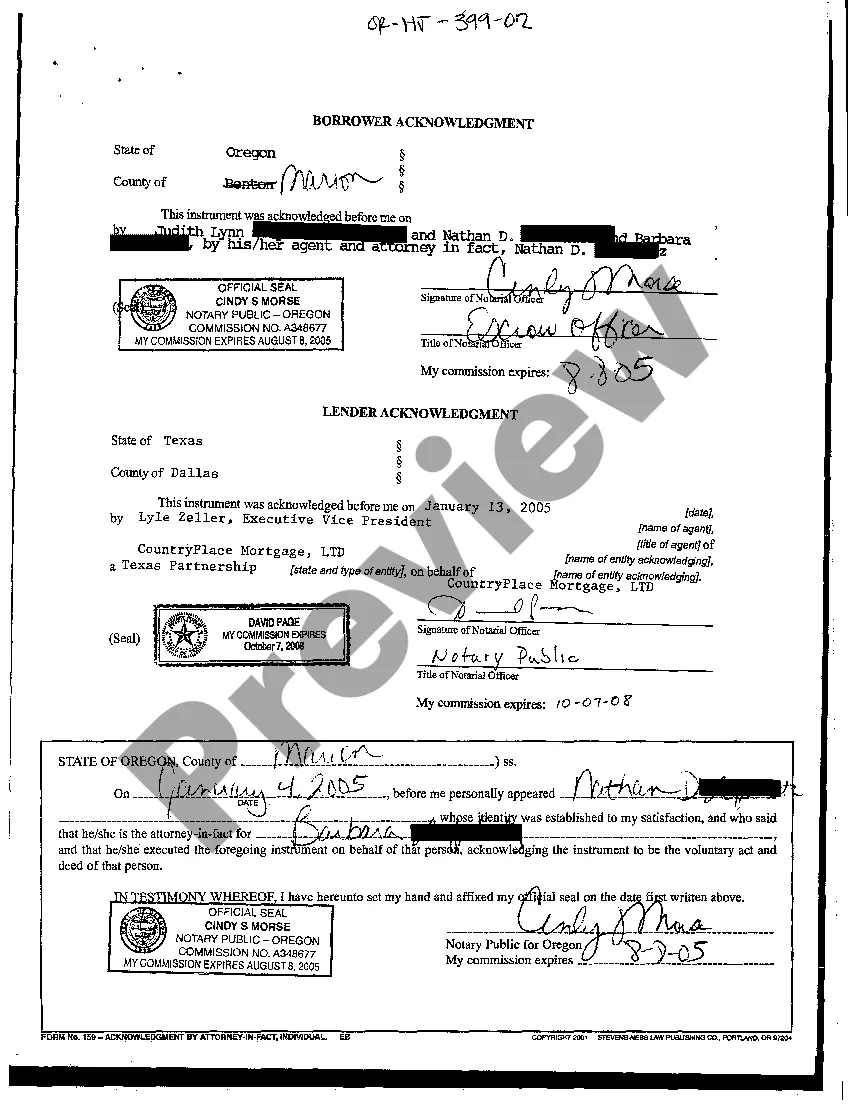

Portland Oregon Borrower Acknowledgment is a legal document that serves as evidence that a borrower in Portland, Oregon has received and comprehends the terms and conditions of a loan or financial agreement. This acknowledgment plays a crucial role in safeguarding the rights and responsibilities of both the lender and the borrower during the loan process. It ensures that the borrower is aware of their obligations, including repayment terms, interest rates, late payment penalties, and any specific clauses pertinent to the loan agreement. Portland Oregon Borrower Acknowledgment is typically used in various types of loans, such as personal loans, auto loans, mortgage loans, student loans, and business loans. Regardless of the loan type, this acknowledgment is essential for lenders to maintain a legally binding agreement with borrowers and to ensure both parties are on the same page. The acknowledgment document contains key information, including the borrower's full name, address, contact details, loan amount, loan purpose, repayment schedule, interest rate, loan term, and any additional terms that both parties have agreed upon. The borrower is required to carefully read and confirm their understanding of the terms outlined in the acknowledgment before signing it. Different variations of Portland Oregon Borrower Acknowledgment may exist based on the specific requirements of lenders or the nature of the loan. Some examples include: 1. Personal Loan Borrower Acknowledgment: This acknowledgment is used for personal loans between individuals, wherein terms and conditions are agreed upon outside of formal financial institutions. 2. Mortgage Loan Borrower Acknowledgment: This acknowledgment applies specifically to mortgage loans, ensuring that borrowers fully comprehend the responsibilities and potential consequences associated with their property purchase. 3. Auto Loan Borrower Acknowledgment: This acknowledgment is used for borrowers seeking a loan to finance the purchase of a car, highlighting the specific terms and conditions relevant to auto loans. 4. Student Loan Borrower Acknowledgment: As the name suggests, this acknowledgment is tailored for student loans, emphasizing the unique features and repayment requirements associated with educational financing. Overall, the Portland Oregon Borrower Acknowledgment is a vital legal document that protects the rights of both borrowers and lenders while ensuring transparency and clear communication regarding the terms of a loan agreement.

Portland Oregon Borrower Acknowledgment

Description

How to fill out Portland Oregon Borrower Acknowledgment?

We always strive to reduce or prevent legal issues when dealing with nuanced legal or financial affairs. To do so, we sign up for legal services that, as a rule, are very expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to an attorney. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Portland Oregon Borrower Acknowledgment or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is equally easy if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Portland Oregon Borrower Acknowledgment complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Portland Oregon Borrower Acknowledgment is proper for your case, you can pick the subscription plan and make a payment.

- Then you can download the form in any available file format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!