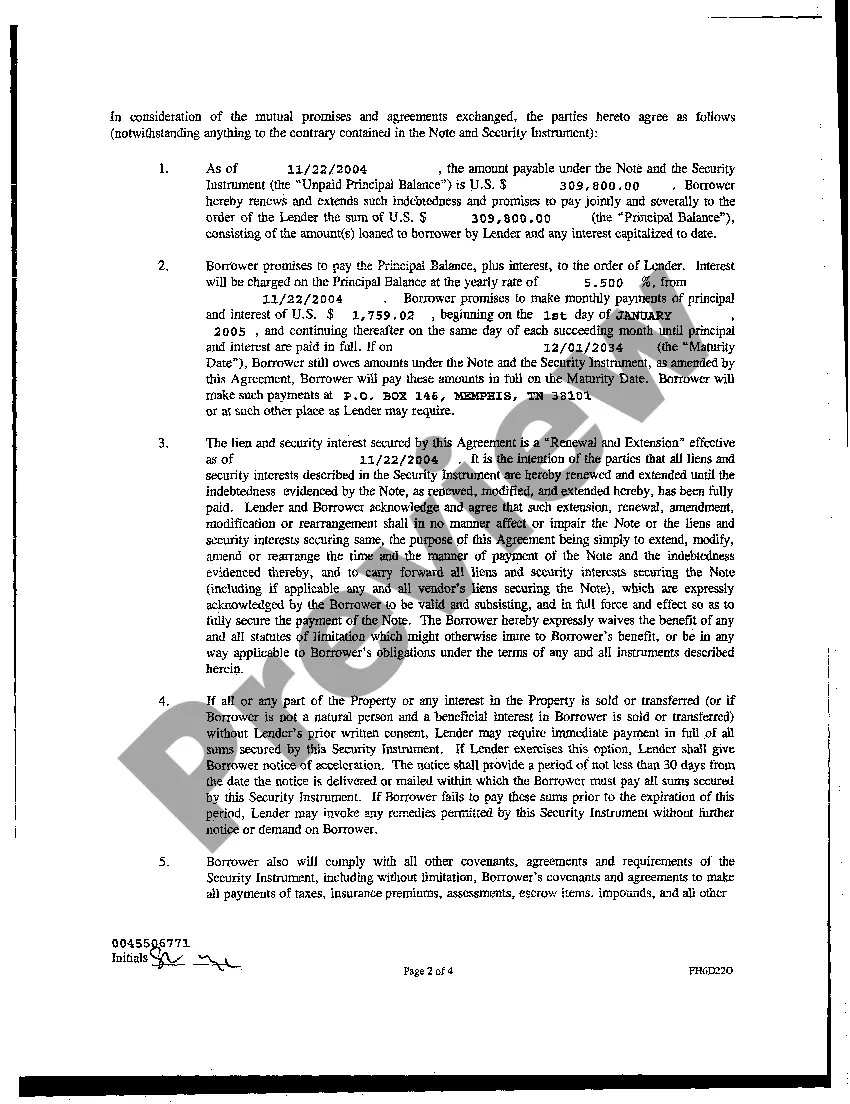

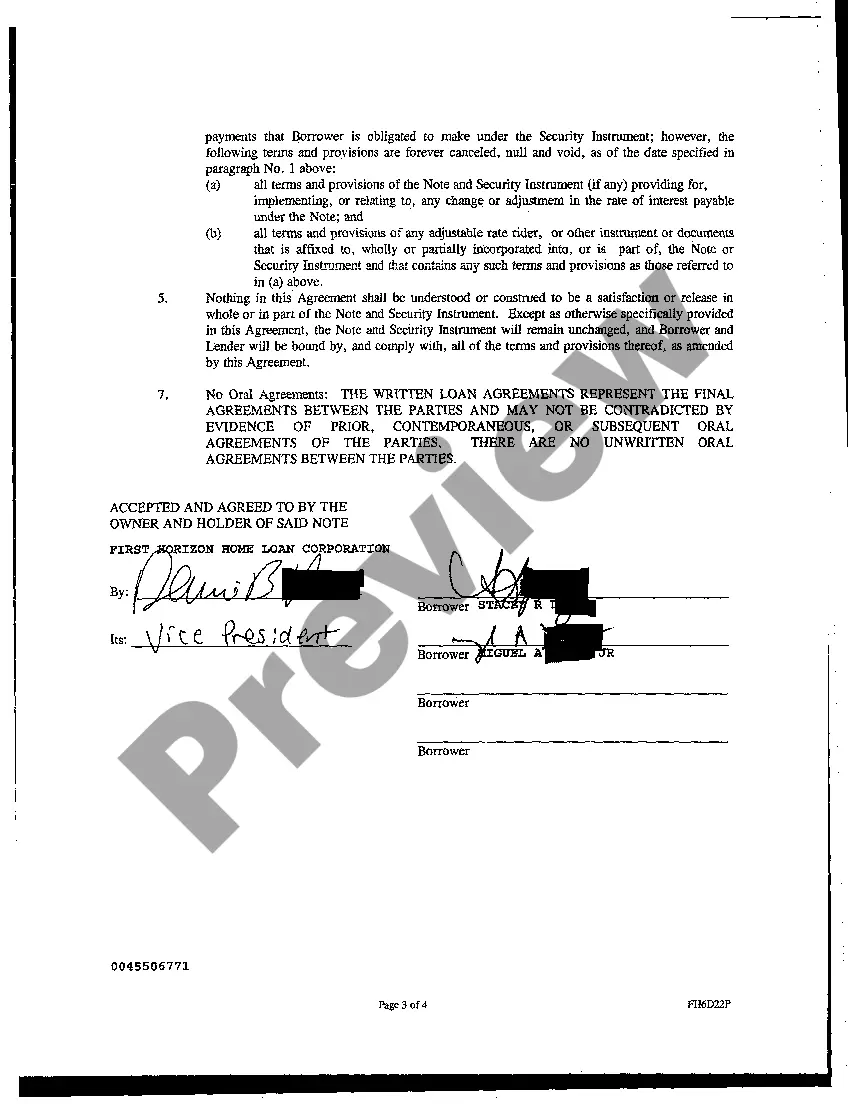

A loan modification agreement is a legal contract that allows homeowners in Eugene, Oregon, to modify the terms of their existing mortgage loans in order to make them more affordable and manageable. It is a mutually agreed-upon arrangement between the borrower and the lender to modify the loan's interest rate, payment amount, term, or other loan terms. In Eugene, Oregon, there are different types of loan modification agreements available to homeowners facing financial difficulties. These include: 1. Interest Rate Modification: This type of loan modification involves reducing the interest rate on the existing mortgage loan. By lowering the interest rate, borrowers can potentially reduce their monthly mortgage payments, making it more affordable. 2. Payment Reduction Modification: With this type of loan modification, the lender may agree to reduce the monthly payment amount, making it more manageable for the borrower. The reduction may be achieved by extending the loan's term or adjusting other loan terms. 3. Loan Term Extension: Under this agreement, the lender may extend the loan's term, allowing borrowers to repay the debt over a longer period. This can help reduce the monthly payment amount, making it more affordable for homeowners in Eugene, Oregon. 4. Principal Reduction: In some cases, the lender might agree to reduce the loan's principal amount owed. This can help homeowners, particularly those facing underwater mortgages, by reducing the overall debt burden and potentially making the loan more affordable. 5. Loan Refinancing: Although not strictly a loan modification agreement, refinancing involves replacing the existing mortgage loan with a new loan, which may have more favorable terms such as lower interest rates or longer repayment periods. Refinancing can lower monthly payments and help homeowners in Eugene, Oregon, improve their financial situation. It is important to note that the availability and specific terms of loan modification agreements can vary depending on various factors, such as the homeowner's financial situation, the lender's policies, and government programs or initiatives aimed at assisting struggling homeowners. Homeowners facing difficulties with their mortgage payments should consult with a professional or seek advice from reputable housing counseling agencies to explore their options and determine the most suitable loan modification agreement for their specific situation in Eugene, Oregon.

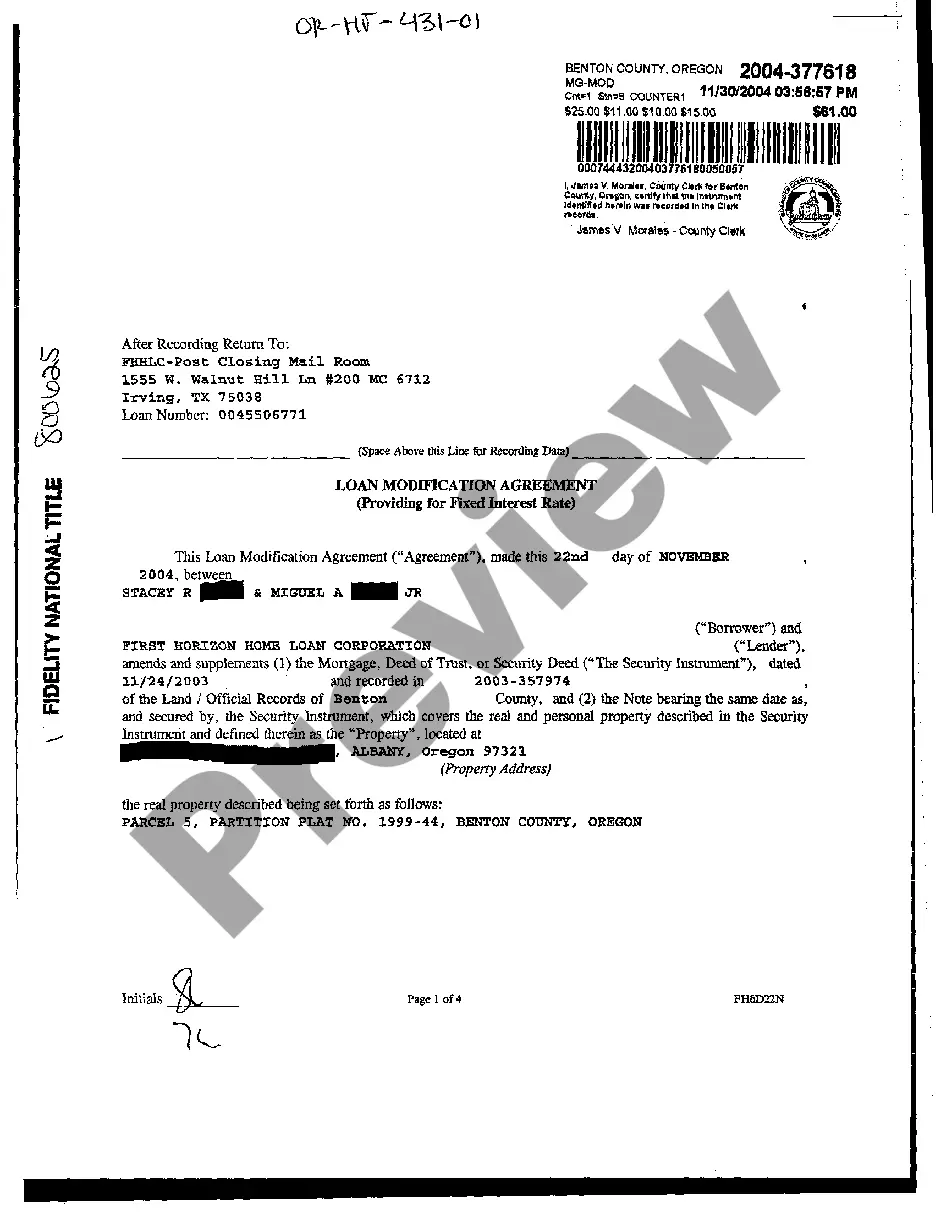

Eugene Oregon Loan Modification Agreement

State:

Oregon

City:

Eugene

Control #:

OR-HJ-431-01

Format:

PDF

Instant download

This form is available by subscription

Description

A01 Loan Modification Agreement

A loan modification agreement is a legal contract that allows homeowners in Eugene, Oregon, to modify the terms of their existing mortgage loans in order to make them more affordable and manageable. It is a mutually agreed-upon arrangement between the borrower and the lender to modify the loan's interest rate, payment amount, term, or other loan terms. In Eugene, Oregon, there are different types of loan modification agreements available to homeowners facing financial difficulties. These include: 1. Interest Rate Modification: This type of loan modification involves reducing the interest rate on the existing mortgage loan. By lowering the interest rate, borrowers can potentially reduce their monthly mortgage payments, making it more affordable. 2. Payment Reduction Modification: With this type of loan modification, the lender may agree to reduce the monthly payment amount, making it more manageable for the borrower. The reduction may be achieved by extending the loan's term or adjusting other loan terms. 3. Loan Term Extension: Under this agreement, the lender may extend the loan's term, allowing borrowers to repay the debt over a longer period. This can help reduce the monthly payment amount, making it more affordable for homeowners in Eugene, Oregon. 4. Principal Reduction: In some cases, the lender might agree to reduce the loan's principal amount owed. This can help homeowners, particularly those facing underwater mortgages, by reducing the overall debt burden and potentially making the loan more affordable. 5. Loan Refinancing: Although not strictly a loan modification agreement, refinancing involves replacing the existing mortgage loan with a new loan, which may have more favorable terms such as lower interest rates or longer repayment periods. Refinancing can lower monthly payments and help homeowners in Eugene, Oregon, improve their financial situation. It is important to note that the availability and specific terms of loan modification agreements can vary depending on various factors, such as the homeowner's financial situation, the lender's policies, and government programs or initiatives aimed at assisting struggling homeowners. Homeowners facing difficulties with their mortgage payments should consult with a professional or seek advice from reputable housing counseling agencies to explore their options and determine the most suitable loan modification agreement for their specific situation in Eugene, Oregon.

Free preview

How to fill out Eugene Oregon Loan Modification Agreement?

If you’ve already utilized our service before, log in to your account and save the Eugene Oregon Loan Modification Agreement on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Make sure you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Eugene Oregon Loan Modification Agreement. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!