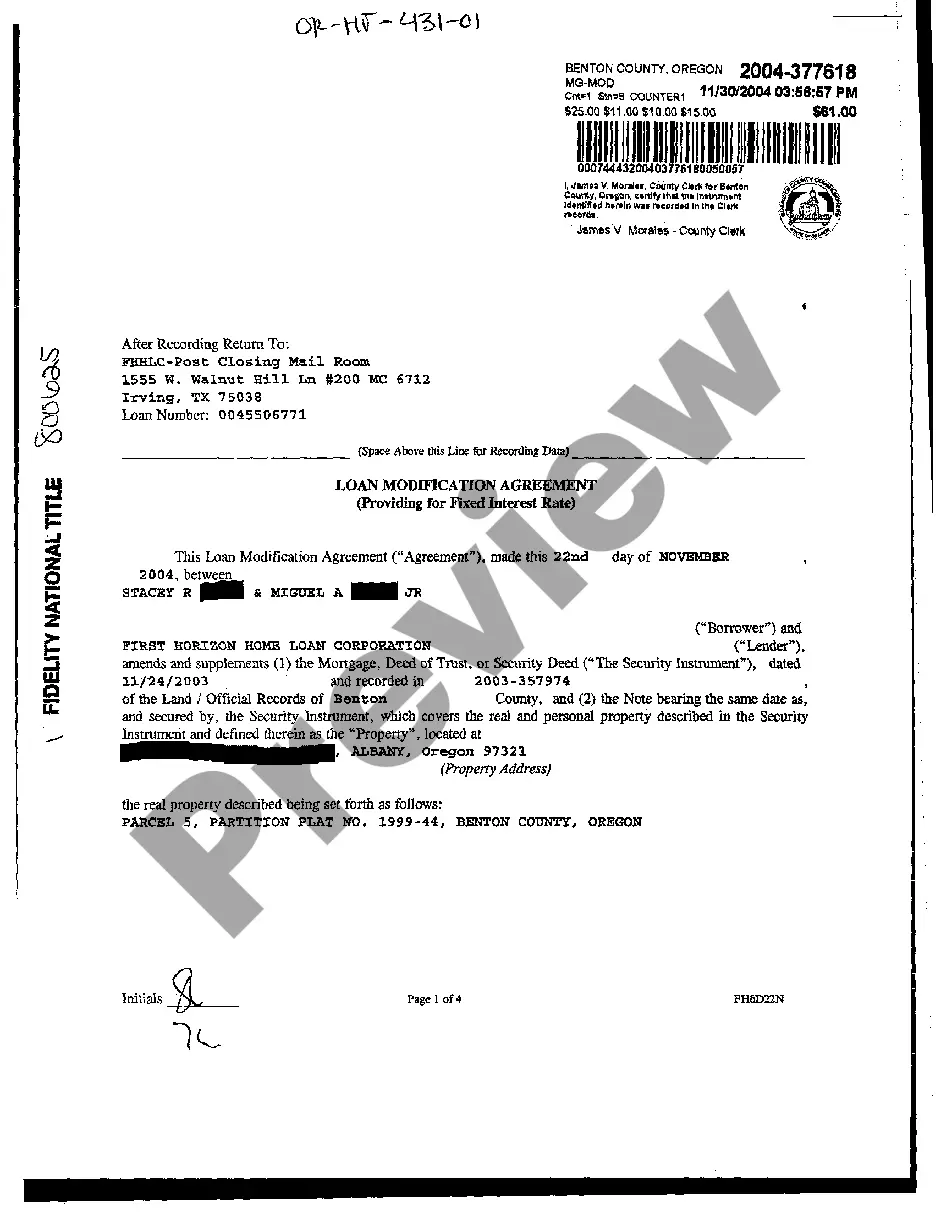

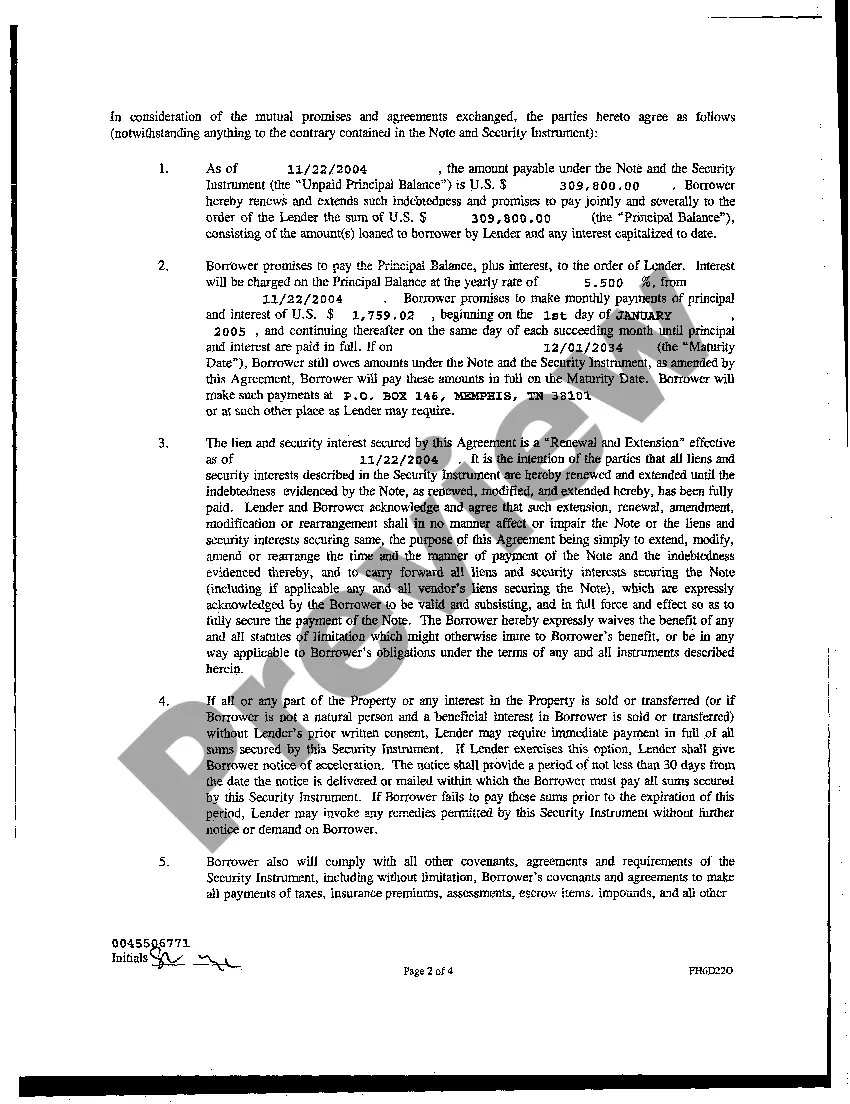

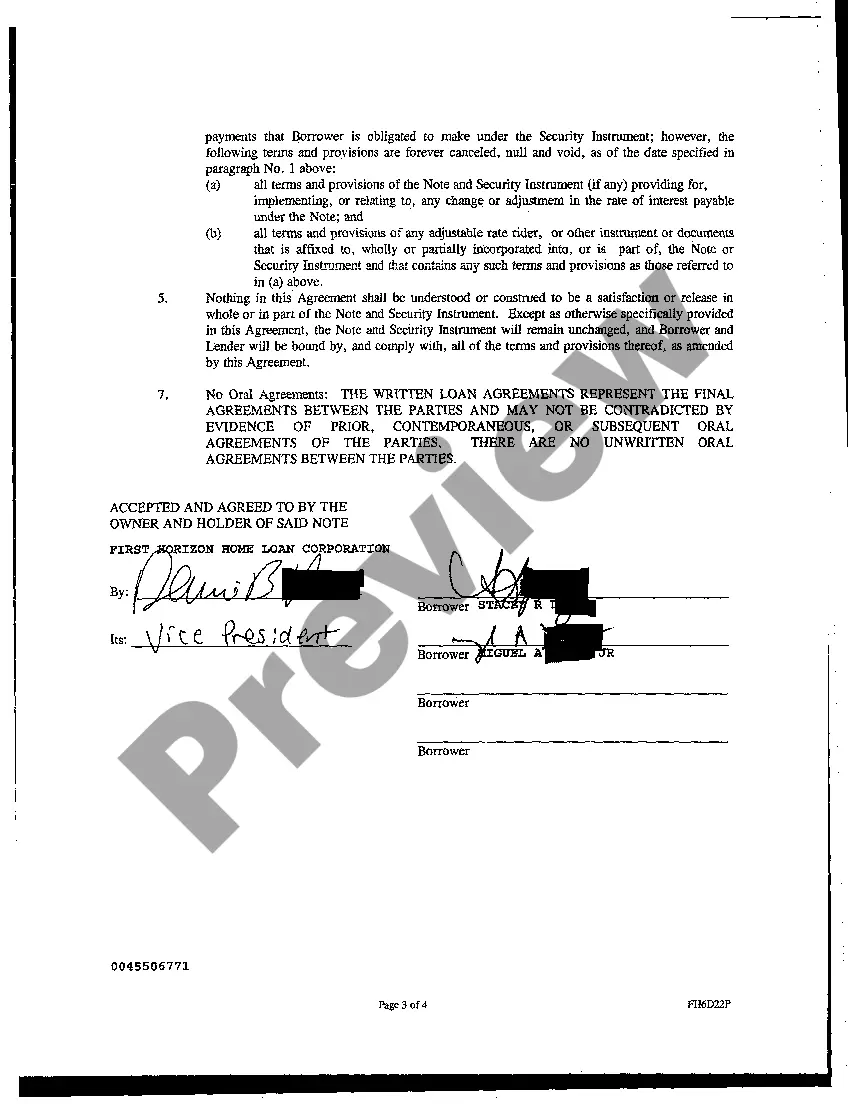

Hillsboro Oregon Loan Modification Agreement is a legal contract that aims to renegotiate the terms and conditions of an existing loan to provide financial relief to borrowers who are struggling to meet their mortgage payments or facing foreclosure. This agreement is designed to help homeowners in Hillsboro, Oregon, prevent foreclosure and maintain homeownership. Typically, a Hillsboro Oregon Loan Modification Agreement involves modifications to the loan's interest rate, loan term, or principal balance. The goal is to create a more affordable and sustainable monthly payment for the borrower. One type of Hillsboro Oregon Loan Modification Agreement is an interest rate modification. This entails reducing the interest rate on the loan, which can significantly lower the monthly payment burden for the borrower. Another type is a loan term extension. This involves extending the length of the loan, spreading the remaining balance over a longer period. By doing so, the borrower can enjoy smaller monthly payments. Principal balance reduction is yet another type of Hillsboro Oregon Loan Modification Agreement. In this case, a portion of the outstanding loan balance is forgiven, allowing the borrower to have a lower principal amount to repay. The Hillsboro Oregon Loan Modification Agreement is often facilitated by the lender or loan service. To qualify for a loan modification, borrowers must demonstrate financial hardship, provide detailed financial documentation, and submit a complete application package. It is essential to note that each lender may have its specific guidelines and requirements for loan modifications in Hillsboro, Oregon. It is advisable for borrowers seeking a loan modification to consult with a qualified attorney or housing counselor who specializes in foreclosure prevention and loan modifications in the area. In conclusion, Hillsboro Oregon Loan Modification Agreement is an agreement that allows borrowers in Hillsboro, Oregon, to renegotiate the terms of their mortgage to make the loan more affordable and prevent foreclosure. This agreement can involve interest rate reduction, loan term extension, or principal balance reduction. To explore these options, borrowers are recommended to consult with professionals familiar with the local guidelines and requirements.

Hillsboro Oregon Loan Modification Agreement

Description

How to fill out Hillsboro Oregon Loan Modification Agreement?

If you are searching for a relevant form template, it’s difficult to find a more convenient service than the US Legal Forms website – probably the most considerable libraries on the internet. With this library, you can get a large number of form samples for business and individual purposes by types and states, or key phrases. With the advanced search option, discovering the most recent Hillsboro Oregon Loan Modification Agreement is as elementary as 1-2-3. Additionally, the relevance of every document is proved by a group of professional attorneys that regularly review the templates on our website and revise them according to the newest state and county regulations.

If you already know about our system and have an account, all you should do to receive the Hillsboro Oregon Loan Modification Agreement is to log in to your profile and click the Download button.

If you make use of US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have discovered the sample you require. Check its explanation and make use of the Preview feature to explore its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to find the needed file.

- Confirm your decision. Choose the Buy now button. Next, choose your preferred pricing plan and provide credentials to register an account.

- Make the financial transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Get the form. Select the format and save it to your system.

- Make adjustments. Fill out, edit, print, and sign the obtained Hillsboro Oregon Loan Modification Agreement.

Each form you save in your profile does not have an expiration date and is yours forever. It is possible to gain access to them via the My Forms menu, so if you need to get an extra copy for editing or creating a hard copy, feel free to come back and save it once more at any time.

Take advantage of the US Legal Forms professional collection to get access to the Hillsboro Oregon Loan Modification Agreement you were looking for and a large number of other professional and state-specific samples on a single website!