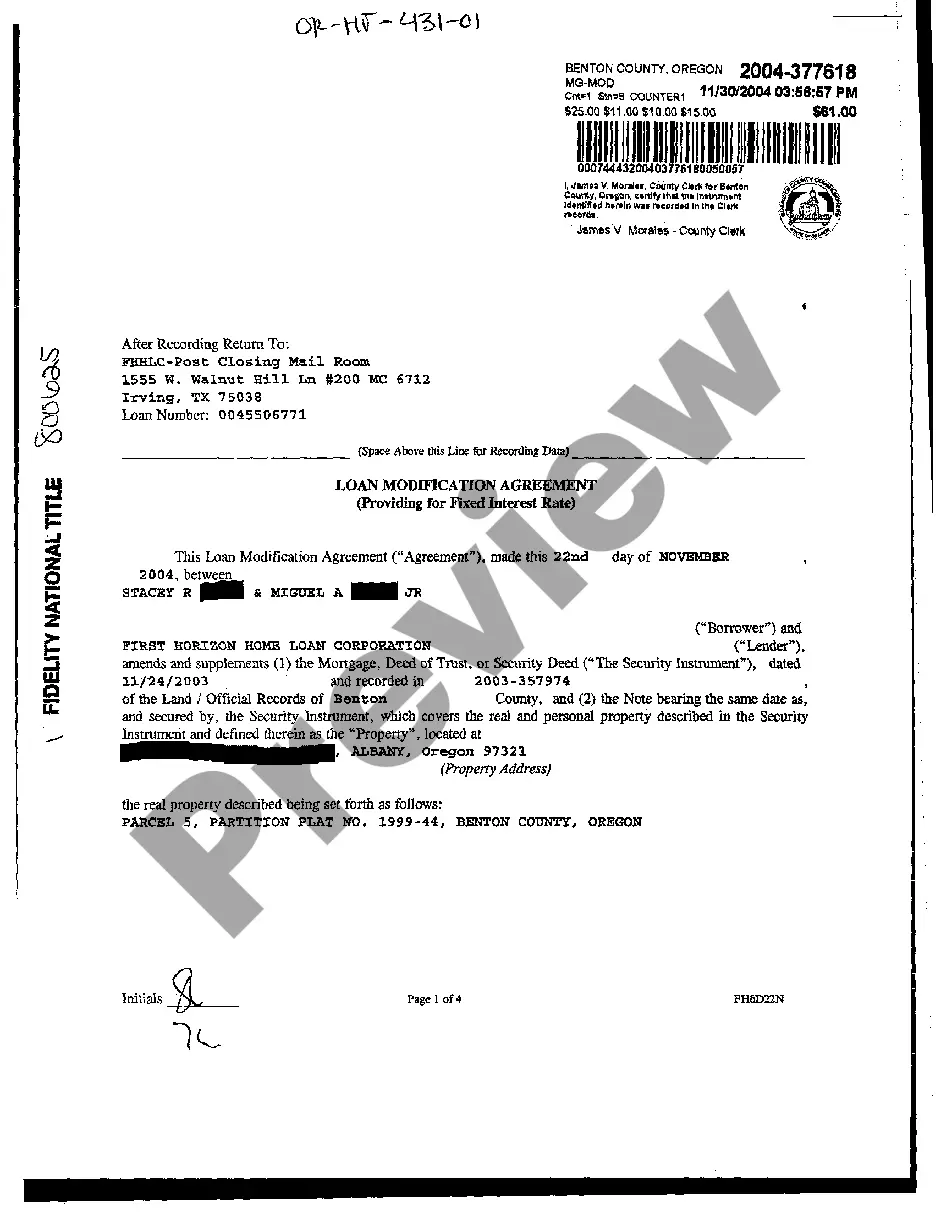

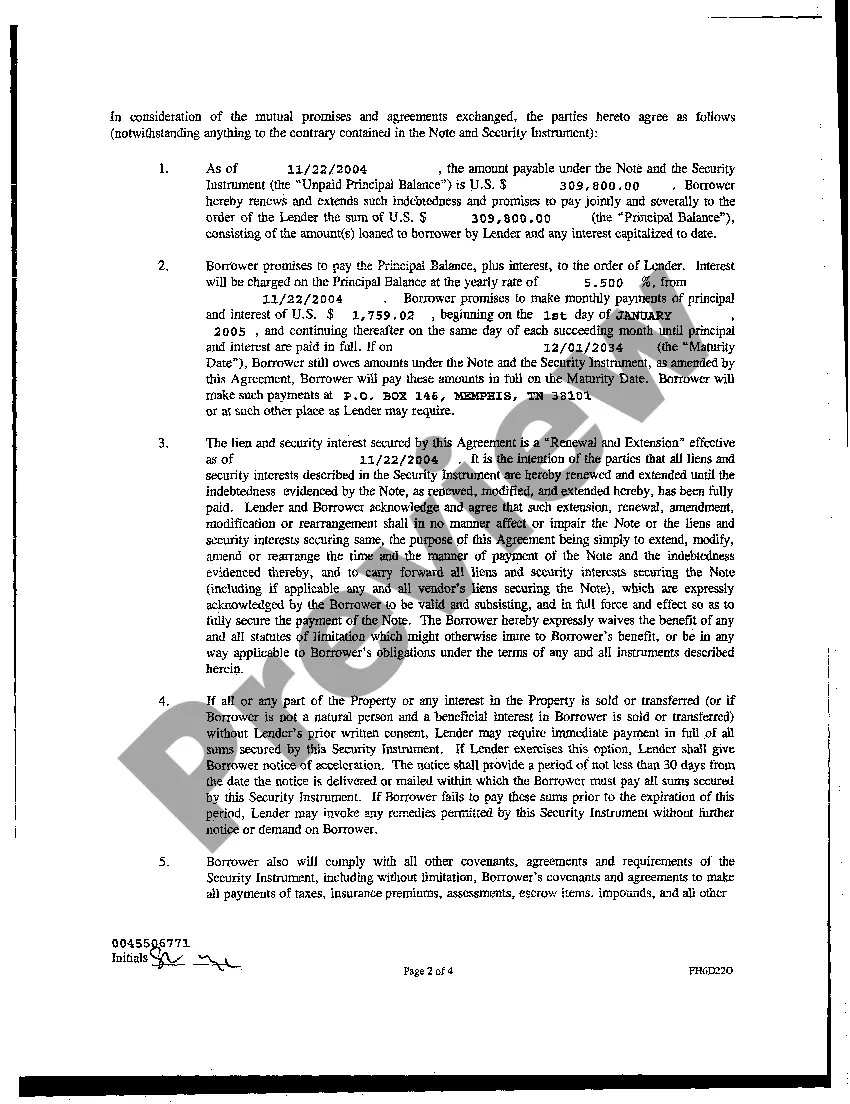

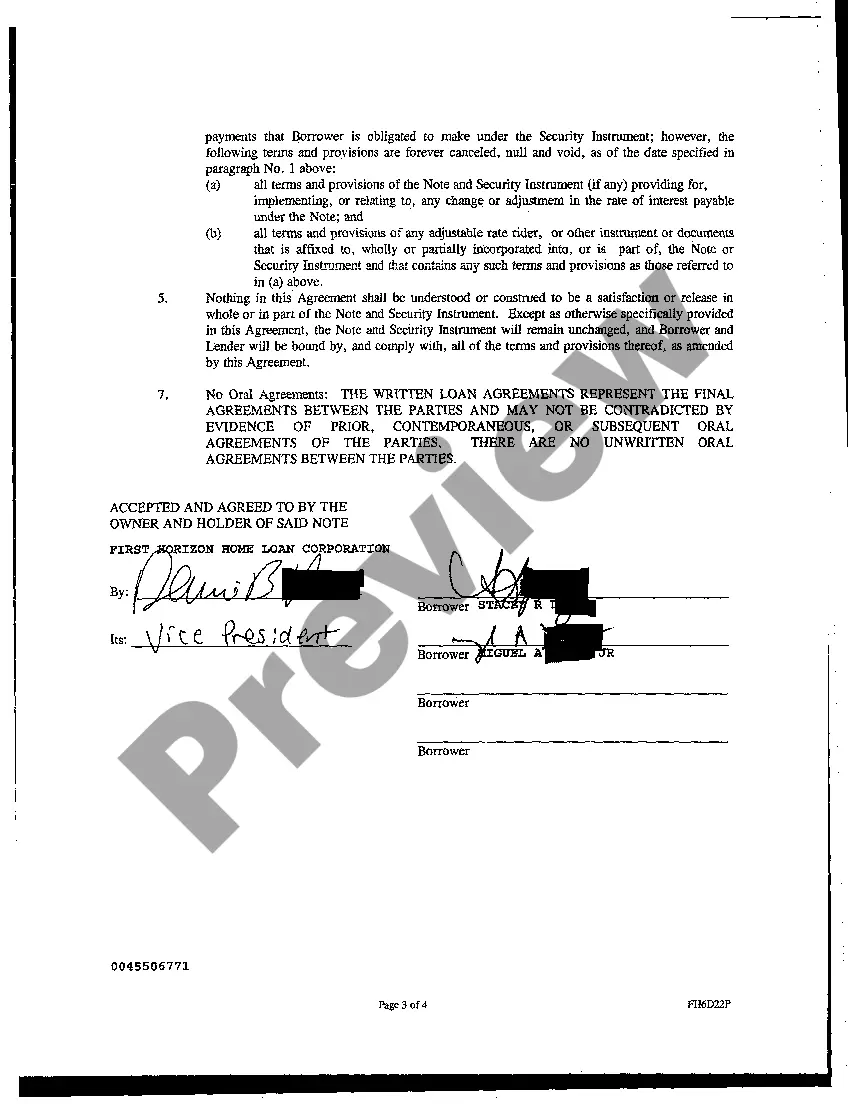

A Bend Oregon Loan Modification Agreement is a legal document that outlines the terms and conditions for modifying an existing loan in Bend, Oregon. This agreement is designed to help borrowers who are facing financial difficulties and struggling to make their mortgage payments. By modifying the terms of the loan, borrowers can potentially lower their monthly payments, reduce interest rates, or extend the loan term to make it more affordable. The Bend Oregon Loan Modification Agreement typically includes important details such as the borrower's and lender's information, loan account number, and the current terms of the loan. It also outlines the proposed changes to the loan, such as the new interest rate, reduced monthly payments, extended loan maturity date, and any specific requirements or conditions. Bend Oregon Loan Modification Agreements may vary based on the specific circumstances of the borrower and the lender's policies. Some common types of loan modification agreements in Bend, Oregon, include: 1. Interest rate reduction: This type of modification agreement aims to lower the borrower's interest rate, resulting in lower monthly payments. It can provide immediate relief to homeowners struggling with high-interest rates. 2. Loan term extension: By extending the loan term, borrowers can spread their payments over a longer period, thereby reducing their monthly payments. This agreement is suitable for those who require more time to repay their loan. 3. Principal forbearance: In certain cases, lenders may agree to defer a portion of the principal amount, allowing borrowers to make reduced payments for a specific period. This type of agreement is helpful for individuals dealing with temporary financial setbacks. 4. Payment deferral: A payment deferral modification suspends payments temporarily, usually for a few months. The deferred payments are added to the end of the loan term, extending the repayment period. 5. Combination modification: In complex situations, lenders may propose a combination of modifications, incorporating multiple changes to the loan terms. This approach is tailored to specific circumstances and may involve a combination of interest rate reduction, principal forbearance, or loan term extension. It's important to note that loan modification agreements are subject to the lender's approval and may require submitting financial documents, such as proof of income, expenses, and hardship reasons. Consulting a knowledgeable attorney or housing counselor can provide valuable guidance and ensure that the Bend Oregon Loan Modification Agreement suits the borrower's needs and complies with legal requirements.

Bend Oregon Loan Modification Agreement

Description

How to fill out Bend Oregon Loan Modification Agreement?

If you’ve already used our service before, log in to your account and save the Bend Oregon Loan Modification Agreement on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make certain you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Bend Oregon Loan Modification Agreement. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!

Form popularity

FAQ

You can only appeal when you're denied for a loan modification program. You can ask for a review of a denied loan modification if: You sent in a complete mortgage assistance application at least 90 days before your foreclosure sale; and. Your servicer denied you for any trial or permanent loan modification it offers.

You could receive your mortgage loan modification in as little as 30 days. Or you could be left waiting upwards of 90 days for everything to go through. It really comes down to the individual lender and their ability to quickly process mortgage modifications.

No matter how focused your attention to detail, your credit score almost certainly will take a hit with a home loan modification. Often, a homeowner won't get approved for a loan modification unless there is evidence of one or several missed payments.

You can only get a loan modification through your current lender because they must approve the terms. Some of the things a modification may adjust include: Loan term changes: If you're having trouble making your monthly payments, you may be able to modify your loan and extend your term.

There are many reasons a lender might deny an application for a loan modification or claim you don't qualify for one, including but not limited to: An incomplete or untimely loan modification application. Insufficient finances to afford a modified payment.

No matter how focused your attention to detail, your credit score almost certainly will take a hit with a home loan modification. Often, a homeowner won't get approved for a loan modification unless there is evidence of one or several missed payments. Those missed payments hurt your credit score.

Once approved for a modification, your lender will usually require you to go through a Trial Payment Plan (TPP) before they complete the modification. A TPP requires you to make a mortgage payment for a fixed number of months prior to fully modifying the loan.

There are many reasons a lender might deny an application for a loan modification or claim you don't qualify for one, including but not limited to: An incomplete or untimely loan modification application. Insufficient finances to afford a modified payment.

Loan Modification Denied Frequently Asked Questions FAQ There are many reasons why a loan modification application may be denied. Some common reasons include: -The borrower failed to provide all of the required documentation. -The borrower's income was not sufficient to support the modified payment amount.

While it's true that, in the past, lenders would only consider giving homeowners a modification if they were in default on their loan, this situation is no longer the case. Now, you can be current on your mortgage payments and still qualify for the vast majority of modification programs.