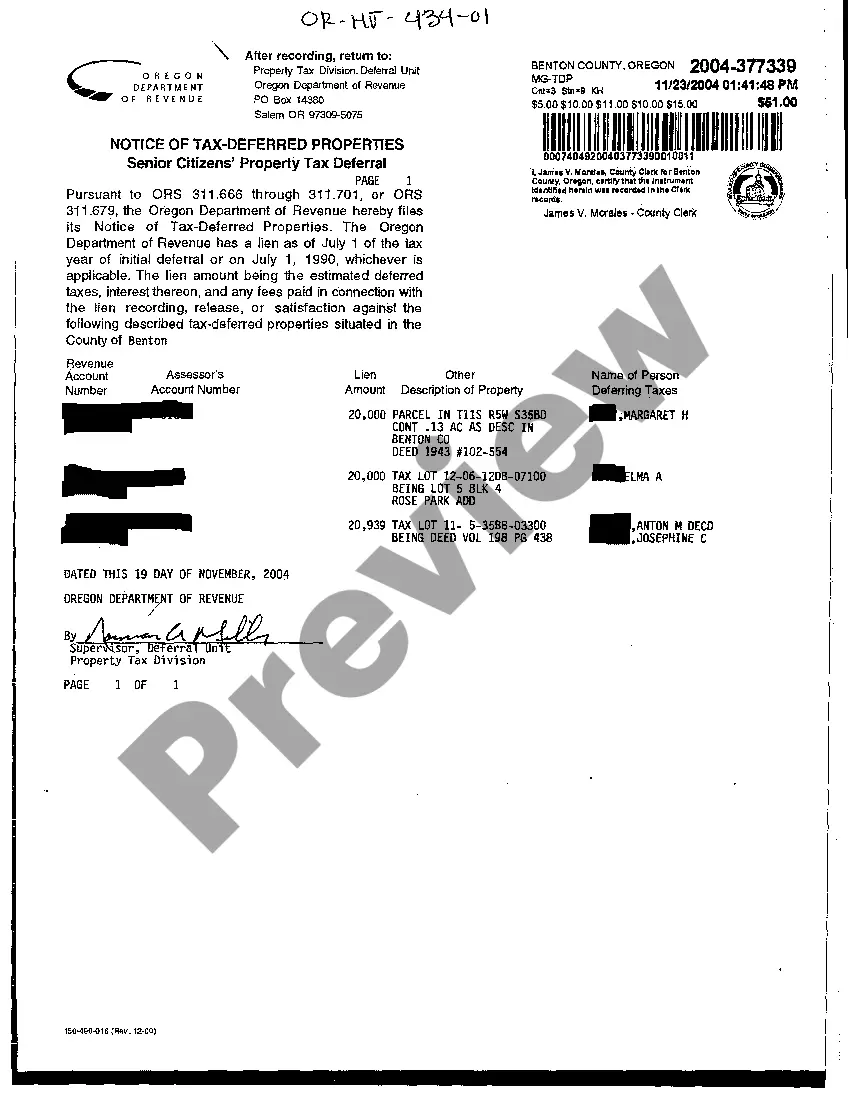

The Bend Oregon Notice of Tax-Deferred Properties is an important document that taxpayers should be familiar with when it comes to understanding their property tax obligations and potential benefits. This notice provides crucial information regarding properties that may qualify for tax deferrals or exemptions in the city of Bend, Oregon. Tax-deferred properties are those that meet specific criteria set by the local government, allowing eligible taxpayers to postpone paying property taxes or potentially reduce their tax burden. These tax deferrals can be particularly beneficial for individuals and businesses facing financial hardships or those wanting to invest in property improvements. There are different types of Bend Oregon Notice of Tax-Deferred Properties, including: 1. Senior Citizen and Disabled Tax Deferral: This program is designed to assist senior citizens and disabled individuals with limited incomes. It allows these qualified property owners to postpone their property tax payments until the property is sold or transferred, or until the owner's passing. 2. Historic Property Tax Deferral: This tax deferral option aims to preserve and maintain historic properties in Bend. It provides eligible property owners with the ability to defer payment of property taxes for historical structures, encouraging the preservation and protection of the city's heritage. 3. Enterprise Zone Property Tax Exemption: Bend offers an Enterprise Zone program, which provides tax incentives to businesses that invest and create jobs in designated areas. Under this program, qualified businesses can be exempt from a portion of their property taxes, thereby encouraging economic development and growth in the city. Applying for tax deferrals or exemptions outlined in the Bend Oregon Notice of Tax-Deferred Properties requires meeting specific criteria and completing the necessary paperwork. It is crucial for property owners in Bend to read this notice thoroughly to fully understand the eligibility requirements, deadlines, and potential benefits. Understanding the Bend Oregon Notice of Tax-Deferred Properties is essential for property owners, as it allows them to make informed decisions about their tax obligations and potential opportunities for financial relief. By familiarizing oneself with the different types of tax deferrals available, individuals and businesses in Bend, Oregon can effectively manage their property tax responsibilities and make the most of the available incentives.

Bend Oregon Notice of Tax-Deferred Properties

Description

How to fill out Bend Oregon Notice Of Tax-Deferred Properties?

We always want to minimize or avoid legal damage when dealing with nuanced law-related or financial affairs. To do so, we apply for legal solutions that, usually, are very expensive. However, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of legal counsel. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Bend Oregon Notice of Tax-Deferred Properties or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is equally effortless if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Bend Oregon Notice of Tax-Deferred Properties complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Bend Oregon Notice of Tax-Deferred Properties would work for your case, you can choose the subscription option and make a payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!