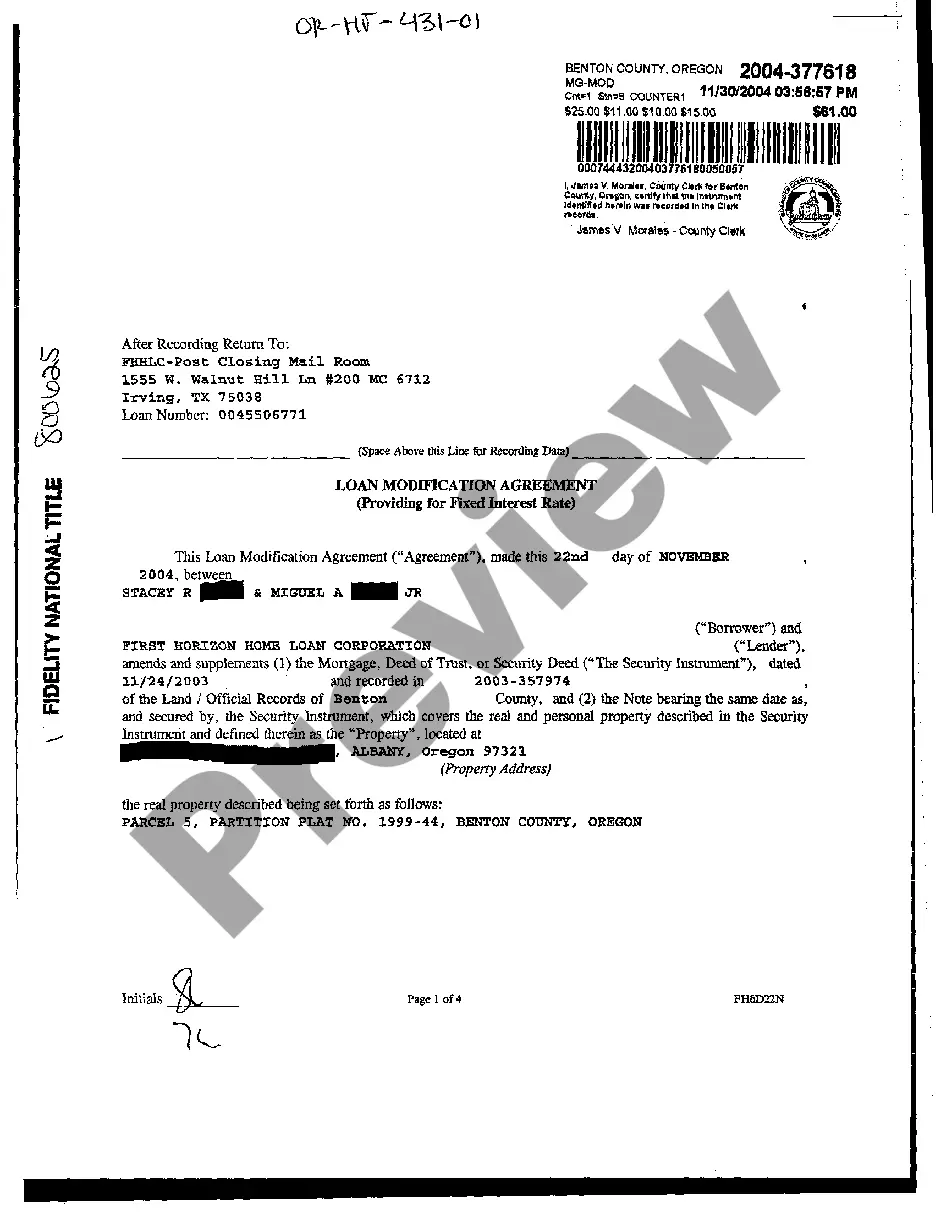

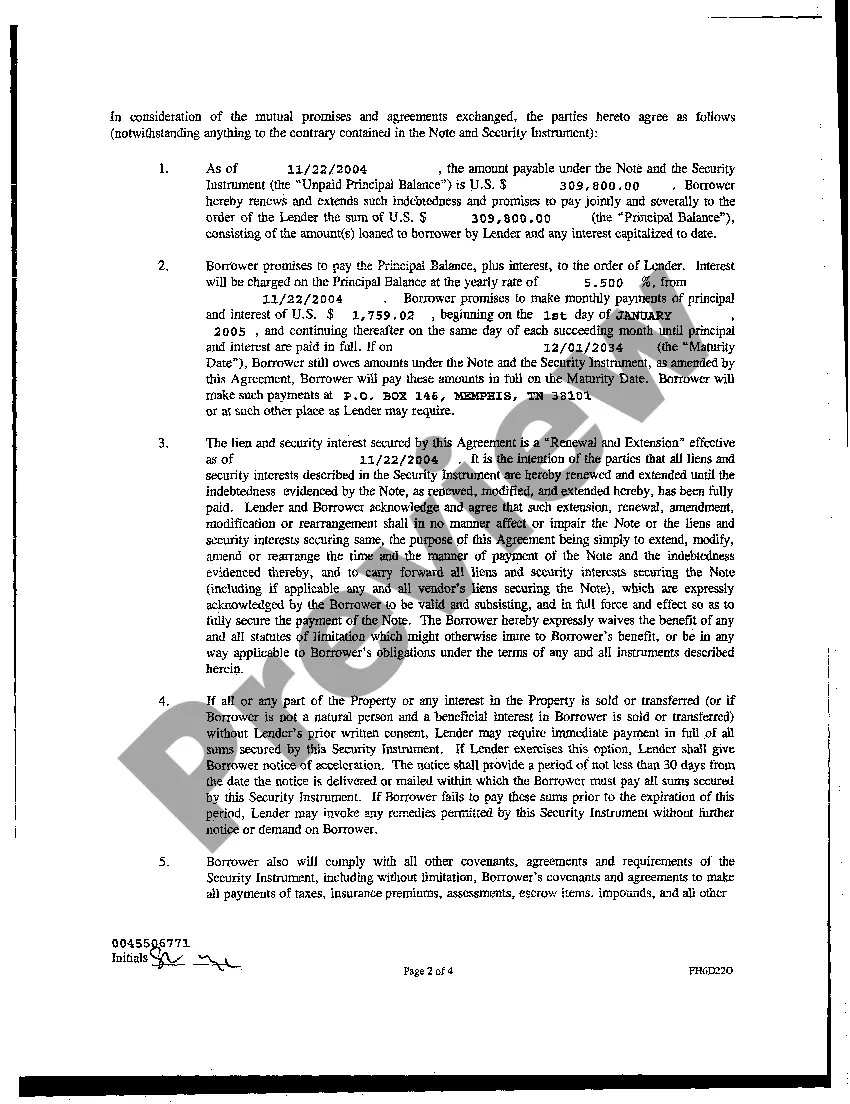

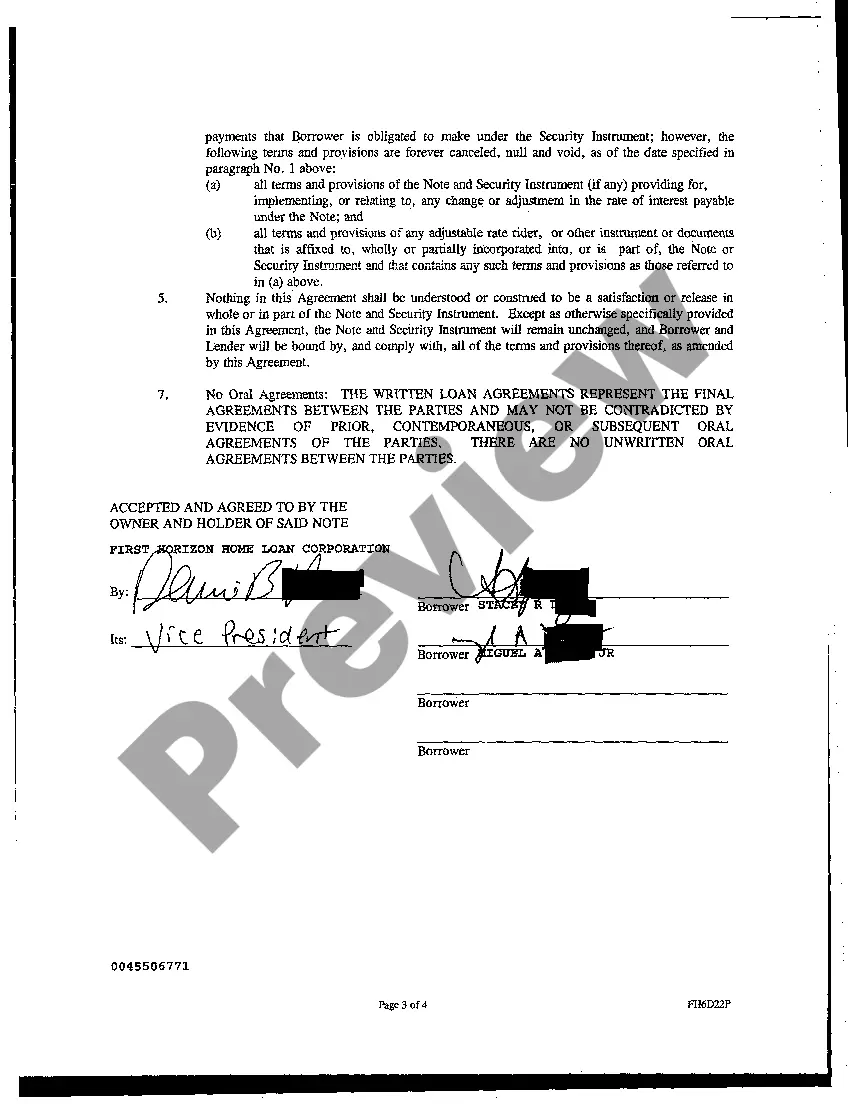

Gresham Oregon Loan Modification Agreement is a legal document that serves as a means to modify the terms and conditions of an existing home loan in Gresham, Oregon. It is commonly used by homeowners who are facing financial hardships and are struggling to meet their loan obligations. Gresham, Oregon, being a vibrant city in the Portland metropolitan area, offers different types of Loan Modification Agreements depending on the specific needs and circumstances of the homeowners. Some frequently encountered types are: 1. Gresham Oregon CAMP Loan Modification Agreement: This type of modification agreement follows the guidelines set by the federal Home Affordable Modification Program (CAMP). It aims to assist homeowners facing financial difficulties by reducing their monthly mortgage payments to a more affordable level. 2. Gresham Oregon Principal Reduction Loan Modification Agreement: This type of loan modification agreement involves reducing the principal balance on the loan amount, resulting in lower monthly payments. This can help homeowners who are severely underwater on their mortgage or have experienced a significant decrease in property value. 3. Gresham Oregon Interest Rate Reduction Loan Modification Agreement: This type of loan modification agreement focuses on lowering the interest rate on the existing loan, which ultimately reduces monthly mortgage payments. It can be beneficial for homeowners who are struggling to keep up with high-interest rates but have an otherwise stable financial situation. 4. Gresham Oregon Forbearance Loan Modification Agreement: This modification agreement provides temporary relief to homeowners facing short-term financial hardships. During the forbearance period, the lender agrees to suspend or reduce mortgage payments, offering homeowners the opportunity to get back on track financially. 5. Gresham Oregon Loan Extension Loan Modification Agreement: In situations where homeowners desire to extend the loan term beyond the originally agreed-upon period, a loan extension modification agreement is commonly used. This can help in reducing monthly payments by spreading them over a more extended period. In Gresham, Oregon, Loan Modification Agreements are designed to tailor solutions that meet the specific needs of homeowners, considering their financial circumstances, the severity of distress, and the lender's willingness to cooperate. Homeowners should consult with experienced professionals or legal advisors to fully understand the implications and options available under these agreements.

Gresham Oregon Loan Modification Agreement

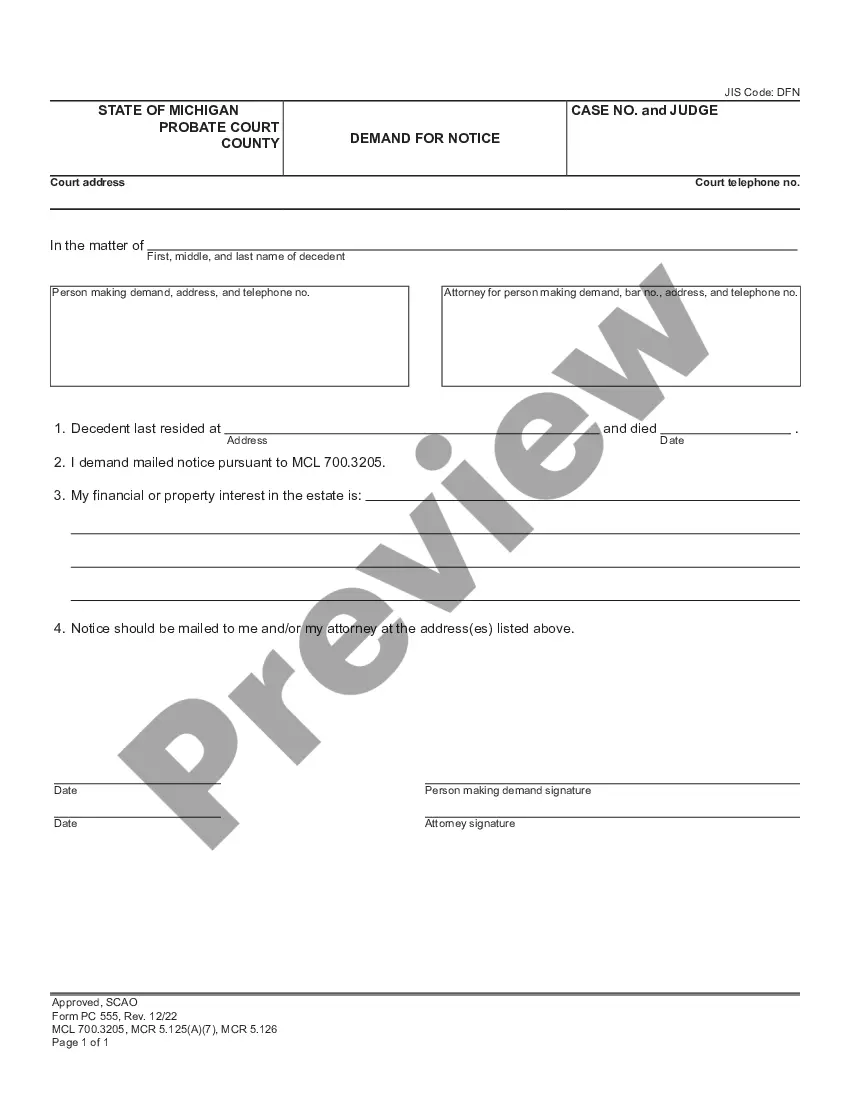

Description

How to fill out Gresham Oregon Loan Modification Agreement?

Take advantage of the US Legal Forms and get instant access to any form sample you want. Our helpful platform with thousands of documents allows you to find and obtain virtually any document sample you want. You are able to download, fill, and certify the Gresham Oregon Loan Modification Agreement in a few minutes instead of surfing the Net for many hours trying to find the right template.

Using our catalog is a wonderful strategy to improve the safety of your record filing. Our experienced legal professionals regularly check all the records to make certain that the templates are relevant for a particular state and compliant with new acts and polices.

How do you obtain the Gresham Oregon Loan Modification Agreement? If you have a subscription, just log in to the account. The Download button will appear on all the samples you view. Additionally, you can get all the earlier saved documents in the My Forms menu.

If you haven’t registered a profile yet, follow the instruction below:

- Find the form you need. Make certain that it is the template you were hoping to find: verify its headline and description, and utilize the Preview feature when it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Start the saving procedure. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order using a credit card or PayPal.

- Export the file. Choose the format to obtain the Gresham Oregon Loan Modification Agreement and edit and fill, or sign it according to your requirements.

US Legal Forms is one of the most considerable and trustworthy document libraries on the web. Our company is always ready to help you in any legal procedure, even if it is just downloading the Gresham Oregon Loan Modification Agreement.

Feel free to take full advantage of our form catalog and make your document experience as straightforward as possible!