Portland Oregon Loan Modification Agreement refers to a legally binding arrangement between a borrower and a lender in the state of Oregon, specifically in the city of Portland, relating to the modification of an existing loan. This agreement is designed to help borrowers who are struggling with mortgage payments to restructure their loan terms and conditions, enabling them to afford their monthly payments more easily and avoid foreclosure. The primary purpose of a Portland Oregon Loan Modification Agreement is to provide financial relief to borrowers facing economic hardships by adjusting certain aspects of the loan. These adjustments may include changes in the interest rate, extending the loan term, reducing the principal amount, or a combination of these factors, depending on the lender's policies and borrower's financial situation. The Portland Oregon Loan Modification Agreement aims to create a win-win situation for both the borrower and the lender. By modifying the loan terms, the borrower can secure a more affordable payment plan, which helps prevent default and protects their credit score. Additionally, lenders benefit by avoiding the costly and time-consuming foreclosure process. While there may not be specific types of Portland Oregon Loan Modification Agreements, the terms and conditions can vary depending on the lender and the circumstances of the borrower. Lenders may offer different loan modification programs such as: 1. Interest Rate Reduction: The lender may reduce the interest rate on the loan, which can result in substantial monthly savings for the borrower. 2. Loan Term Extension: Extending the loan term allows the borrower to spread out the remaining balance over a longer period, thereby reducing the monthly payments. 3. Principal Reduction: Some lenders may agree to reduce the total outstanding balance on the loan, helping to make the monthly payments more affordable. 4. Combination Modifications: In certain situations, lenders may combine various modification options to tailor a solution that best suits the borrower's financial needs. It is important to note that the specifics of a Portland Oregon Loan Modification Agreement are subject to negotiation and approval by the lender. Borrowers seeking loan modification agreements in Portland, Oregon, should consult with their lenders or professional loan modification companies to understand the available options and determine the most suitable course of action based on their financial circumstances.

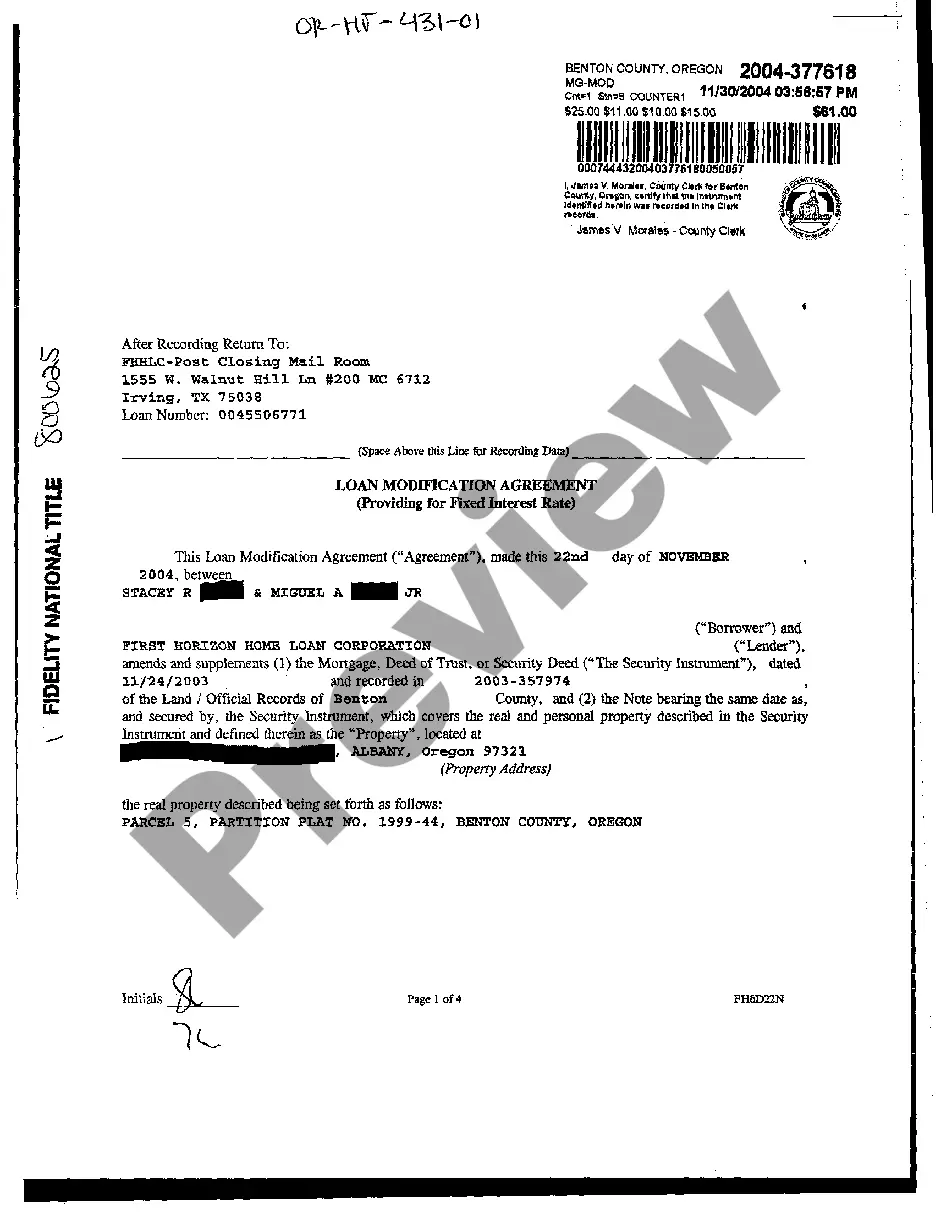

Portland Oregon Loan Modification Agreement

Description

How to fill out Portland Oregon Loan Modification Agreement?

We consistently aim to reduce or evade legal repercussions when managing intricate legal or financial matters.

To achieve this, we enlist the services of attorneys, which are often quite costly.

However, not every legal matter is similarly intricate. Many can be managed independently.

US Legal Forms is an online directory of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions.

Simply Log In to your account and click the Get button beside it.

- Our library enables you to handle your matters independently without the need for an attorney's services.

- We provide access to legal document templates that may not be widely available to the public.

- Our templates are specific to your state and region, significantly easing the search process.

- Utilize US Legal Forms whenever you need to obtain and download the Portland Oregon Loan Modification Agreement or any other document conveniently and securely.

Form popularity

FAQ

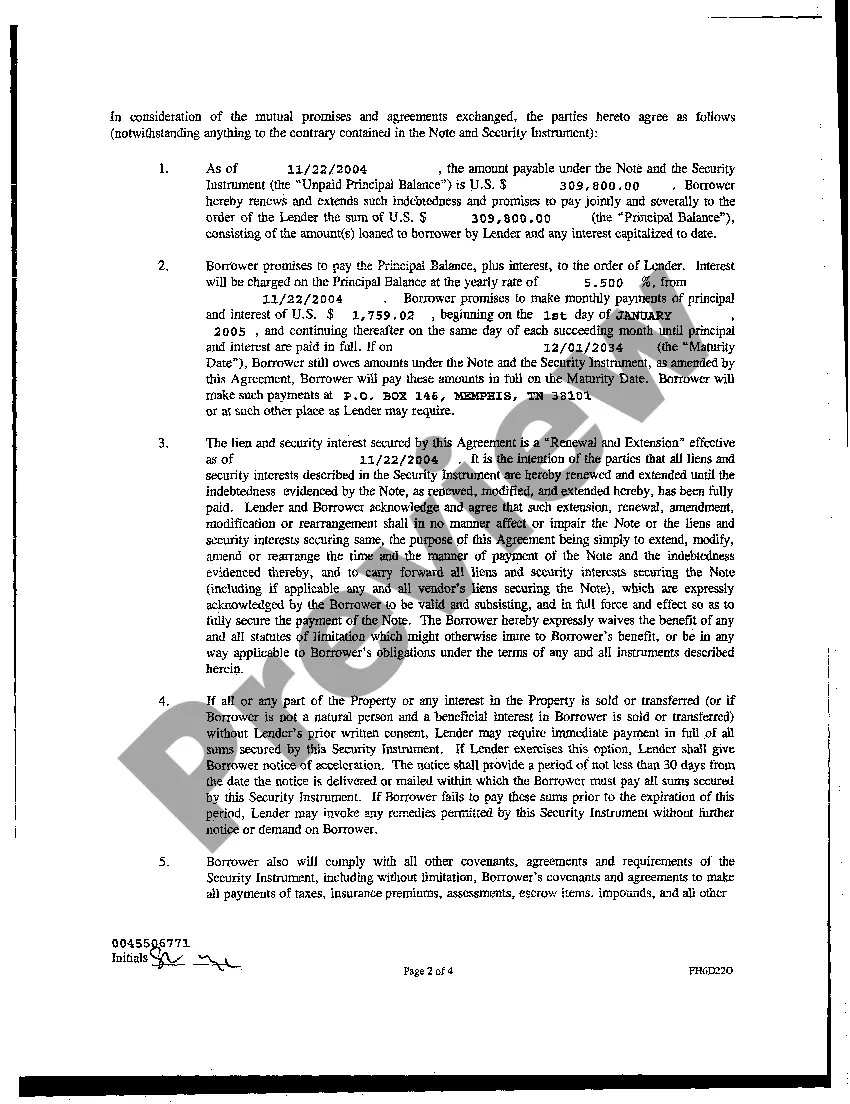

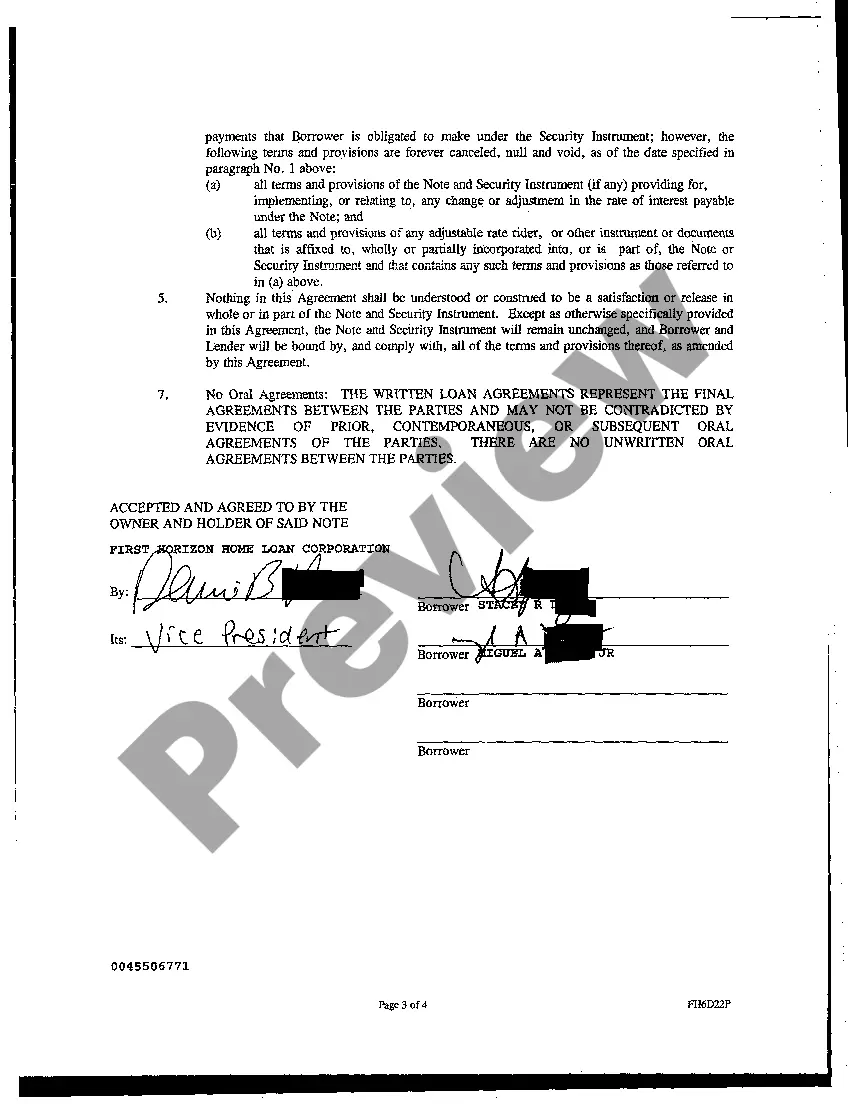

What Is A Loan Modification? A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan.

You could receive your mortgage loan modification in as little as 30 days. Or you could be left waiting upwards of 90 days for everything to go through. It really comes down to the individual lender and their ability to quickly process mortgage modifications.

Required Paperwork Application. The first thing you'll need to complete a loan modification is your mortgage lenders application.Paystubs.Signed IRS form 4506-T or 4506-EZ.Two Most Recent Bank Statements.Investment Statements.Monthly Bills.Divorce Decree or Separation Agreement (if applicable)Hardship Letter.

Some loan modifications are a debt settlement, and it can affect your credit depending on your the type of program in which you enroll. Debt settlement will hurt your credit score, even if there is an agreement with the lender.

Modification Agreement means the written order to the Contractor signed by the County authorizing an addition, deletion, or revision in the goods, Services and/or Work to be provided under the Contract Documents or an adjustment in the Contract Price issued after execution of the Agreement.

Why Was I Denied for a Loan Modification? An incomplete or untimely loan modification application. Insufficient finances to afford a modified payment. ?Lack of hardship,? or ability to pay the current mortgage payments without issue. You have already received the maximum number of loan modifications the lender allows.

You'll usually need to provide at least two bank statements. Lenders ask for more than one statement because they want to be sure you haven't taken out a loan or borrowed money from someone to be able to qualify for your home loan.

A loan modification can relieve some of the financial pressure you feel by lowering your monthly payments and stopping collection activity. But loan modifications are not foolproof. They could increase the cost of your loan and add derogatory remarks to your credit report.

There are many reasons why a loan modification application may be denied. Some common reasons include: -The borrower failed to provide all of the required documentation. -The borrower's income was not sufficient to support the modified payment amount.

The underwriter will evaluate and assess the borrower's financial status, current income and asset situation and ability to pay. Using an updated appraisal report the modification underwriter will confirm the current market value of the property as security for the loan.