the earlier saved records in the My Forms menu.

If you haven’t registered a profile yet, follow the tips below:

- Find the template you need. Ensure that it is the form you were seeking: check its name and description, and utilize the Preview feature when it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the downloading process. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Save the document. Select the format to get the Eugene Oregon Borrower Acknowledgment and edit and complete, or sign it for your needs.

US Legal Forms is among the most significant and trustworthy form libraries on the web. Our company is always ready to assist you in any legal procedure, even if it is just downloading the Eugene Oregon Borrower Acknowledgment.

Feel free to take advantage of our form catalog and make your document experience as convenient as possible!