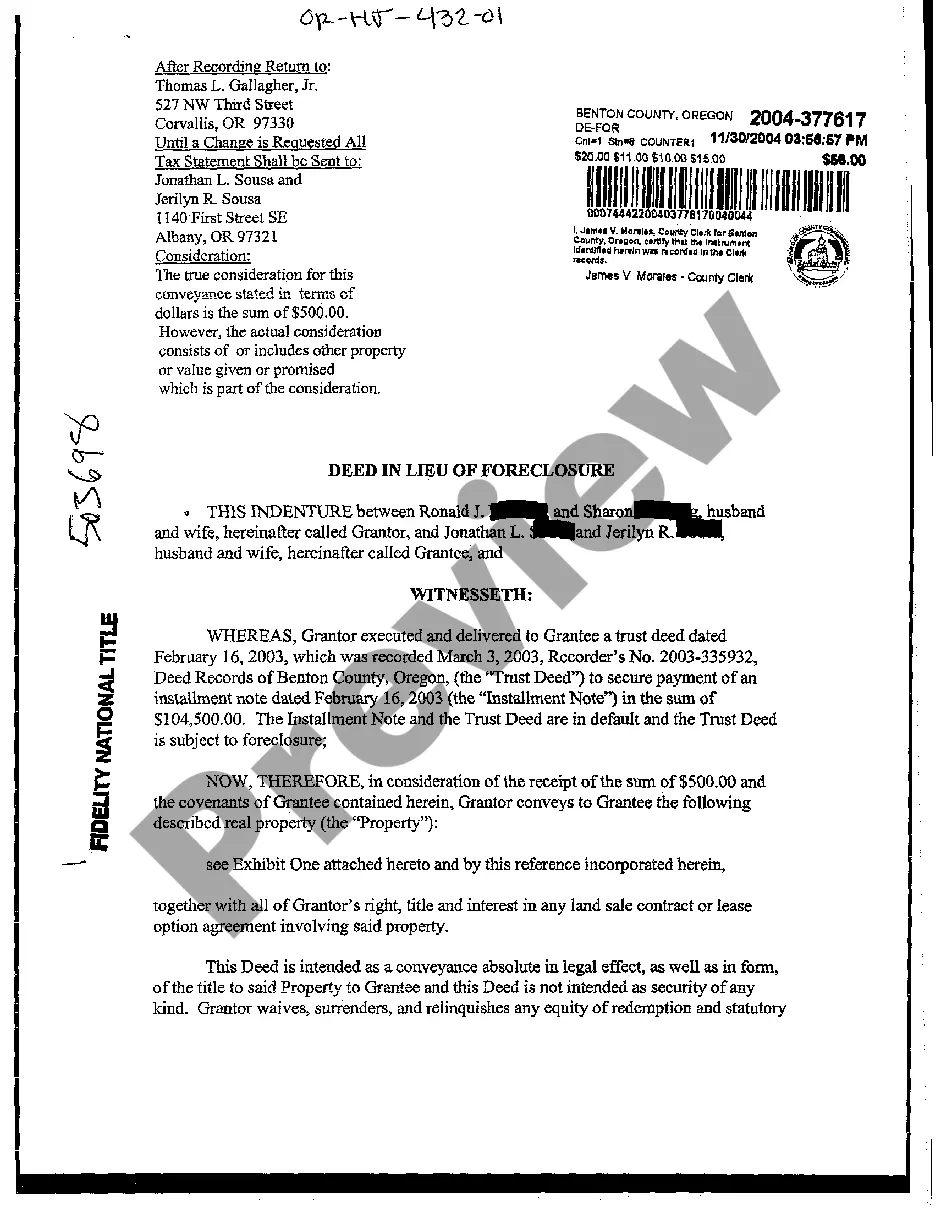

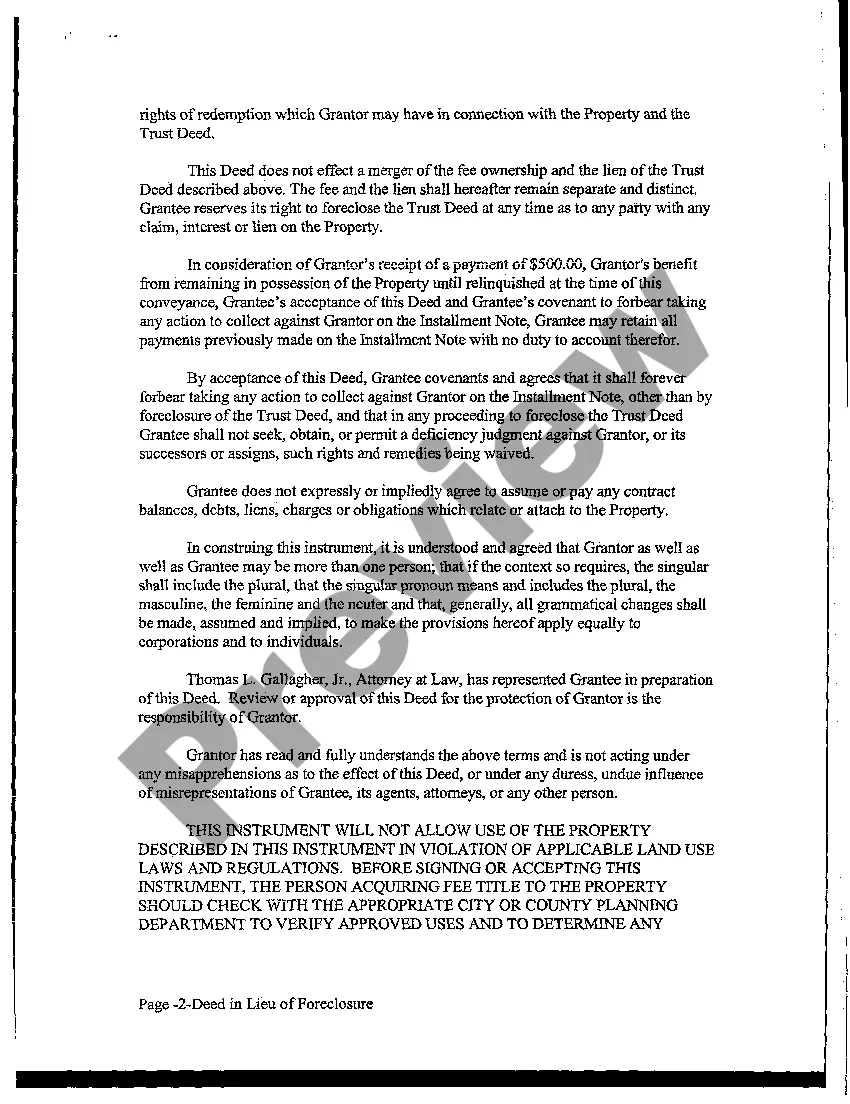

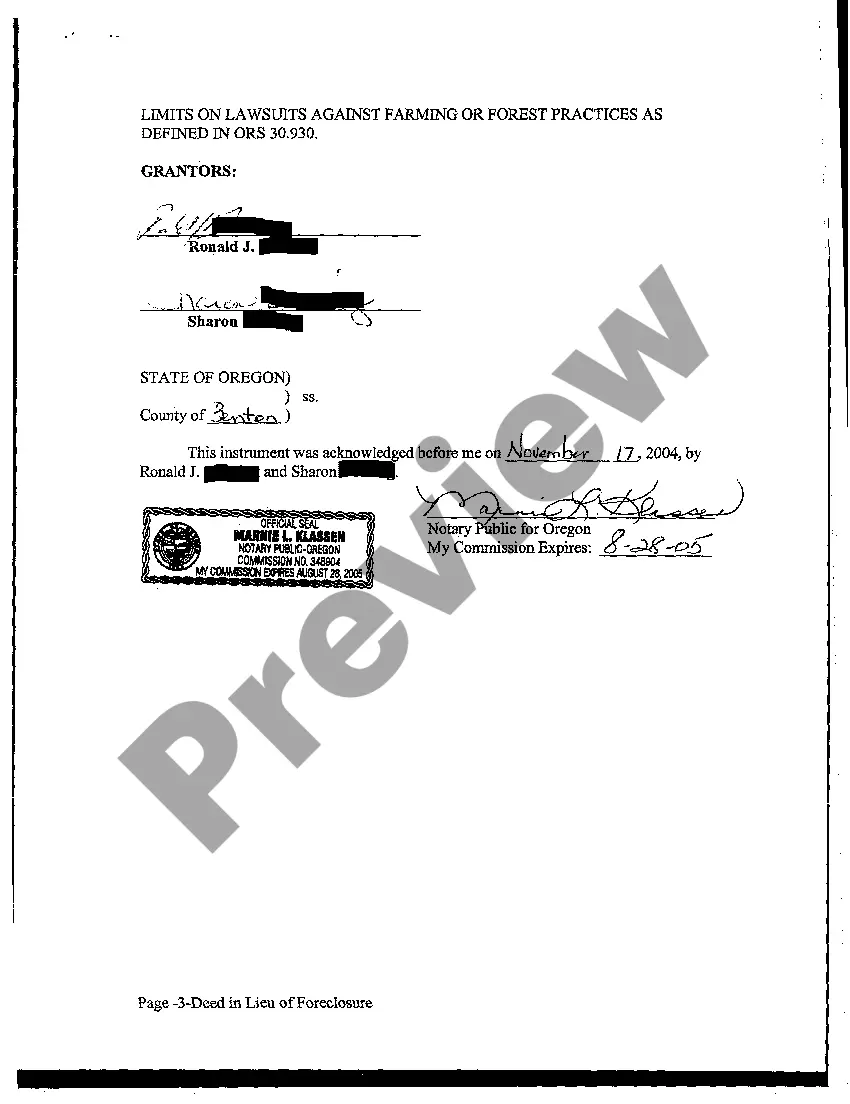

Eugene, Oregon Deed in Lieu of Foreclosure: A Comprehensive Overview In Eugene, Oregon, a deed in lieu of foreclosure is a legal arrangement between a homeowner and a lender where the homeowner voluntarily transfers the property's title to the lender in exchange for the cancellation of their mortgage debt. This alternative to foreclosure is often pursued when homeowners are unable to meet their mortgage obligations and face the possibility of losing their home. By engaging in a deed in lieu of foreclosure, homeowners can avoid the lengthy and costly foreclosure process. Keywords: Eugene Oregon, Deed in Lieu of Foreclosure, homeowner, lender, property, mortgage debt, alternative, foreclosure process. A Eugene, Oregon deed in lieu of foreclosure offers numerous benefits to homeowners, including the ability to maintain some control over the situation. By initiating this process, homeowners actively participate in resolving their financial challenges. It allows them to avoid the stressful foreclosure proceedings, which typically involve court hearings, public auctions, and potential damage to their credit score. There are various types of Eugene, Oregon Deed in Lieu of Foreclosure: 1. Traditional Deed in Lieu: This is the most common type of deed in lieu of foreclosure, where homeowners transfer their property's title to the lender without any further negotiations. Both parties must agree on the terms and conditions for the transfer to take place, including the cancellation of mortgage debt. 2. Cash for Keys Deed in Lieu: In some cases, lenders may offer homeowners a cash incentive to motivate them to complete the deed in lieu process promptly. This financial assistance can help cover relocation expenses or serve as a financial cushion during the transition period. 3. Junior Lien Deed in Lieu: This type of deed in lieu of foreclosure occurs when a homeowner has multiple liens or mortgages on their property. The homeowner negotiates with both primary and junior lien holders to release their claims on the property through this arrangement. Regardless of the specific type, Eugene, Oregon deed in lieu of foreclosure processes generally involve several steps. Initially, the homeowner must express their willingness to pursue this option to the lender, providing necessary documentation such as financial statements, hardship letters, and a proposal outlining the terms of the agreement. The lender will then evaluate the homeowner's eligibility, considering factors such as the value of the property, remaining mortgage debt, and the borrower's financial circumstances. If the lender approves the deed in lieu request, they may require the homeowner to vacate the property by a specific date, ensuring it is clear of any personal belongings. The final step involves the transfer of the property's title from the homeowner to the lender, effectively solidifying the agreement. Choosing a deed in lieu of foreclosure can have both positive and negative consequences for homeowners. While it may resolve their immediate mortgage debt issue, it may also impact their credit score and create tax implications. It is crucial for homeowners considering this option to consult with professionals, such as real estate attorneys or financial advisors, to fully understand the implications and make informed decisions. In conclusion, a Eugene, Oregon deeds in lieu of foreclosure can provide struggling homeowners with an alternative solution to foreclosure. By entering into this arrangement, homeowners can voluntarily transfer their property's title to their lender, effectively cancelling their mortgage debt and avoiding the lengthy and distressing foreclosure process. Note: There may be additional types of deed in lieu of foreclosure specific to Eugene, Oregon that are not covered in this description.

Eugene Oregon Deed in Lieu of Foreclosure

Description

How to fill out Eugene Oregon Deed In Lieu Of Foreclosure?

Regardless of your social or professional rank, completing legal documents is a regrettable requirement in modern society.

Too frequently, it’s nearly unfeasible for someone without any legal training to compose such documents from the beginning, primarily due to the intricate terminology and legal nuances they involve.

This is where US Legal Forms can be beneficial.

Ensure that the chosen form is appropriate for your region, as different jurisdictions have varying regulations.

Review the document and check a brief summary (if available) of situations where the paper may be applicable.

- Our platform provides a vast collection of over 85,000 ready-to-use state-specific templates that cater to nearly any legal situation.

- US Legal Forms serves as a valuable resource for associates or legal advisors aiming to enhance their efficiency utilizing our DIY papers.

- Regardless of whether you need the Eugene Oregon Deed in Lieu of Foreclosure or another document suitable for your region, US Legal Forms has everything readily available.

- Below is a guide on how to quickly acquire the Eugene Oregon Deed in Lieu of Foreclosure through our reliable platform.

- If you are already a customer, you may proceed and Log In to your account to obtain the correct form.

- If you are new to our repository, please follow these steps before securing the Eugene Oregon Deed in Lieu of Foreclosure.

Form popularity

FAQ

A deed in lieu of foreclosure in Oregon is a legal agreement where a homeowner voluntarily transfers their property title to the lender to avoid foreclosure. This option can be beneficial for both parties, as it allows for a quicker resolution to financial difficulties while preventing a lengthy foreclosure process. In Eugene, Oregon, homeowners can explore this option further with resources available on platforms like USLegalForms to facilitate understanding and execution. Utilizing these tools can help homeowners navigate the complexities of this option more effectively.

The process of obtaining a deed in lieu of foreclosure in Eugene, Oregon, typically takes a few weeks to a few months. This timeframe can vary based on factors such as lender requirements and property conditions. It is important to work closely with your lender and seek guidance through resources like USLegalForms to ensure a smoother process. By preparing the necessary documentation ahead of time, you can help reduce potential delays.

A deed in lieu of foreclosure in the UK functions similarly to its counterpart in the US, where homeowners voluntarily give their property back to the lender to settle their mortgage debt. However, there are differences in legal terminology and processes between the two countries. In the context of a Eugene Oregon deed in lieu of foreclosure, it provides homeowners with relief from debt while giving lenders a chance to recover some financial loss. Overall, it's essential to understand the local laws governing this process in both regions.

To file a deed in lieu of foreclosure, begin by contacting your lender to discuss your situation and express your interest in this option. You will need to provide necessary documentation, including income statements and a hardship letter. When the lender accepts your request, they will help you through the Eugene Oregon deed in lieu of foreclosure process, guiding you on how to complete the paperwork effectively. Using uslegalforms can simplify this process by offering templates and assistance tailored to your needs.

The best alternative to foreclosure is often a deed in lieu of foreclosure. This option allows homeowners to voluntarily transfer their property's title to the lender to avoid the lengthy foreclosure process. By choosing the Eugene Oregon deed in lieu of foreclosure, you can protect your credit and possibly receive some debt forgiveness. It is a proactive approach that can lead to a smoother transition for both you and the lender.

To write a foreclosure letter, begin with a clear and concise statement of your situation. Explain your inability to maintain mortgage payments and your desire to resolve this issue, perhaps through a deed in lieu of foreclosure. Include important details such as your property address in Eugene, Oregon, and contact information for your lender. Ensuring your letter is professional and direct will increase the chances of a favorable response.

Filing a deed in lieu of foreclosure involves several steps. First, you should gather all necessary documents, including your mortgage agreement and proof of financial hardship. Then, submit these documents to your lender along with your signed deed in lieu. It's essential to confirm that the deed is properly recorded in the Eugene, Oregon, land records after completion, which protects you from future claims on the property.

The deed in lieu of foreclosure process can take anywhere from a few weeks to several months. In Eugene, Oregon, the time frame often depends on the lender’s policies and the complexity of the situation. Typically, it's crucial to follow all required steps and provide necessary documentation promptly to expedite the process. Staying proactive and organized will benefit you throughout this journey.

An example of a deed in lieu of foreclosure is when a homeowner in Eugene, Oregon, voluntarily transfers their property title back to the lender to avoid foreclosure. For instance, if a homeowner cannot make mortgage payments due to financial hardship, they may agree to give the property back to the bank instead of going through a lengthy foreclosure process. This arrangement can benefit both parties by allowing the lender to recover their investment faster.

One disadvantage of a deed in lieu of foreclosure is that it can negatively impact your credit score. While it may be less damaging than a foreclosure, a recorded deed in lieu still shows financial distress. Additionally, it may not relieve you from all debts associated with the property, meaning you could still face financial obligations in Eugene, Oregon. Therefore, it’s crucial to weigh your options carefully.