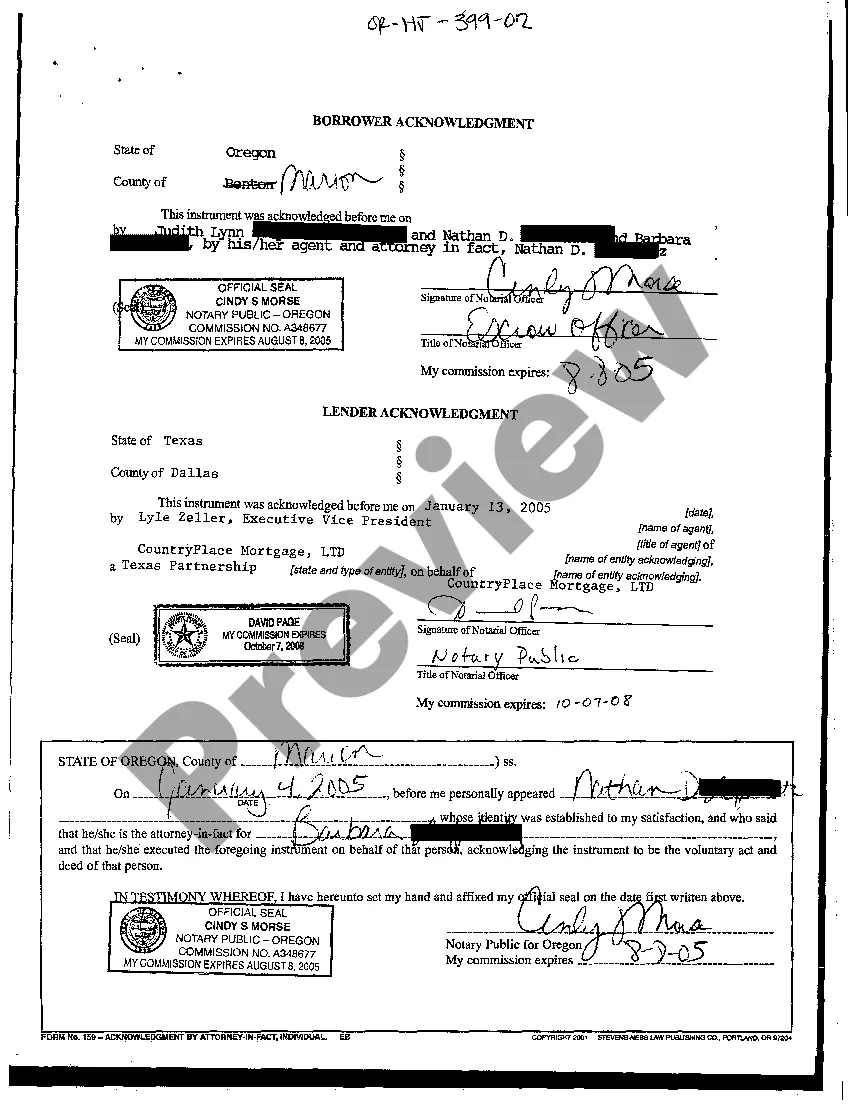

The Hillsboro Oregon Borrower Acknowledgment is a legal document that serves as evidence of a borrower's understanding and acceptance of the terms and conditions associated with a loan agreement in Hillsboro, Oregon. This acknowledgment is crucial for both lenders and borrowers as it ensures transparency and compliance, protecting the rights and interests of all parties involved. The Hillsboro Oregon Borrower Acknowledgment typically includes important details such as the borrower's personal information (name, address, contact details), loan specifics (loan amount, interest rate, repayment schedule), and any additional terms or conditions specific to the loan agreement. It also serves as proof that the borrower has received and reviewed all relevant loan documents, including the loan agreement, promissory note, and any disclosure statements mandated by law. Different types of Hillsboro Oregon Borrower Acknowledgment may exist depending on the type of loan and its specific requirements. For instance, there may be distinct acknowledgments for mortgage loans, auto loans, personal loans, business loans, or student loans. These varying acknowledgments would address the unique conditions and provisions associated with each loan type, ensuring clarity and understanding for the borrower. The Hillsboro Oregon Borrower Acknowledgment is an integral part of the loan process, as it not only protects the lender's interests but also safeguards the rights of borrowers. It ensures that there is mutual understanding and agreement between parties involved, minimizing the potential for disputes or misunderstandings in the future. In summary, the Hillsboro Oregon Borrower Acknowledgment is a crucial legal document that establishes the borrower's understanding and acceptance of the terms and conditions of a loan agreement. Its purpose is to promote transparency, compliance, and protect the rights of both lenders and borrowers. Different types of acknowledgments may exist to cater to specific loan types and their unique requirements.

Hillsboro Oregon Borrower Acknowledgment

Description

How to fill out Hillsboro Oregon Borrower Acknowledgment?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Hillsboro Oregon Borrower Acknowledgment becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Hillsboro Oregon Borrower Acknowledgment takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve selected the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Hillsboro Oregon Borrower Acknowledgment. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!