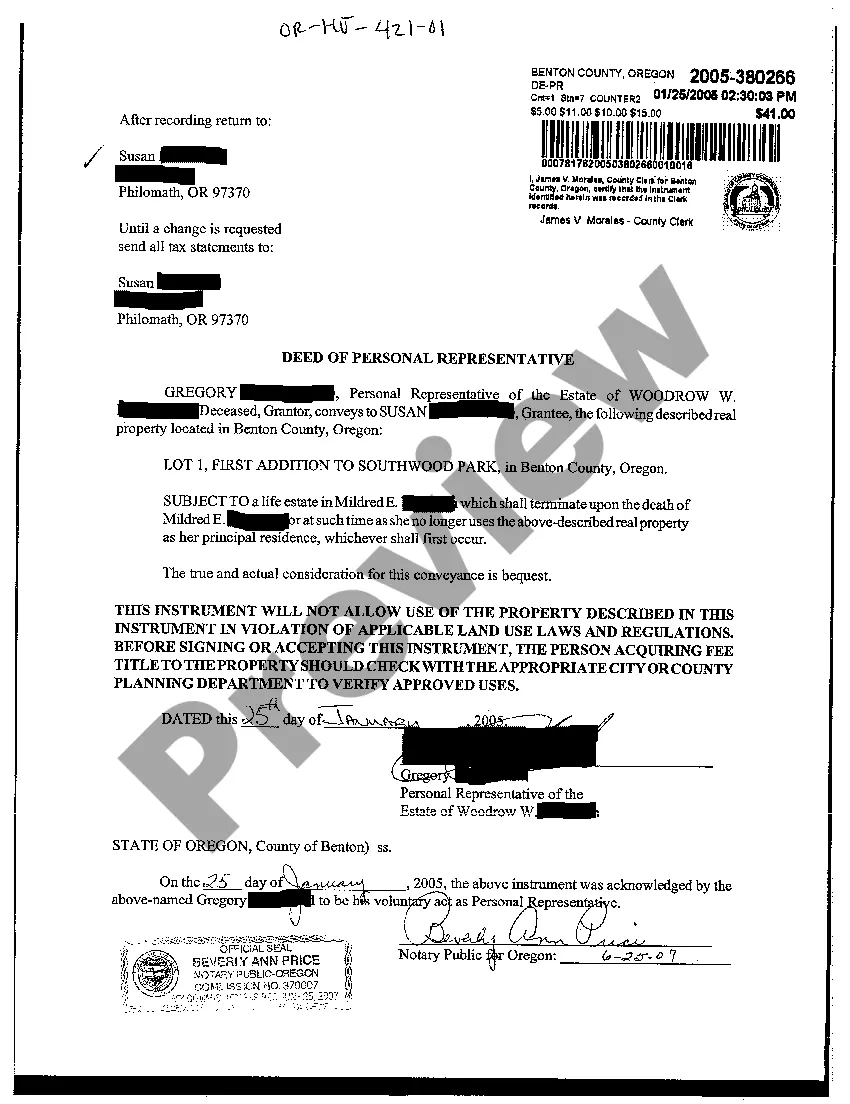

Gresham Oregon Deed of Personal Representative

Description

How to fill out Oregon Deed Of Personal Representative?

We consistently aim to minimize or avert legal repercussions when engaging with intricate legal or financial issues. To achieve this, we seek legal assistance that is typically quite expensive. However, not every legal dilemma is equally complicated. Many can be addressed independently.

US Legal Forms is an online repository of current DIY legal documents covering a range of topics from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our collection empowers you to manage your affairs without relying on a lawyer. We offer access to legal form templates that are not always available to the public. Our templates are specific to states and regions, significantly easing the search effort.

Utilize US Legal Forms whenever you need to acquire and download the Gresham Oregon Deed of Personal Representative or any other form quickly and securely. Just Log In to your account and click the Get button adjacent to it. If you happen to lose the document, you can always re-download it from the My documents section.

The procedure is equally simple if you're new to the platform! You can set up your account within minutes.

With over 24 years of service, we’ve assisted millions by providing customizable and current legal forms. Take advantage of US Legal Forms today to conserve time and resources!

- Ensure the Gresham Oregon Deed of Personal Representative aligns with the laws and regulations of your state and locality.

- It’s also vital to review the form’s description (if available), and if you detect any inconsistencies with what you initially sought, look for a different form.

- After confirming that the Gresham Oregon Deed of Personal Representative meets your needs, you can select the subscription plan and continue to payment.

- You can then download the document in any compatible format.

Form popularity

FAQ

A personal representative deed generally includes details such as the name of the decedent, the name of the personal representative, and a clear legal description of the property. For instance, it might state, 'I, John Doe, as Personal Representative of the estate of Jane Smith, hereby convey property located at 123 Oak St, Gresham, Oregon.' If you need a formal example, US Legal Forms offers templates tailored for Oregon's legal requirements.

To effectively avoid probate in Oregon, consider using a transfer-on-death deed. This allows you to name beneficiaries who automatically receive the property upon your death without going through probate. If you need assistance with creating such documents, including a Gresham Oregon Deed of Personal Representative, platforms like US Legal Forms can simplify the process and provide clear templates.

In a Gresham Oregon Deed of Personal Representative, the property technically belongs to the estate of the deceased until it is fully settled. The personal representative holds legal title to the property to act on behalf of the estate, but they cannot claim ownership for personal benefit. Once all debts are settled and distributions are made, the title can be transferred to the rightful heirs or beneficiaries.

In Oregon, a personal representative and an executor serve similar roles, but there are some distinctions. A personal representative is appointed by the court to administer an estate, while an executor is specifically named in a will to carry out its instructions. Both oversee the process of settling a deceased person's affairs, including the Gresham Oregon Deed of Personal Representative if real property is involved.

Yes, an unrecorded deed can be valid in Oregon, including the Gresham Oregon Deed of Personal Representative. However, it is important to understand that while it holds legal weight, it does not offer the same protections as a recorded deed. To prevent potential conflicts over property ownership, it is advisable to record the deed as soon as possible.

While some elements are essential for a deed to be considered valid, the Gresham Oregon Deed of Personal Representative does not require a witness signature. What matters most is that the deed is in writing, properly signed by the grantor, and includes adequate identification of the parties and property. Be aware of the specifics to avoid issues during the transfer process.

In Oregon, a deed does not have to be recorded to be valid, including the Gresham Oregon Deed of Personal Representative. However, recording a deed provides legal protection and public notice of your ownership interest. It is advisable to record the deed promptly to safeguard against disputes and establish your rights clearly.

Failing to record a deed can expose you to various risks, particularly concerning the Gresham Oregon Deed of Personal Representative. Unrecorded deeds may lead to disputes over property ownership or claims from creditors. Further, without recording, a subsequent buyer may not recognize your claim to the property, potentially jeopardizing your rights.

You can acquire personal representative papers through the probate court in your local area. This process generally involves filing a petition along with the decedent's will, if there is one. Alternatively, platforms like US Legal Forms provide access to essential legal documents, including the necessary forms for acquiring a Gresham Oregon Deed of Personal Representative.

You can obtain a personal representative deed by completing the necessary legal forms, which can often be found online or through legal stationery stores. Alternatively, using a platform like US Legal Forms can streamline the process, providing templates for a Gresham Oregon Deed of Personal Representative tailored to meet state requirements. Once completed, the deed must be signed and notarized before recording.